Are you preparing for a third-party audit and feeling a bit overwhelmed? You're not alone! Many organizations find the process daunting, but with the right approach and a clear letter template, you can streamline your communication and set the stage for a successful audit. If you're curious to learn more about creating an effective audit arrangement letter, read on!

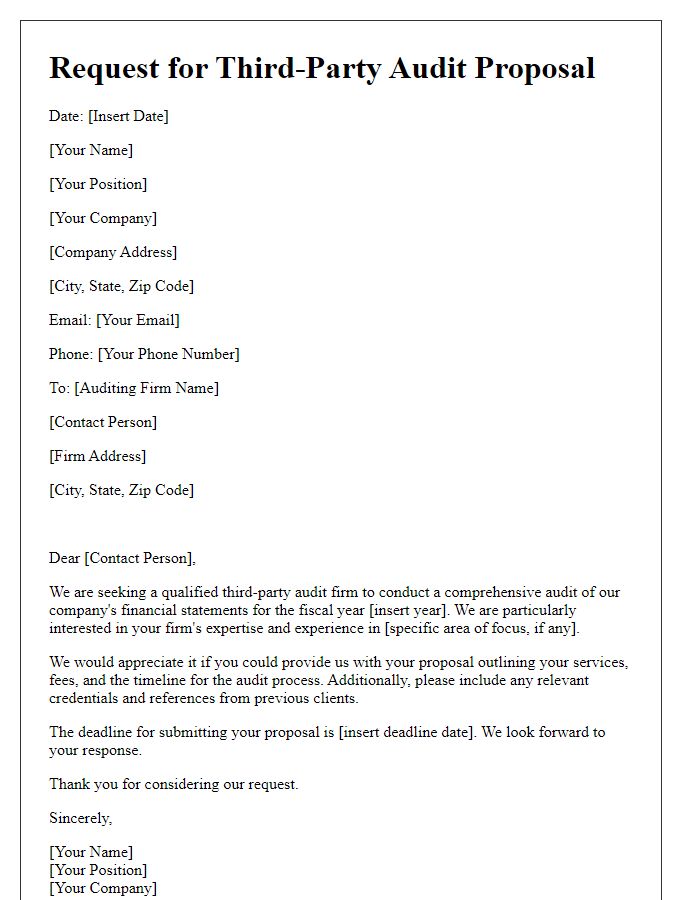

Contact Information

Effective third-party audit arrangements require clear communication and organization of contact information for involved parties. Designate a primary contact person for the audit, typically an internal audit manager, with a full name, title, and direct phone number (e.g., John Doe, Audit Manager, +1-555-123-4567). Include the email address (e.g., johndoe@example.com) for efficient correspondence. Ensure to provide the external auditor's details as well, including the firm name and contact person's information, such as Sarah Smith, Senior Auditor, +1-555-987-6543, sarahsmith@auditingfirm.com. Furthermore, list other relevant contacts such as compliance officers and department heads, along with their contact details, to ensure a smooth auditing process. Keeping this information accessible and up-to-date is critical for seamless communication during the audit.

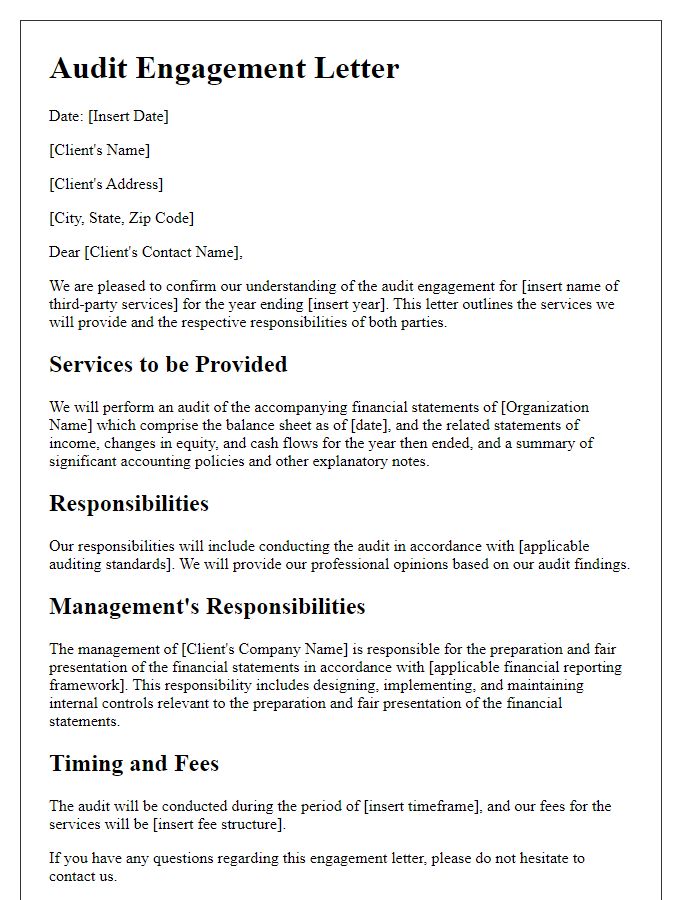

Purpose of Audit

A third-party audit aims to evaluate the compliance and efficacy of an organization's processes based on established industry standards and regulations. This systematic examination focuses on financial statements and operational efficiencies to ensure accurate reporting, such as adherence to GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). The audit can also assess quality management systems like ISO 9001 in manufacturing sectors. Ensuring transparency improves stakeholder trust and minimizes risks associated with fraud or misrepresentation. The findings from the audit can guide future improvements and strategic planning, enhancing overall organizational performance.

Audit Scope and Objectives

The third-party audit arrangement focuses on evaluating compliance with financial regulations and operational standards for Company X, headquartered in New York City. Key objectives include assessing adherence to the Generally Accepted Accounting Principles (GAAP), identifying potential inefficiencies in internal controls, and verifying the accuracy of financial statements for the fiscal year ending December 31, 2023. The audit will also aim to evaluate risk management processes, ensuring the company meets industry benchmarks and regulatory requirements. Specific areas of interest include revenue recognition practices, inventory management processes, and cybersecurity protocols to safeguard customer data, particularly in light of recent data breach incidents throughout the technology sector.

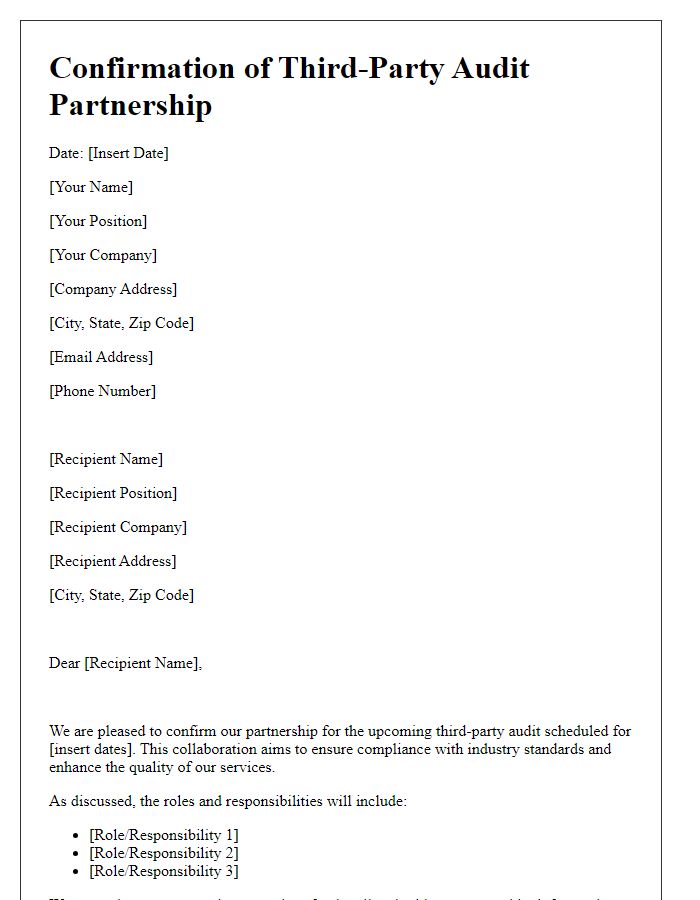

Timeline and Schedule

The third-party audit arrangement involves a comprehensive timeline and schedule crucial for meeting compliance requirements and ensuring thorough evaluations. Initial planning sessions should occur in early January 2024, focusing on defining audit scope and objectives. On-site evaluations scheduled for mid-March 2024 allow auditors from Deloitte, a leading firm in the auditing sector, to conduct interviews and gather data. Preliminary findings are due by April 15, 2024, providing a two-week review period for stakeholders. Final report delivery by May 1, 2024, will outline identified risks, recommendations, and compliance status for the fiscal year ending 2023. Follow-up meetings with management to discuss findings are planned for the first week in May, reinforcing commitment to continuous improvement and regulatory adherence.

Confidentiality and Compliance Requirements

A third-party audit arrangement ensures compliance with established standards and confidentiality agreements between the audited organization and the auditing firm. This process typically involves adherence to industry-specific regulations, such as the Sarbanes-Oxley Act for financial practices or ISO 27001 for information security management. Key stakeholders, including audit managers and compliance officers, will outline clear expectations regarding the handling of sensitive data, requiring the auditing firm to sign a non-disclosure agreement (NDA). Regular audits are essential in identifying potential vulnerabilities, mitigating risks, and fostering trust between clients and service providers. Document retention policies must also be established, dictating the duration for which audit findings must be securely stored, often ranging from five to seven years, depending on jurisdictional requirements.

Comments