If you're launching a new venture or expanding your existing business, applying for a temporary business permit is an essential step that ensures you operate legally and smoothly. In this article, we'll break down everything you need to know about the process, including key documents, potential challenges, and tips for a successful application. We'll also delve into the importance of understanding local regulations that can affect your business startup or expansion plans. So, if you're ready to navigate the world of temporary business permits, keep reading to find out how to streamline your application!

Applicant's Business Information

An applicant's business information section for a temporary business permit typically includes details such as the business name, registration number (if applicable), address (including city, state, and zip code), contact information (phone number and email address), and the type of business entity (such as sole proprietorship, partnership, corporation). Additionally, it often highlights the nature of the business activities being conducted, the location of operations, expected duration of the temporary permit, and any relevant licenses or permits that have been previously obtained. This section is crucial for regulatory bodies to assess compliance with local laws and ordinances, ensuring that business operations align with zoning regulations and public safety guidelines.

Purpose of Permit

A temporary business permit, often necessary for pop-up shops or temporary events like street fairs, functions as a crucial document allowing businesses to operate legally for a specific duration. This permit typically outlines the purpose, ensuring compliance with local regulations governing short-term activities. For example, food vendors require this permit to serve customers at music festivals, while craft sellers need it for local artisan markets. Regulatory bodies, such as city councils or health departments, issue these permits, often requiring specific documentation like previous compliance history, insurance proofs, or event details including dates and locations. The overarching goal is to manage public safety, zoning laws, and health standards while fostering community engagement and entrepreneurship.

Duration of Permit

A temporary business permit allows entrepreneurs to operate legally while they await full licensing. This permit typically covers a specific duration, often ranging from three months to one year, depending on local regulations and the type of business. For instance, in metropolitan areas like Los Angeles, businesses such as food trucks may receive permits valid for six months, allowing operators to demonstrate compliance with health department standards. Key deadlines must be adhered to ensure permit renewal or transition to a permanent license, which can involve inspections and fees. Businesses should keep a calendar of these dates to avoid interruptions in operation.

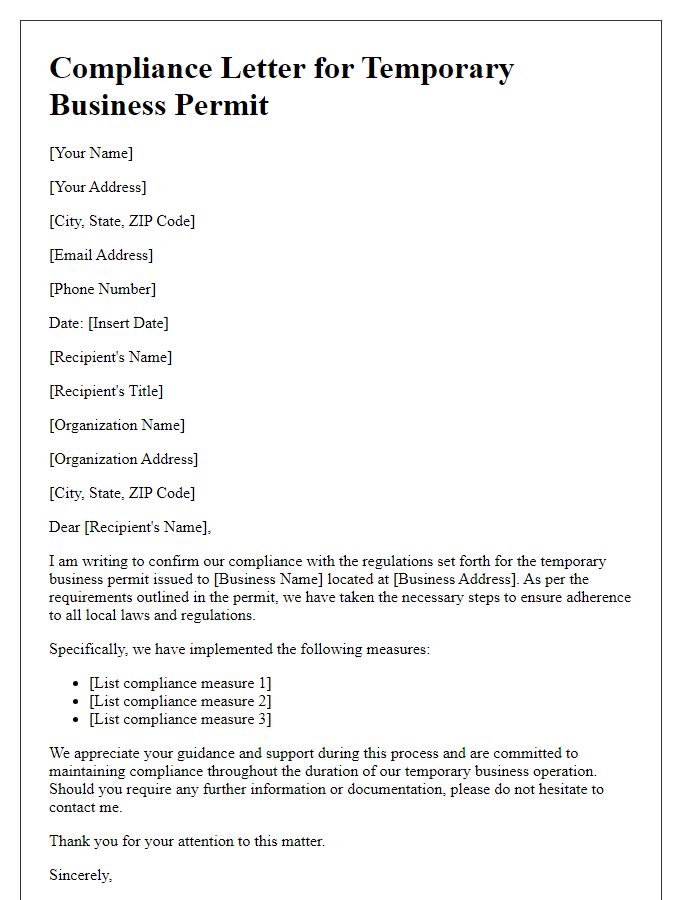

Compliance with Local Regulations

To obtain a temporary business permit, it is essential to adhere to local regulations established by municipal authorities. These regulations typically include specific requirements such as submitting a completed application form, providing a valid identification (like a driver's license), and paying a non-refundable processing fee, which may vary by location. Furthermore, business premises, whether in New York City or Los Angeles, must meet zoning laws specific to the area, impacting allowable business types. Other factors may include securing necessary safety inspections, possibly from fire departments or health authorities. Adherence to these regulations ensures that the business operates legally while maintaining community safety and standards. Non-compliance could result in fines or revocation of the permit.

Contact Information

Temporary business permits are essential for entrepreneurs seeking to operate legally in a designated area, such as a city or county. These permits typically require detailed contact information, including the business owner's name, mailing address, email address, and phone number. Locations like Los Angeles or New York may have specific forms to fill out, often requesting unique identifiers, such as a federal tax identification number. Submission of this information is usually accompanied by a fee, which varies depending on the municipality and type of business activity planned. Additionally, local regulations might necessitate proof of insurance or zoning compliance to ensure that the business aligns with community standards and safety measures.

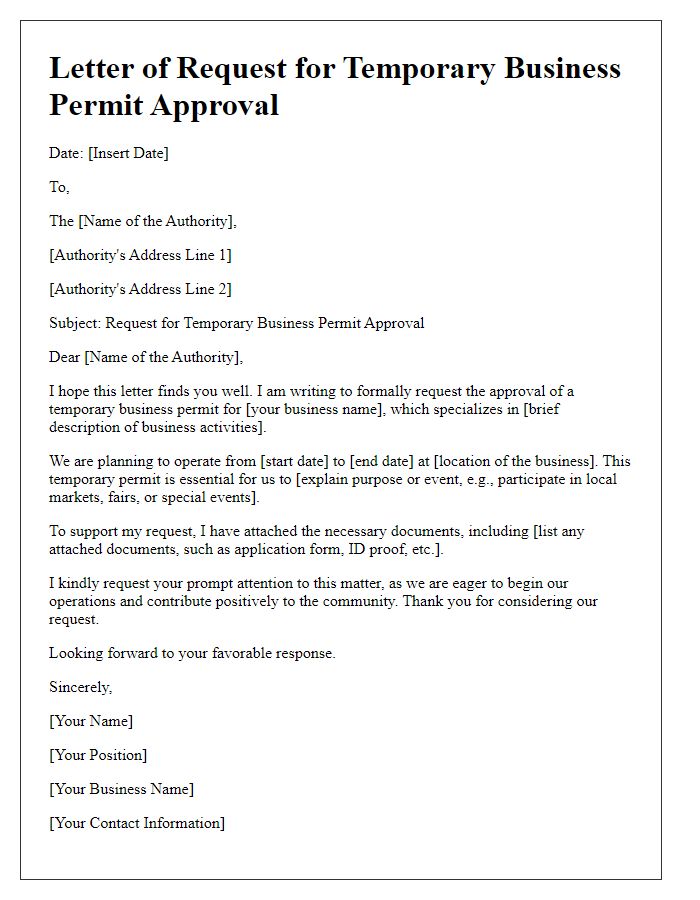

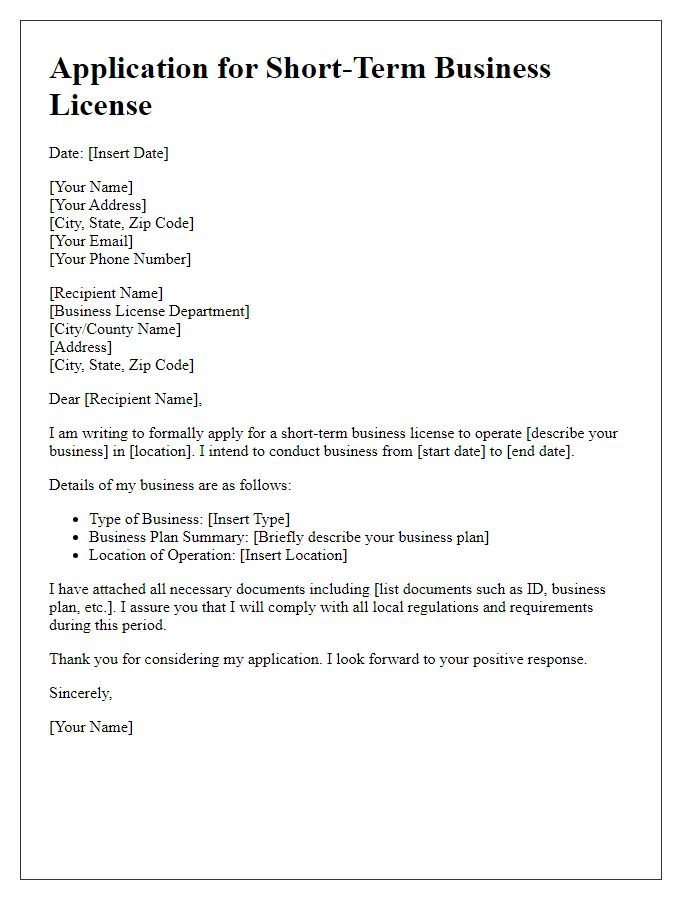

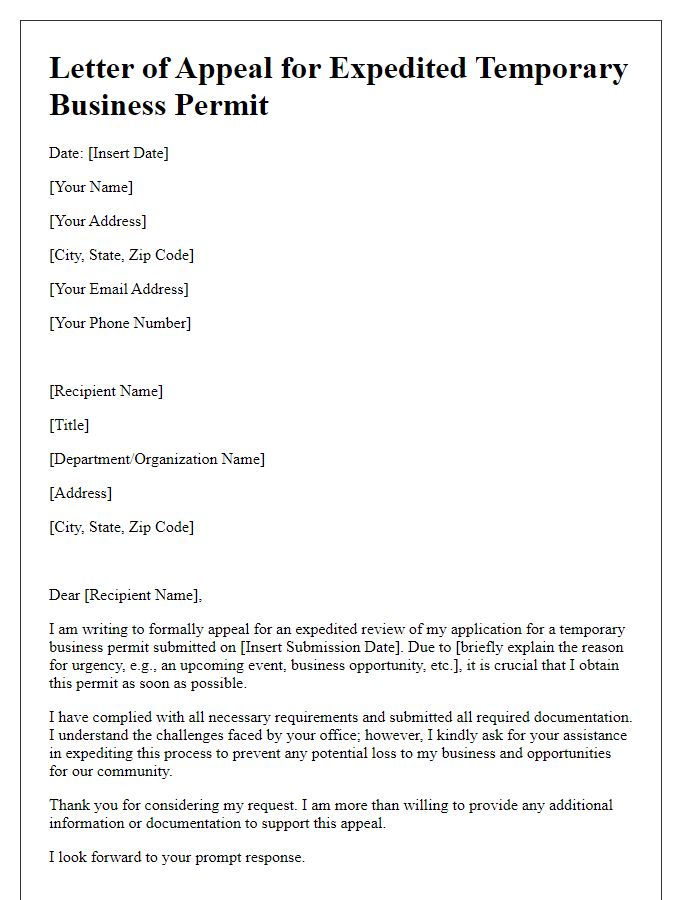

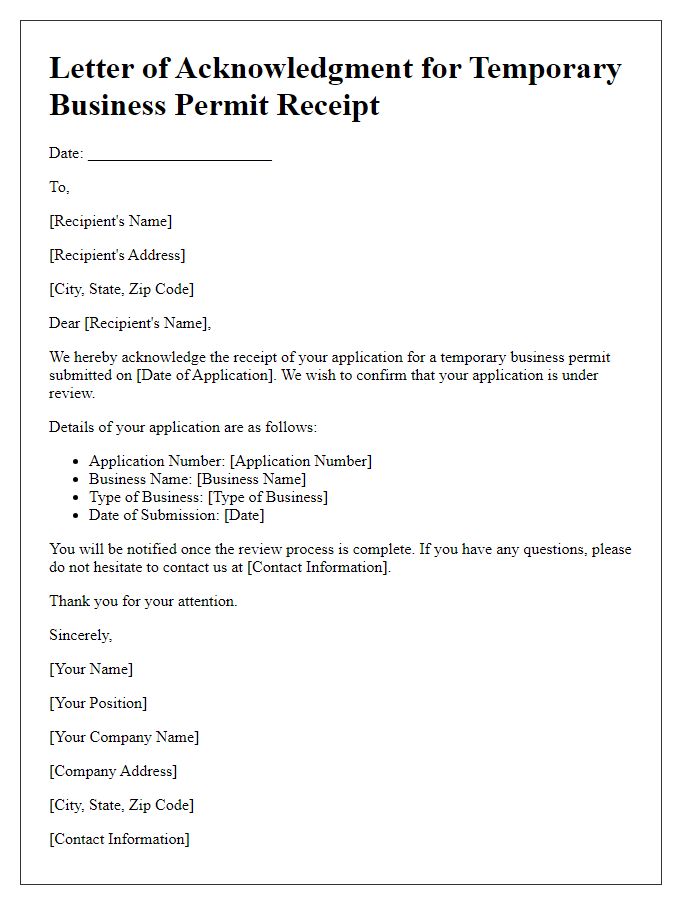

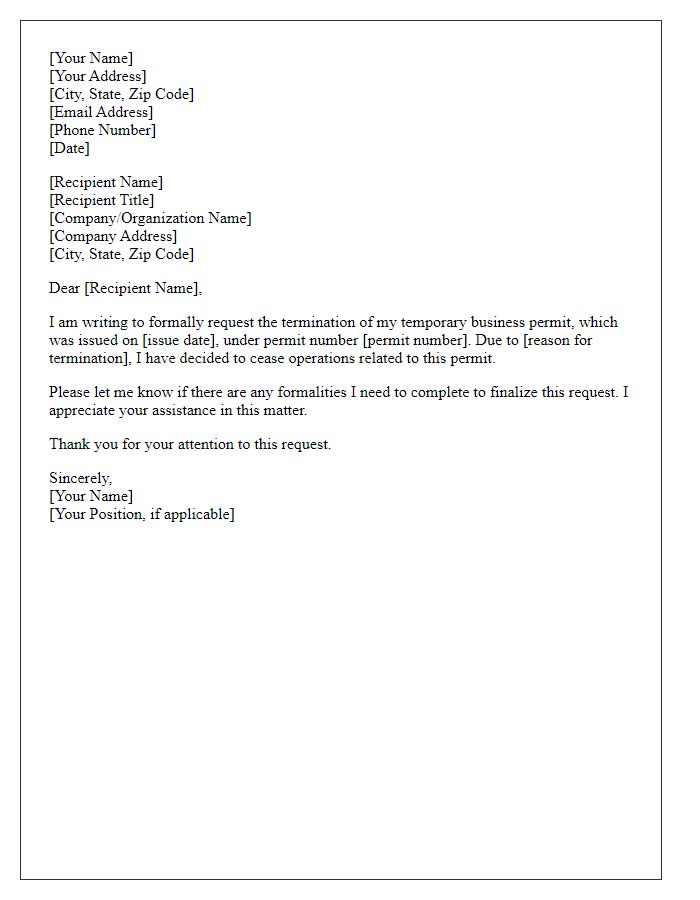

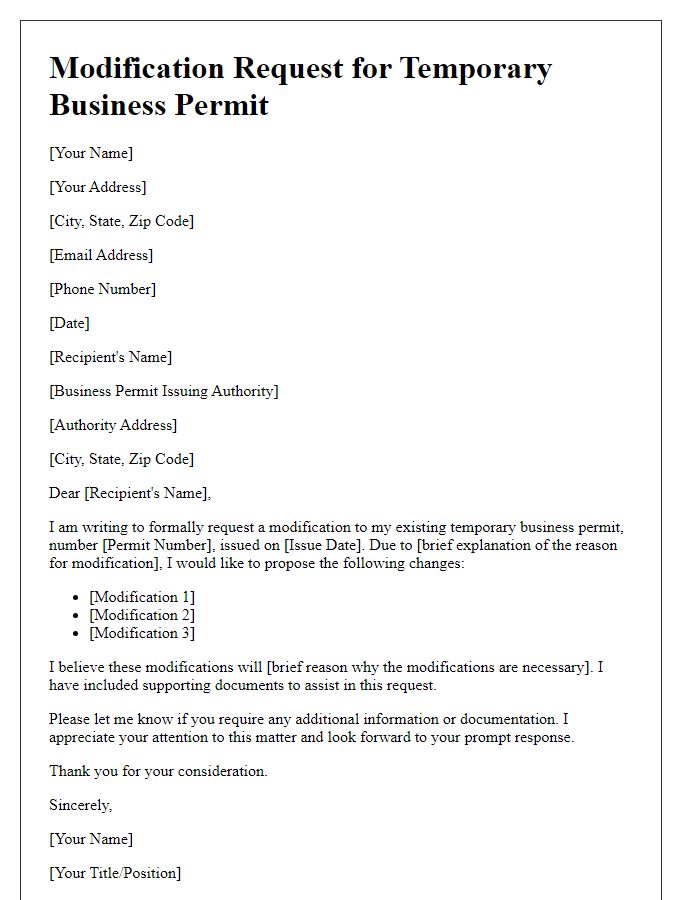

Letter Template For Temporary Business Permit Samples

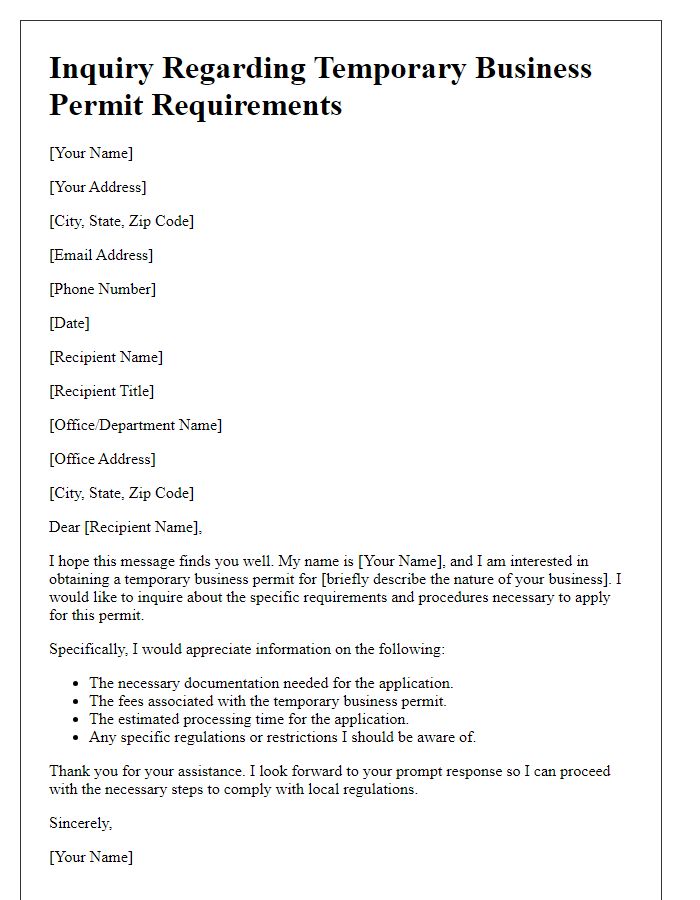

Letter template of inquiry regarding temporary business permit requirements

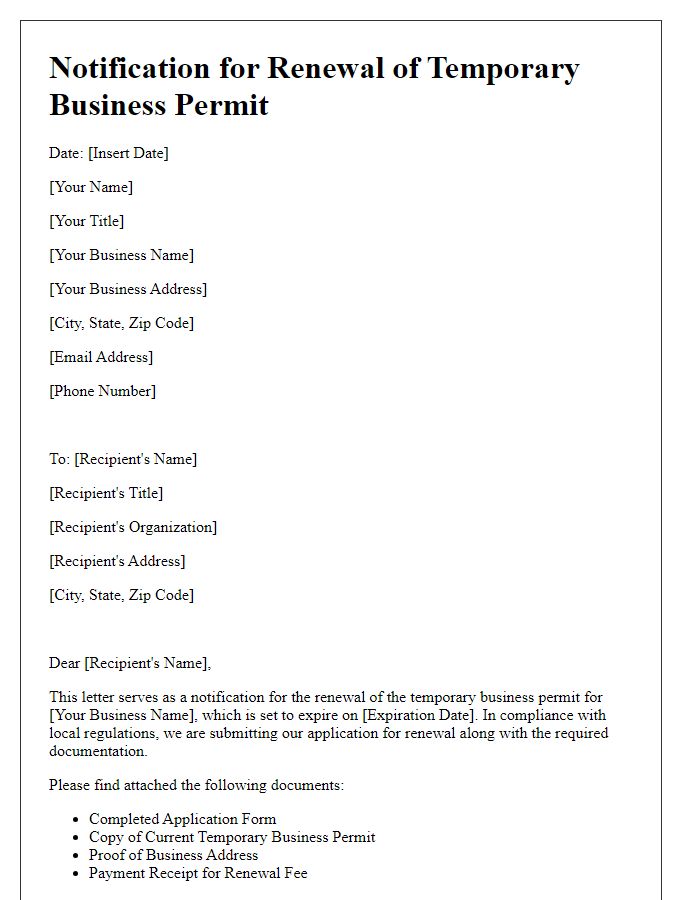

Letter template of notification for renewal of temporary business permit

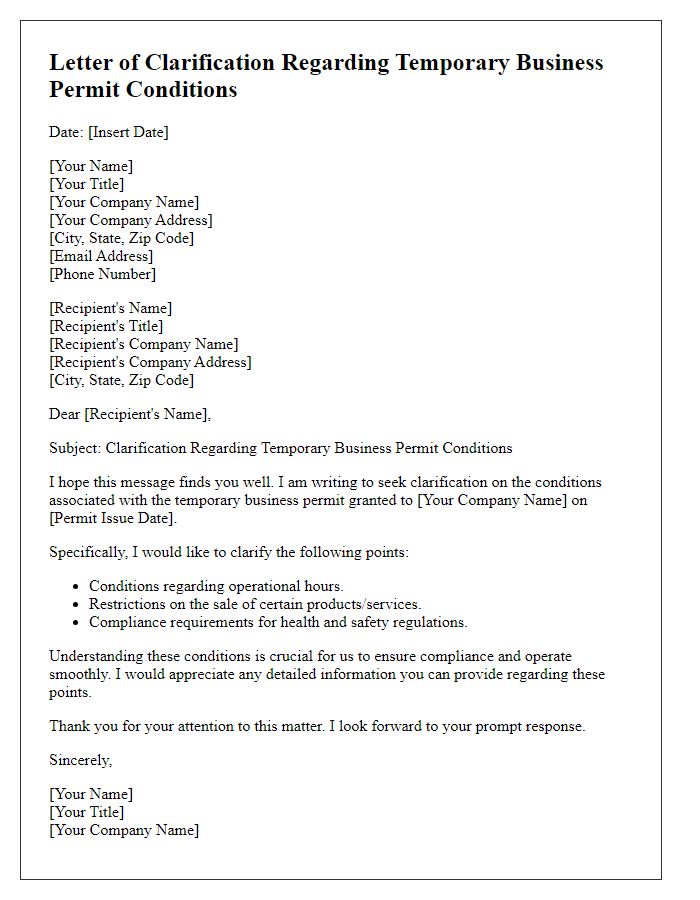

Letter template of clarification about temporary business permit conditions

Comments