In the modern business landscape, effective corporate governance is not just a regulatory requirement; it's a crucial element for building trust and ensuring longevity in any organization. As companies adapt to evolving challenges and opportunities, regularly reviewing governance policies becomes essential to safeguard ethical practices and enhance decision-making processes. This article serves as a guide to understanding the key components of a robust corporate governance policy and the best practices for conducting a review. Dive in to explore how these insights can empower your organization towards a more transparent and accountable future!

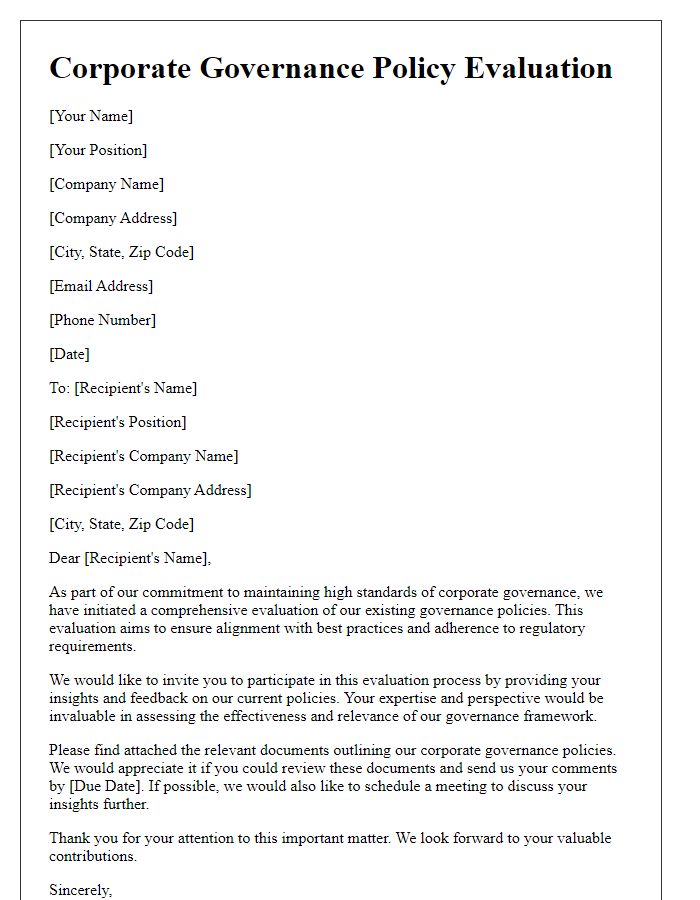

Introduction and Objective of Review

The corporate governance policy (focusing on organizational frameworks, regulations, and practices) review aims to evaluate compliance with established principles, ensuring transparency, accountability, and ethical decision-making within entities such as publicly traded companies. Objectives include assessing the effectiveness of governance structures, identifying areas for improvement, and aligning practices with statutory requirements (like the Sarbanes-Oxley Act, enacted in 2002 in the United States). This review will provide recommendations that enhance stakeholder trust and strengthen overall governance, fostering an environment conducive to sustainable growth and risk management.

Current Policy Overview

The current corporate governance policy, established in 2020, delineates the framework and practices guiding the ethical management of organizations across various sectors. This document encapsulates essential principles such as accountability, transparency, and shareholder rights, impacting both publicly traded corporations and private enterprises. The policy mandates regular evaluations to ensure compliance with governing laws, including the Sarbanes-Oxley Act of 2002 in the United States, which aims to protect investors by improving the accuracy and reliability of corporate disclosures. Recent trends indicate an increasing focus on environmental, social, and governance (ESG) criteria, compelling corporations to integrate sustainable practices into their governance structures. Key stakeholders, including board members, executives, and shareholders, are involved in the decision-making processes, emphasizing the importance of representation and diverse perspectives in fostering a robust governance environment.

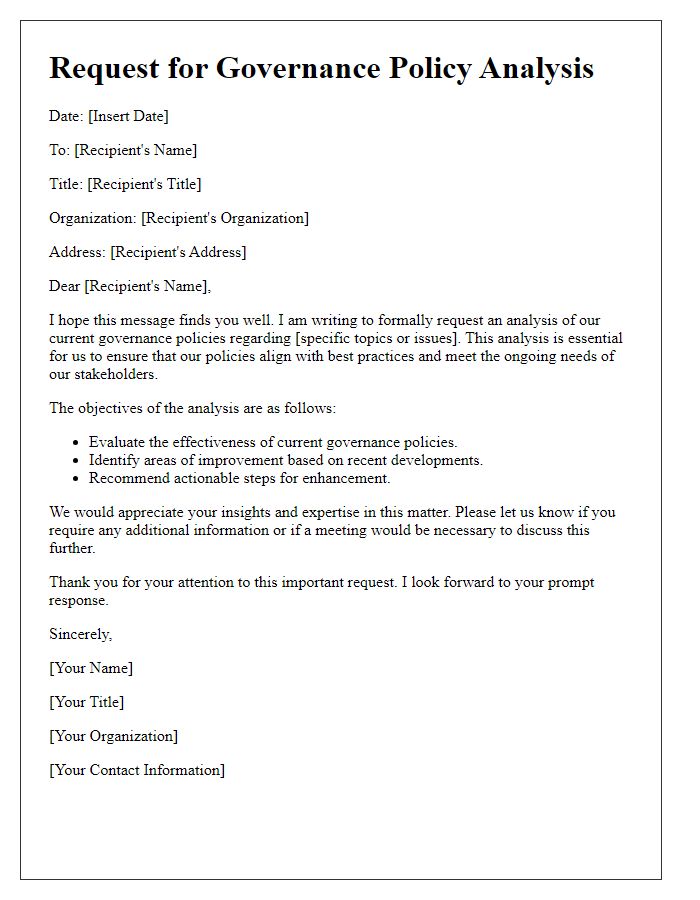

Areas of Improvement and Recommendations

A comprehensive corporate governance policy review identifies several key areas for improvement essential to enhancing organizational transparency and accountability. Firstly, board diversity metrics should be evaluated, as research from institutions like Harvard Business School indicates that diverse boards (including gender and racial diversity) can lead to improved decision-making. Secondly, the effectiveness of internal controls must be bolstered, ensuring compliance with regulatory frameworks such as the Sarbanes-Oxley Act (SOX), aiming to safeguard financial integrity. Thirdly, stakeholder engagement processes should be refined, enabling better communication avenues with shareholders, specifically focusing on Annual General Meetings (AGMs) to foster inclusivity and participation. Lastly, a regular review schedule for these policies, aligned with best practices from the Organisation for Economic Co-operation and Development (OECD), would ensure that governance frameworks remain adaptable to emerging trends and challenges in the corporate landscape.

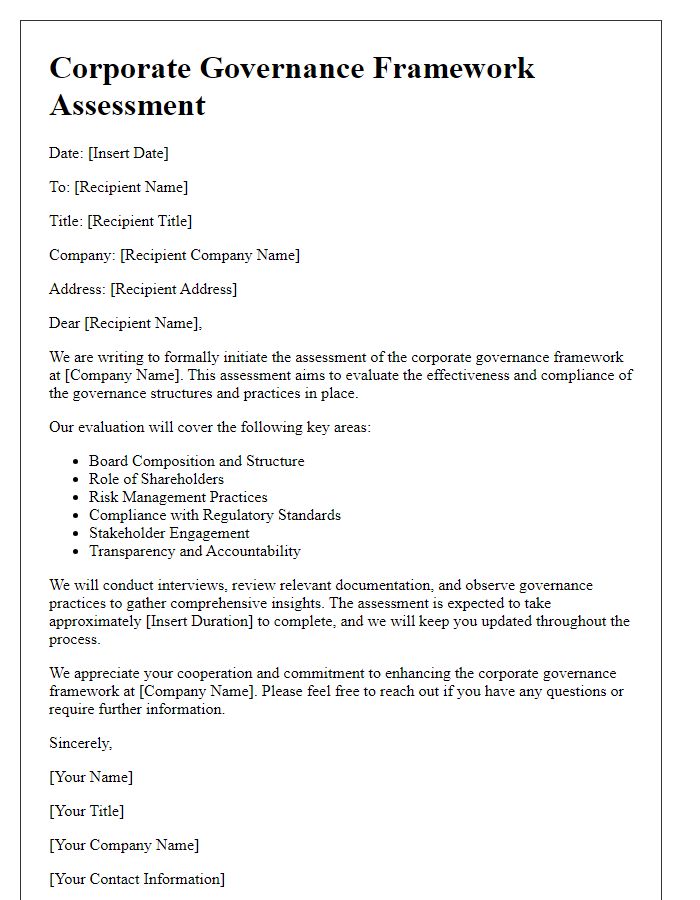

Stakeholder Consultation and Engagement

Stakeholder consultation and engagement play a pivotal role in the effective review of corporate governance policies. Engaging diverse groups--such as shareholders, employees, customers, and community representatives--ensures that multiple perspectives are considered during policy development. Feedback sessions, conducted both virtually and in-person, can significantly enhance transparency and foster trust among stakeholders. Surveys and focus groups, utilizing structured questionnaires, gather quantitative and qualitative data on stakeholder expectations and concerns. This informed approach not only aligns governance practices with stakeholder interests but also strengthens compliance with regulatory frameworks, such as the Sarbanes-Oxley Act in the United States. The engagement process should culminate in a comprehensive report, summarizing key findings and actionable insights, guiding policy adjustments that enhance corporate responsibility and promote sustainability.

Implementation and Monitoring Plan

The Implementation and Monitoring Plan for corporate governance policies, specifically designed for organizations, outlines key areas requiring attention and evaluation to ensure compliance and effectiveness. Action items include conducting regular audits (at least quarterly) to assess adherence to governance frameworks, providing training sessions for board members regarding best practices in transparency and accountability, and scheduling annual reviews of policy impact assessments to measure efficacy. Performance indicators, such as stakeholder satisfaction surveys and compliance tracking metrics, will facilitate ongoing assessments. A designated governance officer will oversee these initiatives, reporting findings to the board of directors during biannual meetings to ensure alignment with organizational objectives and regulatory requirements.

Comments