Are you looking to streamline the process of issuing tax receipts for your non-profit organization? Creating a clear and well-structured letter template can make this important task much easier and more professional. In this article, we'll walk you through the essential components of a non-profit tax receipt letter, ensuring you maintain compliance and foster donor trust. Join us as we explore the key elements and provide helpful tips to enhance your communication with contributors!

Organization's Name and Logo

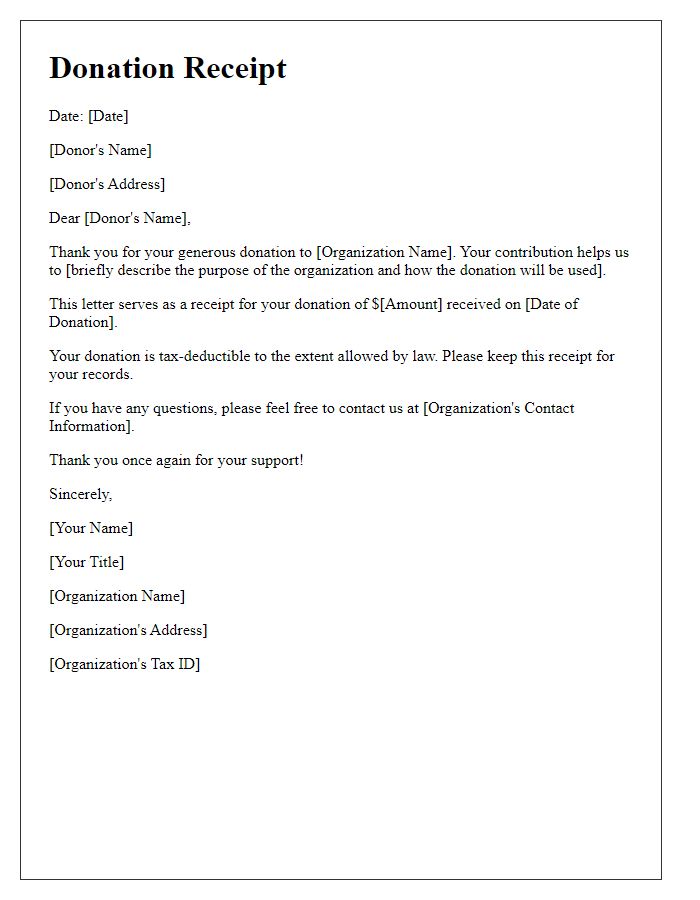

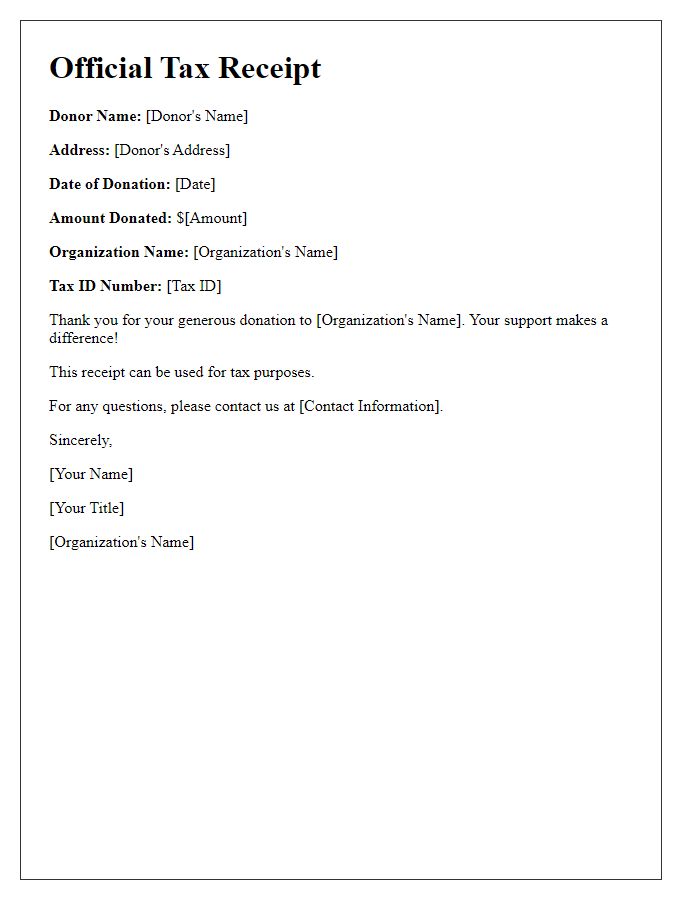

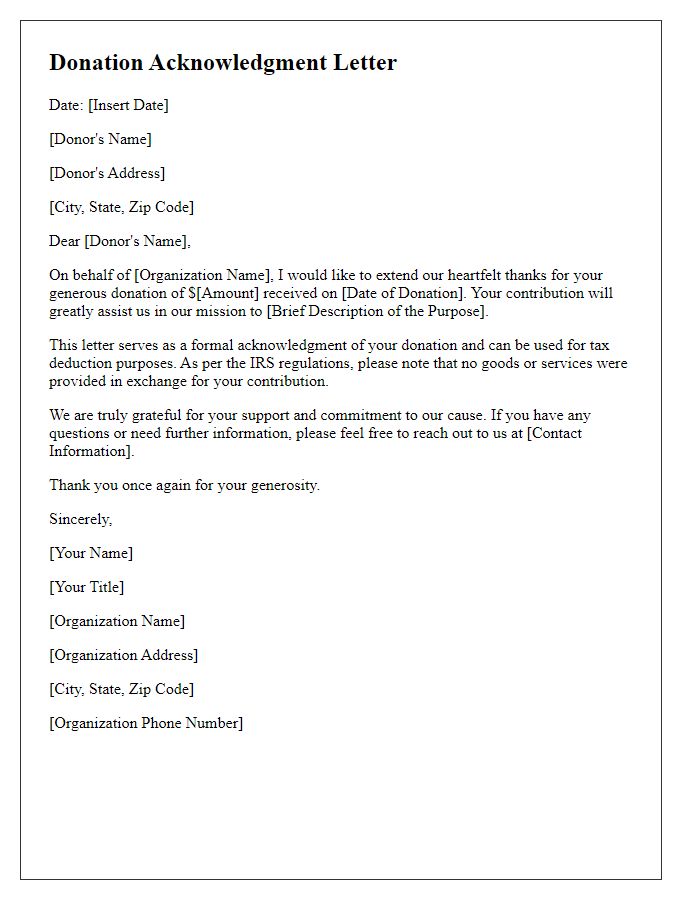

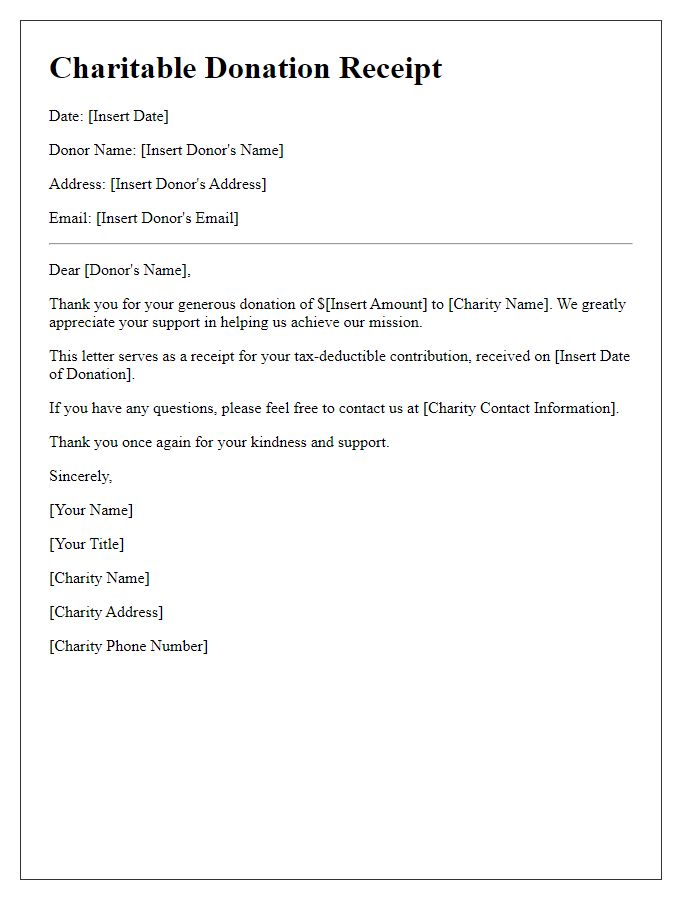

A non-profit tax receipt issued by an organization must include essential details to comply with IRS regulations. The organization's name displayed prominently at the top, along with the logo for branding identity, creates a professional appearance. The receipt should list the date of the contribution, which serves as a crucial reference for tax deductions. The name and address of the donor helps ensure accurate record-keeping and verification for IRS purposes. Specific details regarding the donation amount (in dollars) and the nature of the contribution, whether monetary or in-kind, are necessary for transparency. A statement confirming that no goods or services were provided in exchange for the donation reinforces the receipt's validity. Finally, the authorized signature from a key officer in the organization lends credibility to the document, ensuring the donor has all necessary information for their tax filings.

Donor's Name and Contact Information

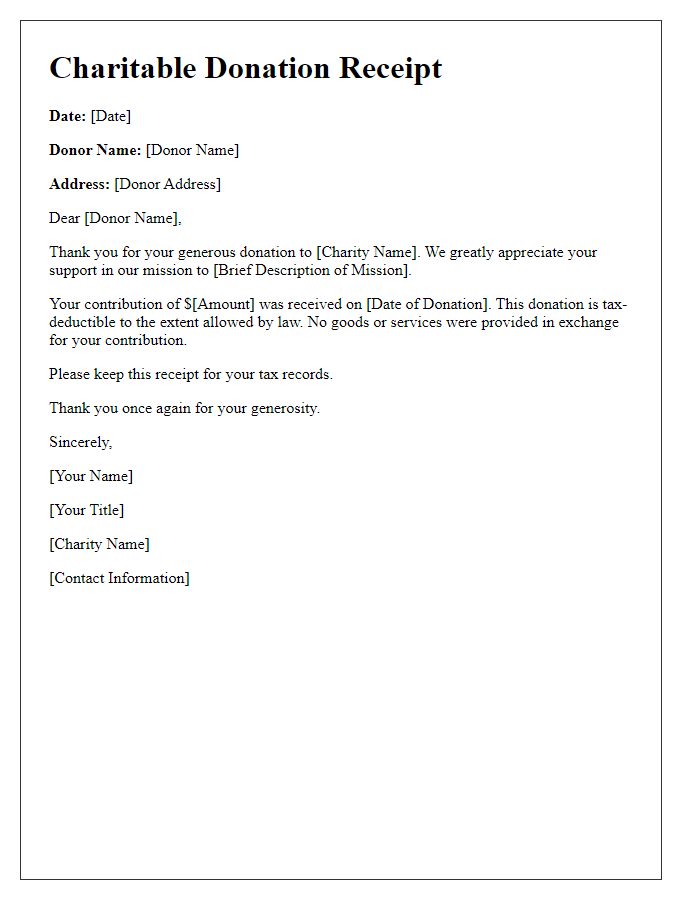

Non-profit organizations must issue tax receipts to donors for contributions, ensuring compliance with IRS regulations. A tax receipt typically includes the donor's name, which identifies the individual or organization making the contribution, and contact information such as an address and email, necessary for communication and verification. The receipt should state the amount donated, the date of the contribution, and a confirmation that no goods or services were provided in exchange for the donation, which is crucial for the donor's tax deduction claims. It may also contain the non-profit's name, EIN (Employer Identification Number), and a statement of appreciation, fostering goodwill and encouraging future support.

Description of Donation

Donations to non-profit organizations play a crucial role in sustaining various social causes and community services. Monetary contributions, such as a $500 donation received on September 15, 2023, support essential programs like food distribution and educational workshops. In-kind donations, including a truckload of canned goods valued at approximately $1,200, significantly enhance resource availability. Donations made to non-profits should be documented meticulously, as they qualify for tax deductions under Section 501(c)(3) of the Internal Revenue Code. Issuance of tax receipts, stating the value and nature of donations, ensures transparency and accountability while providing donors with essential documentation for tax purposes.

Statement of Tax Deductibility

The issuance of non-profit tax receipts serves as a crucial process for organizations qualifying under Section 501(c)(3) of the Internal Revenue Code, ensuring donors can claim deductions on their federal income tax returns. Each receipt must include the name and address of the non-profit organization, such as "Helping Hands Community Center," alongside its unique Employer Identification Number (EIN), prominently displayed. Detailed information about the contribution, including the date (for example, April 15, 2023), the amount (such as $250), and the nature of the gift (monetary or in-kind) is essential for accountability. It's also important to note whether any goods or services were provided in exchange for the donation, as this impacts the deductible amount for the donor. The statement should conclude with a confirmation of the organization's tax-exempt status, enhancing the validity of the tax deduction for contributors.

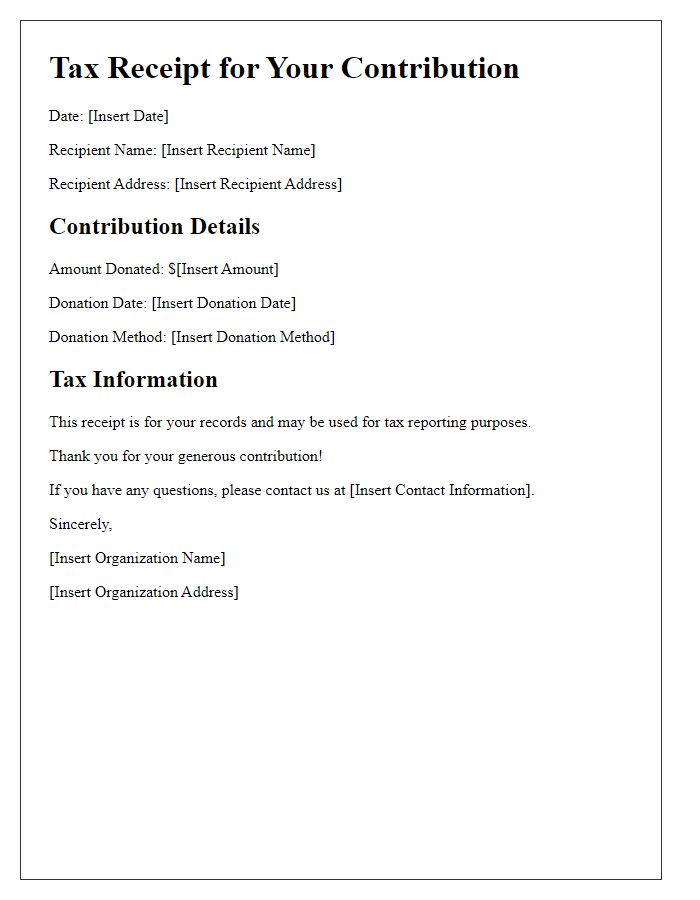

Issuance Date and Signature

Issuance of tax receipts is a crucial process for non-profit organizations, ensuring donors recognize their contributions for tax deduction purposes. The issuance date (documented prominently) indicates when the receipt is generated, which is vital for tax reporting deadlines, typically by April 15th in the United States. A signature (either electronic or handwritten) from an authorized representative of the organization adds authenticity and validation to the receipt, reinforcing donor trust. Non-profits should include the organization's name, tax identification number, and a description of the donation (including value) to provide comprehensive documentation. Careful attention to these components ensures compliance with IRS regulations and enhances the donor's experience.

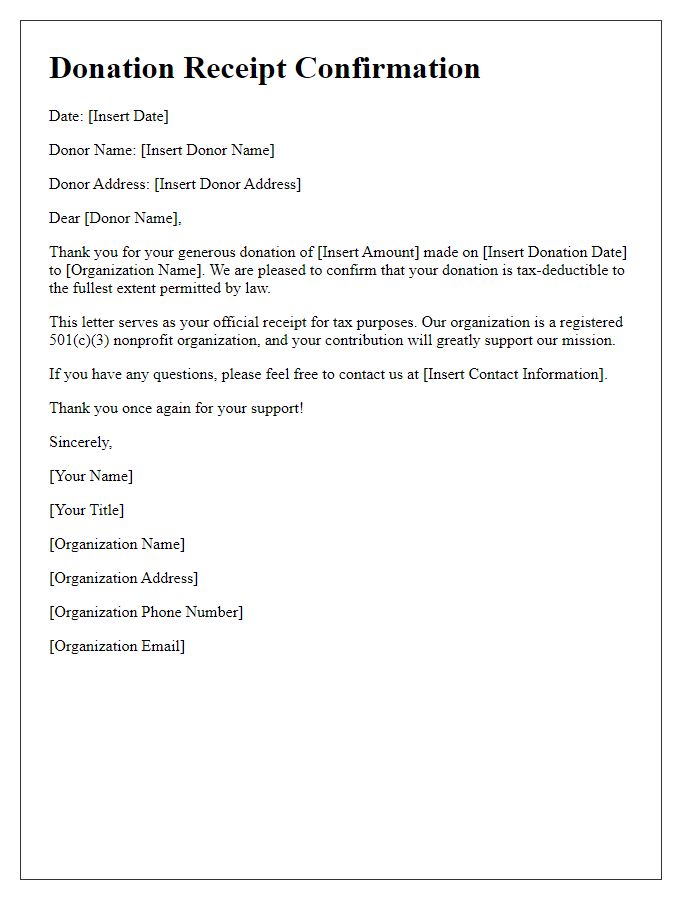

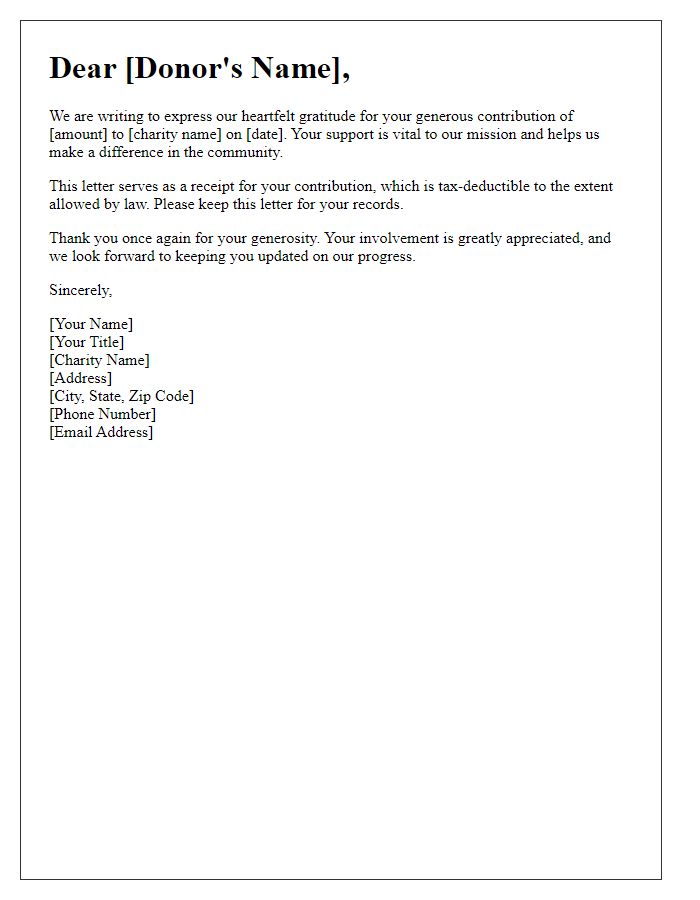

Letter Template For Non-Profit Tax Receipt Issuance Samples

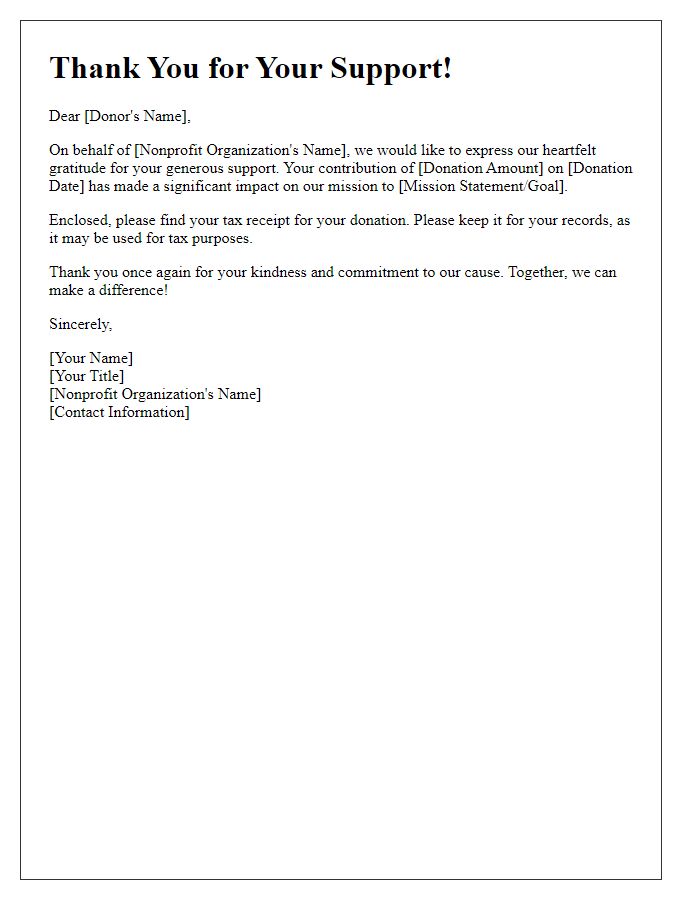

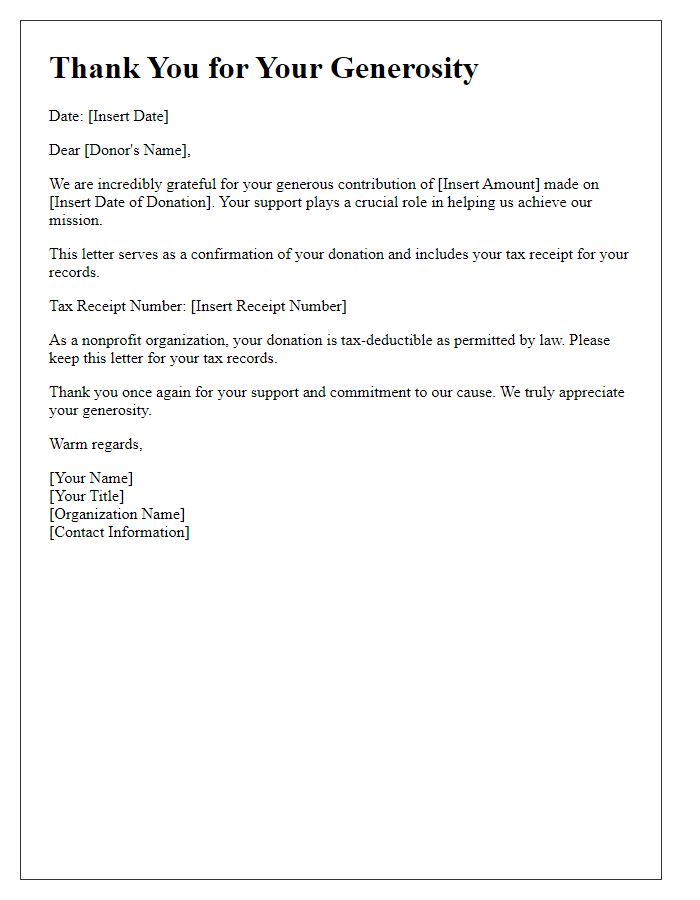

Letter template of thank you for supporting our nonprofit with tax receipt

Comments