Are you approaching retirement and feeling a bit overwhelmed by the complexities of retirement benefits? You're not alone! Many individuals have questions about their entitlements, ranging from pension plans to healthcare options. In this article, we'll guide you through the essential steps to inquire about your retirement benefits, ensuring you're well-prepared for this exciting new chapter in your lifeâso let's dive in!

Contact Information

Contacting the Human Resources department of the company is essential for inquiring about retirement benefits. Employees should prepare their full name, employee identification number, and current contact information, including phone number and email address. It is vital to specify the purpose of the inquiry regarding retirement plans, such as 401(k), pension options, or health benefits after retirement. Mentioning the intended retirement date can provide additional context for the inquiry. Including any relevant documents, like pay stubs or previous retirement statements, may speed up the process. Ensuring the correct department, such as Benefits Administration or Retirement Services, is crucial for an effective response.

Subject Line

Subject Line: Inquiry Regarding Retirement Benefits Eligibility and Options

Personal Details

Employees wishing to inquire about retirement benefits often need to provide specific personal details to facilitate accurate processing. Essential personal details include full name, employee identification number (ID number issued by employer), date of birth (important for age-related benefits), and contact information (such as email and phone number). Employment details should also be included, such as the start date (indicating length of service), department (for organizational context), and job title (to understand the role and corresponding benefits). Providing this accurate and comprehensive information allows for a more efficient inquiry into retirement benefit entitlements and options.

Inquiry Specifics

Retirement benefits inquiry involves understanding pension plans, Social Security entitlements, and other financial provisions for employees aged 60 and older. Employers often provide detailed documents outlining the benefits accrued, eligibility criteria, and application processes. Key documents include the Summary Plan Description (SPD) that explains the specific retirement benefits available, any waiting periods, and how benefits are calculated based on years of service and salary history. Additionally, potential tax implications upon withdrawal, such as federal and state income taxes, can significantly affect the net benefits received. Engaging with the Human Resources department or a financial advisor can help clarify individual rights and options related to these retirement benefits.

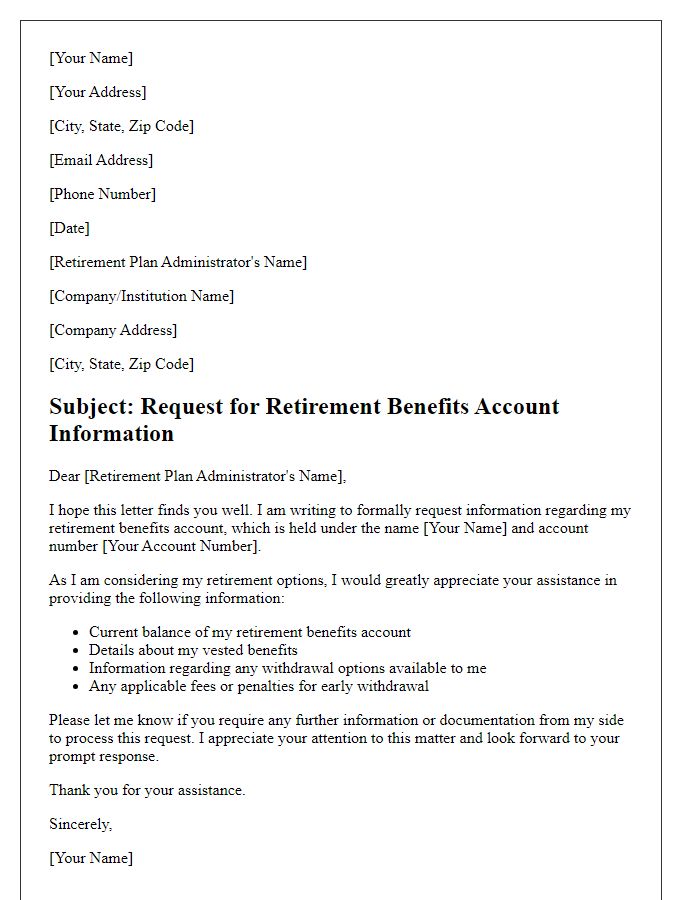

Request for Documentation

Retirement benefits inquiries often involve the detailed examination of specific documents and records related to an individual's employment history and accumulated benefits. Relevant documents include pension plan statements (issued by employers), Social Security statements (provided by the Social Security Administration), and eligibility verification forms (necessary to confirm eligibility for benefits). Additionally, contact information for human resources (HR) departments (which maintain records) can facilitate the request for documentation. The inquiry may include details such as the retirement date (typically marked by an official letter of resignation), the length of service (often calculated in years), and any specific benefit plans (like 401(k) or traditional pension plans) that the employee was vested in.

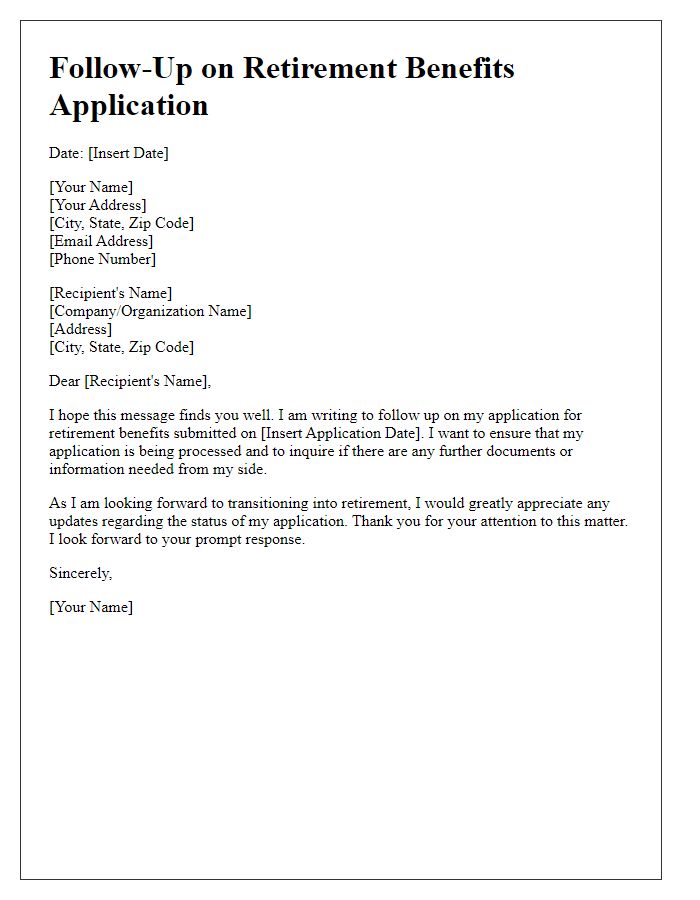

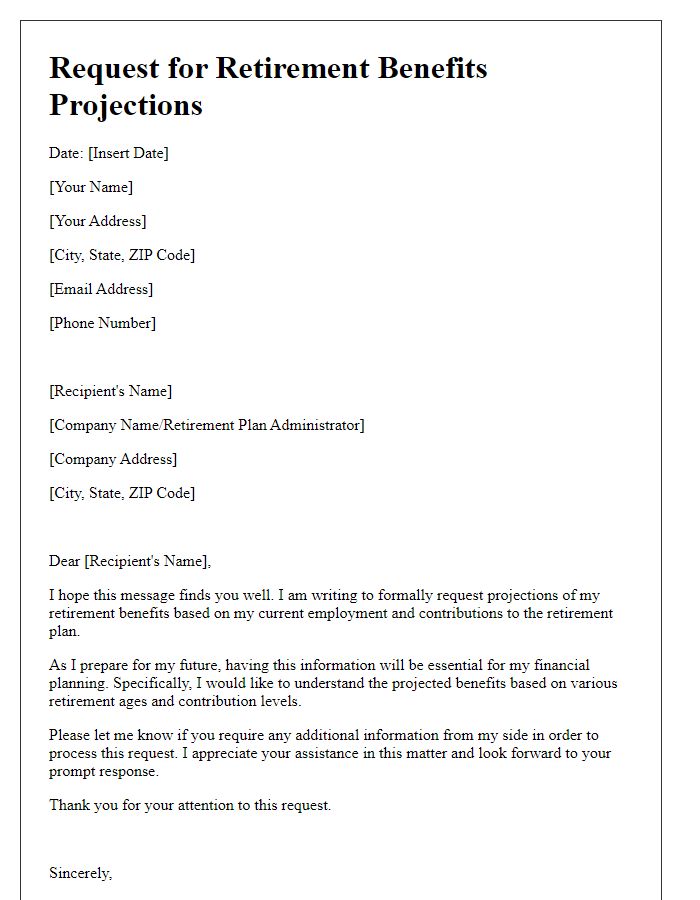

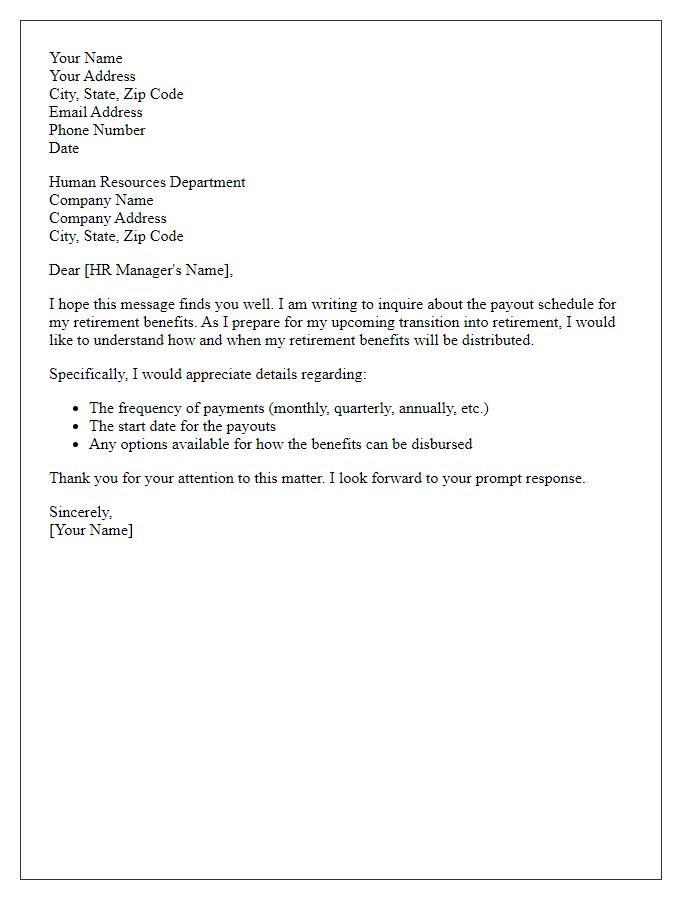

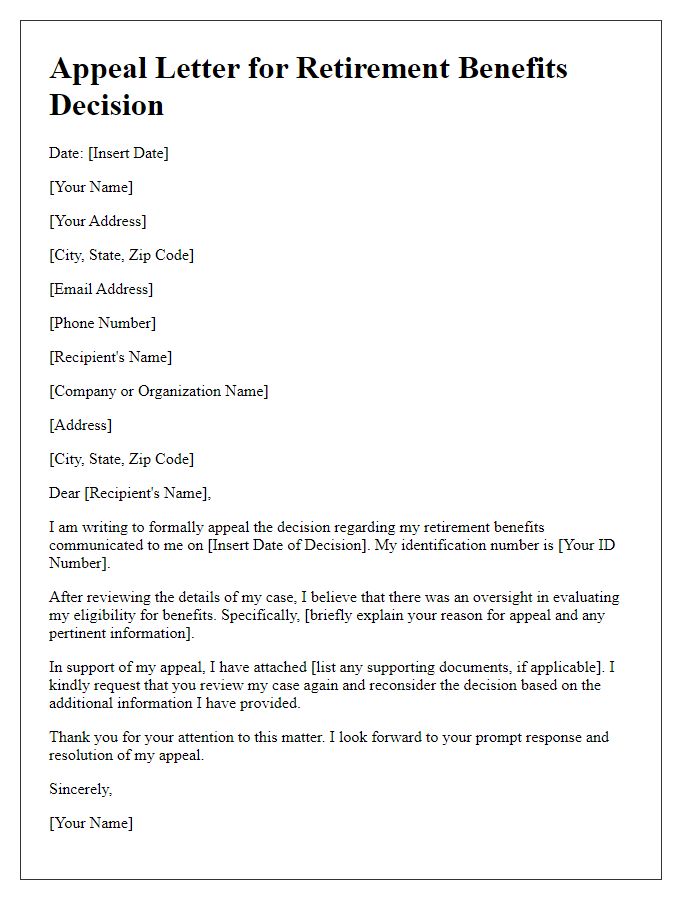

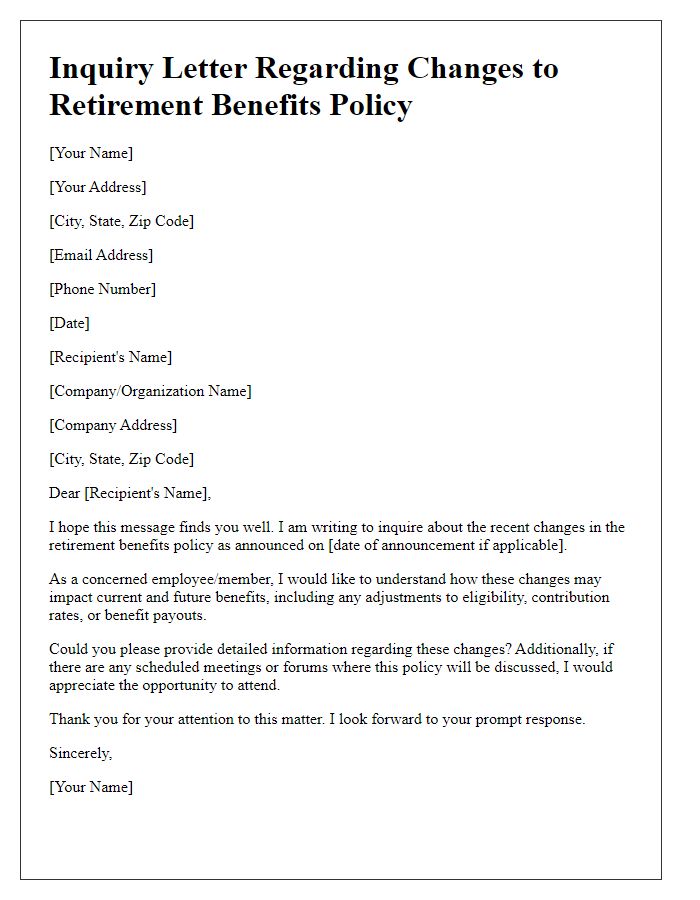

Letter Template For Retirement Benefits Inquiry Samples

Letter template of request for clarification on retirement benefits options.

Letter template of inquiry about retirement benefits documentation requirements.

Letter template of question about retirement benefits eligibility criteria.

Comments