Welcome to our guide on crafting the perfect letter for confirming your medical insurance! This essential document not only provides peace of mind but also ensures that you're fully aware of your coverage details. Whether you're reaching out to your provider or verifying your policy, having a clear and concise letter is crucial. So, let's dive in and explore some practical tips and templates to help you get started!

Patient's Full Name and Identification Number

Confirmation of medical insurance provides essential details for patients' financial coverage and health security. Patient's full name, such as John Doe, and identification number, for example, 123456789, play a crucial role in verifying coverage eligibility. Specific insurance plans, like Blue Cross Blue Shield or Aetna, offer varying levels of benefits depending on the policy type, either individual or family coverage. Effective communication about the coverage period, often ranging from six months to one year, ensures patients understand the duration of their insurance protection. Additionally, including contact information for inquiry, such as a customer service phone number or email address, facilitates easy access to further information about claims and benefits.

Insurance Provider's Contact Information

The confirmation of medical insurance serves as a vital document for policyholders, providing reassurance and clarity regarding their coverage. The insurance provider's contact information typically includes critical details such as the name of the provider, often a well-known entity like Blue Shield or Aetna, their primary customer service phone number (usually a direct line with an option for claims inquiries), and their website URL for online policy management. Additionally, it may feature a mailing address for correspondence, including city and state, which facilitates communication for premium payments or claims submissions. This comprehensive information ensures that policyholders can easily reach out for assistance regarding their healthcare needs, understanding their benefits, and addressing any coverage-related questions.

Policy Number and Coverage Details

A confirmation of medical insurance typically includes essential information such as the policy number, coverage details, and beneficiary information. A policy number, unique to each insured individual or family, serves as an identifier for all future claims and inquiries. Coverage details outline the specific benefits provided by the insurance plan, which can include hospitalizations, outpatient services, preventive care, and prescription medications. Emergency services, rehabilitation therapies, and mental health support may also be included in comprehensive policies. Additionally, networks of available healthcare providers, deductibles, copayments, and coverage limitations need to be clearly specified to ensure understanding of policy obligations. This document may be used when seeking medical care, confirming acceptance by providers and ensuring smoother processing of claims.

Confirmation of Coverage and Effective Dates

The confirmation of medical insurance coverage serves as a pivotal document, outlining essential details such as policy number, coverage limits, and effective dates. For instance, an insurance policy may cover hospital visits, preventive services, and emergency care, commencing on a specific date like January 1, 2024. The document also delineates exclusions and copayment requirements for various services, ensuring individuals understand their financial obligations. In addition, it includes contact information for customer service, facilitating navigation through claims and inquiries, particularly important for policyholders seeking assistance during health-related emergencies.

Instructions for Claims and Support Channels

Medical insurance claims often require detailed procedures for proper processing and support. Policyholders should review their insurance policy documentation to understand eligibility criteria and necessary documentation for claims. Claims typically include forms detailing medical services received, provider information, dates of service, and itemized bills from healthcare providers. Most insurance companies offer support channels such as customer service hotlines, online portals, and dedicated email addresses for query resolution. For urgent matters, contacting the claims department directly via the toll-free number can expedite assistance. Additionally, ensuring all required documents are submitted within the claim filing deadline (usually 30 to 90 days post-service) can significantly impact the efficiency of claim approval.

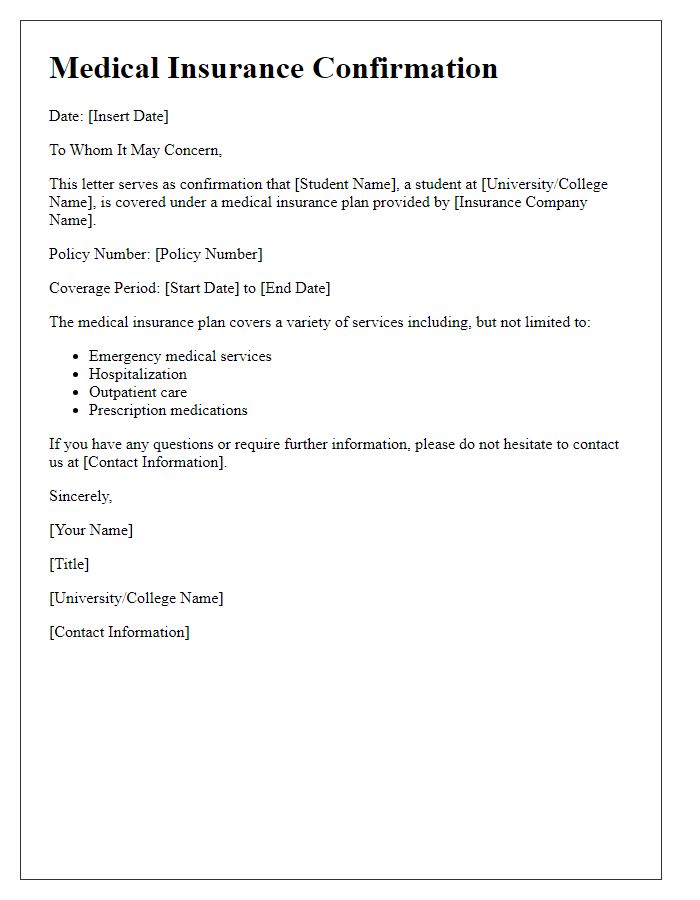

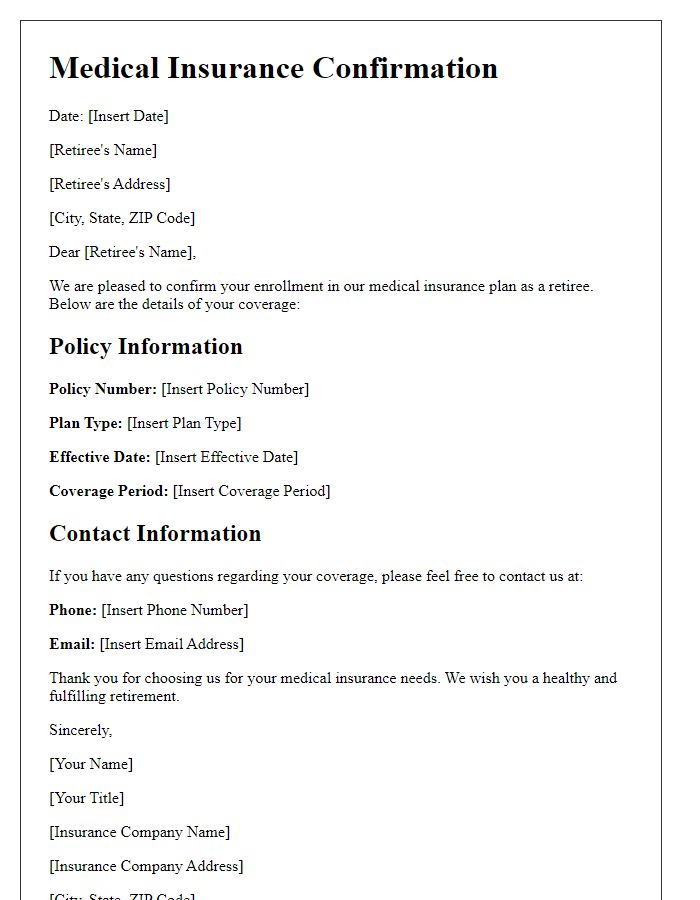

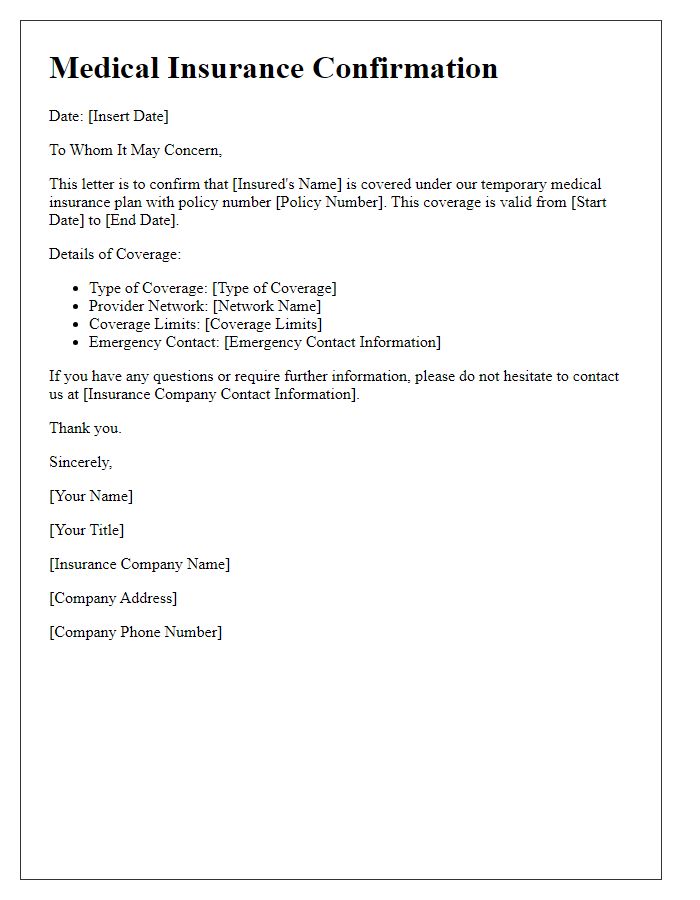

Letter Template For Confirmation Of Medical Insurance Samples

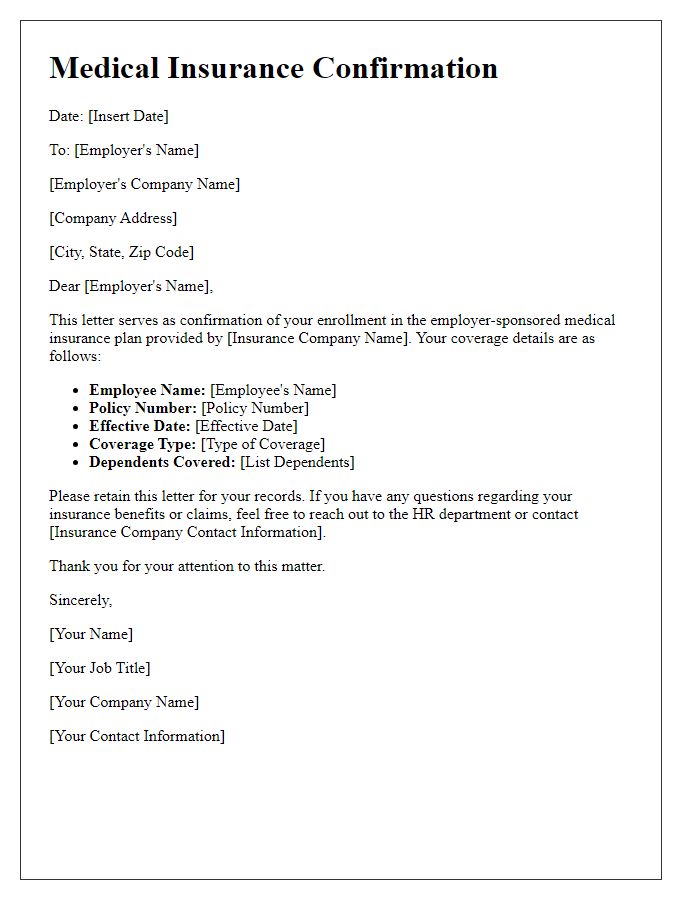

Letter template of medical insurance confirmation for employer-sponsored plan.

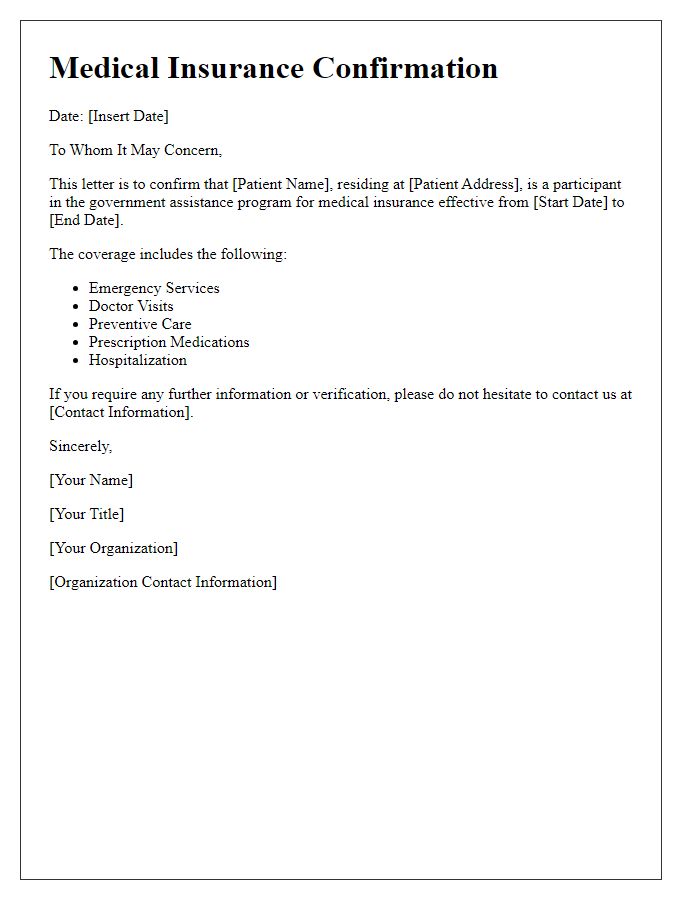

Letter template of medical insurance confirmation for government assistance program.

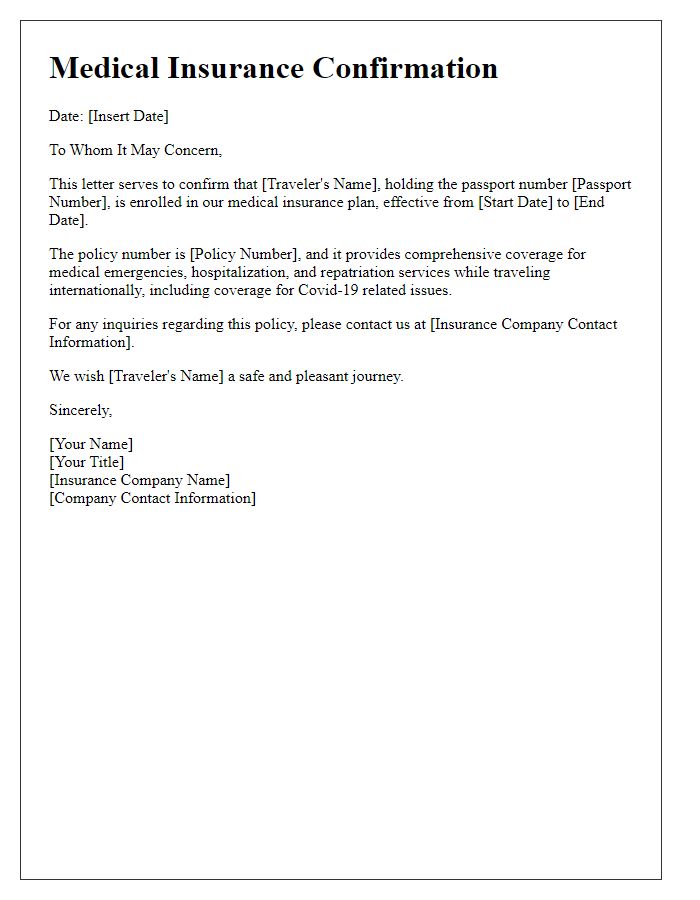

Letter template of medical insurance confirmation for international travelers.

Letter template of medical insurance confirmation for self-employed individuals.

Letter template of medical insurance confirmation for low-income assistance.

Comments