Are you looking to navigate the world of motor vehicle dealer licenses? Whether you're starting a new business or expanding an existing one, understanding the requirements can be quite overwhelming. This article will offer a streamlined approach, providing you with essential tips and insights to simplify the application process. Stick around as we dive deeper into the nuances of obtaining your motor vehicle dealer license!

Applicant information: full name, address, contact details.

The process of obtaining a motor vehicle dealer license entails submitting a detailed application including critical personal information. The applicant's full name, representing the individual or business entity, establishes the primary point of contact. Address specifics, including street name, city, state, and postal code, ensure accurate location identification for compliance checks. Contact details, encompassing telephone numbers and email addresses, facilitate communication with regulatory bodies and potential customers. Each piece of information plays an essential role in ensuring compliance with local regulations and fostering responsible business practices within the automotive sales industry.

Business information: name, address, entity type.

Motor vehicle dealers must provide comprehensive business information when applying for a dealer license. Key details such as the business name, which reflects the company's identity, must be clear and distinguishable. The business address, including street, city, state, and zip code, is essential for official correspondence and site inspections. Additionally, specifying the entity type--whether it is a sole proprietorship, partnership, limited liability company (LLC), or corporation--provides clarity regarding the business's legal structure, influencing regulatory requirements and liabilities. Accurate completion of this information ensures compliance with state and local laws governing motor vehicle dealers.

Compliance declaration: adherence to laws, regulations.

A motor vehicle dealer compliance declaration outlines adherence to pertinent laws and regulations governing dealership operations. This declaration typically affirms compliance with local and state licensing requirements, including specific statutes that regulate vehicle sales (such as Title 46 of the U.S. Code), emissions standards (e.g., California Air Resources Board guidelines), and consumer protection laws (such as the Federal Trade Commission's regulations). It may also reference adherence to financing regulations under the Truth in Lending Act and the Fair Credit Reporting Act, ensuring transparency in financing options provided to consumers. Furthermore, dealerships must maintain accurate inventory records, service histories, and obtain federal Employer Identification Numbers (EINs) to comply with tax laws. The declaration serves as a formal assertion to regulatory authorities, demonstrating commitment to ethical business practices within the automotive industry.

Financial statements: proof of financial stability.

Financial statements serve as critical documentation for demonstrating financial stability to obtain a motor vehicle dealer license. These statements typically include key components such as balance sheets, income statements, and cash flow statements from the past three years. Analyzing the balance sheet reveals total assets, liabilities, and equity, providing insight into overall financial health. The income statement reflects sales revenue, operating expenses, and net profit, illustrating profitability trends. Cash flow statements ensure sufficient liquidity by detailing cash inflows and outflows, crucial for daily operations. Additionally, these documents may require audits by certified public accountants to enhance credibility and conformity with regulatory standards. Such comprehensive financial documentation reinforces the applicant's capacity and reliability in managing a motor vehicle dealership.

Supporting documents: licenses, permits, insurance.

Motor vehicle dealer licenses are essential for legitimate operations in the automotive industry, typically issued by state authorities. Supporting documents for obtaining this license include various licenses, permits, and insurance policies. State permits, like a sales tax permit, validate compliance with tax obligations for automotive sales within states such as California, where the Department of Motor Vehicles oversees dealership operations. Additionally, insurance documentation, specifically liability insurance, safeguards against potential lawsuits resulting from vehicle transactions, with required coverage levels varying by state, often exceeding $1 million. Other vital documents include dealer bond forms, ensuring financial security for consumers, typically mandated in many jurisdictions, further validating the dealer's credibility and authority to conduct business.

Letter Template For Motor Vehicle Dealer License Samples

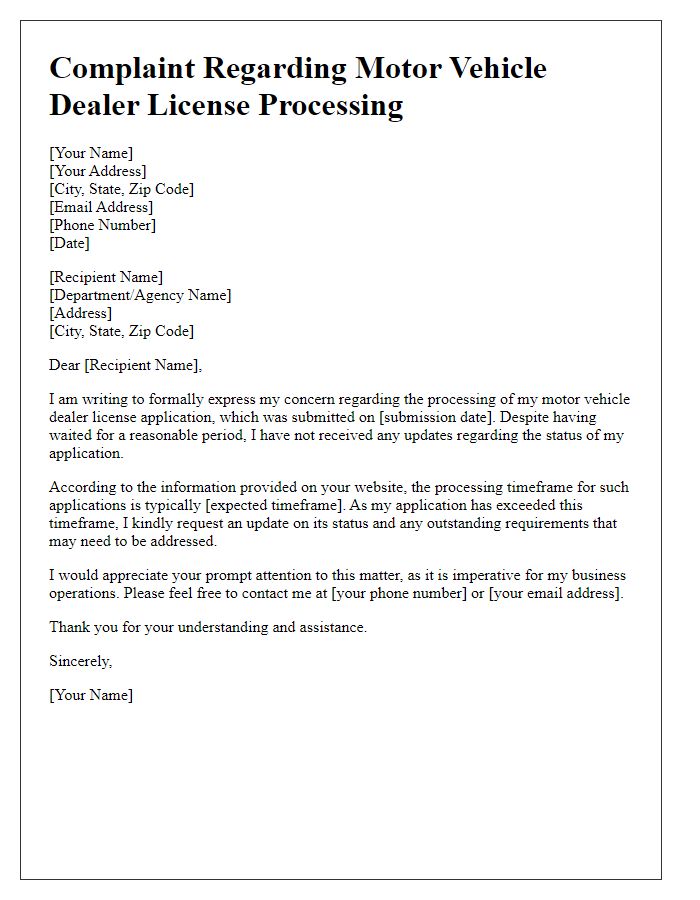

Letter template of complaint regarding motor vehicle dealer license processing

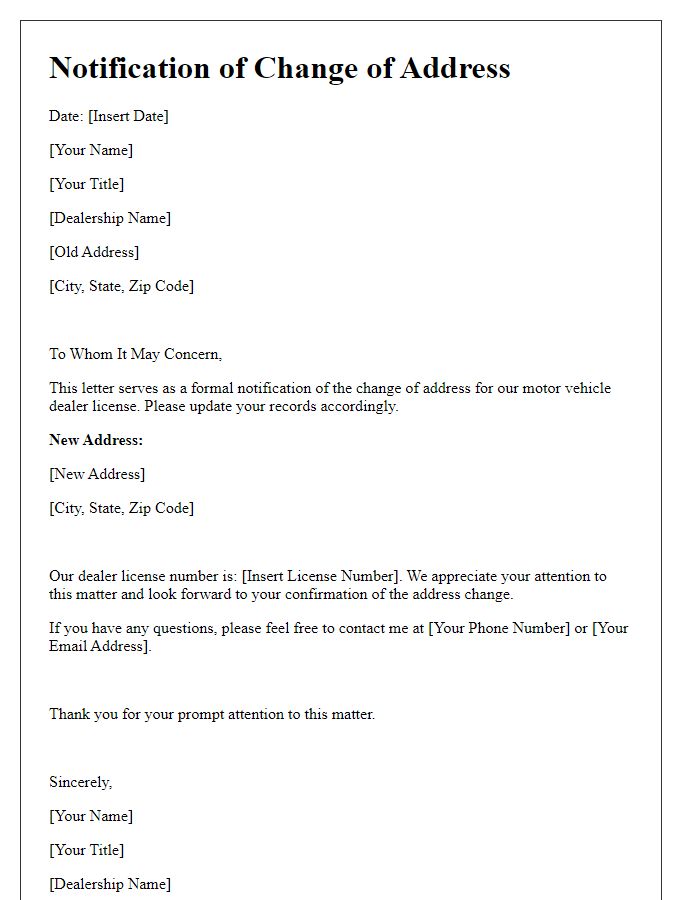

Letter template of notification for change of address for motor vehicle dealer license

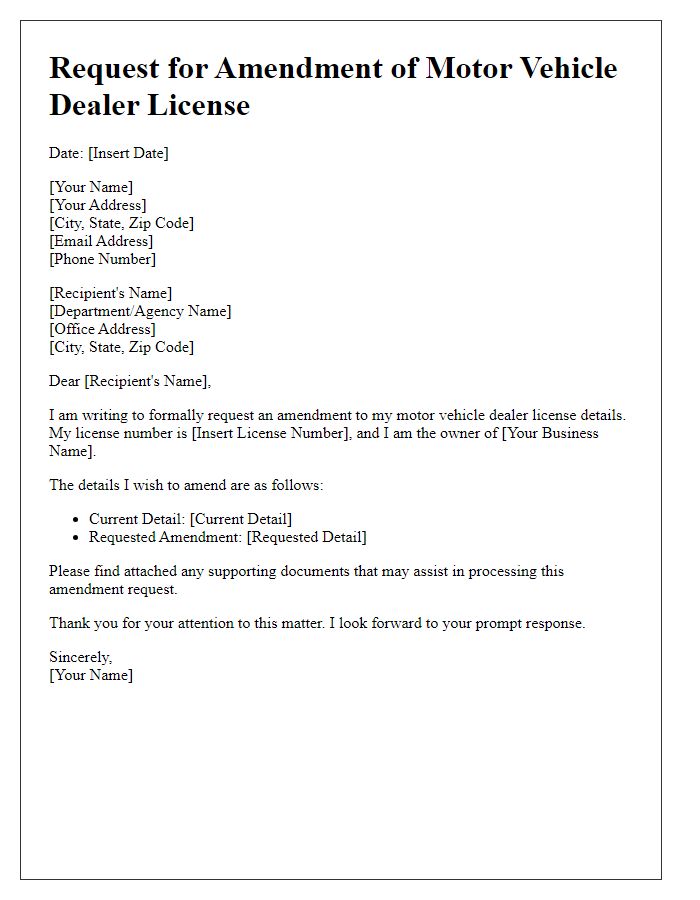

Letter template of amendment request for motor vehicle dealer license details

Letter template of notice of temporary closure affecting motor vehicle dealer license

Comments