When life throws unexpected challenges our way, having a power of attorney in place can be a true lifesaver. This legal document allows someone you trust to manage your affairs, making decisions on your behalf when you can't. Whether it's for healthcare or financial matters, understanding how to craft this authorization is essential. So, if you're curious about the steps to create a power of attorney and why it matters, keep reading for a comprehensive guide!

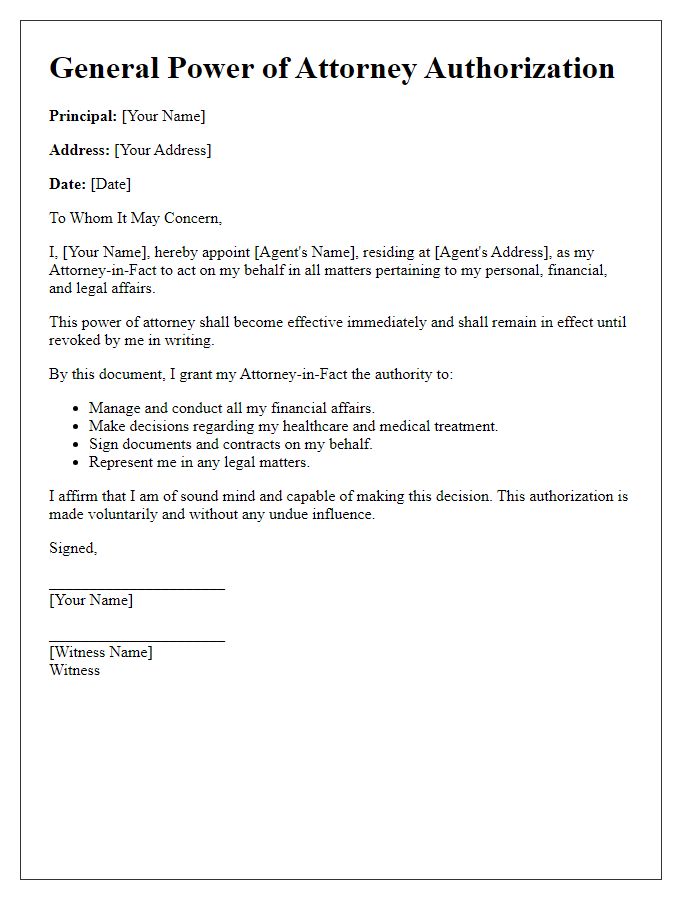

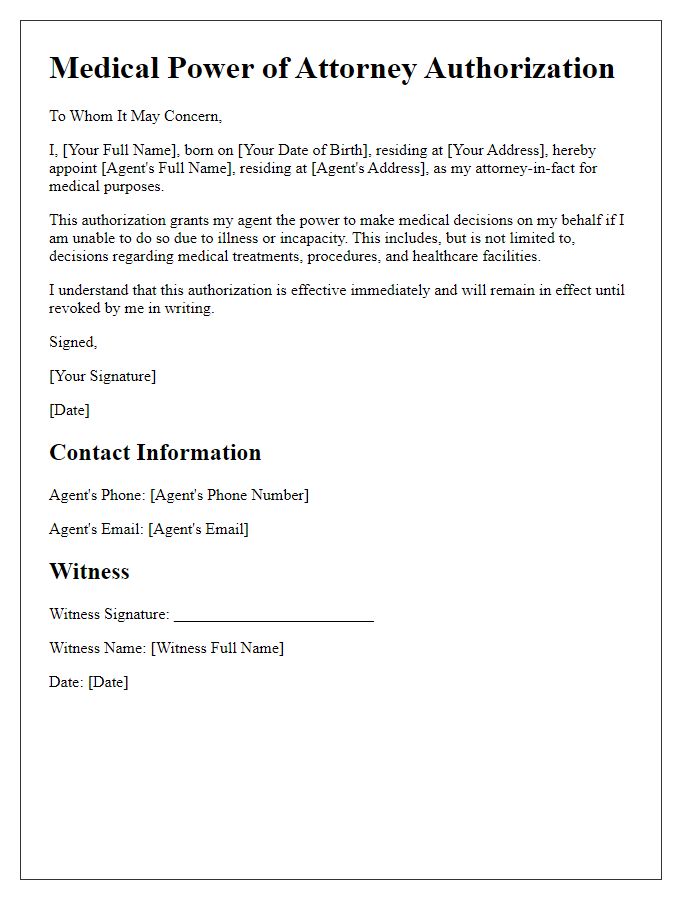

Principal's full name and contact information.

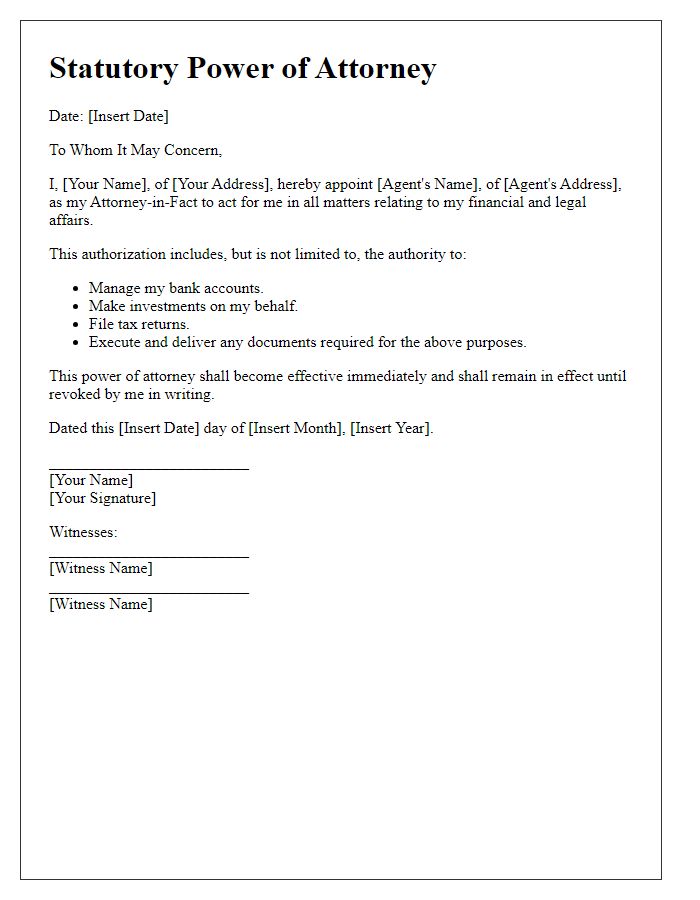

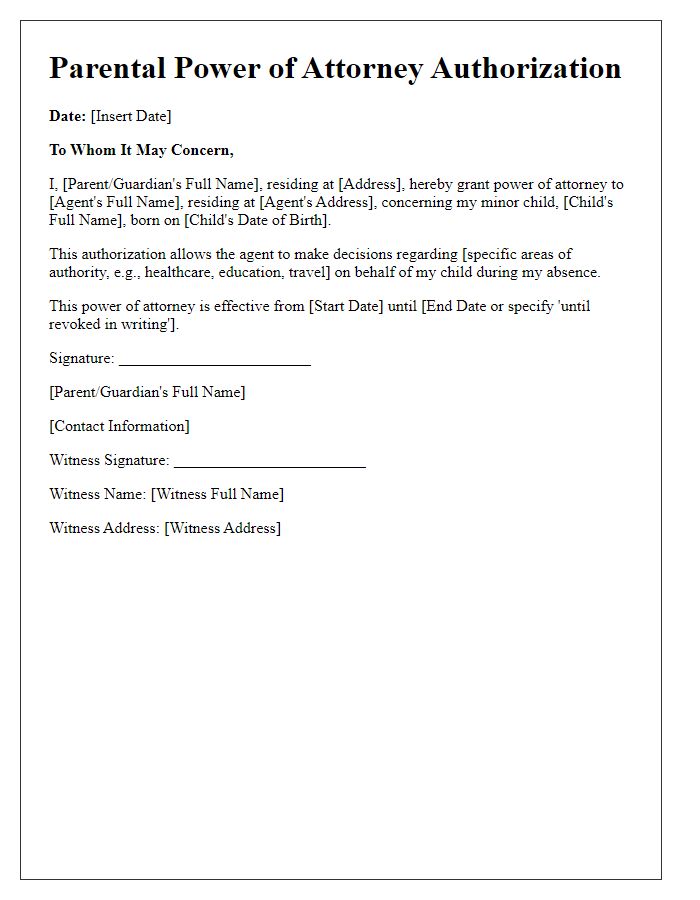

A power of attorney (POA) authorization document requires specific details about the principal's (the person granting authority) identity and contact information. The principal's full name must be prominently displayed, ensuring clear identification in legal contexts. Typically, this name includes the first name, middle name (if applicable), and last name. Additionally, contact information such as a residential or mailing address, including city, state, and zip code, must be included for correspondence purposes. This information ensures that any legal notifications or documents can be sent correctly. Date of birth may also be listed to reinforce identification, alongside a phone number or email address for direct communication. These elements establish the principal's identity unequivocally within the POA document.

Agent's full name and contact information.

A power of attorney authorization allows an individual (the principal) to appoint an agent for managing specific tasks or decisions on their behalf. The agent's full name, such as John Smith, along with comprehensive contact information, including phone number (555-123-4567) and email address (johnsmith@email.com), must be clearly stated. This essential document enables the agent to act confidently while also providing clear communication channels. Legal definitions, responsibilities, and any limitations of authority should be outlined to ensure that the agent understands the scope of their powers, protecting the principal's interests effectively.

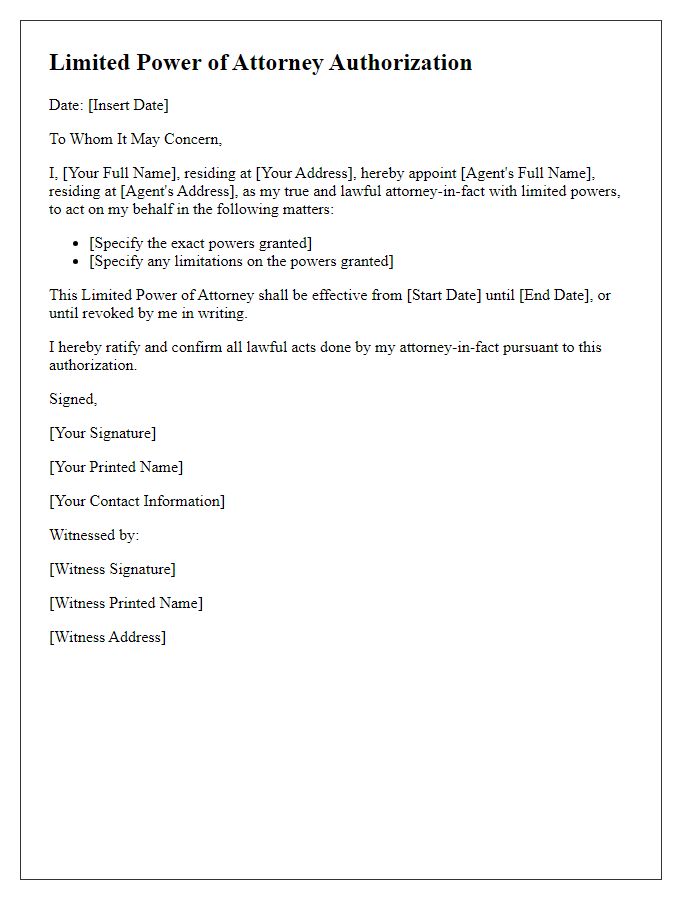

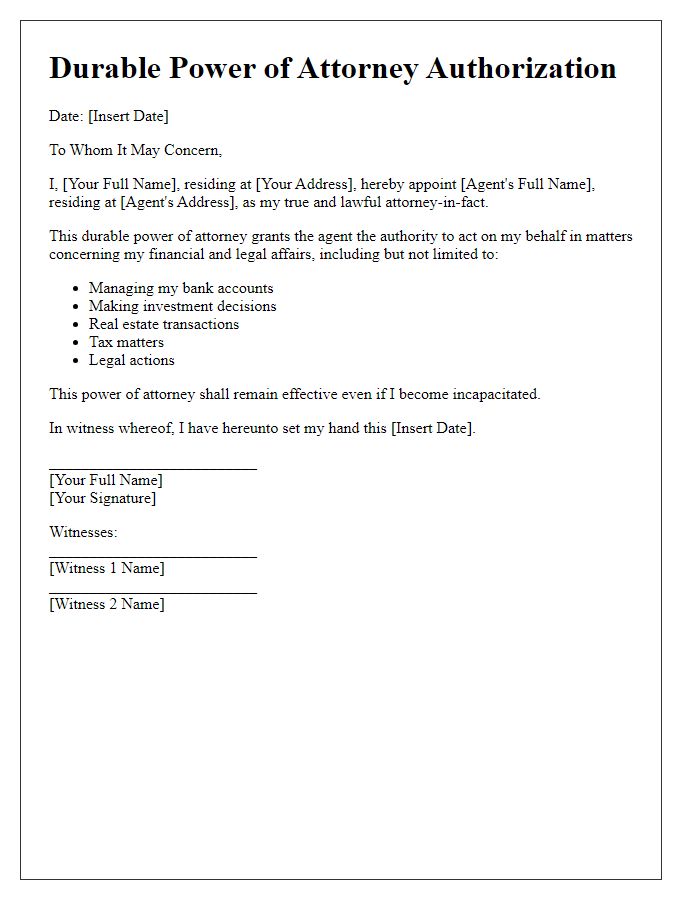

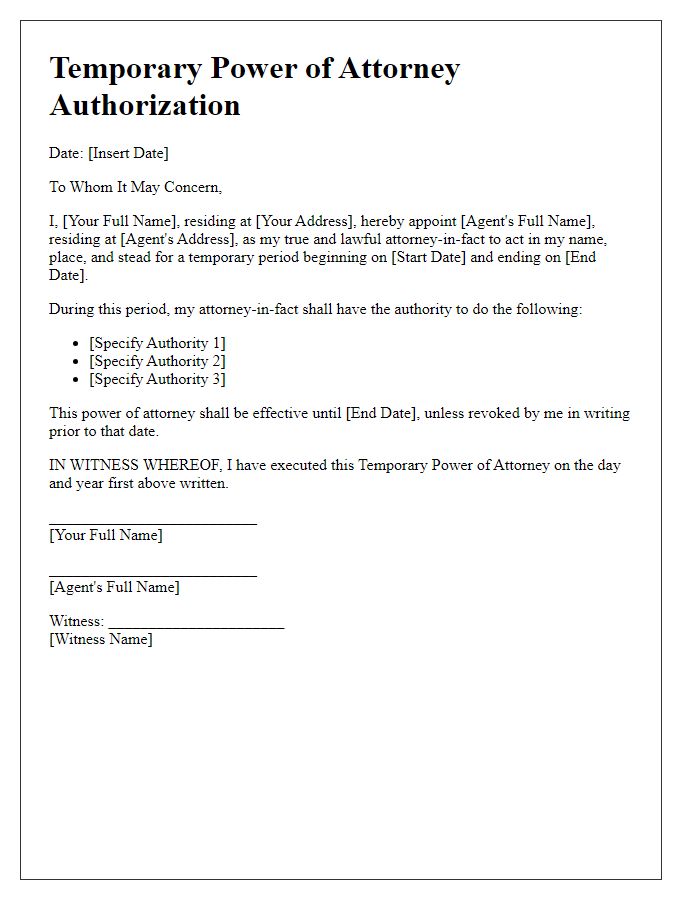

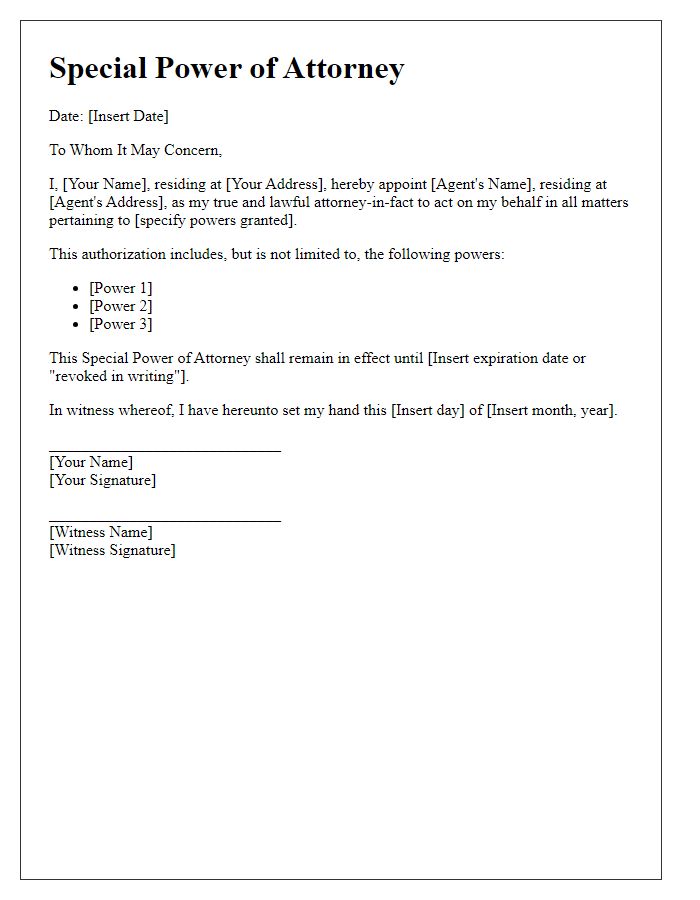

Scope of authority and specific powers granted.

A power of attorney authorization document outlines the scope of authority granted to the designated agent and specifies the exact powers conferred. The principal, the individual granting authority, typically stipulates powers such as managing financial transactions, including bank account access and bill payment, real estate dealings, encompassing property sales or lease agreements, and healthcare decisions, which may involve medical treatment choices and access to medical records. These powers ensure the agent can act in the principal's best interest during periods of incapacity or absence. The document mandates clear identification of the principal (full name, address) and the agent (full name, address), along with dated signatures to validate the agreement. Legal formalities may require notarization or witnesses, depending on jurisdiction, to ensure enforceability and compliance with state laws.

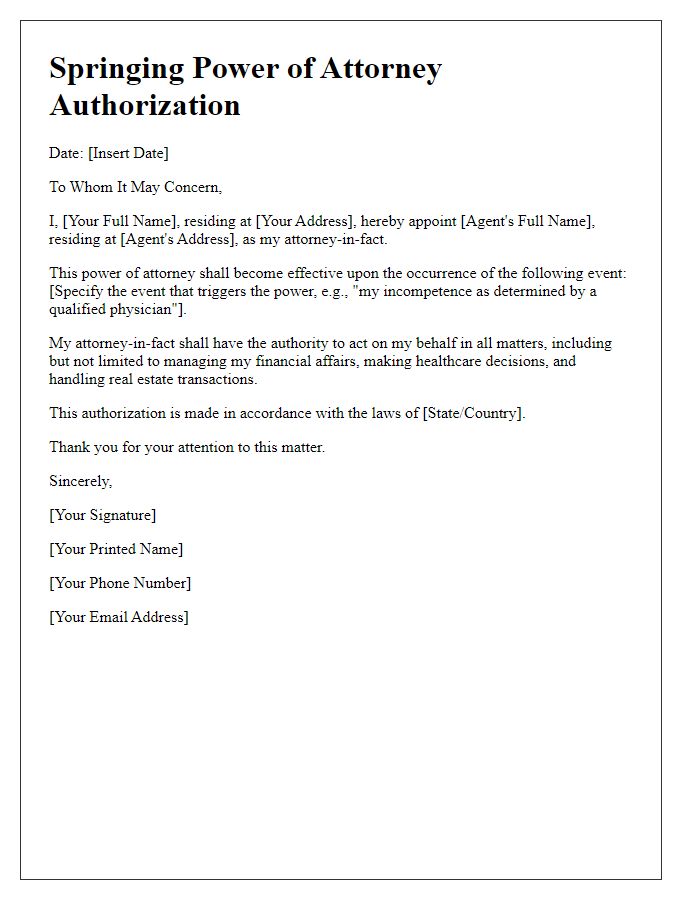

Duration of the authorization and revocation conditions.

A power of attorney authorization grants an individual the authority to act on behalf of another in legal or financial matters. The duration of such authorization is typically specified within the document, often lasting until a predetermined date, such as one year from the date of signing, or until a specific event occurs, such as the principal's incapacity or death. Revocation conditions must also be clearly stated, outlining the process through which the principal can terminate the power of attorney, usually requiring a written notice delivered to the attorney-in-fact and any relevant third parties. This ensures that the principal retains control and can revoke the authority if they choose, maintaining their autonomy over personal and financial decisions.

Signature of principal and notarization acknowledgment.

A power of attorney authorization grants an individual (the agent) the authority to act on behalf of another person (the principal) in legal or financial matters. The principal must sign the document, confirming their consent to delegate specific powers, which may include managing finances, making healthcare decisions, or selling property. Notarization is required to validate the agreement, providing a formal acknowledgment of the principal's signature, ensuring that it was made voluntarily and without coercion. This process often involves a licensed notary public who confirms the identity of the principal and witnesses the signing, enhancing the document's legality and preventing potential disputes.

Comments