Are you struggling to keep track of unpaid invoices from clients? You're not aloneâmany businesses face this challenge, and it's vital to address it professionally to maintain a good working relationship. In this article, we'll share an effective letter template for a non-payment reminder that balances firmness with courtesy, ensuring your message gets through without souring the tone. Read on to discover how to craft the perfect reminder that encourages prompt payment while preserving your client connections!

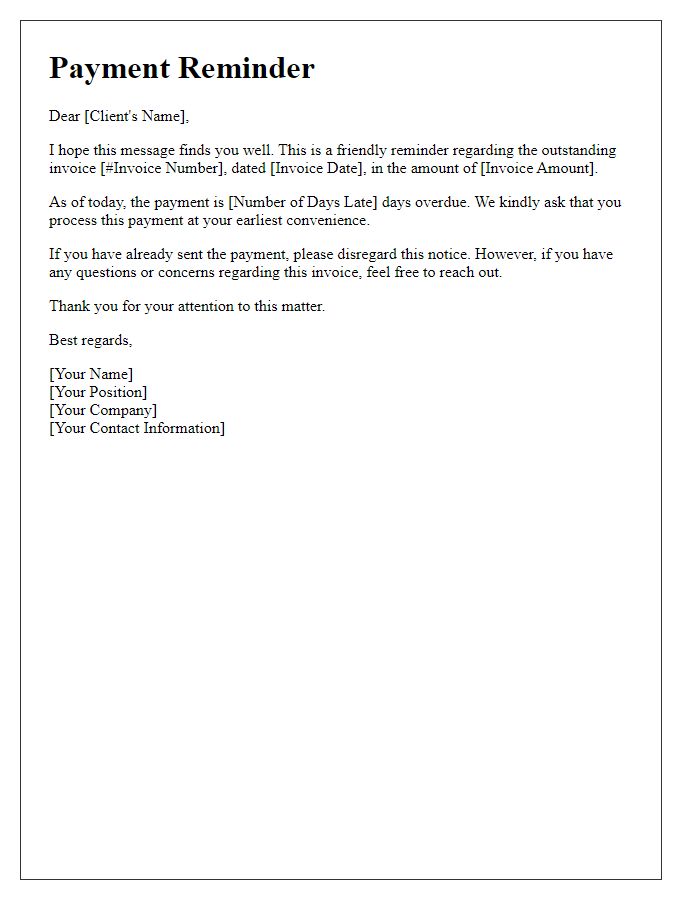

Subject Line

Subject Line: Important Reminder: Outstanding Payment Due for Invoice #12345

Greeting

Property disputes often arise in cities like New York or Los Angeles, where rental agreements (often legally binding contracts) outline terms for payment. Late payments can lead to eviction proceedings under state law, causing financial strain for landlords and tenants alike. Documentation, including emails and notices (usually delivered via certified mail), serves as important evidence in potential legal disputes. Failing to address non-payment promptly may result in lost income, legal fees, and a damaged landlord-tenant relationship, emphasizing the importance of effective communication.

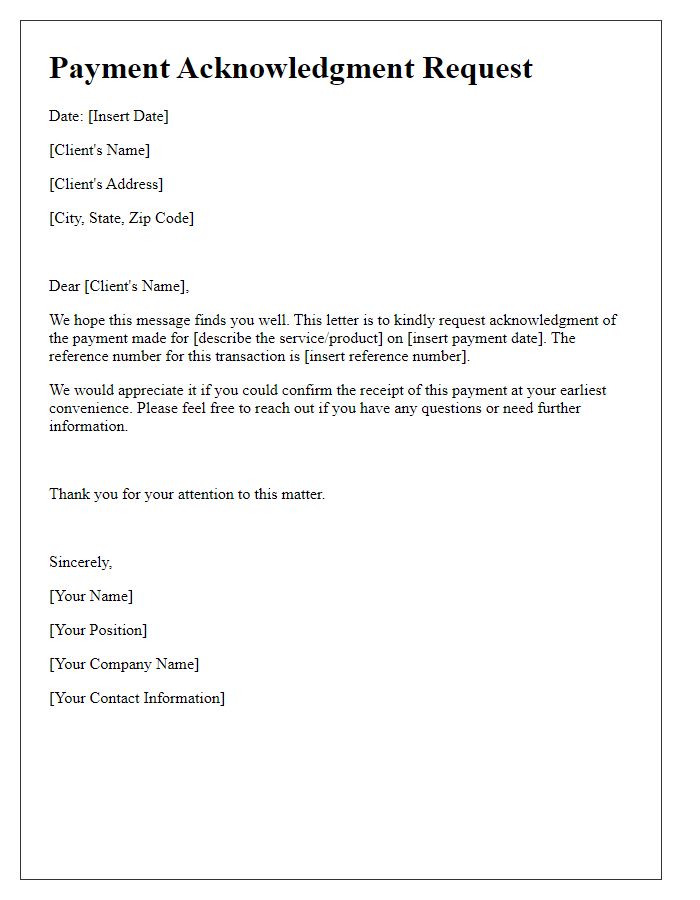

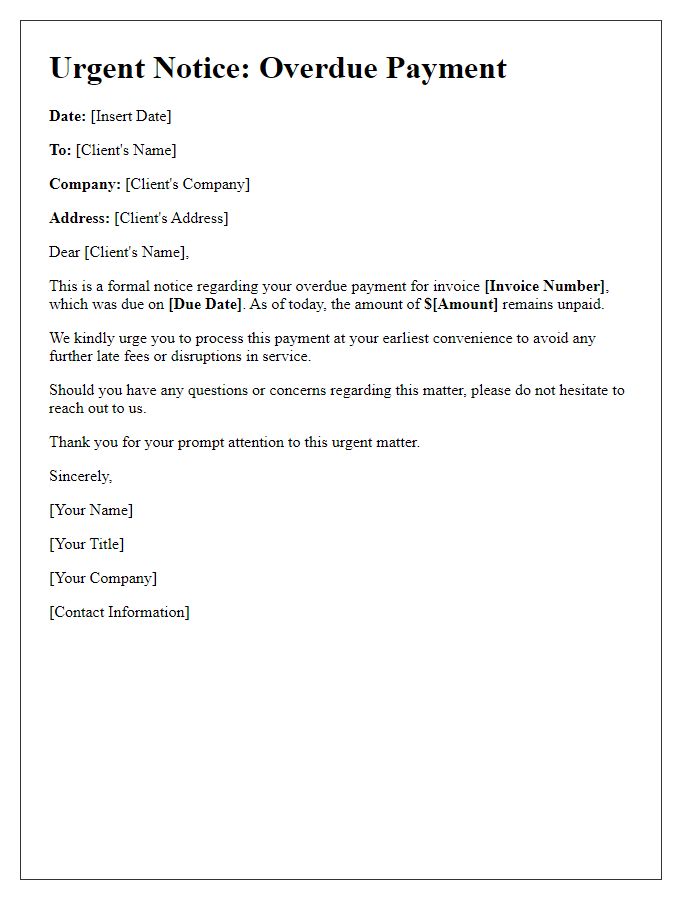

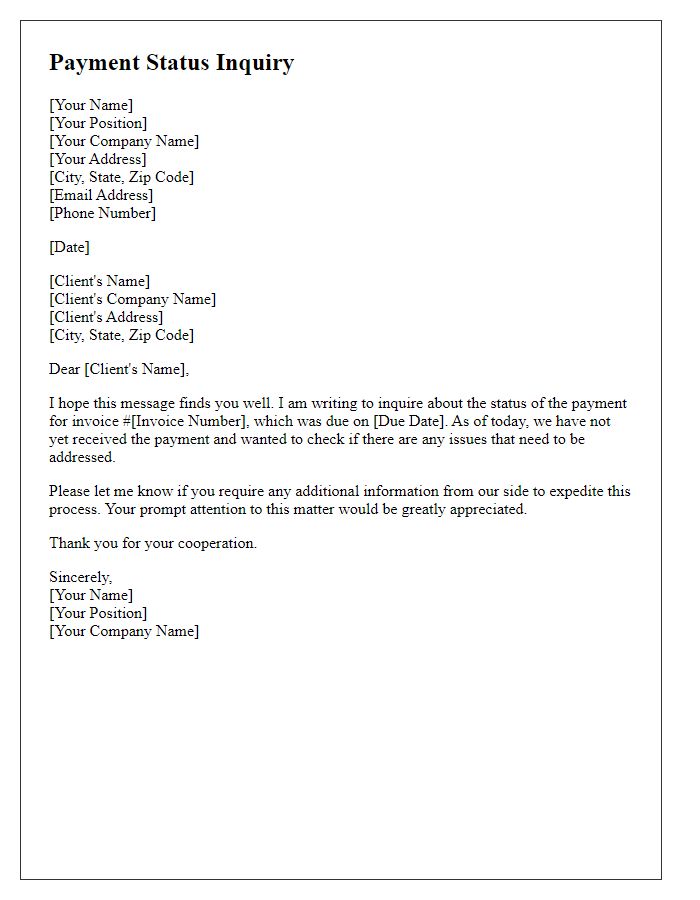

Account and Invoice Details

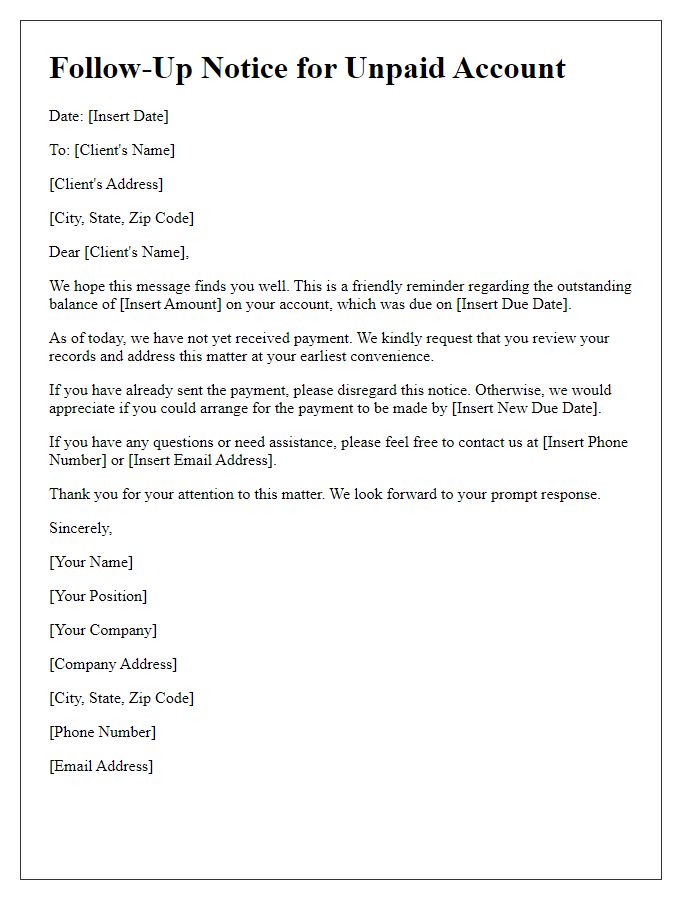

In the context of financial management, timely communication regarding account statuses is vital for business health. Outstanding invoices can lead to cash flow issues if not addressed promptly. The account number, often a unique identifier assigned to each client, allows businesses to easily track payments and outstanding amounts. The invoice details, including the invoice number, date of issue, due date, and total amount owed, serve as critical reference points. It is common practice to follow up on overdue invoices, typically after 30 days past the due date, ensuring that clients are reminded of their obligations. Effective reminders can include contact details and payment options, facilitating easier resolution of the debt.

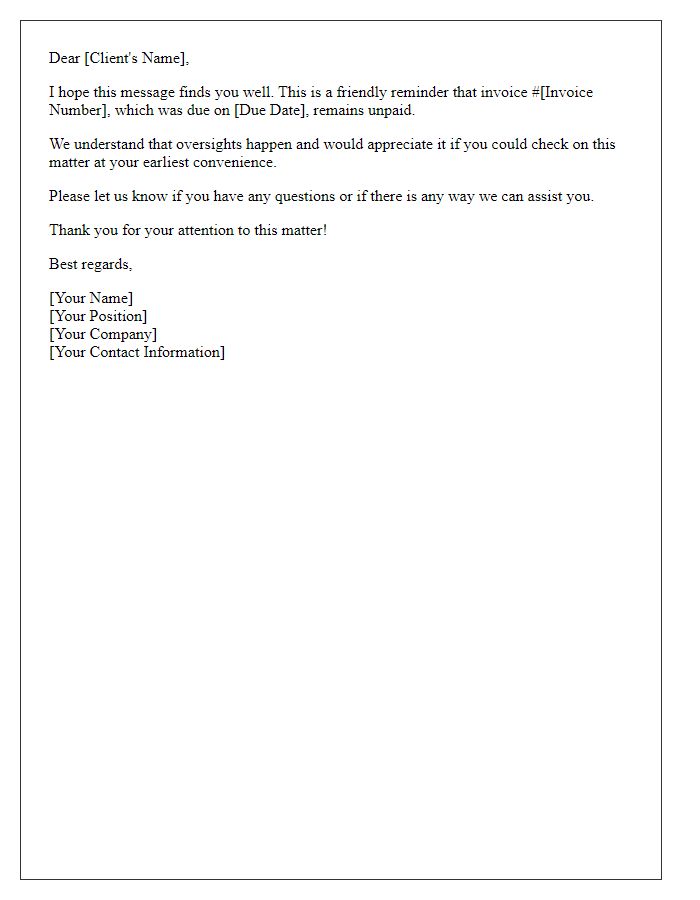

Payment Reminder Matter

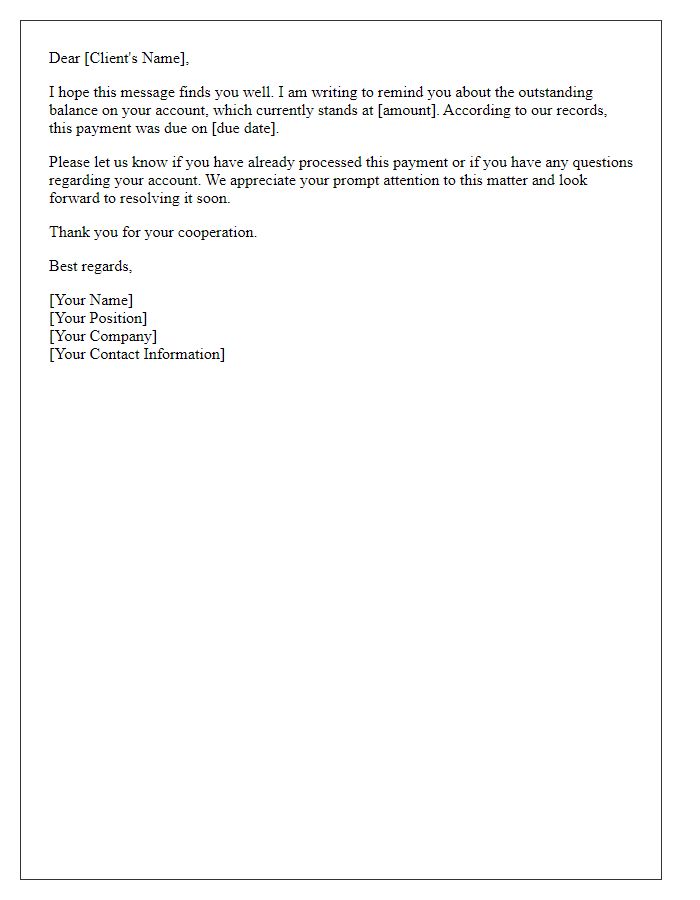

Non-payment can significantly impact cash flow within businesses, especially for small enterprises relying on consistent income. Outstanding invoices, typically due within 30 days, can accumulate, leading to potential financial strain. Communication regarding overdue payments, often initiated via email or phone, is crucial for maintaining professional relationships. Clients in sectors such as construction or freelance services often face delays, making timely follow-ups essential. Providing a detailed account statement, including invoice numbers and due dates, can enhance clarity. Additionally, including late payment terms can encourage prompt resolution.

Contact Information

In today's business environment, managing cash flow is crucial for sustainability. A thorough review of client accounts is often necessary, particularly for overdue invoices. The average payment term for business transactions typically ranges from 30 to 60 days; however, delays can occur. Companies frequently experience non-payment issues from clients valuing services rendered, causing financial strain. A prompt reminder regarding outstanding balances, often utilizing direct communication methods such as email or phone calls, can aid in securing payment. Incorporating specific invoice details, such as the invoice number, due date, and outstanding amount, may foster accountability and clarity. Timely follow-up reinforces the importance of adherence to agreed-upon payment schedules, benefiting both parties in maintaining a solid professional relationship.

Comments