Are you curious about your eligibility for medical benefits but not sure where to start? Understanding the ins and outs of medical benefit eligibility can feel overwhelming, but it doesn't have to be. In this article, we'll walk you through a simple template for inquiring about your medical benefits, ensuring you have all the information you need to make informed decisions. So, grab a pen and paper, and let's dive into the details!

Patient Information

Patient information forms a critical component in determining medical benefit eligibility within healthcare systems. Essential details include full name, often listed as it appears on legal documents, date of birth, typically formatted as MM/DD/YYYY, and Social Security number, which serves as a unique identifier within health records. Address information encompasses street address, city, state, and ZIP code, ensuring accurate communication. Insurance details include the name of the insurance provider, policy number, and group number, allowing verification of coverage. Additionally, the inclusion of medical history, upcoming appointments, and current medications can aid in assessing specific eligibility criteria for benefits and necessary medical services. Individual patient identification ensures the accuracy of coverage claims and eligibility determination.

Provider Details

A medical benefit eligibility inquiry involves gathering specific information about healthcare providers to determine coverage and benefits. Key details include the provider's name, such as Dr. Jane Smith, a physician specializing in internal medicine. The National Provider Identifier (NPI) number is crucial for identification; for instance, Dr. Smith's NPI could be 1234567890. Contact information, including a telephone number (e.g., 555-123-4567) and mailing address (like 123 Health Avenue, Suite 100, Springfield, IL), are necessary for communication. The practice's tax identification number (TIN) also aids in confirming the provider's registration with Medicare or Medicaid, ensuring eligibility verification aligns with specific healthcare plans.

Treatment or Service Description

Medical benefit eligibility inquiries often revolve around specific treatments or services, such as physical therapy, surgical procedures, or diagnostic imaging. Physical therapy involves rehabilitation services designed to improve movement and function, typically after an injury or surgery, and can include various techniques like manual therapy and exercise programs. Surgical procedures range from minimally invasive techniques, such as laparoscopic surgery, to more extensive operations, like joint replacements, often requiring pre-authorization based on medical necessity evaluations. Diagnostic imaging, including MRI (Magnetic Resonance Imaging) and CT (Computed Tomography) scans, provides essential insights into medical conditions and typically requires justification for insurance coverage based on symptom severity and physician referrals. Understanding these parameters is crucial for navigating insurance benefits efficiently.

Medical Necessity Justification

Medical benefit eligibility often hinges on the concept of medical necessity, defined as services or treatments essential for diagnosing, preventing, or treating a medical condition. Health insurance providers evaluate requests based on established clinical guidelines and data, including the specific diagnosis (e.g., diabetes, hypertension), recommended procedures (like surgery or physical therapy), and associated costs. For instance, surgeries typically warrant extensive justification due to potential risks and costs, including inpatient stays, anesthesia, and follow-up care. Proper documentation from healthcare professionals, outlining the supporting medical evidence and prior treatment failures, greatly influences eligibility outcomes. Moreover, the regulatory environment, including state and federal laws, can impact the criteria used by insurers, making thorough knowledge of these factors critical for successful appeals.

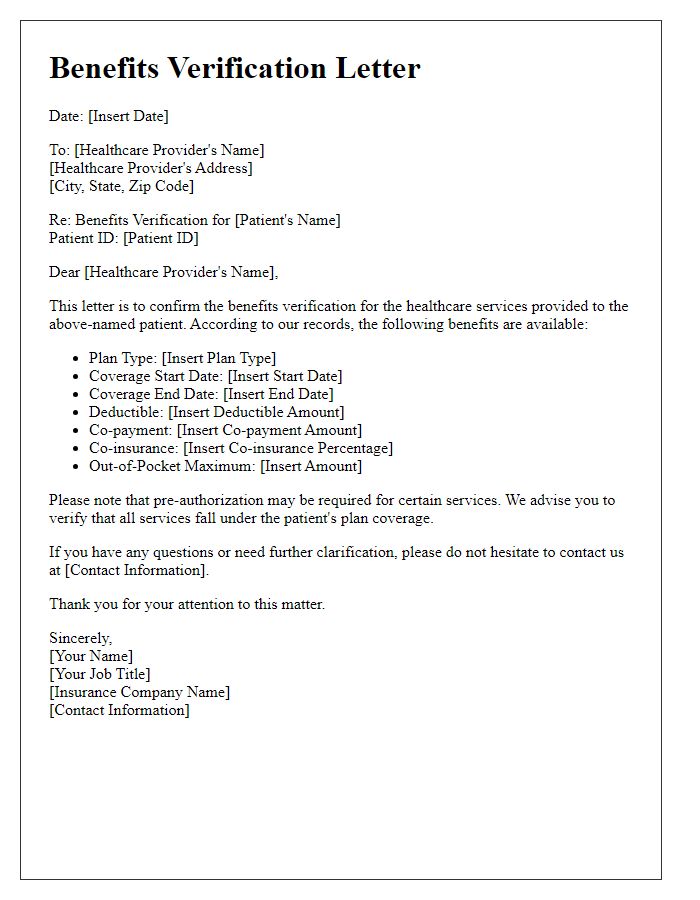

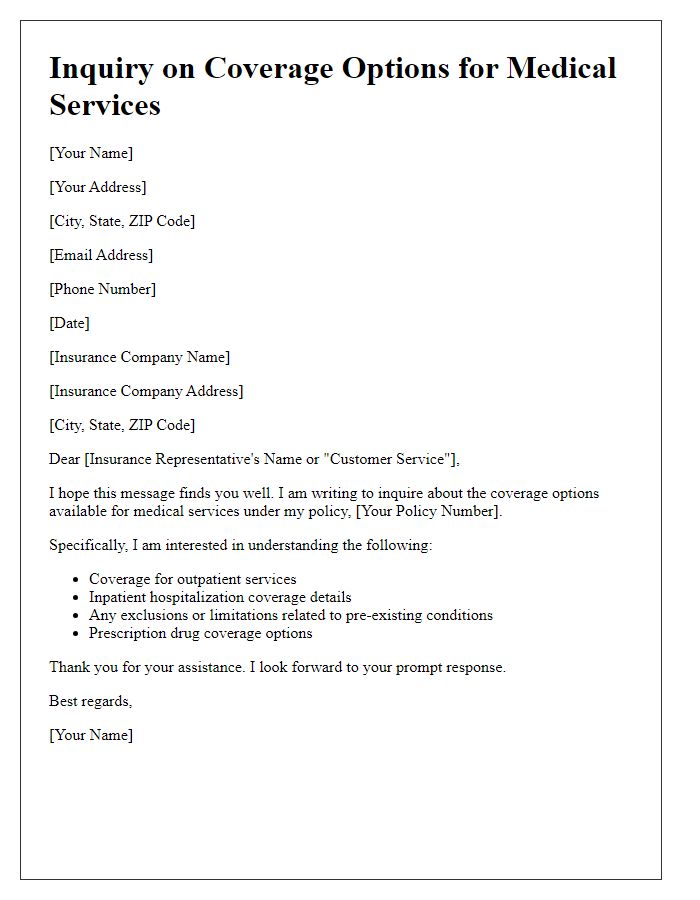

Insurance Policy Details

Insurance policy details play a crucial role in determining medical benefit eligibility. Each policy, such as PPO (Preferred Provider Organization) or HMO (Health Maintenance Organization), has specific coverage requirements impacting access to healthcare services. Important variables include deductible amounts (the out-of-pocket costs before coverage kicks in), copayment values (fixed fees for specific services), and coinsurance percentages (the shared costs after the deductible). Policies often have in-network and out-of-network distinctions, affecting benefits based on service providers' affiliations. Furthermore, coverage for pre-existing conditions, maximum lifetime benefits, and specific excluded services significantly influence eligibility outcomes. Understanding these details is essential for both healthcare providers and patients navigating the complexities of their health insurance landscape.

Comments