Hey there! If you've ever found yourself wondering how to properly acknowledge a charitable contribution, you're in the right place. Crafting an impactful letter not only expresses gratitude but also strengthens the relationship between your organization and its generous supporters. So, let's dive in and explore some essential tips and templates that can make your acknowledgment letters shineâstick around for all the details!

Donor's name and address

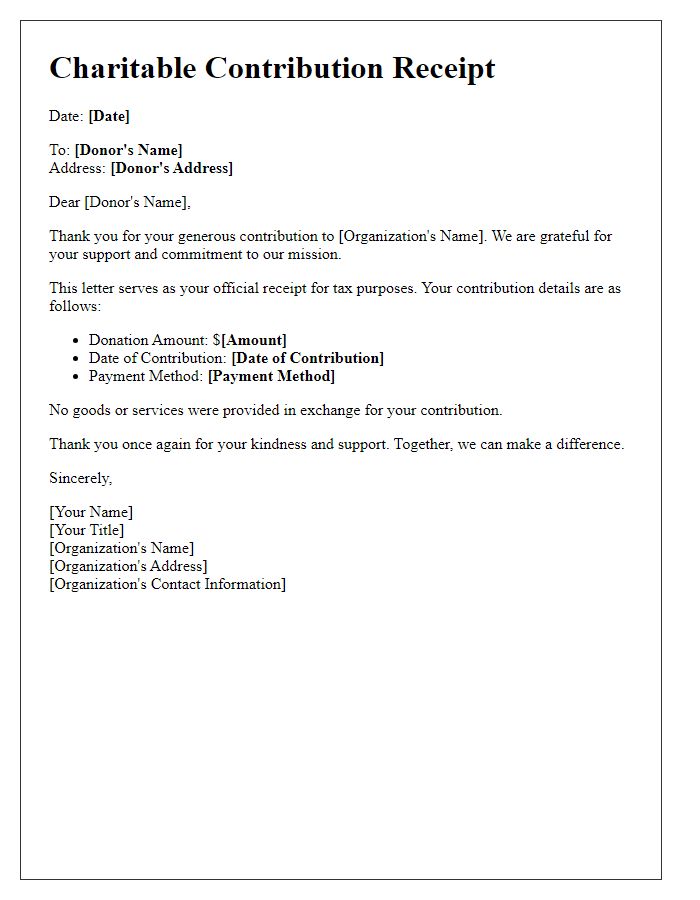

Charitable contributions play a vital role in supporting non-profit organizations and community initiatives. Acknowledgment letters serve as an important means to express gratitude towards benefactors. Accurate documentation of the donor's name, such as John Smith, and the address, 123 Main Street, Springfield, IL, reinforces the personal connection between the organization and the supporter. Each acknowledgment letter typically includes the date of the contribution, the purpose of the donation, and its impact, fostering transparency and trust. Such letters not only affirm the donor's commitment but also serve as a tax deduction record, contributing to further charitable endeavors.

Date of donation

A heartfelt acknowledgment of a charitable contribution is crucial for fostering continued support. Donors appreciate recognition of their generosity. An effective acknowledgment letter includes essential details, such as the date of the donation, which solidifies the timeline of support, and the amount contributed, reflecting the significance of their generosity. Including the organization's name and mission underscores the direct impact of the contribution. Personalized notes about specific projects the donation will support can enhance the connection between the donor and the cause, ensuring that they feel valued and informed about the positive changes their contribution will facilitate.

Description of donated items or amount

Charitable contributions play a crucial role in supporting nonprofit organizations and their missions. For instance, cash donations of $500 received from individuals can be instrumental in funding essential programs. In-kind donations such as clothing (over 100 items collected from a local drive) provide direct assistance to families in need. Additionally, school supplies (including backpacks and notebooks totaling around 200 units) enhance educational resources for underserved youth. Recognizing these contributions fosters community engagement and encourages continued support for charitable endeavors.

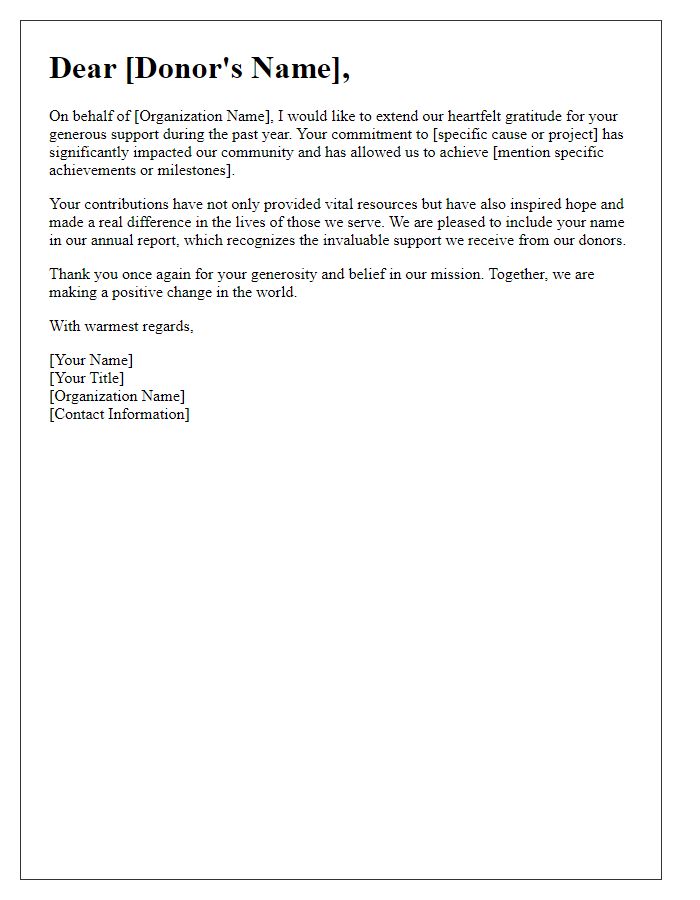

Statement of gratitude

A significant charitable contribution can make a tremendous impact on nonprofit organizations, fostering essential programs and services. For example, donations to local food banks, such as the Atlanta Community Food Bank, help provide meals for families in need, serving over 60,000 individuals each week. Similarly, contributions to educational foundations, like the DonorsChoose.org, allow teachers to obtain necessary supplies, enriching classroom environments and benefiting thousands of students across the United States. Acknowledging these acts of generosity not only expresses gratitude but also reinforces the importance of community support in driving positive change and ensuring ongoing aid to those experiencing hardship.

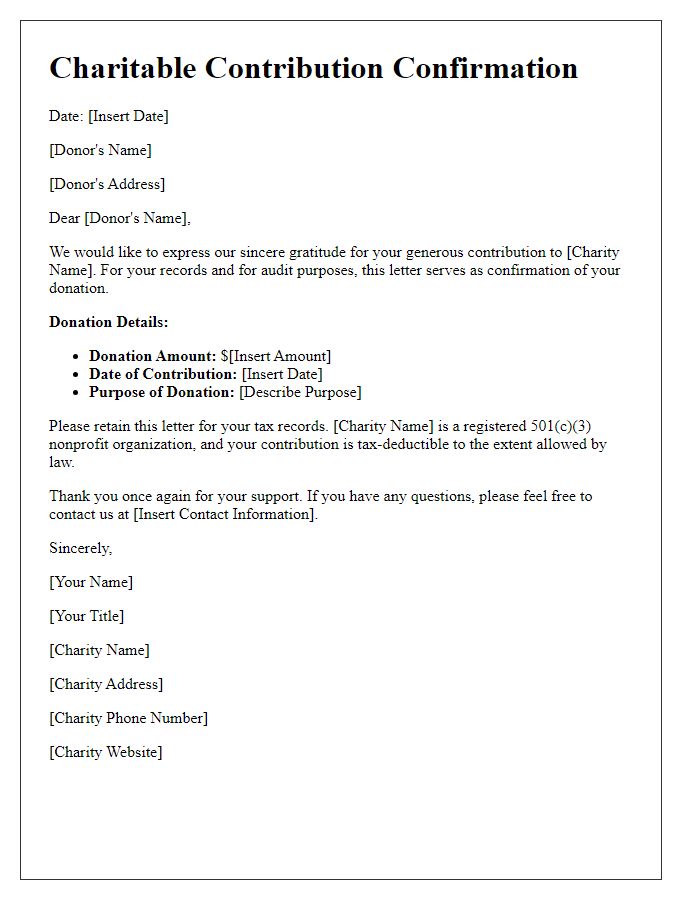

Tax-exemption status acknowledgment

Charitable organizations often issue formal acknowledgments to donors for their contributions. Such acknowledgment serves as a receipt for tax purposes, confirming the donation's tax-exemption status under Internal Revenue Code section 501(c)(3). Acknowledgments typically include the organization's name, address, and federal tax identification number, along with the date of the contribution. It also specifies the donation amount and states that no goods or services were provided in exchange for the contribution, ensuring compliance with IRS regulations. Recipients of these acknowledgments, ranging from individual donors to corporate sponsors, should retain them for their records when filing annual tax returns, as they substantiate charitable deductions. Properly documented contributions enhance transparency and encourage ongoing support for the organization's mission.

Letter Template For Charitable Contribution Acknowledgment Samples

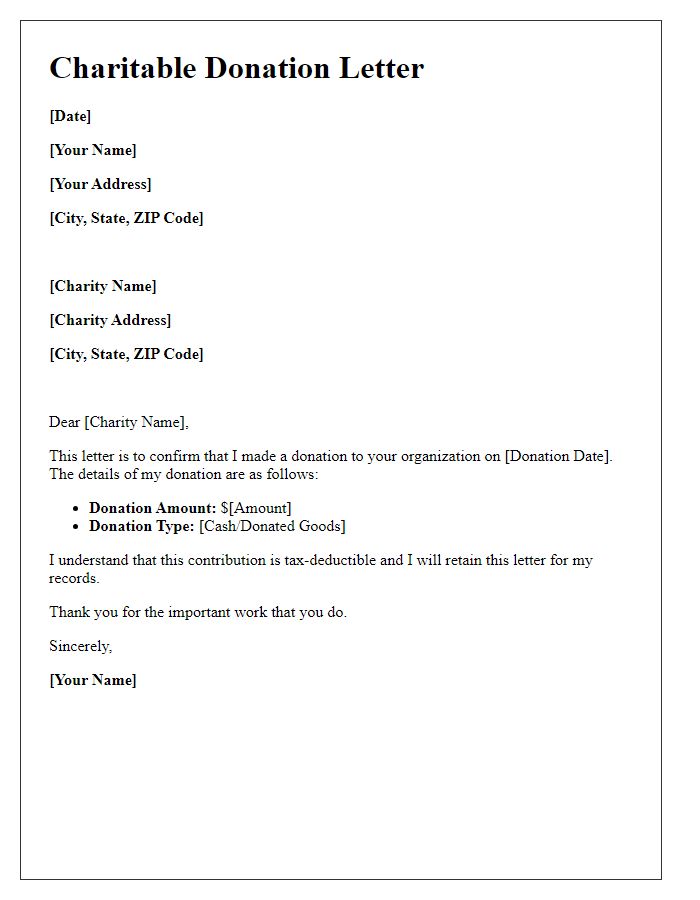

Letter template of charitable contribution receipt for donor acknowledgment.

Letter template of charitable contributions confirmation for audit purposes.

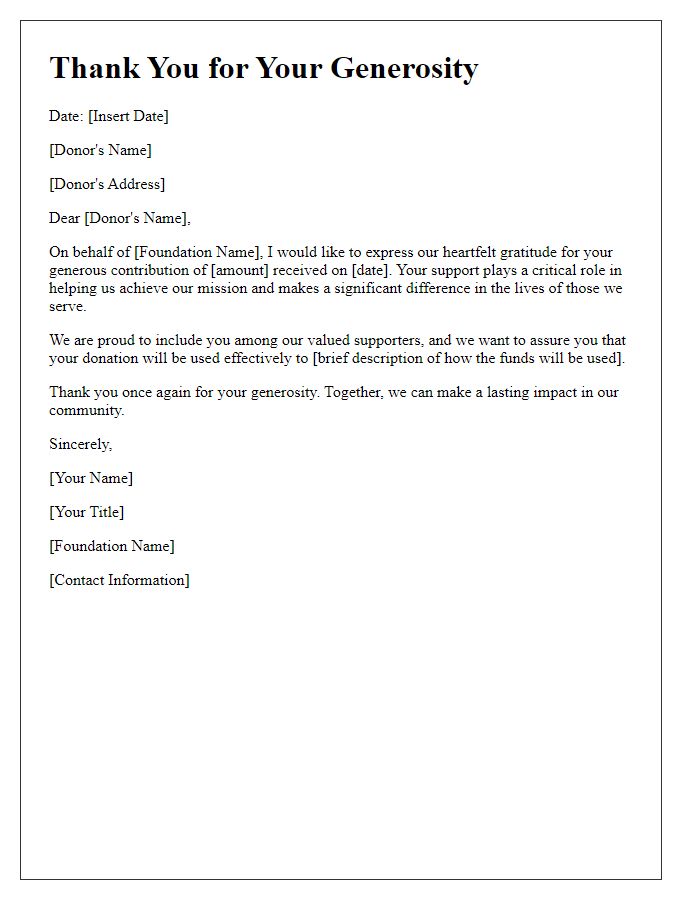

Letter template of charitable support appreciation for annual report inclusion.

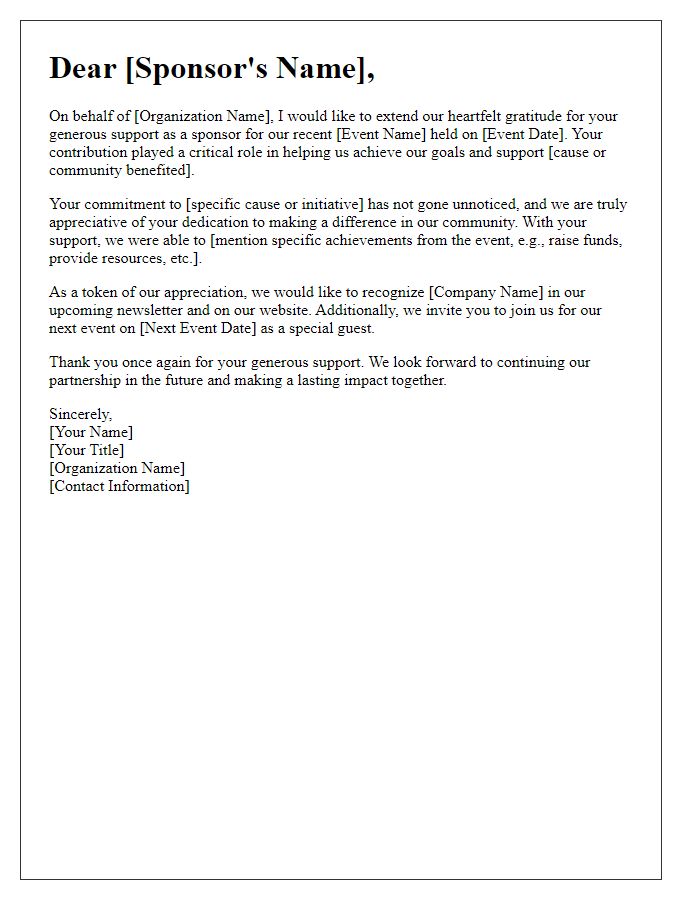

Letter template of charitable giving acknowledgment for corporate sponsors.

Letter template of charitable contribution gratitude for community impact.

Comments