Are you curious about how your health insurance benefits measure up? It's essential to periodically review your coverage to ensure you're making the most out of what's available to you. Understanding the ins and outs of your plan can lead to better health management and potential savings. Join us as we dive deeper into how to effectively assess your health insurance benefits!

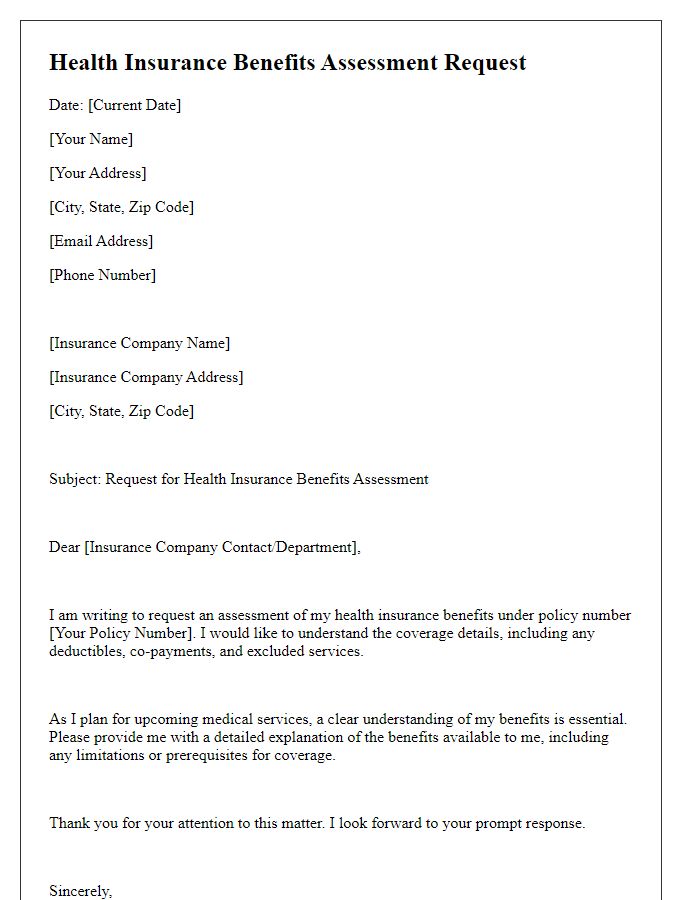

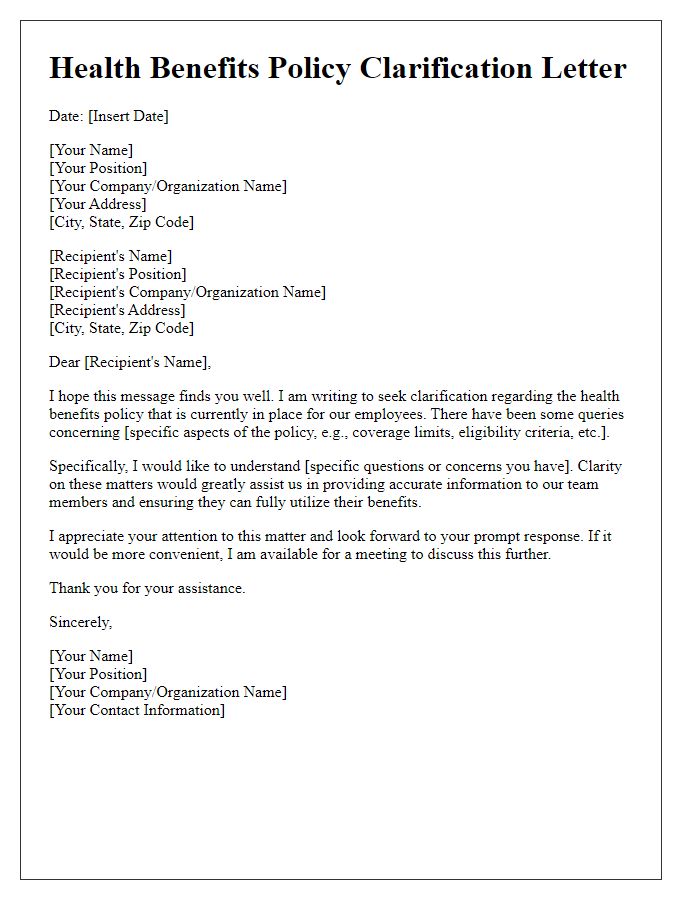

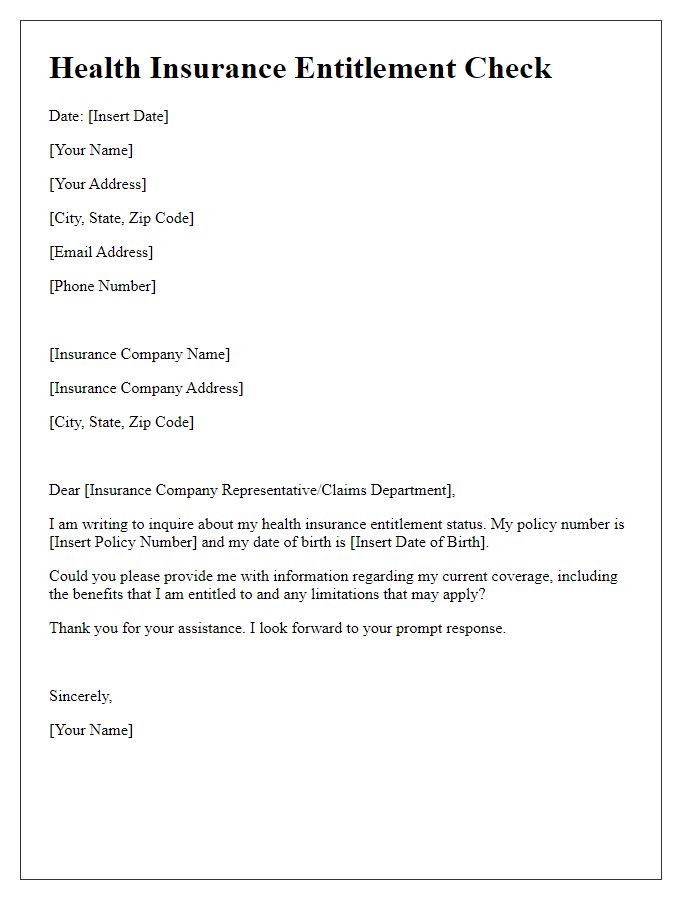

Policyholder Information

Health insurance benefits review requires detailed information about the policyholder's coverage plan and specific benefits. Important factors include the policyholder's name, policy number, and effective date of the insurance coverage. Additional information should include the type of plan (e.g., HMO, PPO) and details about coverage limits and exclusions. Medical conditions, treatment history, and recent healthcare services utilized (such as hospital visits, outpatient procedures) must be documented for a comprehensive understanding of the benefits available. It is crucial to gather data on dependent information and any recent claim submissions to evaluate the status of current coverage accurately. This systematic approach enables insurance representatives to provide a thorough assessment of health benefits for the policyholder.

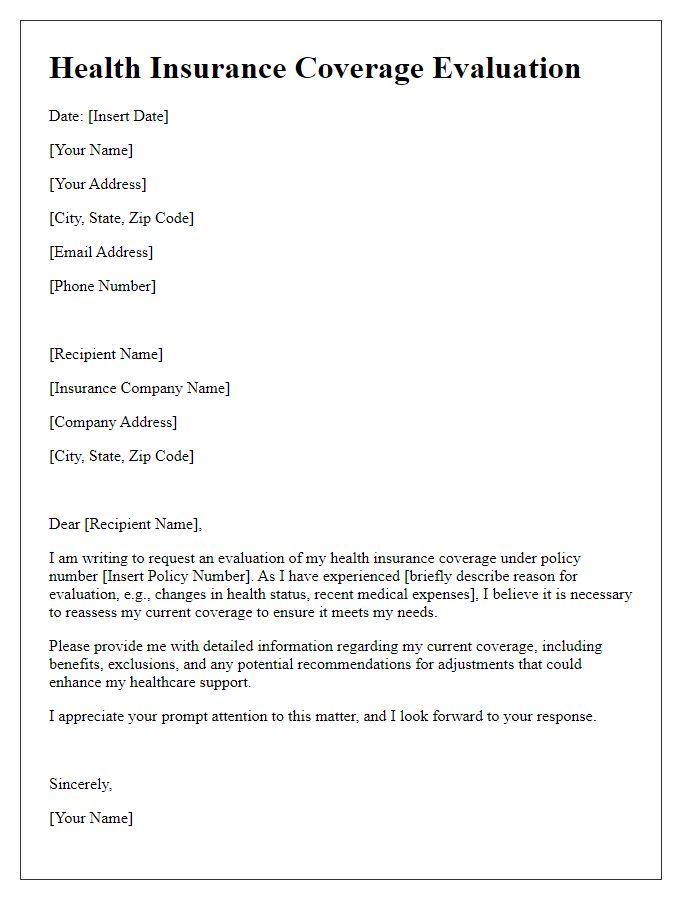

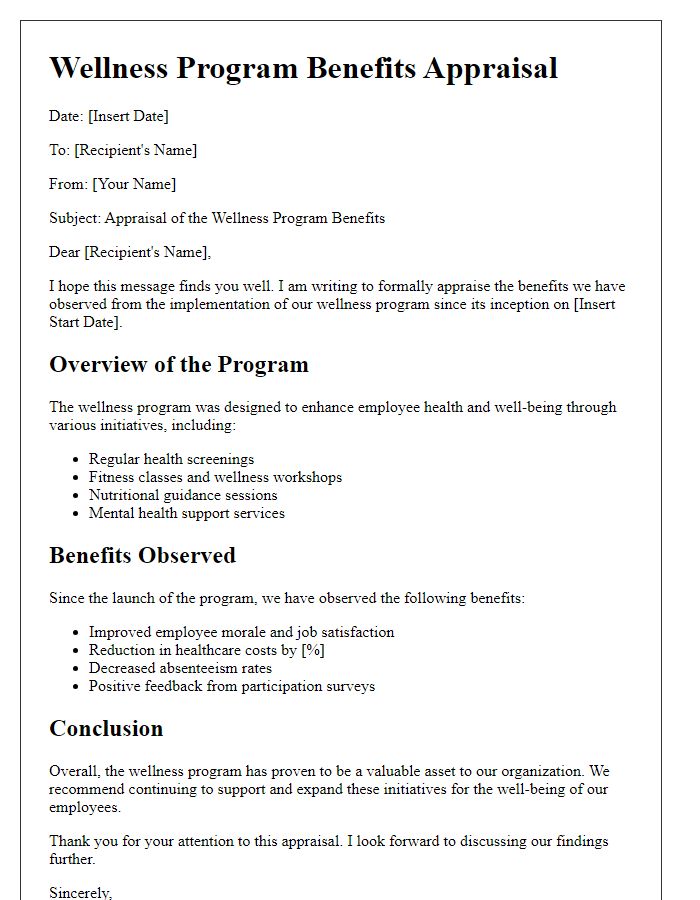

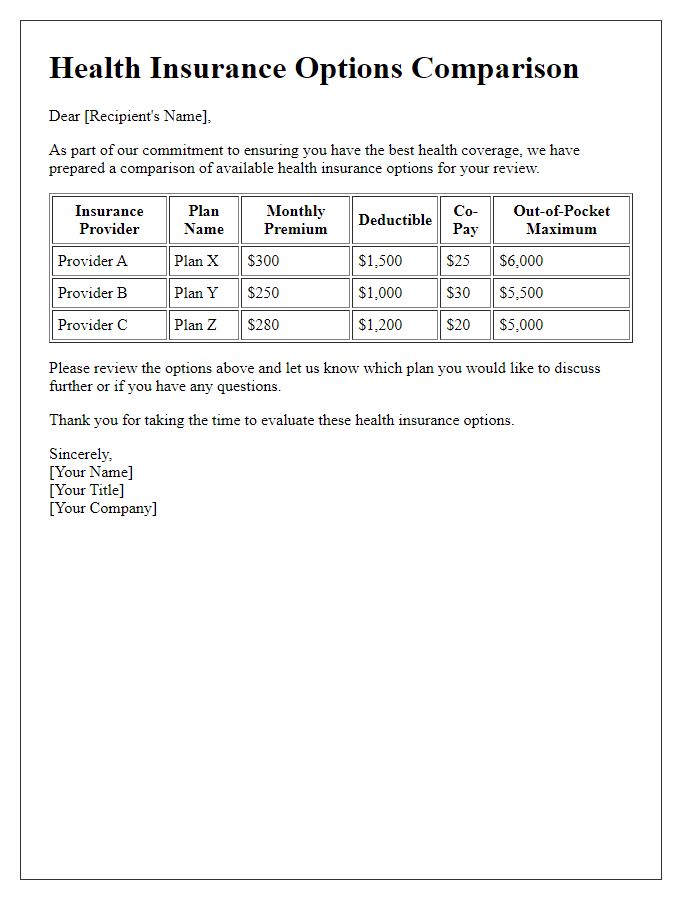

Coverage Details

Health insurance plans, such as Preferred Provider Organizations (PPO) or Health Maintenance Organizations (HMO), provide varying coverage levels for medical services. Essential coverage typically includes regular check-ups, preventive screenings, and necessary surgeries, with most plans adhering to the guidelines set forth by the Affordable Care Act (ACA). Standard policies often comprise a network of participating healthcare providers such as hospitals, specialists, and primary care physicians, which can impact out-of-pocket costs. Additional details, such as copays and deductibles, are critical in understanding total expenses associated with specific treatments. It's essential to review the Summary of Benefits and Coverage (SBC) provided by the insurer to grasp the limitations, exclusions, and any required authorizations for certain services, ensuring proper compliance with health care provisions.

Medical Necessity

Health insurance benefits reviews often require an emphasis on medical necessity to ensure coverage for treatments or procedures. Medical necessity refers to healthcare services or supplies that are suitable and effective for the diagnosis or treatment of a patient's condition, considering generally accepted standards of medical practice. Specific guidelines established by organizations such as the American Medical Association (AMA) and the Centers for Medicare & Medicaid Services (CMS) help determine the criteria for medical necessity. Documentation, such as physician's notes, diagnostic tests, and treatment plans, must clearly justify the need for services. Furthermore, it is essential for insurance companies to evaluate both the clinical efficacy and cost-effectiveness of proposed treatments to ensure compliance with policies surrounding benefits coverage. Properly addressing medical necessity can considerably impact the approval of claims and access to crucial health services for patients.

Billing Codes and Amounts

The process of reviewing health insurance benefits involves an analysis of billing codes and associated amounts. Billing codes, such as CPT (Current Procedural Terminology) codes, categorize medical services and procedures for reimbursement from health insurers. Each procedure, ranging from routine evaluations to complex surgeries, is assigned a specific code that reflects its complexity and resource needs. For instance, a standard office visit may use code 99213, while a comprehensive surgical procedure could be coded as 64721. Additionally, analyzing amounts linked to these codes is crucial, as they determine the financial responsibility of both the insurance provider and the patient. Average payments for these services can vary significantly based on geographic location, insurance plan stipulations, and negotiated rates, leading to discrepancies in patient bills and potential out-of-pocket costs. Careful examination of these codes and amounts is essential for ensuring accurate insurance claim processing and preventing billing errors.

Review and Appeal Process

Health insurance benefits reviews are critical for ensuring that patients receive the full range of services covered under their policies, especially following significant medical events like surgeries or treatments. Understanding the review and appeal process can significantly impact claim outcomes. The initial step involves submitting a written request to the insurance provider, including relevant details such as policy numbers, treatment dates, and specific services denied. The health insurance company, like Anthem or Blue Cross Blue Shield, typically has 30 days to respond to the request. If the claim remains denied, patients can initiate an appeal, which may require additional documentation, such as medical records or service notes from healthcare providers. Specific state regulations, like those outlined in the Affordable Care Act, may also influence the timeline and procedures for the appeal. Successful navigation of this process can lead to overturned decisions and enhanced access to necessary medical care.

Comments