Are you looking to understand the nuances of cost variance analysis? In today's fast-paced business world, keeping track of your financial performance is crucial for making informed decisions. Cost variance analysis not only helps you identify discrepancies between your budgeted and actual costs but also provides insights that can drive your strategic planning. Dive deeper into the intricacies of this vital financial tool and discover effective ways to enhance your operational efficiency by reading more!

Subject: Cost Variance Analysis Report

Cost variance analysis is crucial for understanding financial performance in projects. It compares budgeted costs to actual expenditures, revealing variances that impact profitability. For instance, in a construction project like the Denver International Airport expansion, which had a budget of $500 million, a variance analysis could identify overruns in labor costs or materials, potentially leading to significant budget adjustments. Accuracy in tracking expenses, such as equipment rental costs increasing by 20%, can highlight areas needing attention. Effective management of these variances is essential for ensuring projects stay within financial constraints, ultimately influencing overall project success and stakeholder satisfaction.

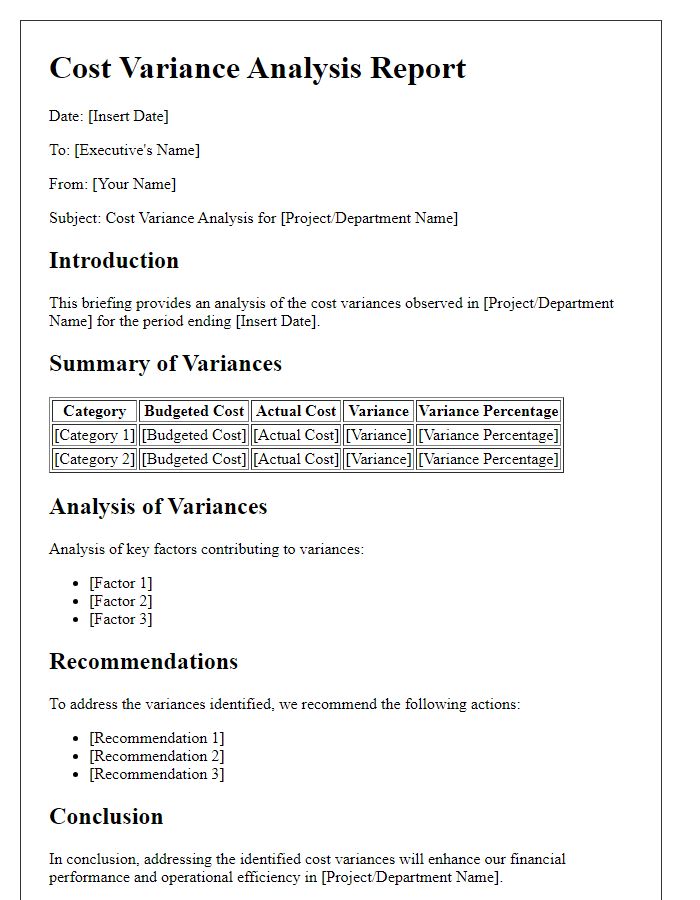

Introduction: Purpose and Scope of Analysis

Cost variance analysis serves as a critical tool for financial management, enabling organizations to evaluate discrepancies between budgeted and actual expenditures. This analysis focuses on identifying root causes for variances, typically resulting from factors such as operational inefficiencies, unexpected market changes, or inaccurate forecasting methods. Various financial metrics, including the Cost Variance (CV) and Budget at Completion (BAC), play essential roles in quantifying these discrepancies. The scope of the analysis encompasses all departments and projects within the organization, aiming to enhance budgeting accuracy and optimize resource allocation strategies through a comprehensive understanding of cost behaviors. By utilizing historical data and performance metrics, this analysis informs decision-making processes and aligns financial resources with strategic objectives.

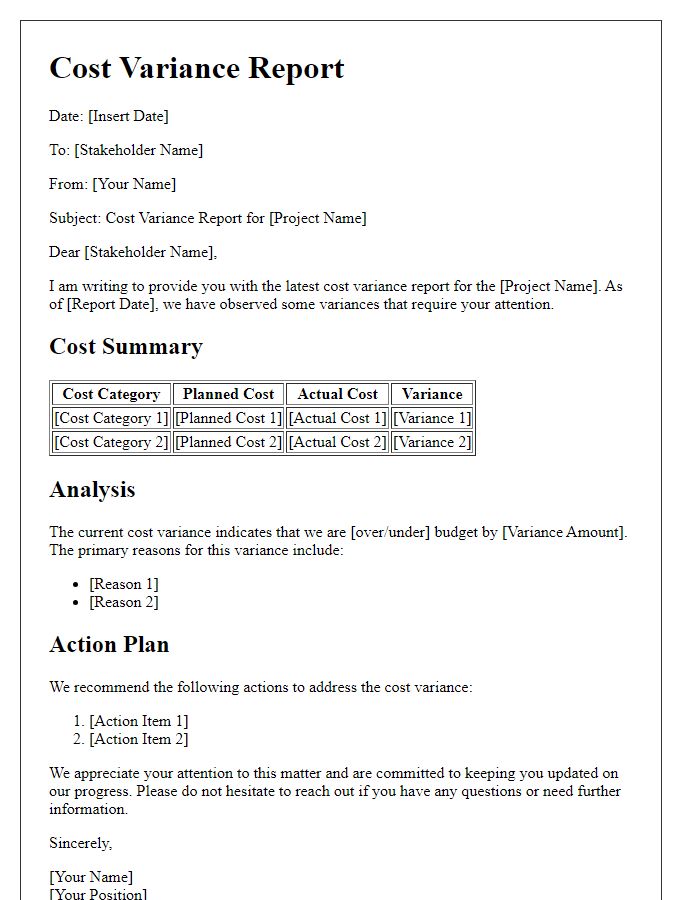

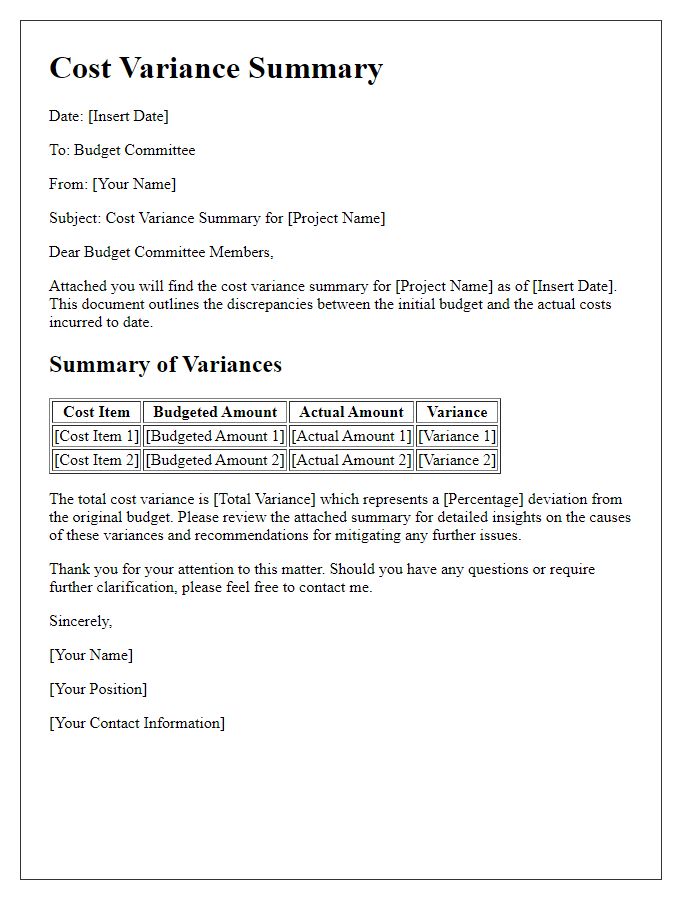

Detailed breakdown: Variance Overview with Categories

Cost variance analysis is crucial for evaluating financial performance within organizations. Categories typically include materials, labor, overhead, and operational expenses. For instance, materials variance reflects discrepancies between budgeted and actual costs of raw materials, which may involve raw commodities like steel or plastic. Labor variance analyzes the difference between expected and actual labor costs, often tied to hourly wage rates or overtime charges. Overhead variance addresses the indirect costs of production, such as utilities (electricity bills exceeding budgeted amounts) and maintenance expenses. Operational expense variance assesses deviations in administrative costs, affecting budget adherence. A thorough variance overview enables stakeholders to identify areas for improvement, realign budgets, and enhance financial decision-making processes.

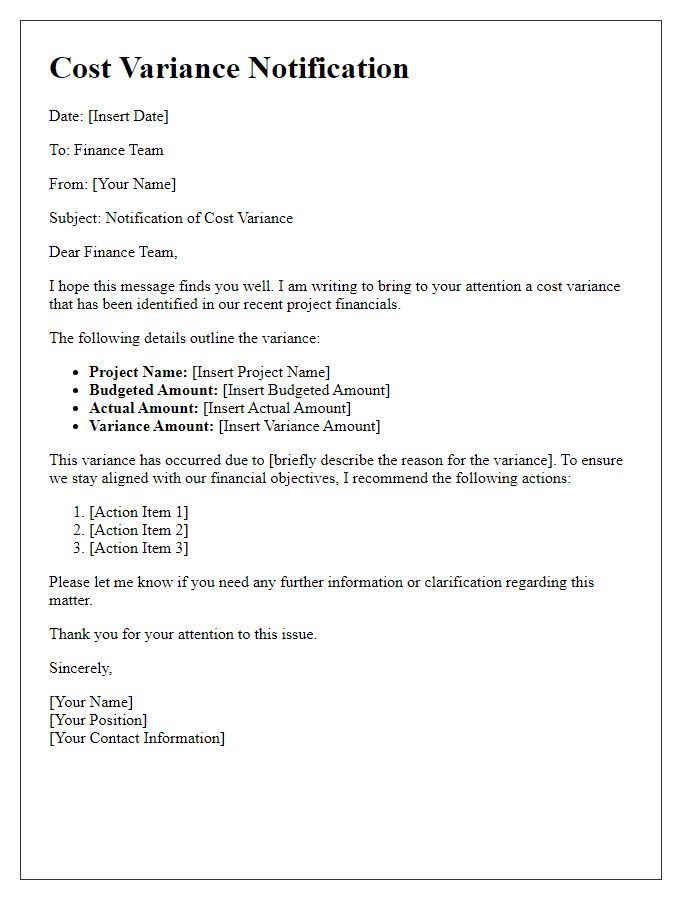

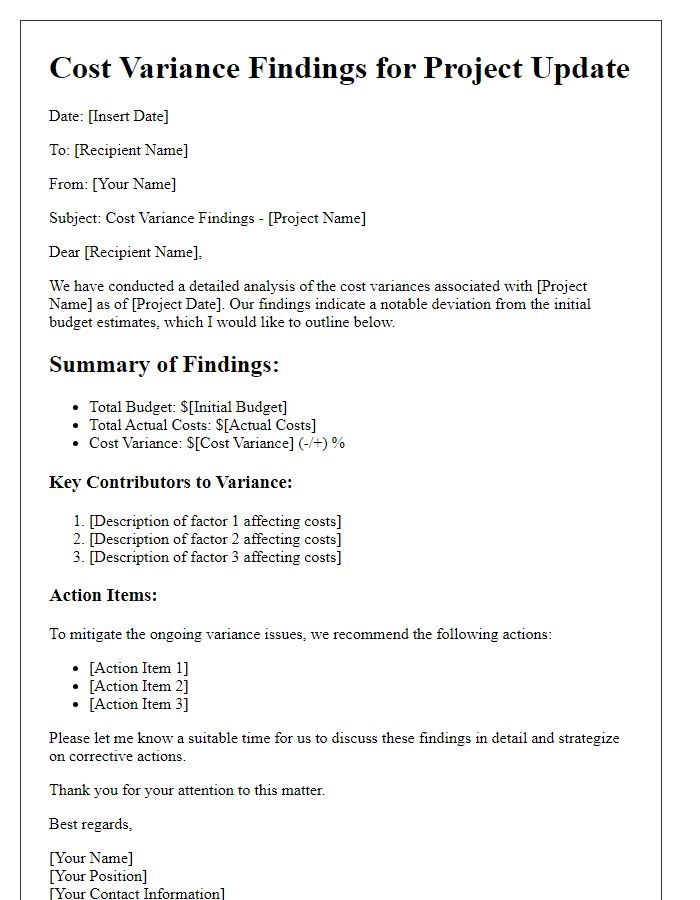

Causes and Contributing Factors: Internal and External Influences

Cost variance analysis highlights discrepancies between budgeted and actual expenditures within financial frameworks. Key elements include internal influences such as inefficient resource allocation (measured in percentage deviations from projected costs) and operational delays (identifying timeframes exceeding initial estimates). External influences comprise market volatility (economic shifts affecting commodity prices, often fluctuating by up to 20%) and regulatory changes impacting compliance expenditures (potential increases due to new legislation). Additionally, unexpected supply chain disruptions caused by geopolitical events (for instance, trade wars or natural disasters) can lead to significant cost overruns. Understanding these causes is essential for businesses aiming to maintain financial health and adjust future budgeting strategies effectively.

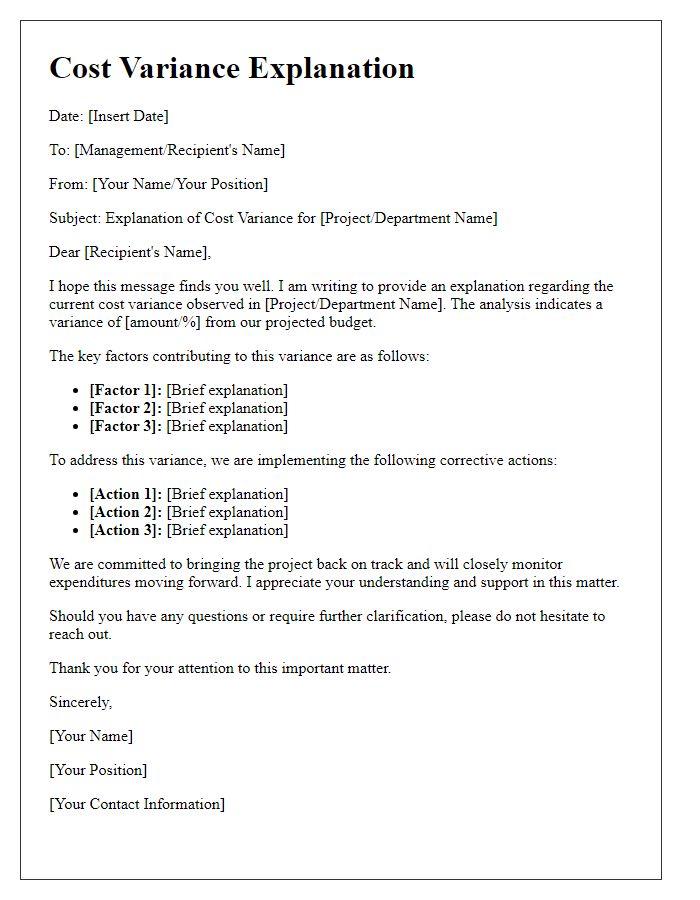

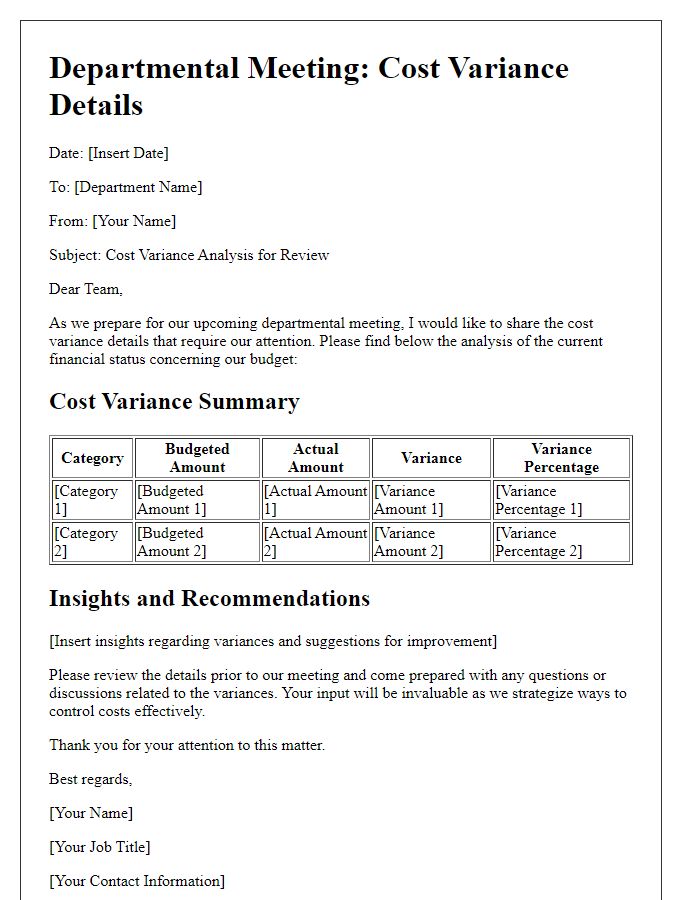

Recommendations and Corrective Actions: Strategic Solutions

Cost variance analysis identifies discrepancies between budgeted and actual expenditures, crucial for effective financial management in organizations. Common causes include unexpected price increases in raw materials, labor overruns, or inefficiencies in operational processes. Recommendations for addressing these variances involve implementing stringent budgeting controls, utilizing advanced forecasting tools for accurate projections, and conducting regular financial reviews. Corrective actions may entail renegotiating supplier contracts to secure better pricing, investing in staff training to improve productivity, or optimizing resource allocation to eliminate waste. Strategic solutions focus on fostering a culture of accountability within teams, encouraging proactive monitoring of expenses, and leveraging technology for real-time reporting to adapt quickly to financial challenges.

Comments