Are you feeling burdened by a property lien and seeking a way to reclaim your financial freedom? Crafting a property lien release request letter can simplify the process and help you navigate this often confusing terrain. Whether you're dealing with unpaid debts or just want to clear the title of your home, knowing how to write a compelling request is key. Join us as we dive deeper into the essential components of this letter, ensuring you're equipped with all the necessary details to get your lien released smoothly!

Accurate property and lienholder details (names, addresses).

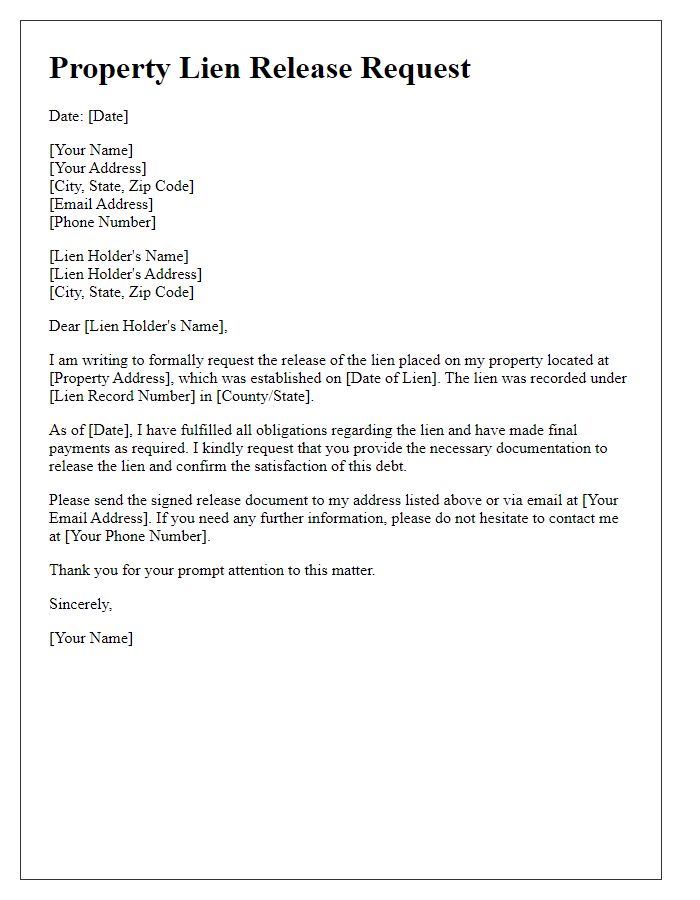

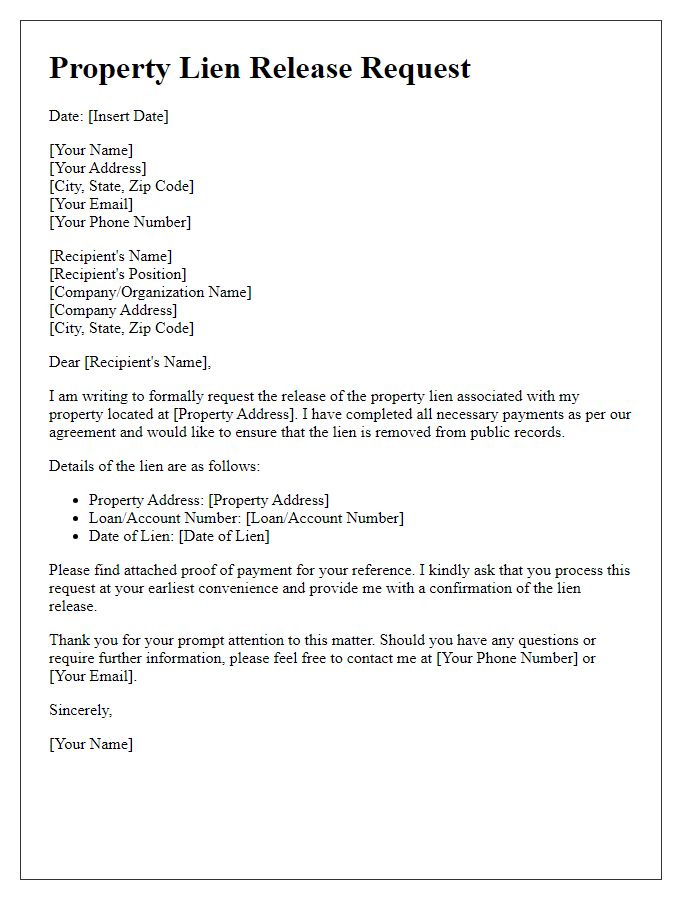

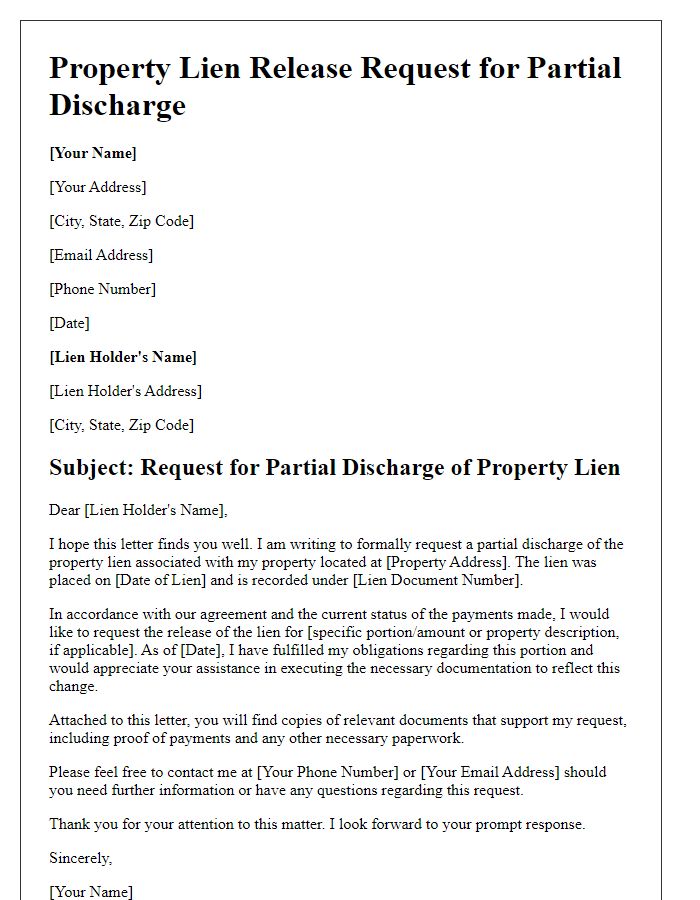

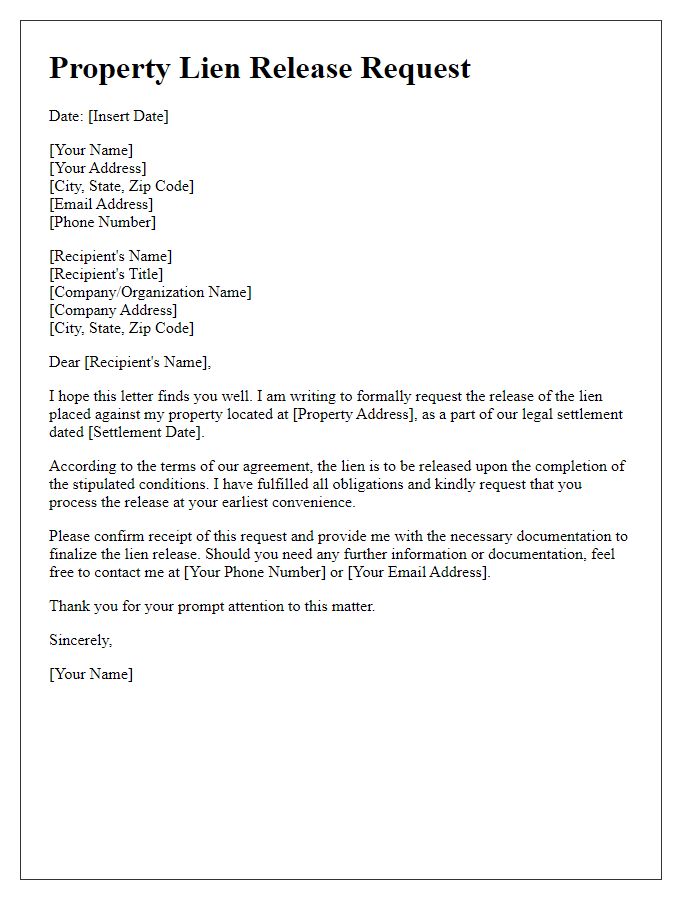

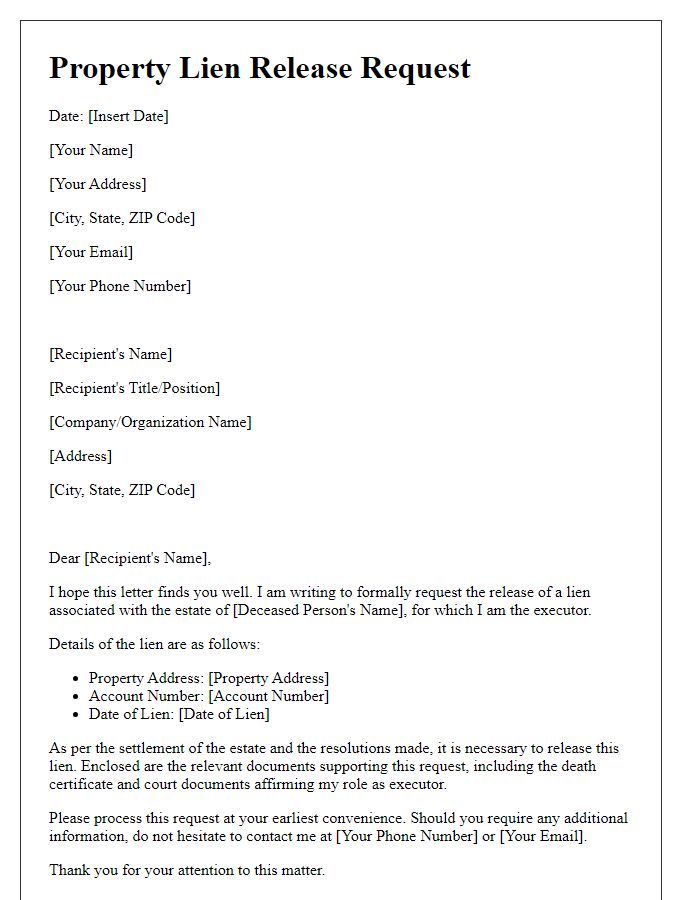

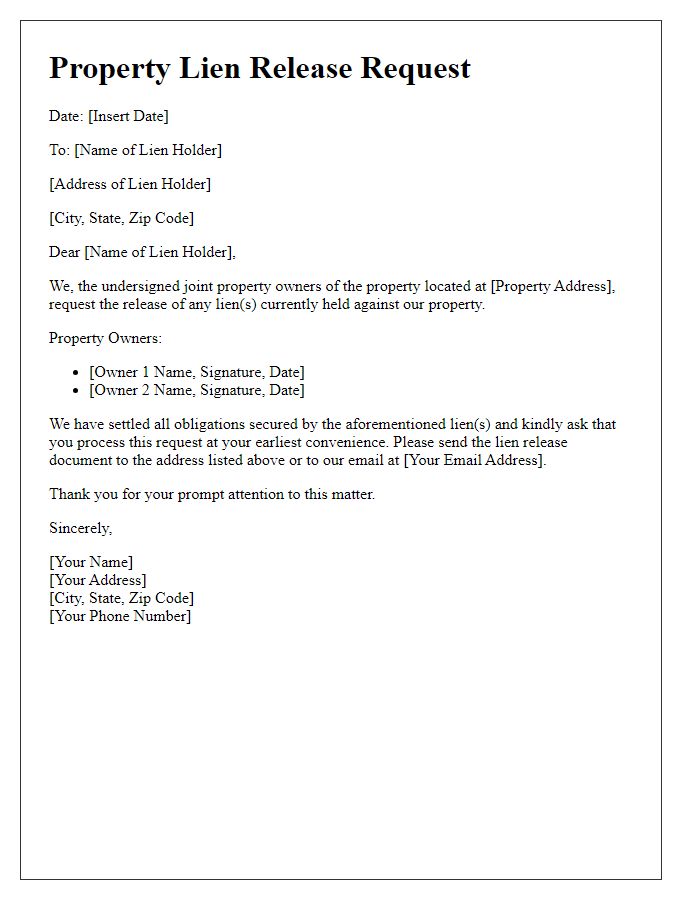

A property lien release request requires precise information to ensure accurate processing. The property owner's full name, address, and identification details should be clearly stated, usually including a street address, city, state, and ZIP code. The lienholder's name should also be specified, along with their contact details, including mailing address and phone number. Additionally, the property description must be included, such as the parcel number and any relevant legal descriptions, to identify the specific property in question. Clear articulation of the request for a lien release, alongside any supporting documentation, will facilitate a smoother transaction process for both parties involved.

Clear subject line indicating lien release request.

To request a property lien release, clearly state the subject line as "Lien Release Request for Property Located at [Property Address]." Provide essential details including the property type (e.g., residential or commercial), the original lien amount (specify the exact figure), the lienholder's name (the entity that placed the lien), and any relevant case or account numbers associated with the lien. Include a formal statement expressing the completion of necessary payments or conditions for lien release, and reference the date of lien placement. Maintain professionalism throughout the correspondence, ensuring clarity and conciseness to facilitate swift processing of the request.

Detailed explanation of lien satisfaction or resolution.

A lien release request pertains to the formal process of removing a lien from a property, often situated within specific legal and financial frameworks. Properties, such as residential homes in suburbs like Pleasanton, California, can have liens placed due to unpaid debts, typically involving amounts exceeding thousands of dollars. Satisfactory resolution of a lien occurs when the debtor fulfills their financial obligations, evidenced by a payment receipt or legal agreement. Documentation, including a lien satisfaction letter from the creditor or municipal authority, must accompany the request. The process often involves verification with the county recorder's office, which may charge a fee for filing the release. Ensuring accurate details on the property description, including parcel number and owner's name, is essential for clarity. This procedure plays a critical role in restoring clear title to the property, allowing for potential future transactions, such as a sale or refinancing, which can involve sums far exceeding the original lien amount.

Supporting documents or proof of lien settlement.

To initiate the property lien release process, it is essential to gather supporting documents that clearly demonstrate the lien settlement. A primary document includes the official lien release form from the lienholder, typically signed by an authorized representative indicating that the debt has been fully satisfied. Additional proof of lien settlement may consist of payment receipts, bank statements reflecting the transaction, or signed agreements detailing the terms of the settlement. Property information such as the legal description, parcel number, and the specific address must be included for clarity. Furthermore, if applicable, records from a court or other governing body affirming the settlement should also be submitted. Having these documents organized and accurate facilitates a smoother lien release process.

Contact information for further communication.

A property lien release request involves formal communication to indicate the removal of a lien on a specific property. Important details include the property address, lienholder's name, and relevant deed or loan information. Organizations like the county recorder's office and legal bodies often manage such documents. Clear contact information is essential, including phone numbers and email addresses for effective follow-up. This ensures all parties maintain open lines of communication for any necessary clarifications or additional documentation required during the release process.

Letter Template For Property Lien Release Request Samples

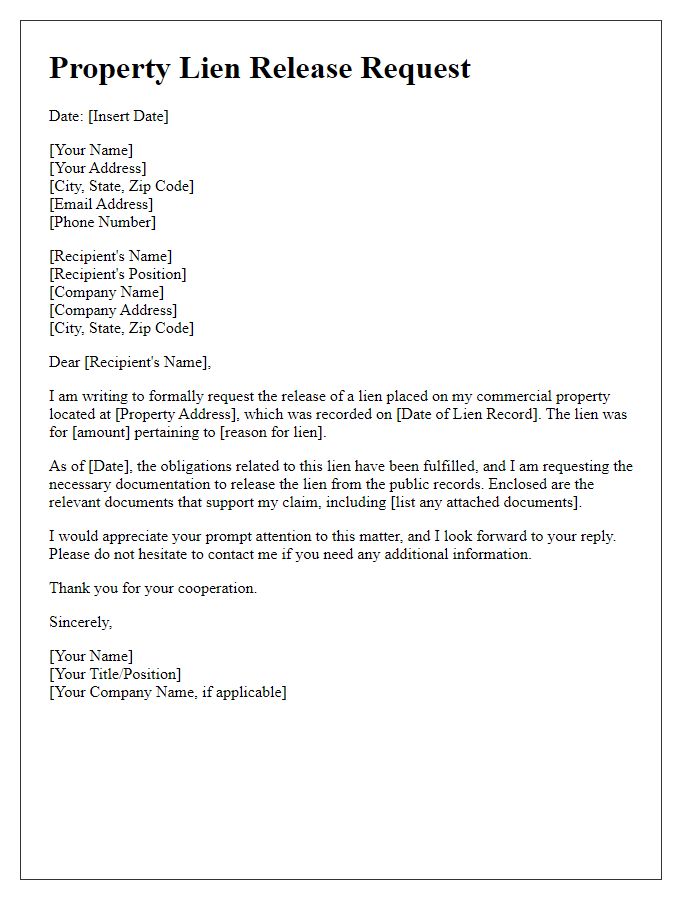

Letter template of Property Lien Release Request for Commercial Property

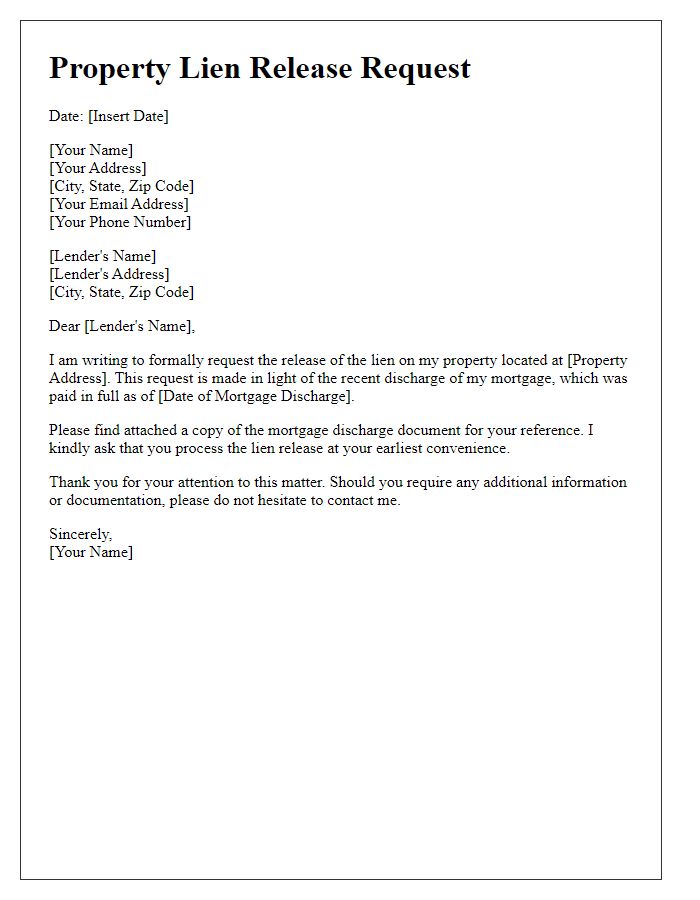

Letter template of Property Lien Release Request for Mortgage Discharges

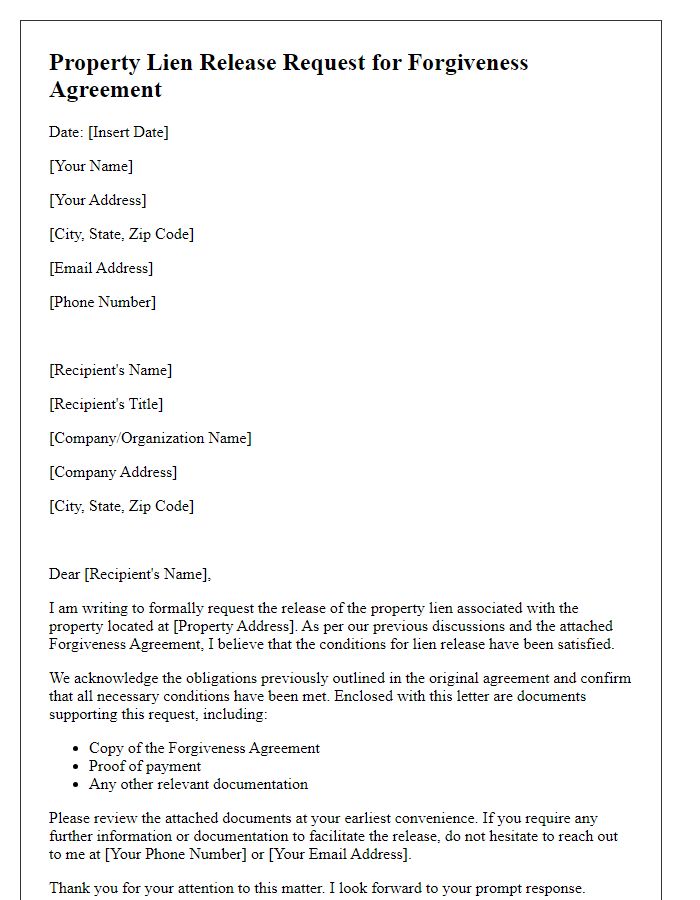

Letter template of Property Lien Release Request for Forgiveness Agreement

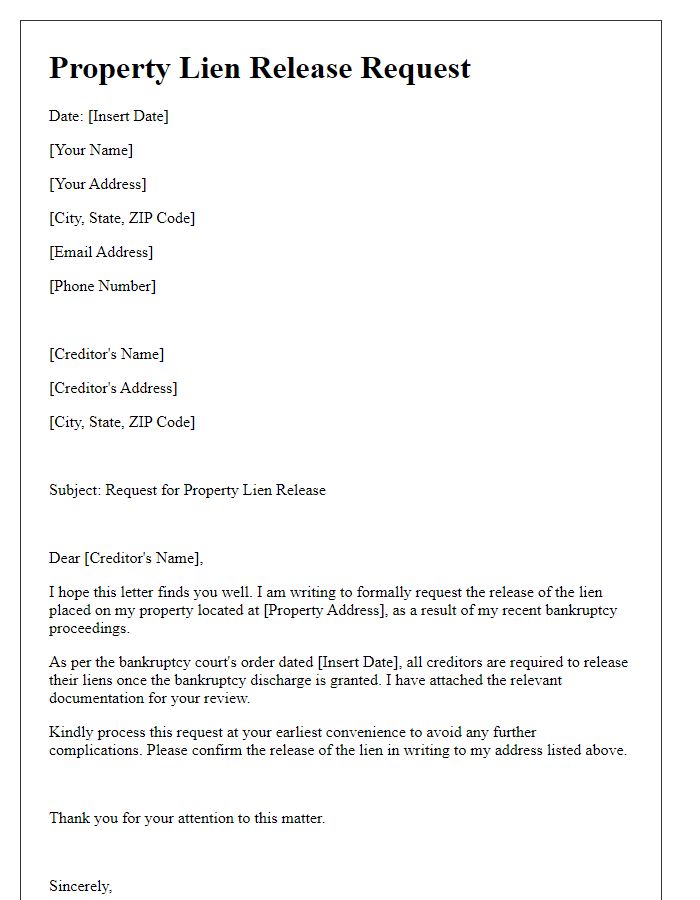

Letter template of Property Lien Release Request for Bankruptcy Proceedings

Comments