Are you feeling a bit overwhelmed by the ever-changing landscape of health insurance? You're not alone! Many individuals find themselves in need of updated information to ensure they have the best coverage available. In this article, we'll guide you through the essential steps for a smooth health insurance information update, so you can make informed decisions about your healthcare optionsâso keep reading!

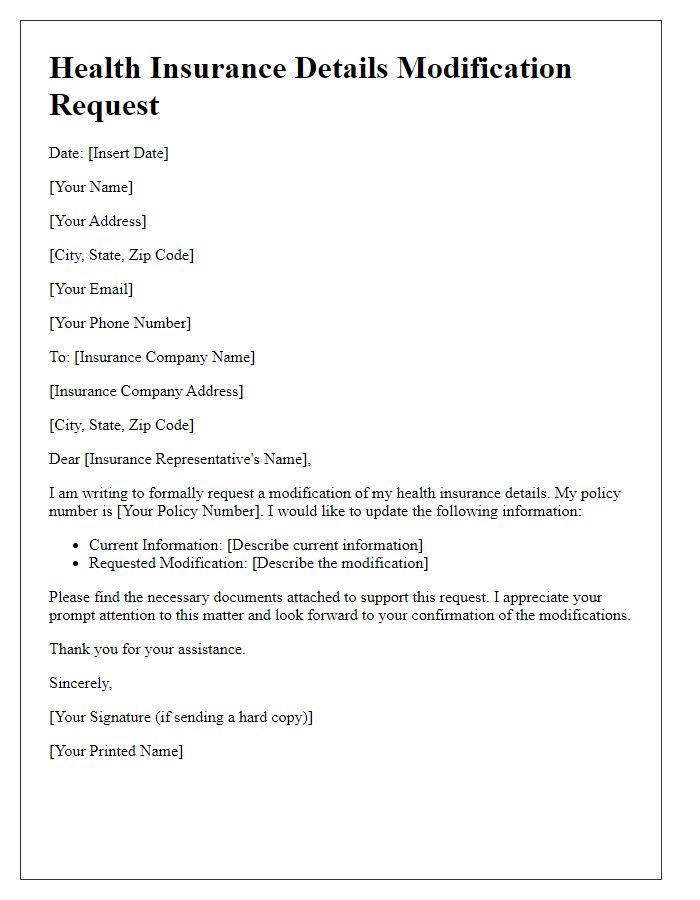

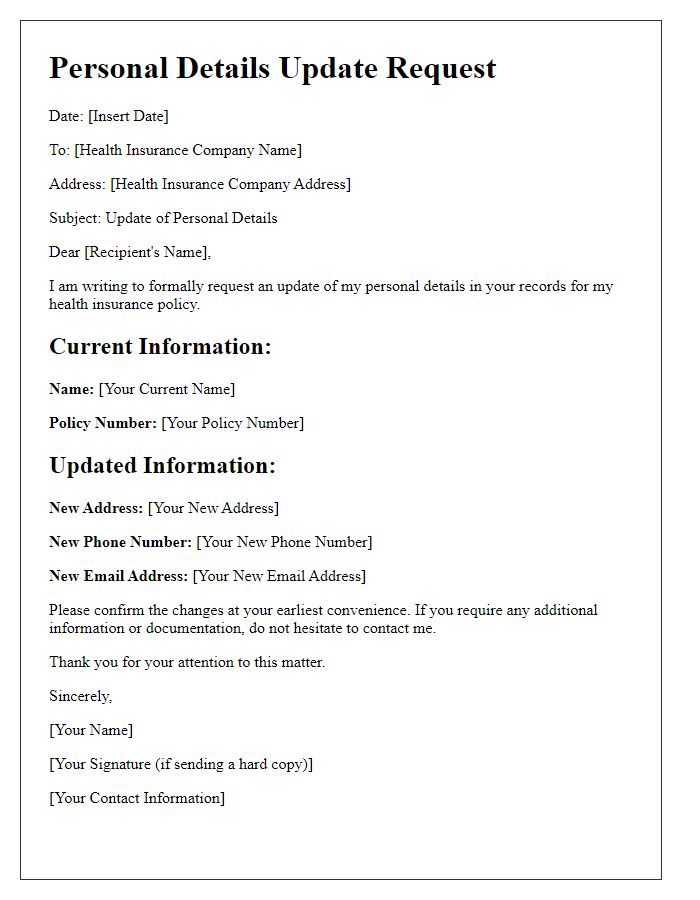

Personal Information Update

Updating personal information in health insurance records is crucial for accurate coverage and communication. Individuals must notify their health insurance provider, such as UnitedHealthcare or Aetna, of changes including address, phone numbers, or marital status. For instance, moving to a new address can impact the network of available providers and coverage options. A change in marital status can affect premiums and dependents covered under the plan. Timely updates prevent complications during claims processing and ensure members receive essential information regarding benefits and policy changes. Failure to update could lead to lapses in coverage or higher out-of-pocket expenses.

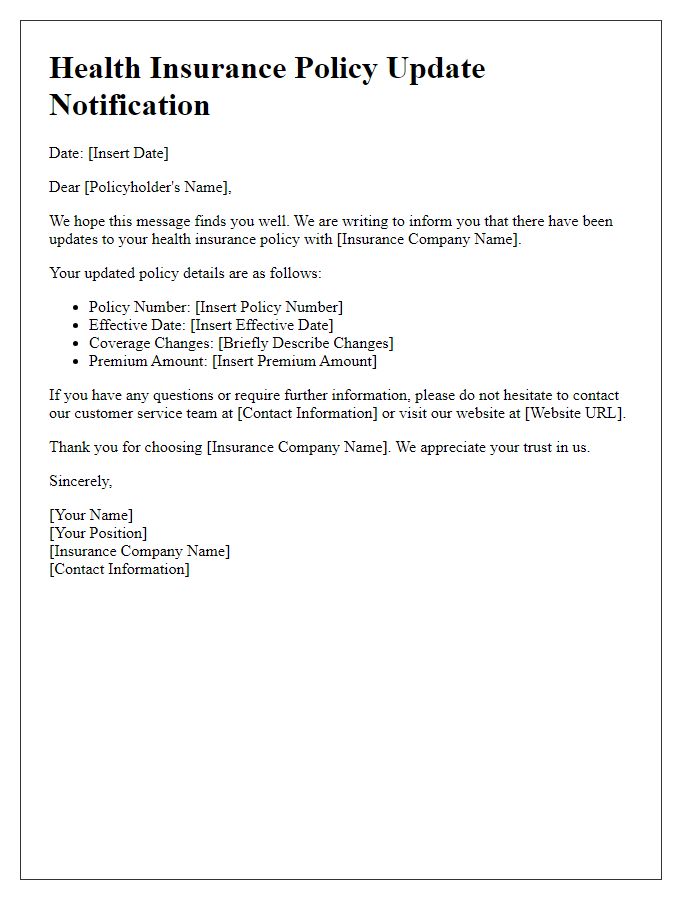

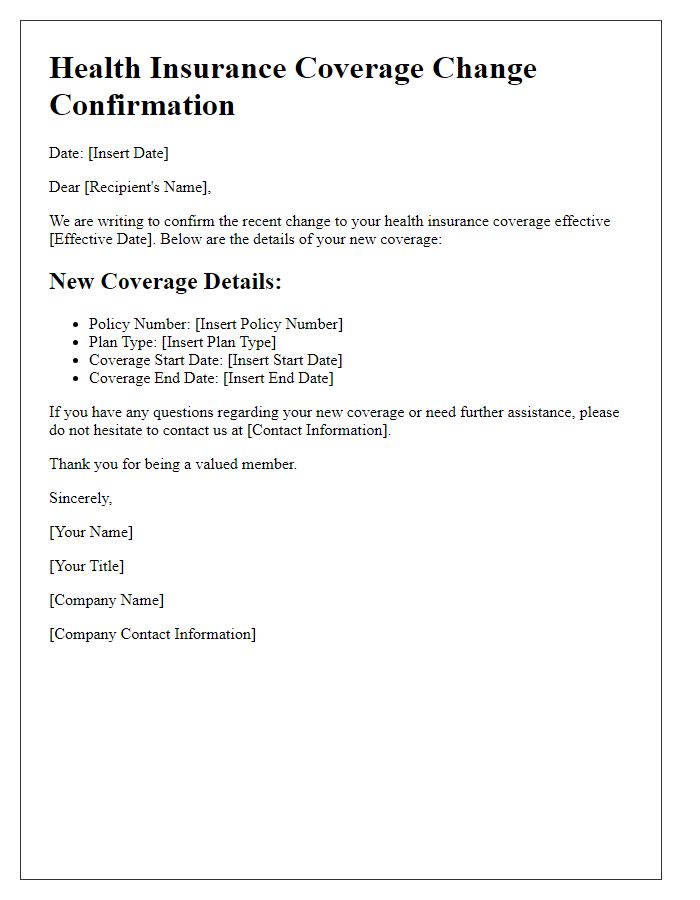

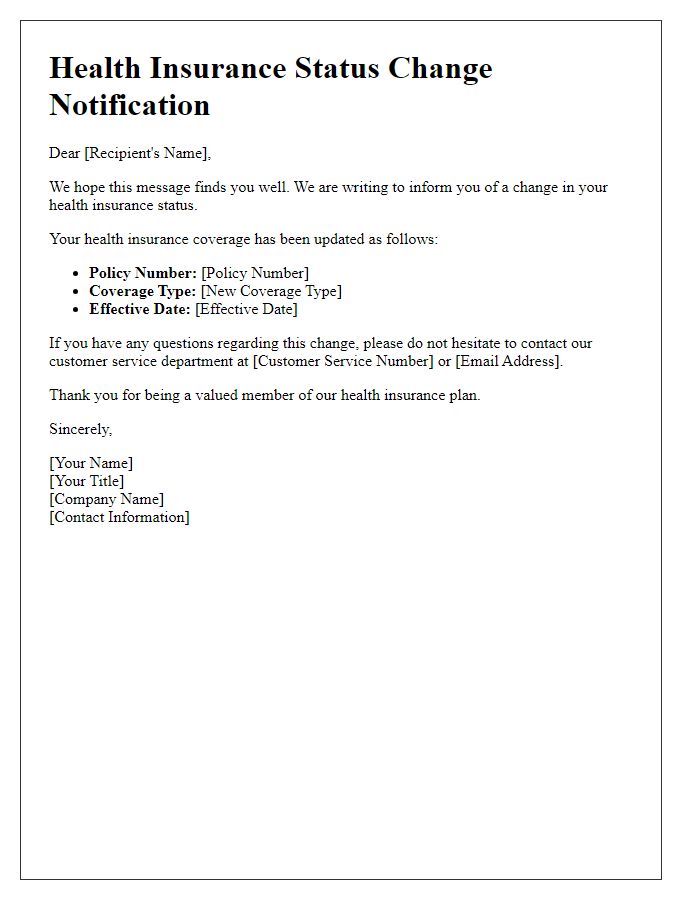

Policy Details and Coverage

Updating health insurance information is essential for policy accuracy and ensuring medical needs are met. Policy details include unique identifiers, such as policy number, effective dates, and coverage limits. Each coverage aspect requires careful attention, encompassing outpatient services, emergency care, prescription medications, and preventive treatments. Notable exclusions, such as cosmetic procedures or experimental treatments, should also be clearly defined. Maintaining communication with the insurance provider (for instance, Blue Cross Blue Shield or UnitedHealthcare) facilitates understanding of benefits and options for additional coverage. Regular updates to personal information, like address or dependent status, ensure coverage remains valid and accessible.

Contact Information Revision

Inaccurate health insurance contact information can lead to delays in service and claim processing. For example, a change of address may prevent important correspondence from reaching policyholders promptly, especially when notifications about coverage updates are sent to outdated addresses. Similarly, incorrect phone numbers can hinder communication with customer service representatives, causing frustration during urgent situations. Regular updates to this information are crucial, particularly after significant life events such as marriage, relocation, or changes in employment, which often necessitate revising policy details to ensure uninterrupted coverage. Keeping email addresses current is equally important for receiving electronic statements or policy notices.

Effective Date of Changes

Health insurance policies often require updates to ensure that the information is accurate and current. The Effective Date of Changes signifies when modifications to coverage or personal details will take effect, typically 30 to 60 days after a request or notification. Accurate record-keeping for health insurance, which includes policy numbers, beneficiary information, and coverage types (like medical, dental, or vision), is essential for smooth claim processing and to avoid disruptions in service. Changes may involve adjustments in premiums or benefits, influencing care access across various healthcare providers or facilities. Understanding this timeline is crucial for policyholders navigating transitions within their coverage or family health needs.

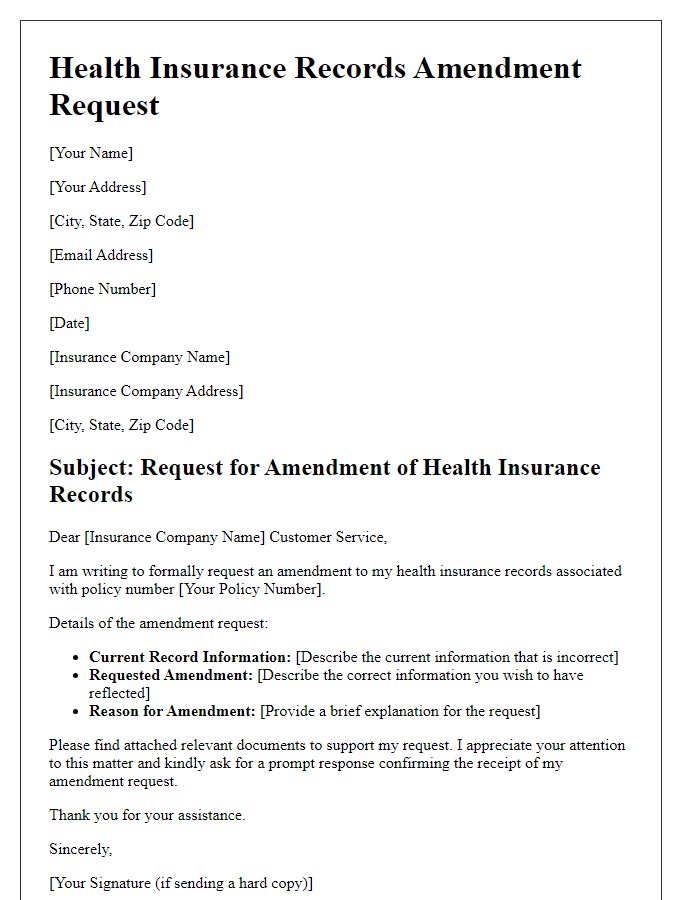

Signature and Authorization

Health insurance information updates require a signed authorization that allows the insurance provider to access personal medical data. A signature acts as a binding consent, necessary for compliance with the Health Insurance Portability and Accountability Act (HIPAA) regulations. This authorization typically includes specific details, such as the patient's full name, policy number, and date of birth, ensuring that the right information is updated. Additionally, it may cover the types of information being shared, including medical records and billing details. The process often involves submitting this signed document to either the insurance company's mailing address or through their secure online portal, depending on the provider's procedures. Proper documentation is crucial to maintain accurate records and ensure timely processing of claims or changes in coverage.

Comments