Are you considering an investment contract and feeling a bit overwhelmed by the fine print? You're not alone; many find navigating legal jargon to be a daunting task. In this article, we'll break down essential components of an investment contract, ensuring you know what to look for before signing on the dotted line. So, let's dive in and empower you with the knowledge you need to make informed decisionsâread on!

Clear Contractual Terms

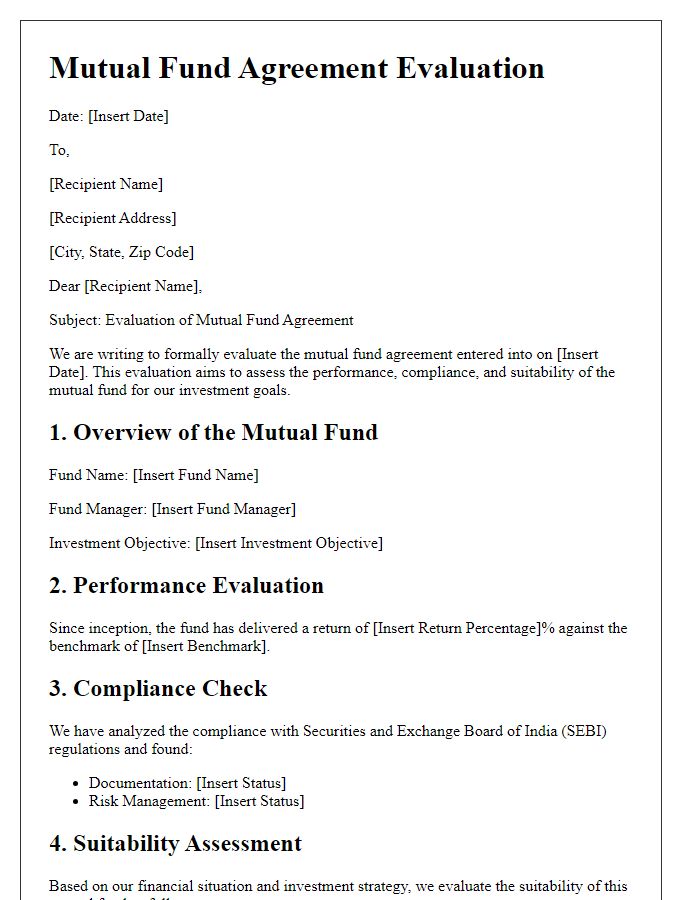

Investment contracts must feature clear contractual terms to ensure mutual understanding between parties involved. Clarity in terms such as investment amount (e.g., $50,000) and return expectations (e.g., 10% annual return) is essential for reducing ambiguity. Milestones (specific events or timelines, such as quarterly reports or annual evaluations) should be distinctly outlined, as well as any potential risks associated with the investment, like market fluctuations or regulatory changes. Legal definitions of terms like "default" or "termination" must be explicitly stated to prevent future disputes. Additionally, the jurisdiction governing the contract (e.g., New York State law) and avenues for dispute resolution (e.g., arbitration process) should be clearly articulated. These elements collectively contribute to a comprehensive and enforceable investment agreement.

Legal Compliance

Investment contract reviews require meticulous attention to legal compliance, ensuring adherence to regulations established by governing bodies, such as the Securities and Exchange Commission (SEC) in the United States. Contracts must clearly define terms like return on investment (ROI), specifying exact percentages and payment schedules. Additionally, the obligations of both parties should be outlined to mitigate risks associated with venture capital or private equity engagements. Clauses that address dispute resolution methods, including mediation and arbitration, must be included to uphold legal standards. Furthermore, compliance with anti-money laundering (AML) regulations and know-your-customer (KYC) protocols is essential to safeguard against potential legal repercussions. Each jurisdiction may have unique laws, making it crucial to consult legal experts familiar with regional regulations to ensure full compliance and mitigate liabilities.

Financial Implications

During an investment contract review, critical financial implications must be considered to ensure profitability and risk management. Cash flow projections forecast income and expenses over a specified period, influencing liquidity management. The rate of return (ROI) reflects the potential profitability percentage, serving as a benchmark for investment attractiveness. Analyzing risk factors (market volatility, interest rates) is essential for understanding potential losses. Fee structures (management fees, performance fees) can significantly impact overall investment returns, requiring careful examination. Additionally, taxation implications on investment gains (capital gains tax rates varying by jurisdiction) could affect net profitability. Comprehensive evaluation of these aspects is vital for informed decision-making.

Risk Assessment

Investment contracts often present various risk factors that require careful consideration and assessment. Evaluating economic risks involves analyzing market volatility, which can fluctuate by percentages based on historical data. Legal risks may arise due to changes in regulatory frameworks, particularly in regions such as the European Union, where directives can impact investment strategies significantly. Operational risks, including management inefficiencies or technological failures, may lead to financial losses, necessitating a thorough examination of the company's internal processes. Additionally, geopolitical risks, especially in emerging markets, can affect economic stability and investment returns, prompting investors to consider various scenarios based on current events. Due diligence in these areas is essential to mitigate potential setbacks and secure long-term returns on investment endeavors.

Dispute Resolution Mechanisms

Dispute resolution mechanisms play a crucial role in investment contracts, ensuring that conflicts between parties can be managed effectively. Common methods include arbitration, which allows a neutral third party to make binding decisions, and mediation, where a facilitator helps negotiate a settlement without imposing a resolution. Jurisdictions such as New York, known for its business-friendly arbitration environment, often host these proceedings. The contract should specify the choice of law (e.g., the governing statutes of Delaware) and the forum for dispute resolution. Timelines for raising disputes, recovery of costs, and enforcement of awards must be clearly defined to ensure smooth resolution. Additionally, including provisions for alternative dispute resolution, such as collaborative law or neutral evaluations, can provide further options for parties to avoid lengthy litigation.

Comments