As we wrap up another year, it's time to take a closer look at our financial journey and assess how we've navigated the challenges and triumphs along the way. This end-of-year financial analysis offers valuable insights into our performance, helping us understand where we excelled and where we can improve moving forward. Whether you're a seasoned finance professional or just starting to engage with financial reports, there's something in this analysis for everyone. So, grab a cup of coffee and get ready to dive into the detailsâlet's explore what this year's numbers have to tell us!

Financial Performance Summary

The end-of-year financial analysis provides a comprehensive overview of a company's fiscal health, encompassing key metrics such as revenue, net income, and expenses. In 2023, total revenue reached $1.5 million, reflecting a 15% increase compared to the previous year, primarily driven by robust sales in the technology sector. Operating expenses amounted to $900,000, while the net income stood at $600,000, indicating an 8% profit margin. Furthermore, cash flow from operating activities totaled $700,000, affirming the liquidity position. Additionally, the return on equity (ROE) was calculated at 12%, showcasing efficient capital utilization. The financial performance summary serves as a crucial tool for stakeholders, aiding in strategic decision-making and future investment considerations.

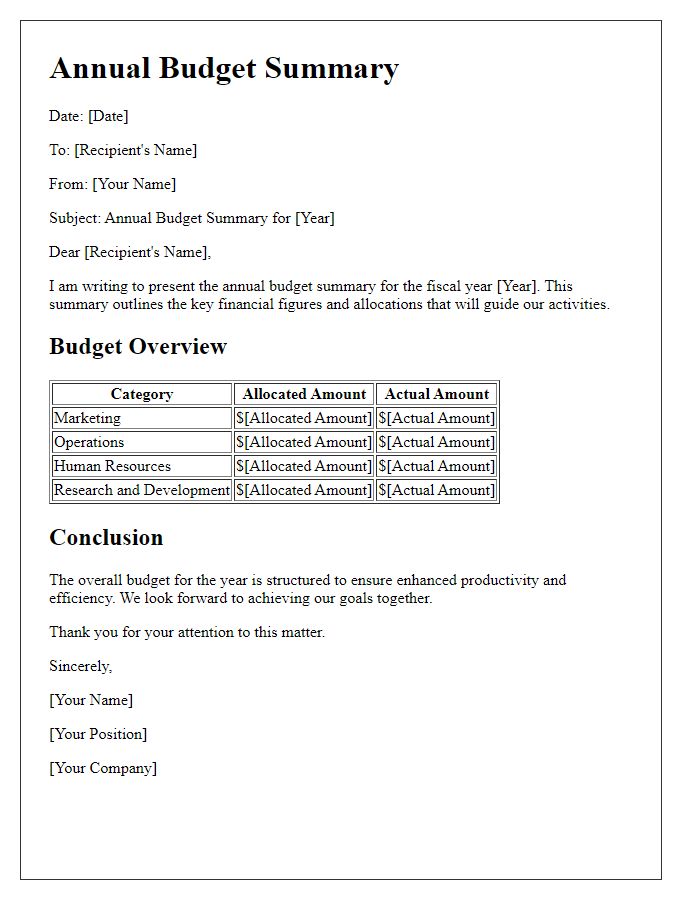

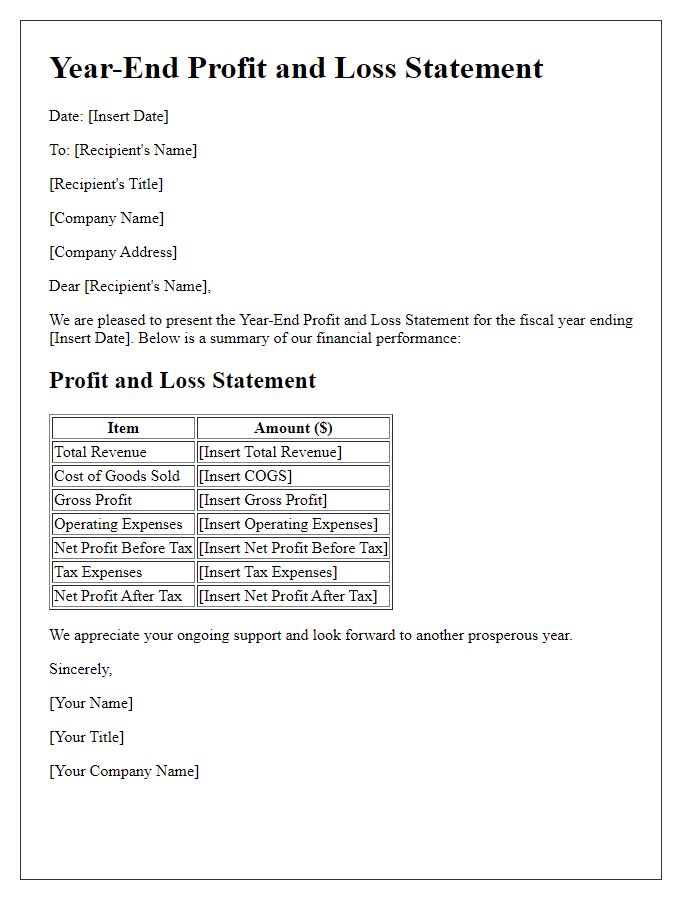

Revenue and Expense Insights

End-of-year financial analysis provides critical insights into a company's performance, highlighting revenue streams and expense allocations. Detailed revenue data (ranging from sales figures in Q1 to project budgets for Q4) reveals trends essential for strategic planning. Expense reports categorize outflows, with significant allocations to payroll, operational costs, and marketing initiatives, often exceeding budget projections by up to 20% in certain departments. The analysis of net profit margins indicates the economic health of an organization, while comparisons with industry benchmarks from reputable sources, such as the Financial Times, offer a broader context for performance evaluation. Understanding these financial dynamics empowers informed decision-making for future growth strategies.

Key Performance Indicators (KPIs)

The year-end financial analysis highlights essential Key Performance Indicators (KPIs) that assess the fiscal health of the organization. Revenue growth, measured at 15% from the previous year, reflects increased sales of product lines, particularly within the tech sector, while net profit margin stands at 20%, showcasing improved cost management and operational efficiencies. The current ratio, positioned at 1.5, indicates robust liquidity, ensuring short-term obligations can be met comfortably. Return on investment (ROI) is recorded at 25%, demonstrating effective capital utilization in growth initiatives. Finally, customer acquisition cost, averaging $150, provides insight into marketing effectiveness and customer lifetime value, projected to increase as brand loyalty strengthens, providing a solid foundation for future endeavors.

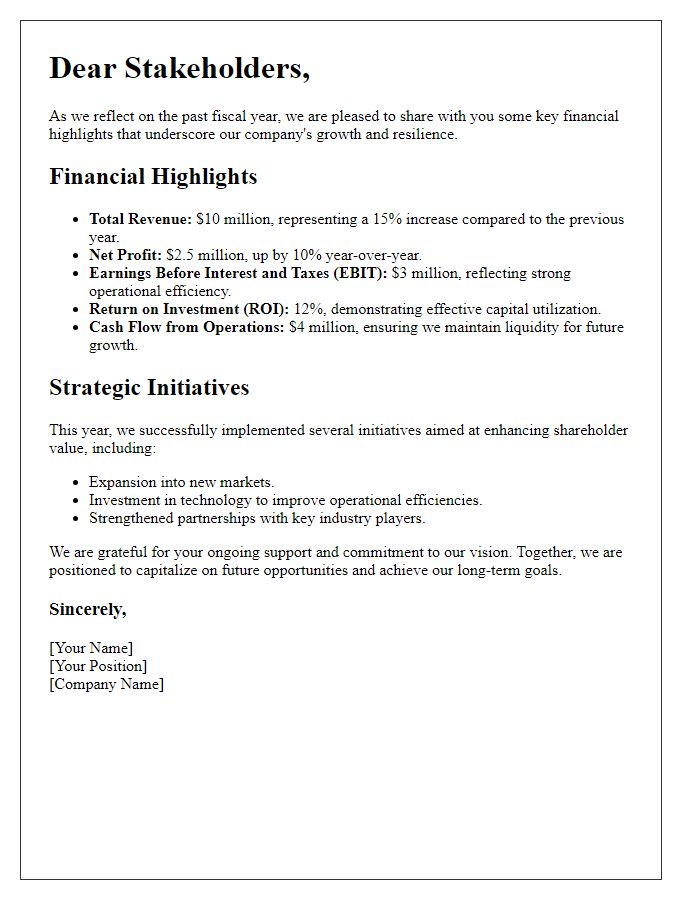

Strategic Recommendations

A comprehensive end-of-year financial analysis reveals critical insights into the fiscal performance of an organization, allowing for informed strategic recommendations. Revenue streams, totaling $5 million, have shown a 15% growth compared to the previous year, driven largely by increased sales in the online sector, which contributed 60% of total income. Cost analysis indicates that operational expenses rose to $3 million, primarily due to a 20% increase in marketing expenditures aimed at bolstering brand awareness. Key performance indicators, like net profit margin, currently at 40%, suggest healthy profitability, yet areas for improvement remain. It's essential to explore diversification strategies into emerging markets, particularly in Southeast Asia, projected to expand by 6% annually. Additionally, investing in automation technologies could enhance operational efficiency and reduce overhead costs by an estimated 10% in the upcoming fiscal year.

Future Forecasting and Planning

End-of-year financial analysis provides critical insights for future forecasting and planning within organizations. Examined data includes revenue growth percentages, operational costs, and profit margins accrued over the fiscal year, specifically from January to December 2023. This analysis integrates key financial statements such as income statements, balance sheets, and cash flow statements, ensuring comprehensive understanding of financial health. External factors influencing predictions encompass economic conditions, market trends, and regulatory changes. Various forecasting methods, including qualitative assessments and quantitative models like regression analysis, contribute to informed planning strategies. Stakeholder engagement and feedback loops are essential in validating assumptions and enhancing financial predictions, ultimately fostering sustainable growth and strategic alignment for the upcoming fiscal periods.

Comments