Thank you for your generous support! We are thrilled to acknowledge your donation, which plays a crucial role in helping us achieve our mission. Your contribution not only makes a significant impact but also inspires others to join our cause. We invite you to read more about the difference you're making in our community!

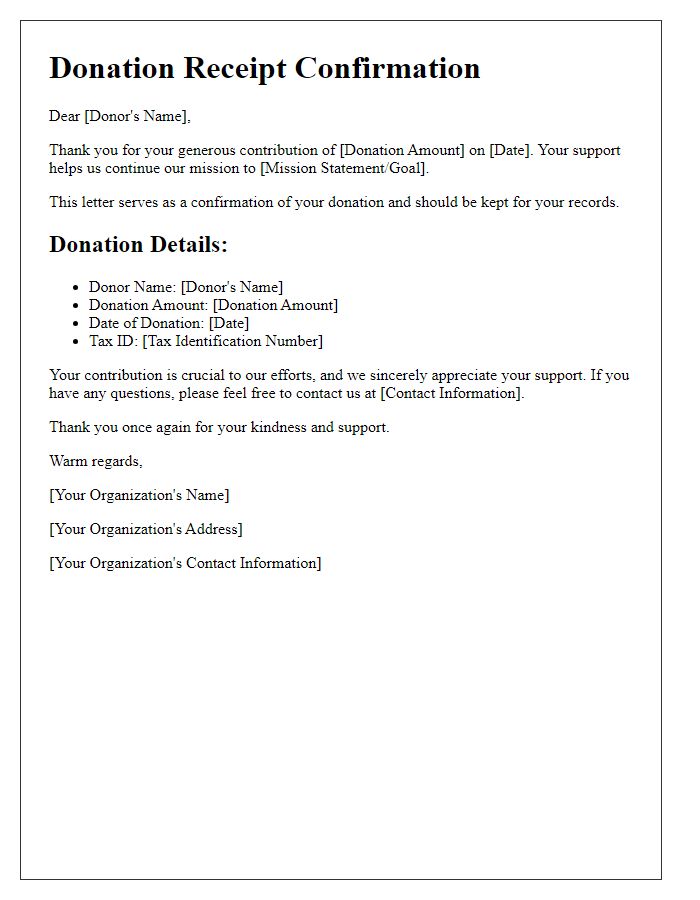

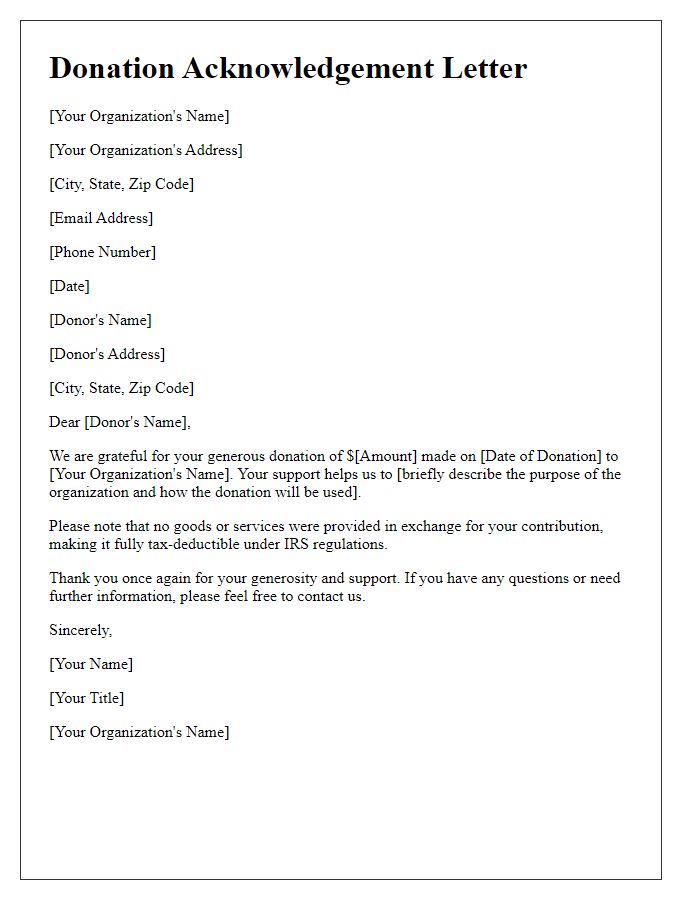

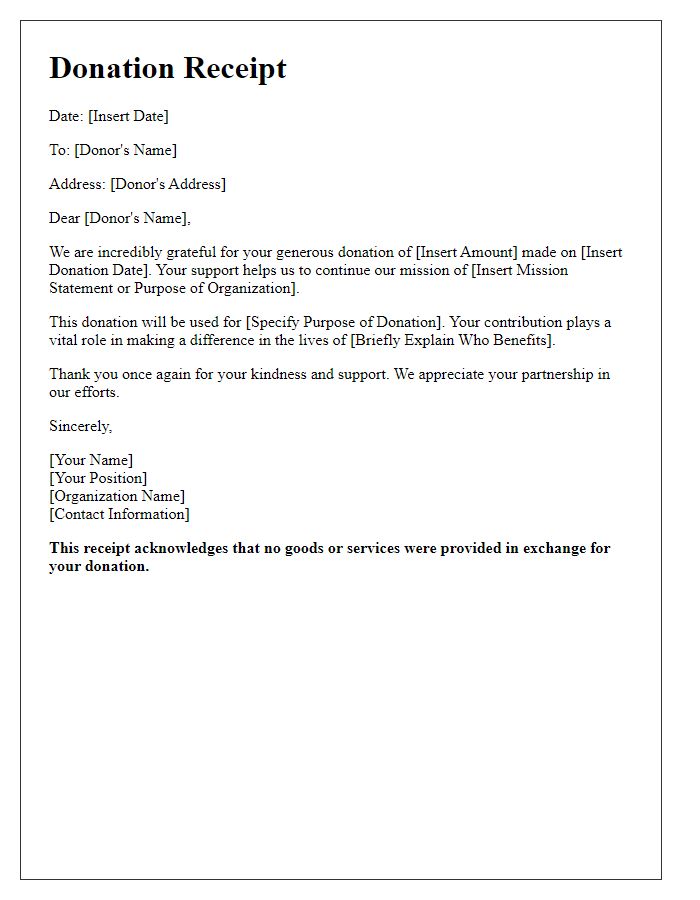

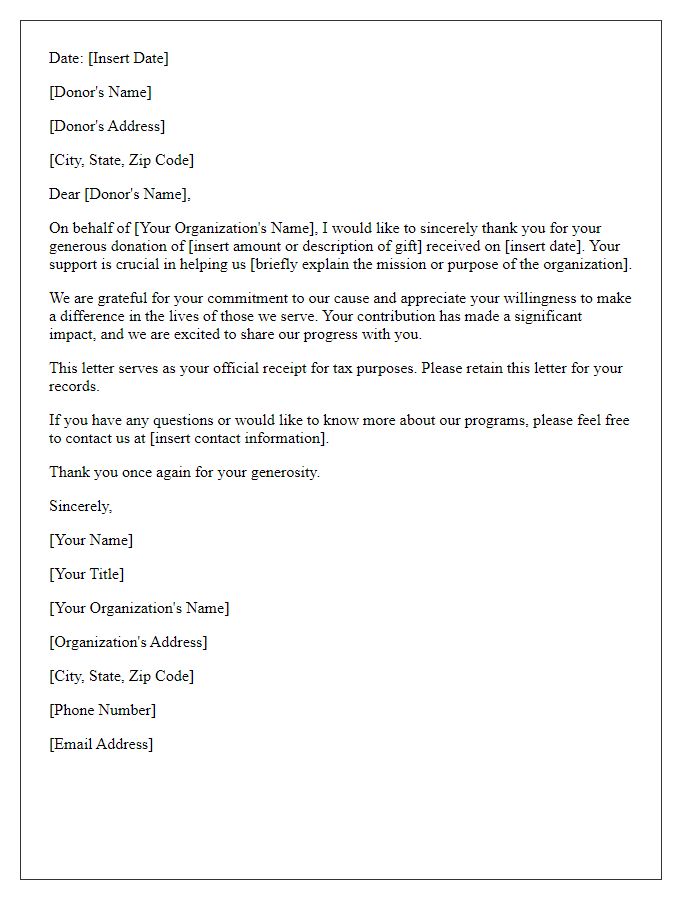

Donor's name and contact information

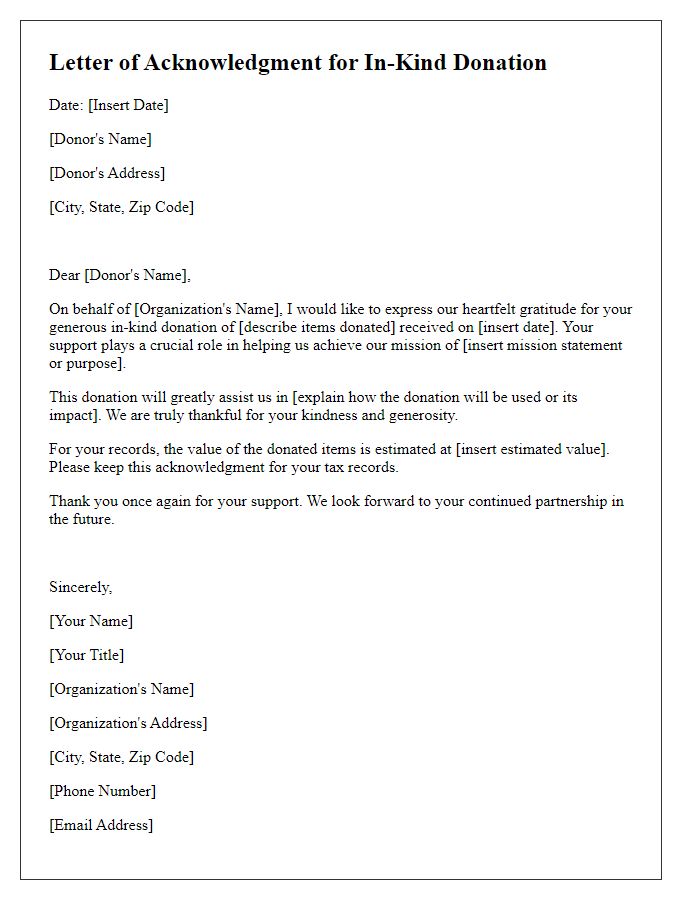

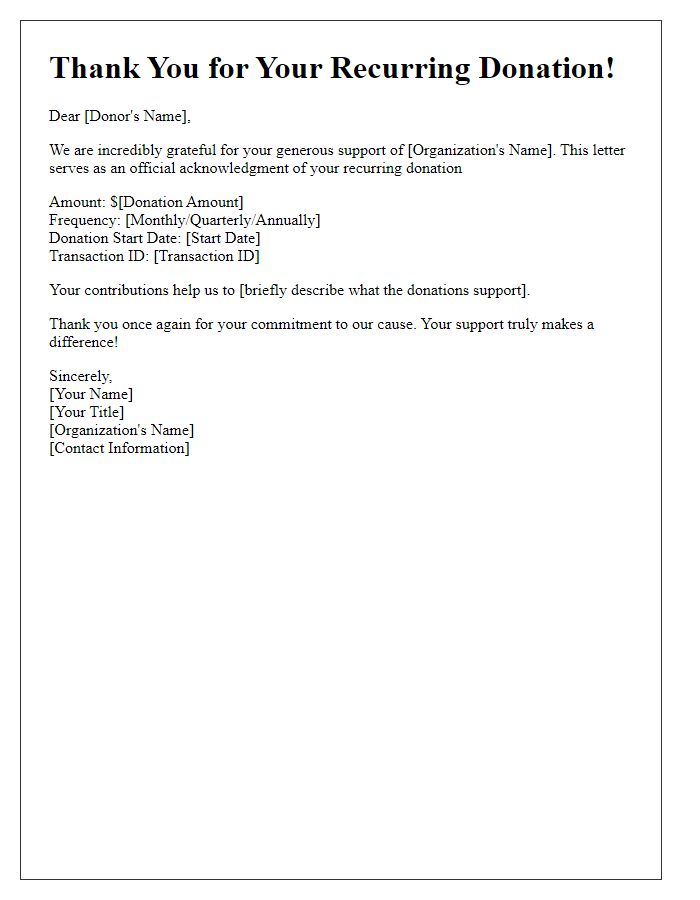

Donor recognition is critical in fostering ongoing relationships within nonprofit organizations. Providing a detailed donation receipt acknowledgment includes the donor's full name, address, and contact number to ensure accurate record-keeping and communication. For many charities, such as the Save the Children Foundation or the American Red Cross, these receipts serve as formal documentation for tax deductions. Including the donation amount, date of the transaction, and purpose of the contribution greatly enhances transparency. Charities often send receipts via email or traditional mail, reinforcing gratitude and establishing a warm connection with contributors, which increases the likelihood of future support.

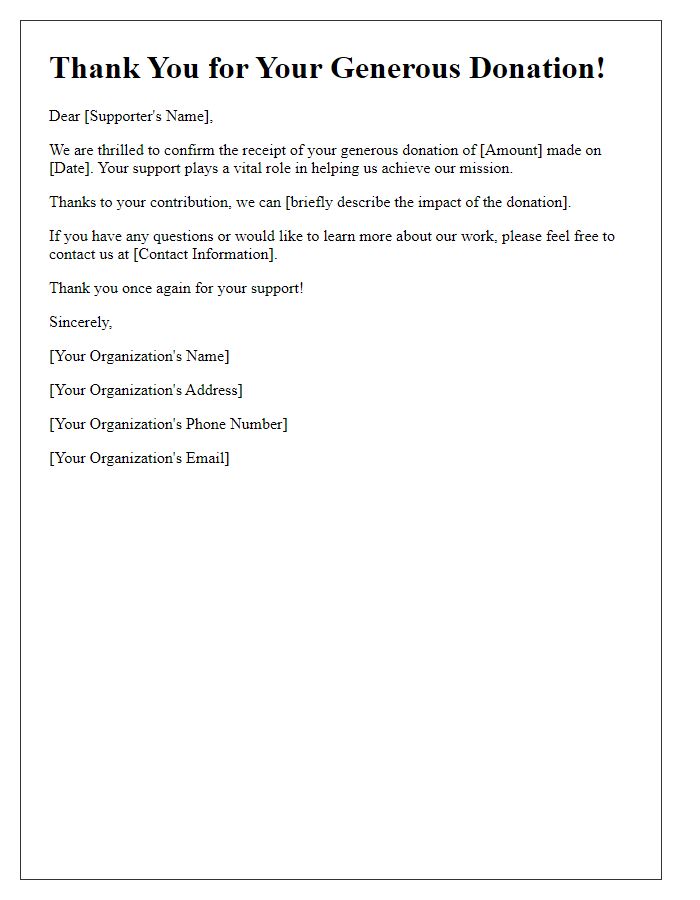

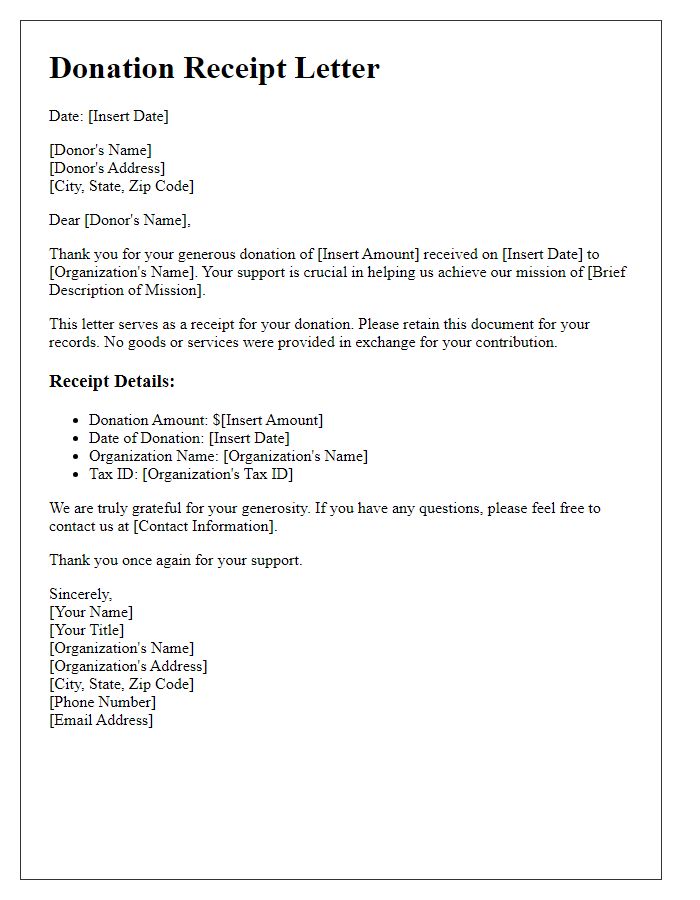

Amount and date of donation

Charitable organizations greatly appreciate donations, recognizing the vital support they provide. For instance, a donation of $100 made on October 15, 2023, can fund essential programs like food distribution or shelter maintenance. Accurate documentation is crucial for both donors and organizations, ensuring transparency and encouraging future contributions. Essential details for acknowledgment include the donor's name, donation amount, and giving date, which can be recorded for tax purposes. A formal receipt not only serves as a record but also reinforces the relationship between the donor and the organization, fostering continued partnership in charitable endeavors.

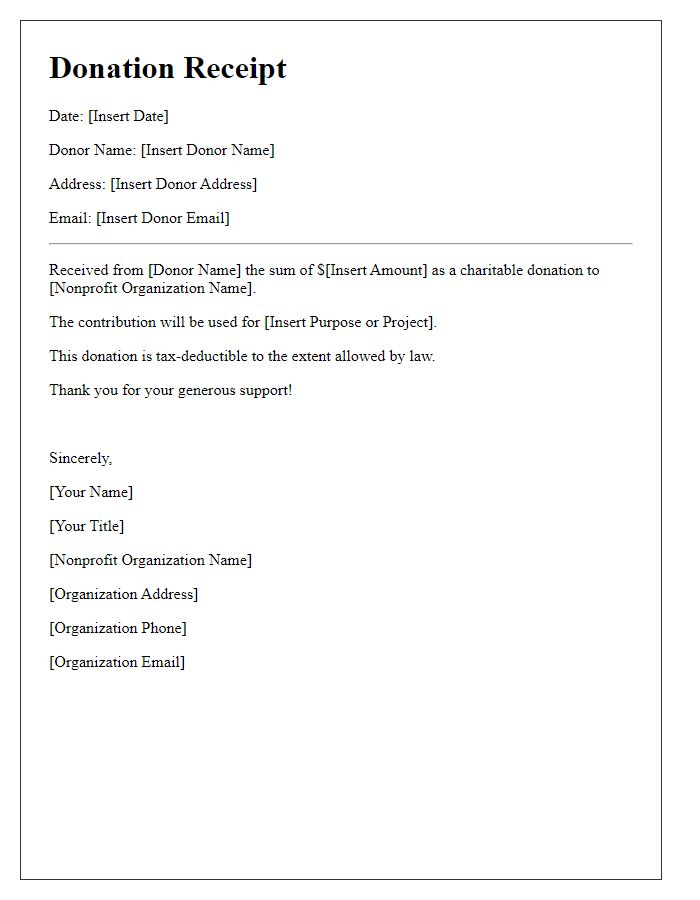

Organization's name and tax identification number

The organization "Helping Hands Charities" (Tax ID: 12-3456789) has received your generous donation of $100 on October 10, 2023, to support various community outreach programs aimed at alleviating poverty and providing education. Your contribution will directly assist in furthering our initiatives like the "Back to School Supplies Drive," where we aim to equip over 500 local children with essential school supplies this coming school year. This donation not only impacts the lives of those we serve but also qualifies for a tax deduction under IRS regulations for charitable contributions. Thank you for your continued support and commitment to making a difference.

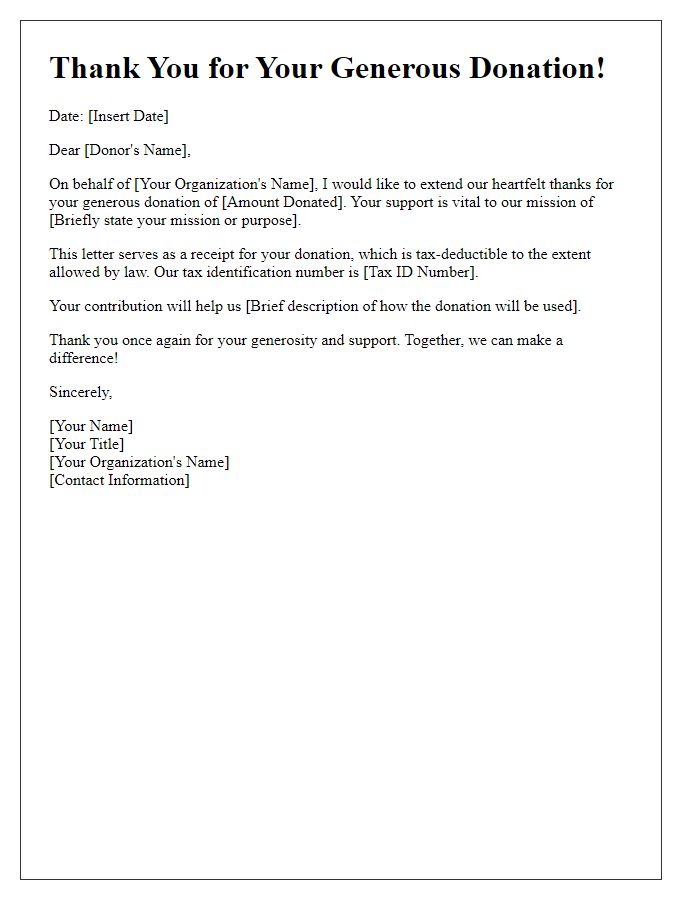

Statement of gratitude and acknowledgement

The generous donation of $500 received on October 1, 2023, from John Smith, a resident of Boston, Massachusetts, will significantly impact our nonprofit organization, Helping Hands. This contribution will directly support our upcoming community outreach program aimed at providing essential resources to low-income families in the greater Boston area. Each dollar contributes to purchasing food supplies, hygiene kits, and educational materials for children. We deeply appreciate the commitment shown by donors like John, whose support allows us to fulfill our mission of creating positive change and empowering those in need.

Statement of tax deductibility and any relevant legal details

Charitable donations play a crucial role in supporting non-profit organizations, enhancing community welfare, and promoting social causes. A tax-deductible donation receipt serves as an essential document, allowing donors to claim deductions on their federal income tax returns. According to the IRS guidelines, contributions made to 501(c)(3) organizations are eligible for such deductions. Donors should retain receipts indicating the date, amount donated, and the organization's tax-exempt status for their records. This documentation is vital during tax season, as it validates contributions and ensures compliance with regulations. Additionally, awareness of local laws governing charitable donations enhances transparency and encourages philanthropic engagements.

Letter Template For Donation Receipt Acknowledgement Samples

Letter template of donation receipt confirmation for charitable contributions

Comments