Are you feeling overwhelmed by debt and considering the possibility of voluntary bankruptcy? Navigating through financial hardship can be daunting, but understanding the process can make it less intimidating. This article will provide you with a clear letter template that can guide you in filing for bankruptcy, ensuring you have the support you need. So, let's dive into the details and empower you to take the next step towards financial relief!

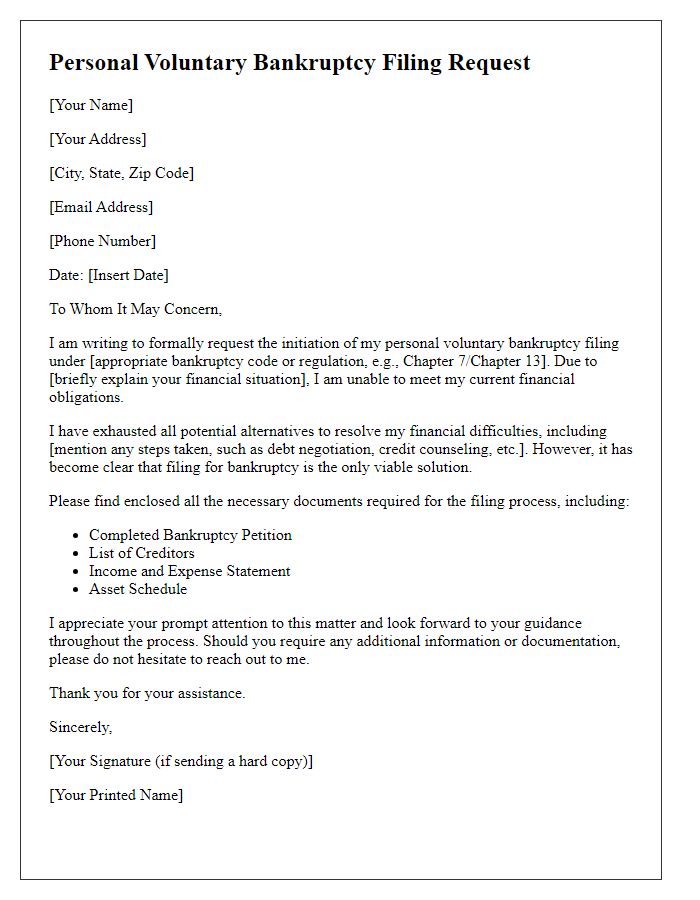

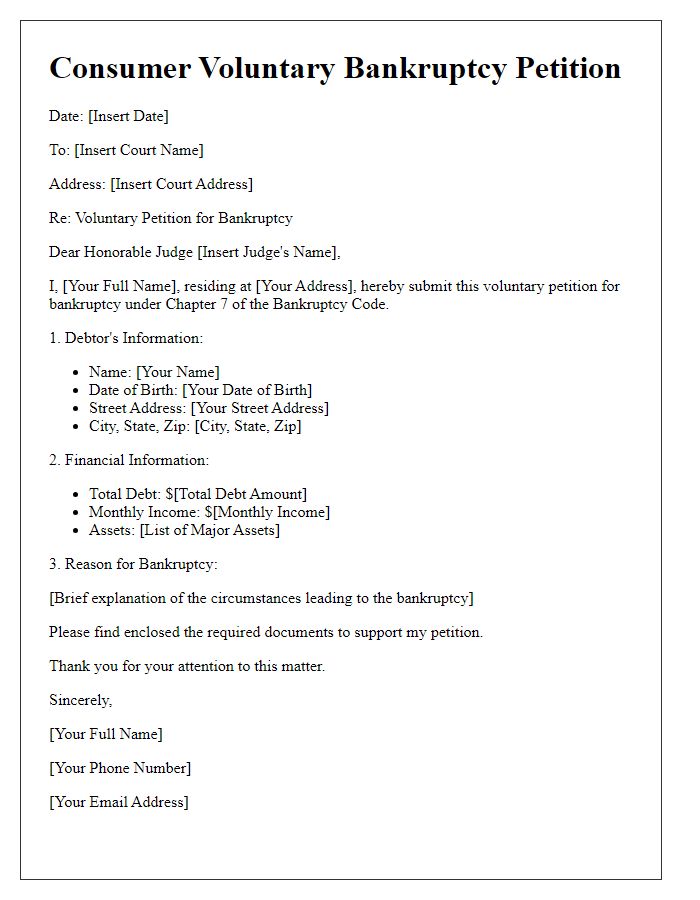

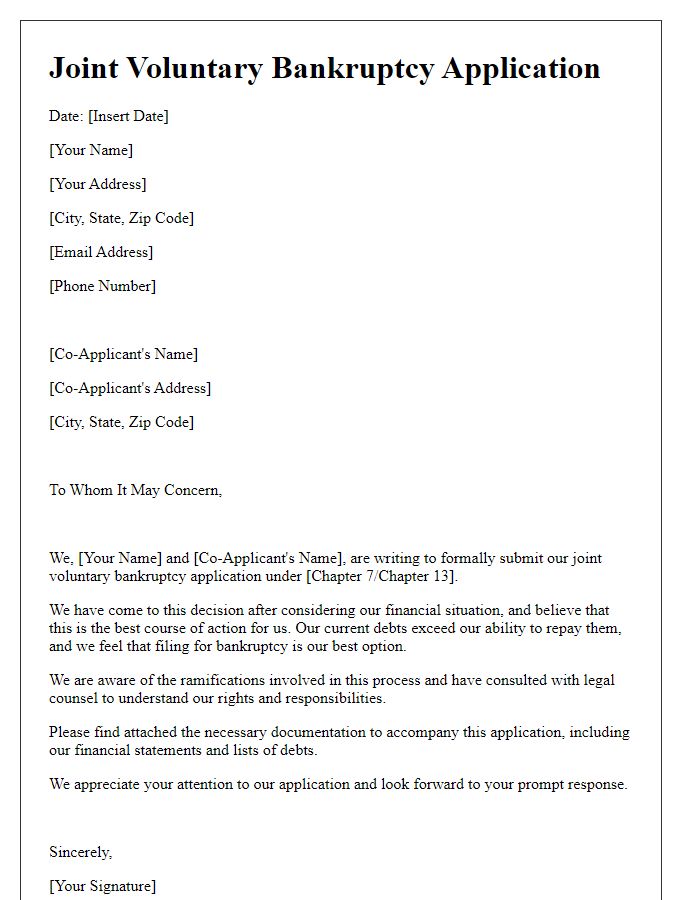

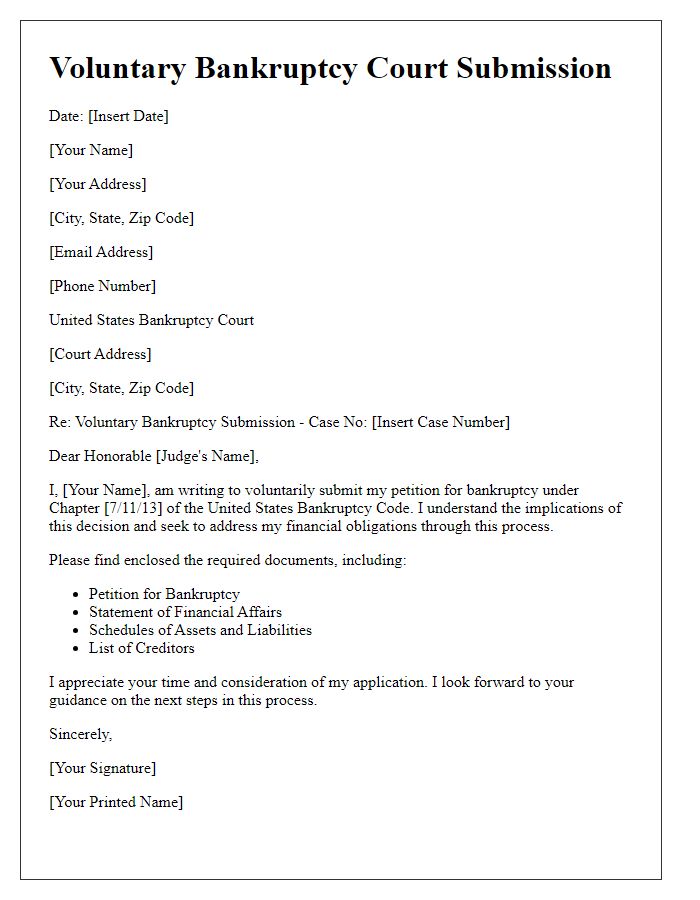

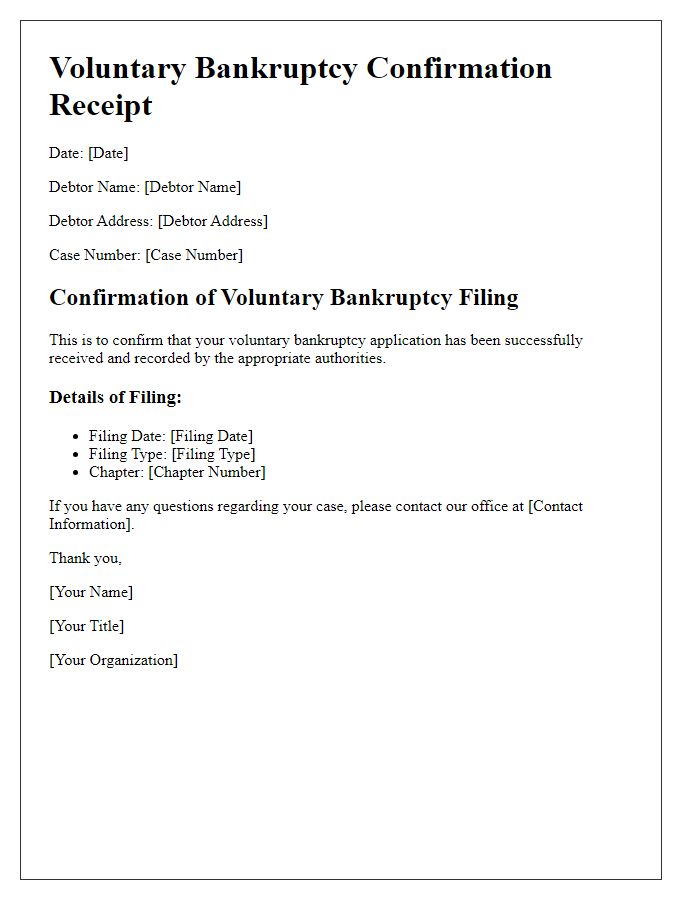

Debtor's Full Legal Name and Contact Information

Voluntary bankruptcy filings require precise documentation to ensure compliance with legal requirements. The Debtor's Full Legal Name should include the complete name as it appears on legal documents, such as government-issued identification or social security records. Contact Information must consist of the complete home address, including the city, state, and zip code for accurate court notification. It is essential to provide a valid phone number and email address (if applicable) for correspondence during the bankruptcy process. Proper documentation helps streamline the filing process in U.S. bankruptcy courts, ensuring that all necessary parties can easily reach the debtor for updates or information regarding the case.

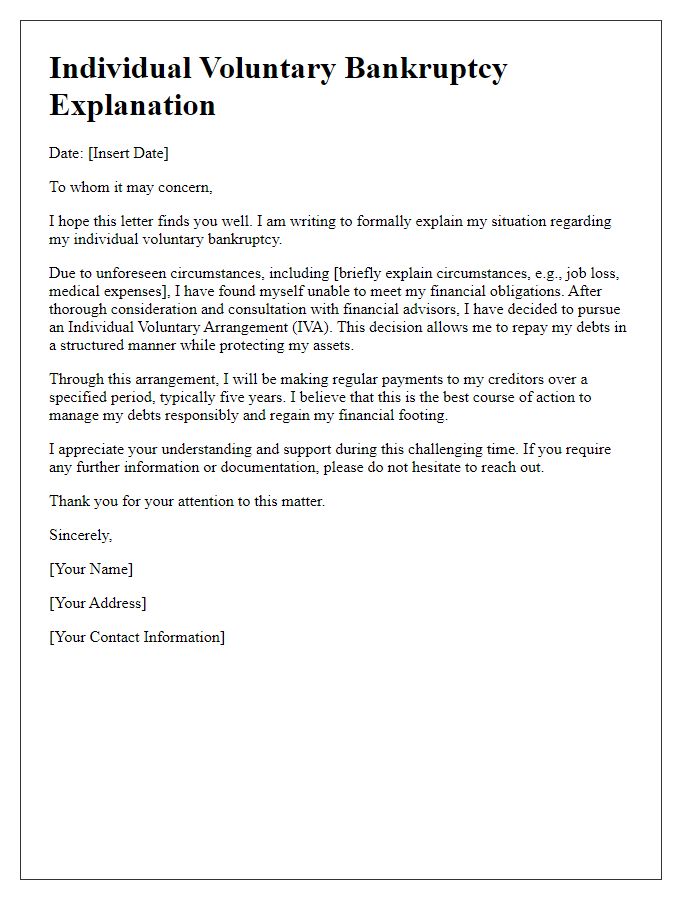

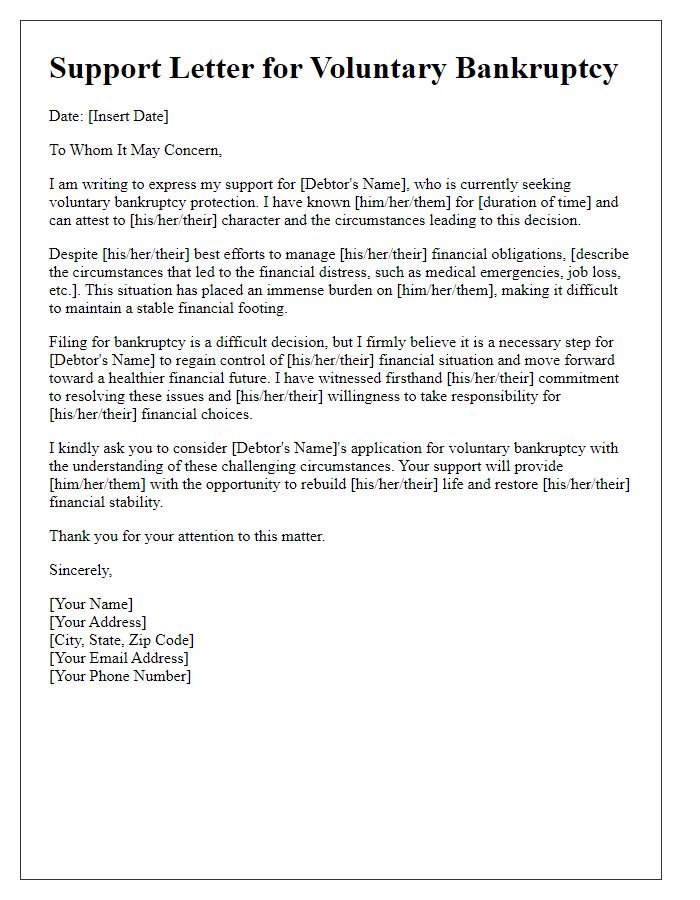

Statement of Financial Distress and Reason for Filing

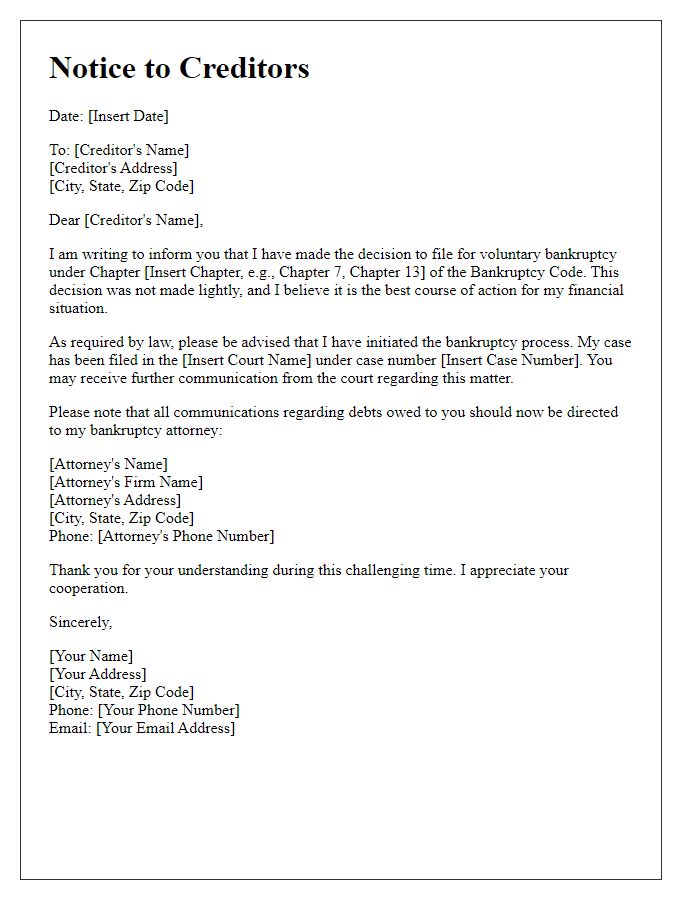

A letter template for voluntary bankruptcy filing serves as a formal document outlining an individual's or business's financial distress circumstances. This statement details the reasons contributing to the inability to meet financial obligations, including mounting debts, unforeseen medical expenses, job loss, or economic downturns. The template typically includes personal information or business details, a clear declaration of intent to file for bankruptcy, and supporting documentation such as income statements, expense analysis, and creditor lists. Clarity and transparency in this letter are essential, as they provide the court and creditors with a comprehensive understanding of the financial situation, ultimately guiding the bankruptcy process.

Detailed List of Debts and Creditors

In the process of voluntary bankruptcy filing, it is essential to compile a thorough and detailed list of debts and creditors to aid in the assessment of financial liabilities. This comprehensive list typically includes various types of debts, such as credit card balances, personal loans, medical bills, and mortgages, illustrating the total amount owed. Each creditor's name and contact information, including addresses and account numbers, should be meticulously documented to facilitate communication during the bankruptcy proceedings. Furthermore, it is crucial to specify the nature of the debt, whether secured or unsecured, alongside any relevant information on overdue amounts and payment histories. This organized compilation not only serves as a critical reference for the bankruptcy court but also provides clarity for the individual seeking financial relief.

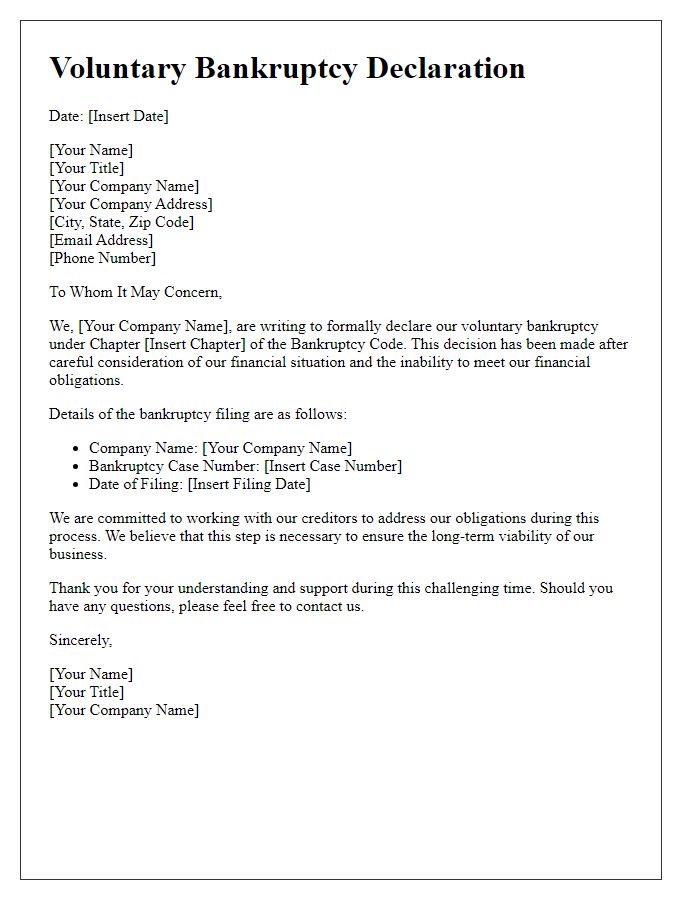

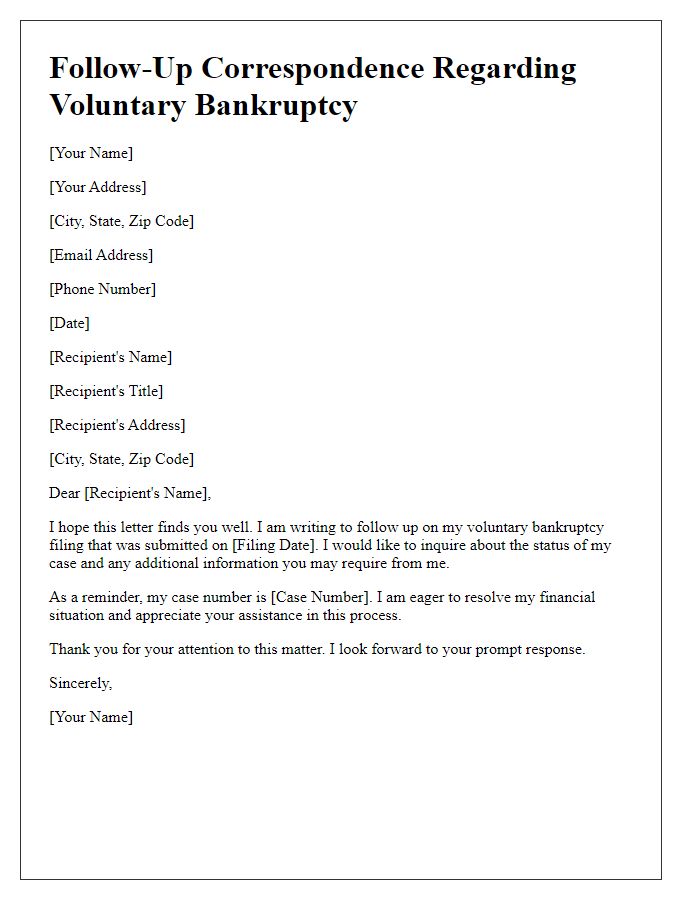

Declaration of Voluntary Intent and Signature

In a Declaration of Voluntary Intent regarding bankruptcy filing, individuals express their intention to seek assistance under bankruptcy laws, typically referenced within Title 11 of the United States Code. This formal document must include essential details such as the debtor's name, addresses, and case number, which provides context for the filing. In legal jurisdictions, such as the Northern District of California, specific forms must be completed and submitted, while also including signatures to validate the intent. This action signifies a willingness to address unmanageable debts, facilitating a structured repayment plan or liquidation of assets, which protects against creditor actions. The signature signifies the debtor's understanding of potential consequences, including credit score impact and asset liquidation processes.

Request for Automatic Stay on Collections

Filing for voluntary bankruptcy under Chapter 7 can provide significant relief from overwhelming debts. Upon submission of the bankruptcy petition, the automatic stay comes into effect immediately. This legal provision prohibits creditors from pursuing collection actions, including calls, letters, or lawsuits, allowing individuals time to reorganize their financial obligations without the pressure of aggressive collection tactics. This stay is crucial in places like California, where residents often face rampant foreclosure rates. It temporarily halts garnishments of wages, seizure of bank accounts, and eviction processes, thus providing immediate protection for those seeking a fresh financial start. The impact of the automatic stay can alleviate stress and promote a more structured approach to debt management.

Comments