Are you feeling overwhelmed by municipal tax bills? You're not alone! Many individuals and families are discovering the benefits of requesting tax exemptions to ease their financial burden. In this article, we'll guide you through an effective letter template for a municipal tax exemption request that can help you achieve relief. So, let's dive in and explore this valuable resource together!

Applicant's Personal Information

Applicants seeking municipal tax exemption should prepare to include comprehensive personal information. This data typically encompasses the applicant's full name, including middle initial, residential address, detailed information about the property in question such as the property's tax identification number and current assessed value, and applicable contact information including phone numbers and email addresses. Additional details might involve the date of birth, social security number, or any other identification that verifies the applicant's eligibility for the exemption. Moreover, specifics regarding the applicant's homeowner status, income level, and any other qualifying criteria outlined by the municipality should be gathered and clearly stated.

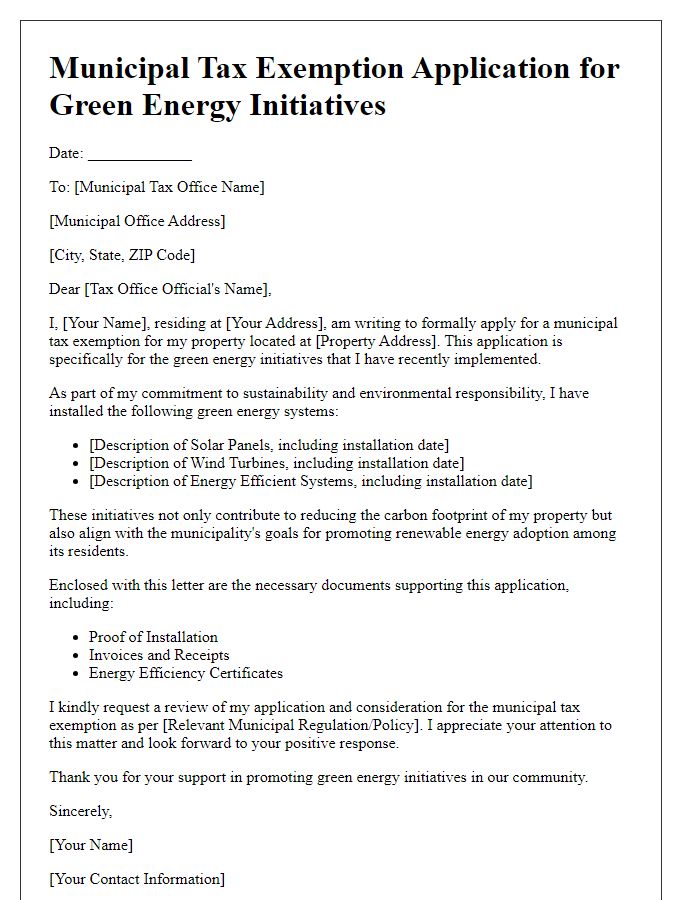

Property Details

Property details play a crucial role in assessing municipal tax exemption requests. Ownership documents must include accurate address details, such as 123 Main Street, Springfield, and tax identification numbers, typically a series of digits assigned to the property (e.g. 123-456-789). Assessment values, determined by local authorities, show the current worth of the property, which may range from $150,000 to $450,000 based on recent market evaluations in the region. Additionally, property type signifies whether it is residential, commercial, or agricultural, influencing eligibility for tax exemptions. Historical significance, such as designation as a landmark or listing in local heritage registers, can also provide grounds for exemption consideration, enhancing the request's validity. Documented compliance with local regulations, including occupancy licenses and zoning classifications, strengthens the claim and demonstrates adherence to municipal requirements. State the specific reason for requesting the exemption, such as charitable use, community service, or financial hardship, to align with municipal guidelines for consideration.

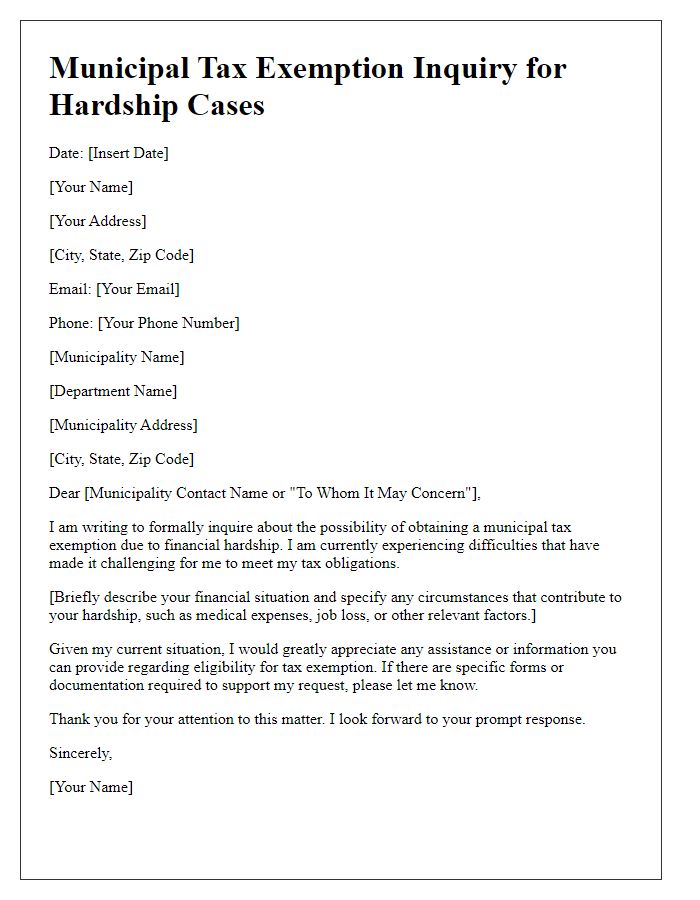

Reason for Exemption Request

Many municipalities provide tax exemptions for certain entities, such as non-profit organizations, educational institutions, and religious groups. Understanding local regulations is essential for making a valid exemption request. Exemptions often depend on specific criteria, including the type of service provided to the community, the financial status of the applicant, and the potential benefits to local residents. Event examples can include local charity events, educational workshops, and community service programs that aim to improve residents' quality of life. Providing evidence of public benefit through documented attendance figures or testimonials from community members strengthens the case. Detailed financial statements may demonstrate the organization's limited funds, supporting the need for tax relief. Knowing the time frame for submission is crucial, as municipalities typically have deadlines each fiscal year for processing these requests.

Supporting Documentation

A municipal tax exemption request requires supporting documentation to substantiate eligibility, such as proof of income (tax returns or pay stubs from 2022), property ownership evidence (deed or mortgage agreement), and any relevant identification (driver's license or state ID). Additionally, documentation demonstrating the qualifying circumstances (disability certificates, veteran status papers, or proof of charitable status for non-profit organizations) strengthens the application. Municipal records indicating previous tax payments (tax bills or receipts) may also be necessary to establish a history of compliance. It is essential to gather and submit comprehensive, organized documentation that adheres to local requirements (specific forms or guidelines provided by the municipality) to ensure a smooth review process for the tax exemption request.

Contact Information

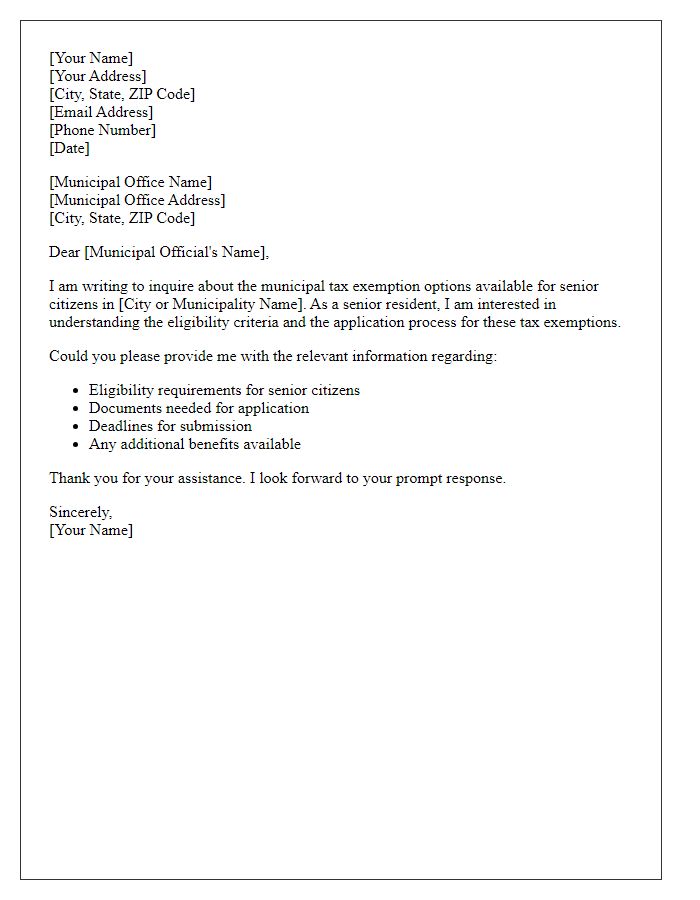

The municipal tax exemption request process requires accurate and detailed contact information for effective communication. This includes full name of the applicant, residential or business address (street, city, state, zip code), telephone number for direct contact, and an email address for electronic correspondence. In addition, the applicant must specify the type of exemption being sought (such as senior citizen, disabled veteran, or low-income) and any relevant identification numbers such as social security or tax identification numbers. Proper documentation must accompany the request, detailing the reason for the exemption, ensuring submission to the appropriate municipal office, usually the tax assessor's office, by stipulated deadlines to avoid penalties.

Letter Template For Municipal Tax Exemption Request Samples

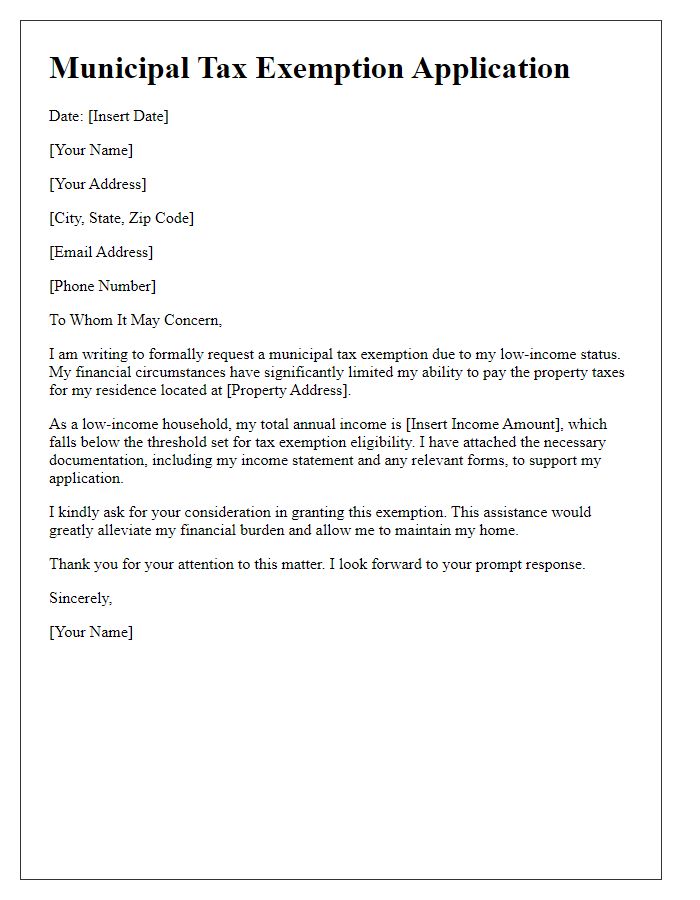

Letter template of municipal tax exemption application for low-income households

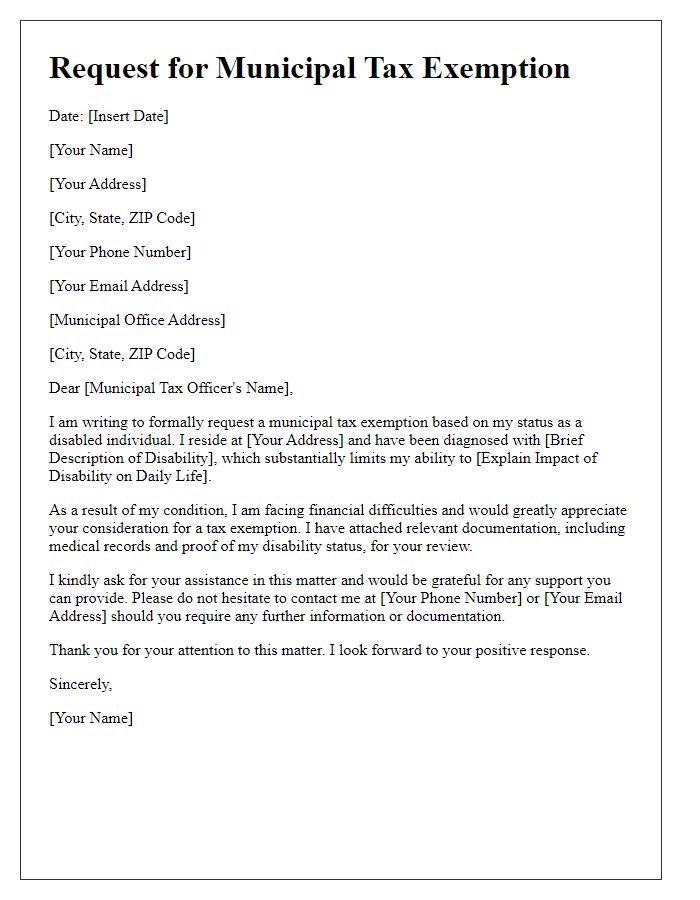

Letter template of municipal tax exemption request for disabled individuals

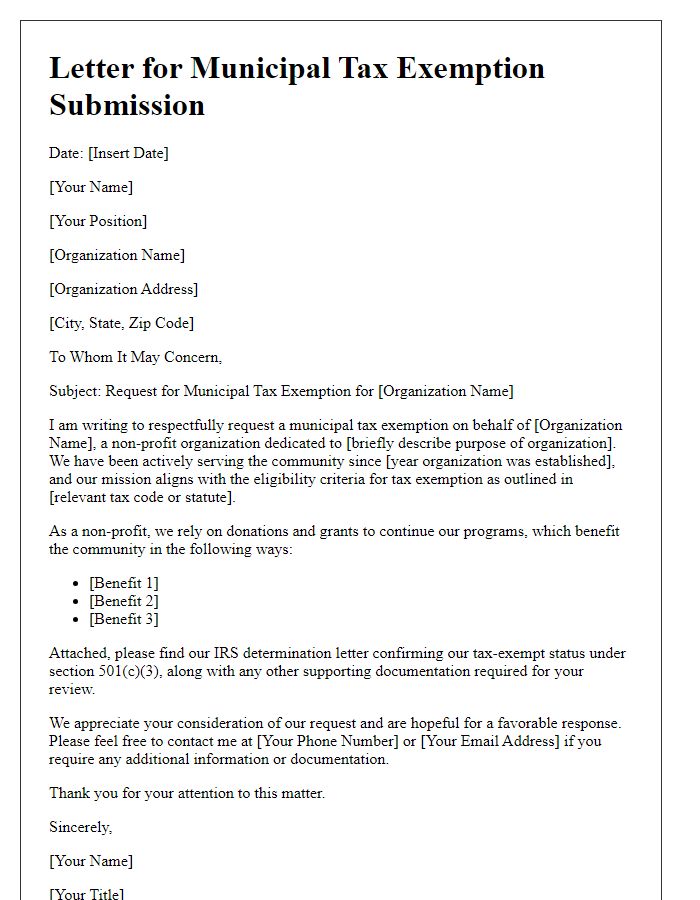

Letter template of municipal tax exemption submission for non-profit organizations

Letter template of municipal tax exemption petition for educational institutions

Letter template of municipal tax exemption form for agricultural properties

Letter template of municipal tax exemption request for home improvements

Comments