Are you facing the complex world of inheritance disputes? Navigating these challenges can be emotional and legally intricate, often leaving family members at odds over the distribution of assets. It's essential to understand your rights and the steps you can take to resolve these conflicts amicably. Join us as we explore effective strategies and insights into handling inheritance disputes, and delve deeper into how you can find clarity and resolution in your situation.

Clear identification of involved parties

In cases of inheritance disputes, clear identification of involved parties plays a crucial role. The decedent, often referred to by name and date of birth, is the individual whose estate is under dispute. Heirs, including primary beneficiaries such as children or spouses, should be named along with their relationship to the decedent. Additionally, any executors appointed, typically designated in a will (or probate document), must be identified by name and their role in the estate management. Furthermore, any claimants or interested parties, such as distant relatives or previous spouses, should be mentioned to establish the scope of the dispute. Accurate identification ensures clarity and may prevent legal complications during resolution proceedings.

Comprehensive overview of disputed assets

In an inheritance dispute, a comprehensive overview of contested assets typically includes properties, financial accounts, and personal valuables. Real estate properties, such as residential homes or commercial buildings, may be appraised to determine their fair market values and clarify ownership claims. Financial accounts, such as bank savings, investment portfolios, and retirement funds, need identification, along with their respective balances and beneficiaries. Personal assets like jewelry, vehicles, and collectibles require detailed descriptions, photos, and estimated values to establish their significance. Additionally, any outstanding debts or liabilities associated with these assets must be documented to provide clarity on the estate's net value, ensuring a transparent resolution to the inheritance dispute.

Reference to legal documents (wills/trusts)

Inheritance disputes often arise from ambiguities in legal documents such as wills or trusts, affecting the distribution of assets after the death of an individual. Proper legal documentation, including a last will and testament or established trusts, is crucial in clarifying the intentions of the deceased. Issues may involve varying interpretations of specific clauses, formalities related to execution, or the validity of amendments. Legal experts emphasize the importance of adhering to jurisdictional requirements, as each state may have different rules regarding inheritance laws. Disputes can escalate, leading to court involvement to resolve claims, validate documents, and ultimately enforce the decedent's wishes regarding the distribution of property and assets.

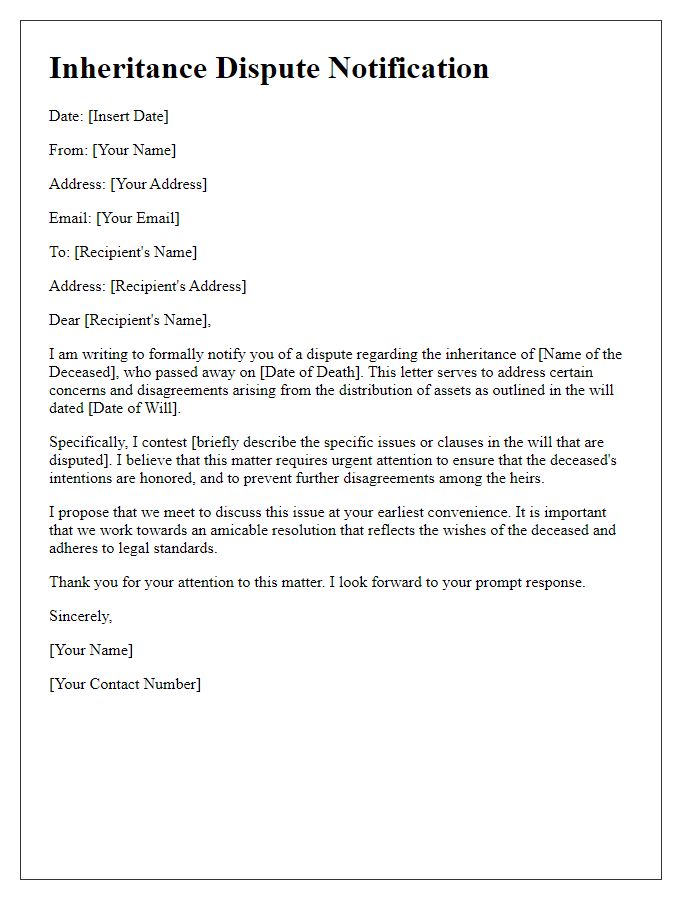

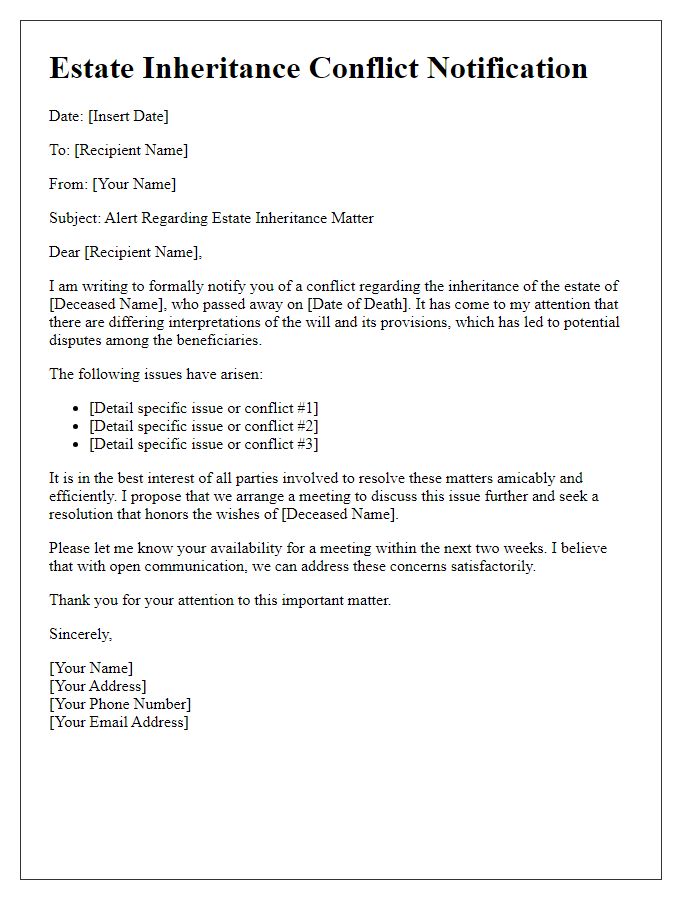

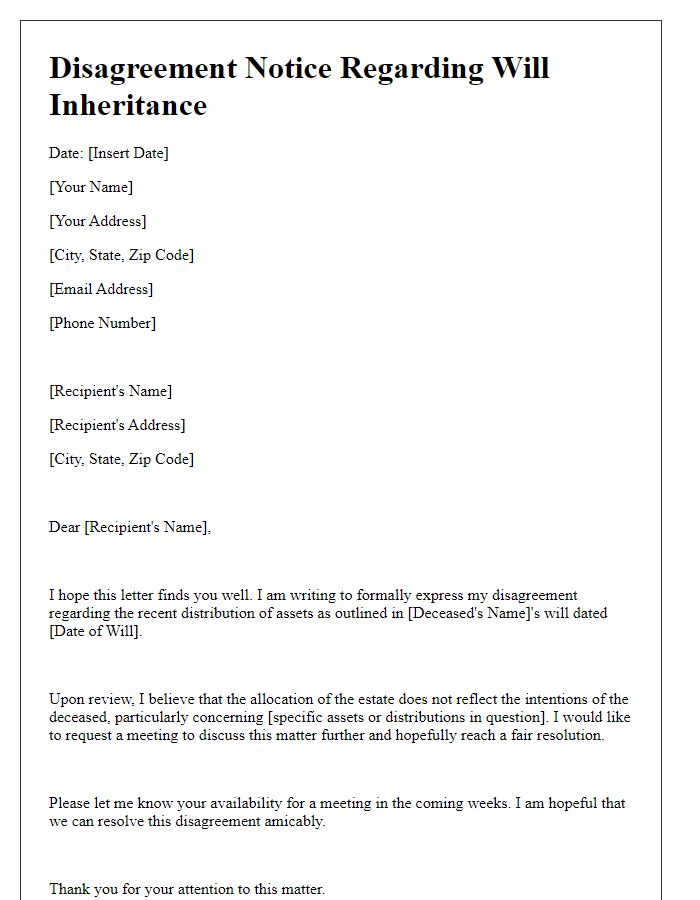

Articulation of specific claims and requests

A notice regarding an inheritance dispute outlines detailed claims and requests related to estate division. Beneficiaries must document their relationship to the deceased, ideally referencing the deceased's last will and testament, which may have been executed in a specific location (such as a courthouse or law office in California). Key claims should address asset distribution discrepancies, citing specific items or monetary values (like a family estate valued at $500,000 or jewelry worth $10,000). Each request should clarify desired outcomes, such as a request for equitable division of assets, an accounting of all estate transactions, or a formal mediation session by a licensed mediator in the locality. This notice should be sent through certified mail to ensure formal acknowledgment.

Details on intended legal actions or mediation

Inheritance disputes often arise in complex family dynamics, especially following the passing of a loved one, which can lead to emotional strain and financial disagreements. Common issues include disagreements over the division of assets, adherence to the deceased's last will (for example, drafting from a law office in San Francisco), and claims from beneficiaries (siblings, children, or spouses) who feel entitled to a larger share. In these situations, parties may consider legal actions, such as filing a suit in probate court (often where the deceased lived, like Los Angeles County), or opting for mediation to resolve disputes amicably. Mediation involves a neutral third party facilitating discussions between heirs to reach a mutually agreeable resolution. Important aspects to remember include deadlines for filing claims (typically within six months of the will being probated), state laws governing inheritance (like intestacy laws in Texas), and the potential costs associated with legal proceedings, which can burden the estate significantly. Understanding these factors can help navigate the complexities of inheritance disputes more effectively.

Comments