Navigating a conflict of interest with clients can feel like walking a tightrope, but it doesn't have to be daunting. Open communication and transparency are key when addressing these delicate situations. By acknowledging the potential issues upfront, you can foster trust and demonstrate your commitment to ethical standards. Curious about how to effectively manage these conversations? Read on!

Identification of Conflict

In a business context, identifying a conflict of interest is crucial for maintaining transparency and trust, particularly in professional services such as legal, financial, or consulting sectors. A conflict of interest can arise when an individual or organization, like a legal firm, has competing interests that could potentially interfere with their obligations to their client, such as representing multiple clients with opposing interests in a legal dispute. For instance, if a law firm represents two corporations, XYZ Corp and ABC Inc, in separate transactions, a potential conflict could emerge if both entities seek to negotiate a deal that may not align with the other's interests. Disclosure of this conflict is essential to avoid ethical dilemmas and maintain professional integrity, adhering to guidelines from regulatory bodies such as the American Bar Association (ABA) or the International Federation of Accountant (IFA).

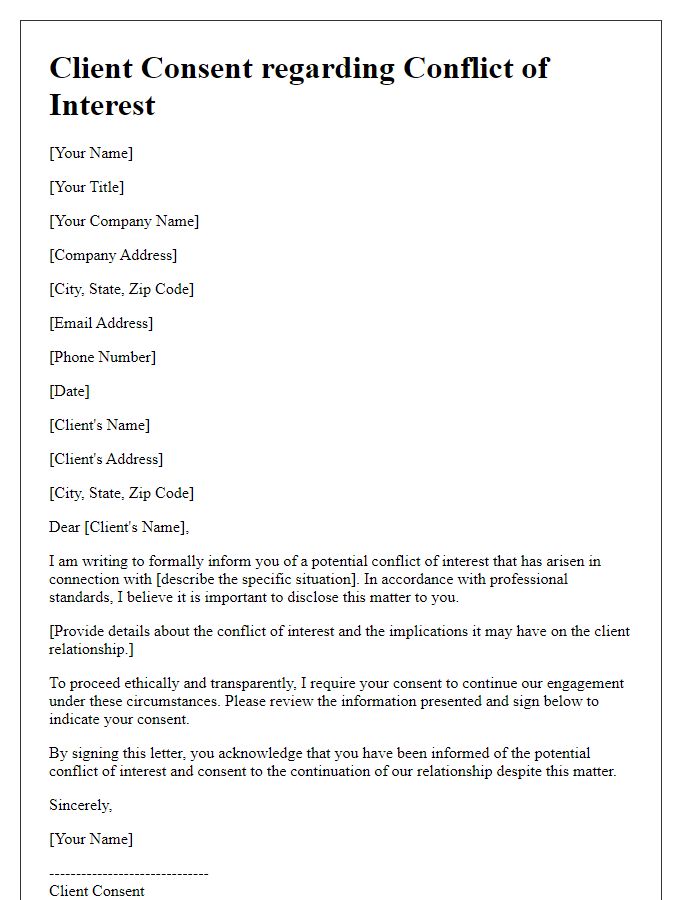

Disclosure Statement

A conflict of interest can arise when a professional relationship has the potential to compromise the integrity or objectivity of the services provided. For instance, if a company has a financial stake in a vendor chosen for a project, this situation could lead to biased recommendations. Transparency is crucial in these instances. A disclosure statement should clearly outline the nature of the relationship, the potential implications on decision-making, and any steps taken to mitigate the conflict. Proper documentation fosters trust and maintains professional ethics within industries such as finance, law, and consulting, where impartiality is essential for fair client treatment. Furthermore, adhering to professional standards set by entities like the American Bar Association enhances credibility and protects client interests.

Client Consent and Acknowledgment

Client conflicts of interest arise when interests of multiple parties overlap, potentially compromising objectivity. In financial services, for instance, an advisor managing assets for a family member may face dilemmas affecting impartiality. Clients must provide informed consent acknowledging these potential conflicts. Detailed documentation should outline the nature of the conflict, outlining any specific relationships, such as family ties or shared business ventures. Clear communication around the implications of these interests helps ensure that clients fully understand their rights. Necessary steps to mitigate conflicts might include the establishment of firewalls or third-party oversight to safeguard the client's best interests, resulting in a transparent and ethical advisory process.

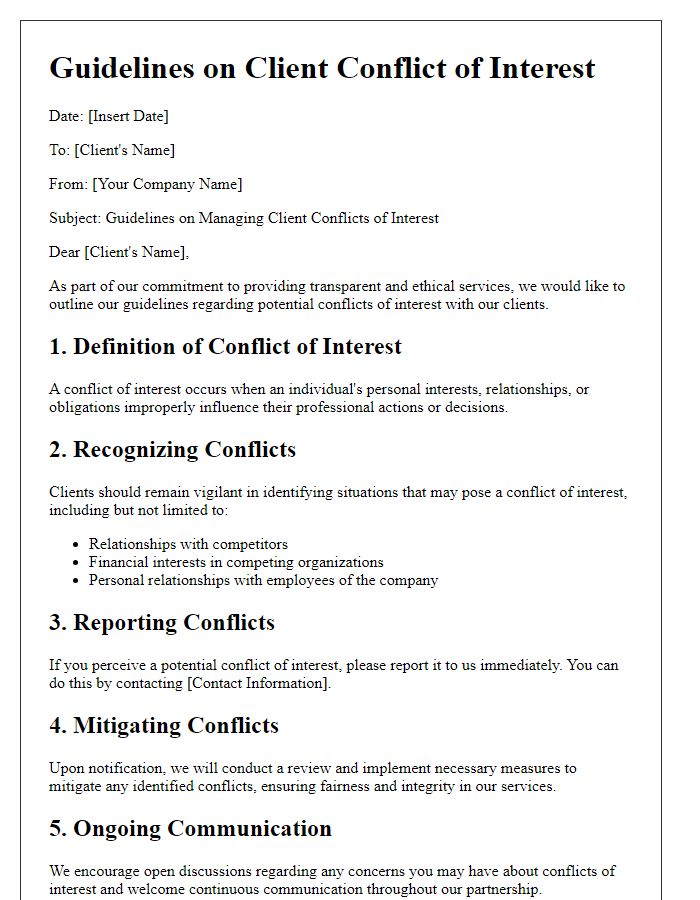

Resolution or Mitigation Strategy

The client conflict of interest arises when two or more parties have competing interests or obligations that could compromise the ability to act in the best interest of each party. Effective resolution strategies involve identifying the specific interests at stake, assessing the potential impact on each party, and determining a clear path forward. This may include implementing measures such as a disclosure process to inform all parties involved, establishing boundaries to separate conflicting interests, or creating a committee to oversee conflict management. Additionally, mediation or neutral third-party consultations may help facilitate open communication and foster a collaborative environment for resolving disputes. Maintaining transparency throughout the process is essential to rebuild trust and ensure that all parties feel their concerns are addressed adequately. Key terms: - Conflict of Interest: A situation in which a person or organization has competing interests that could influence decision-making. - Disclosure Process: The systematic approach to inform involved parties about potential conflicts. - Mediation: A method of conflict resolution involving a neutral third party to assist in negotiations.

Contact Information for Further Queries

In cases of client conflicts of interest, effective communication is essential for resolution, particularly when involving multiple parties. It's important to provide clear contact information for relevant personnel. Ensure that all stakeholders understand where to direct any concerns or inquiries. Include specific names, titles, phone numbers, and email addresses for members of the legal or compliance team, as well as any designated mediators. This transparency facilitates timely communication and promotes a smoother conflict resolution process. For instance, having a designated compliance officer at a law firm, reachable at (555) 123-4567 or compliance@lawfirm.com, ensures clients can easily navigate questions or issues regarding potential conflicts.

Letter Template For Client Conflict Of Interest Samples

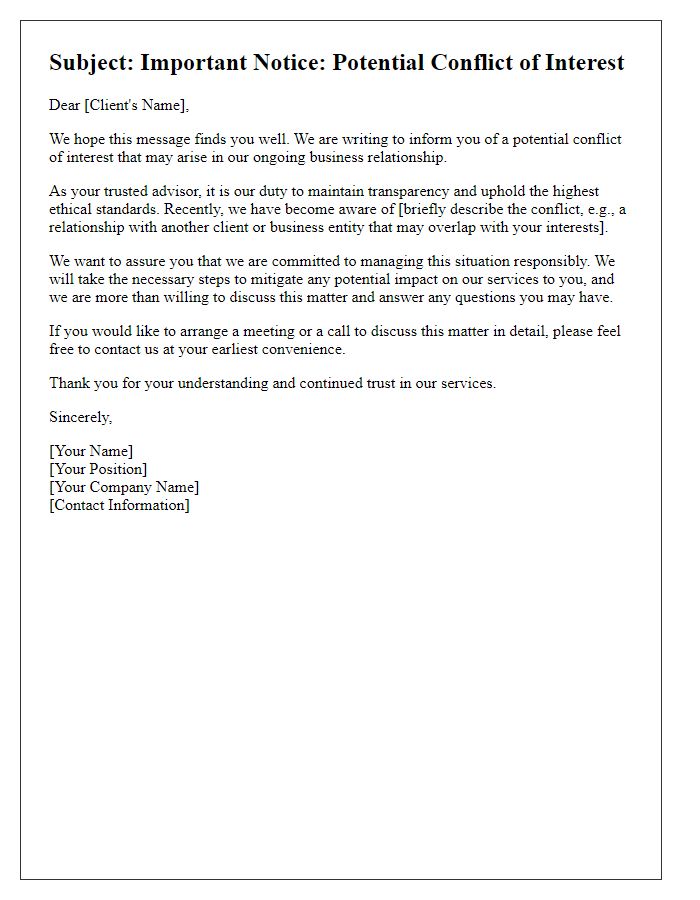

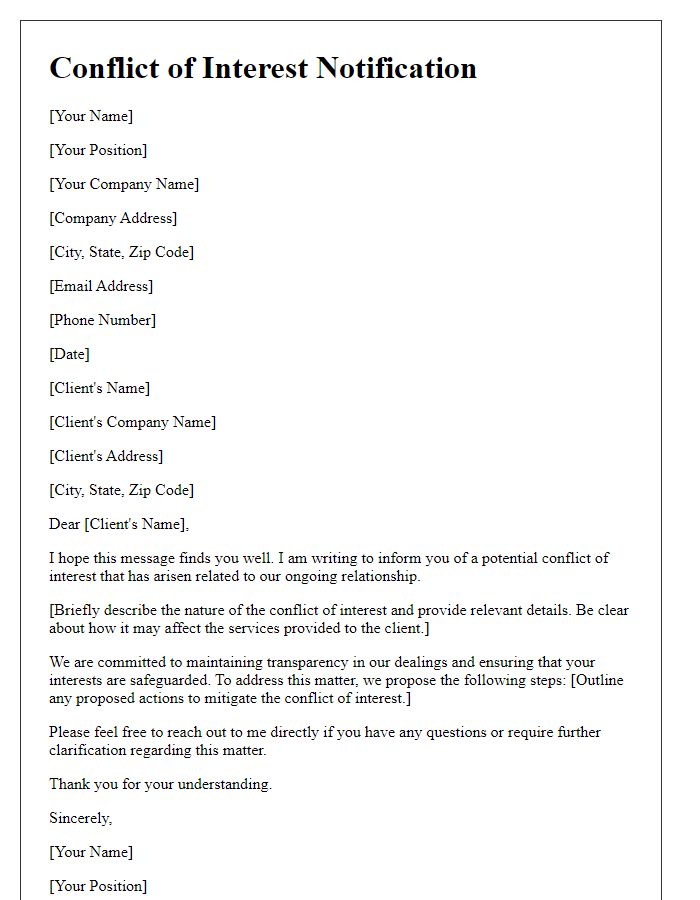

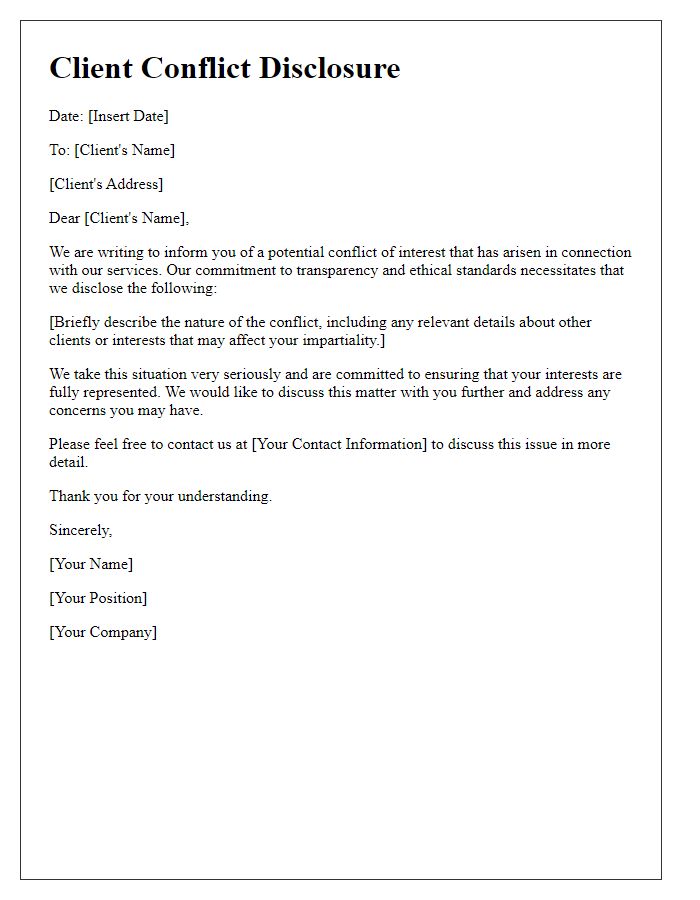

Letter template of informing clients about potential conflict of interest

Comments