When embarking on a new partnership, understanding equity distribution is crucial for fostering a collaborative spirit among partners. It's not just about dividing shares; it's about recognizing each partner's contributions, skills, and commitment. Clear communication and documented agreements can help prevent misunderstandings down the road, granting everyone a fair stake in the business's success. Join us as we explore the essential elements of crafting a partnership equity distribution letter that aligns interests and sets the foundation for a prosperous collaboration!

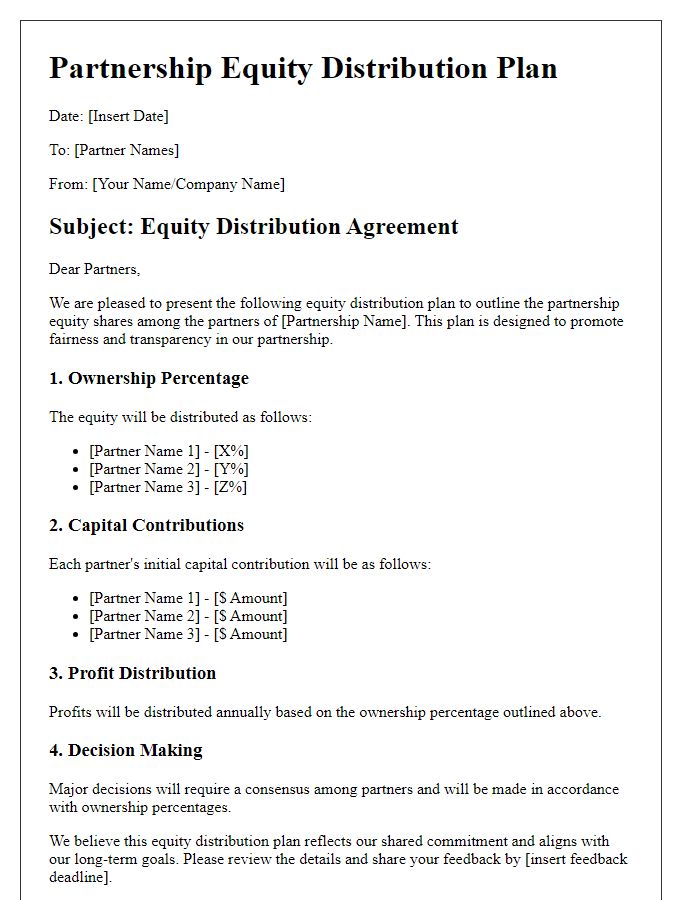

Ownership percentage

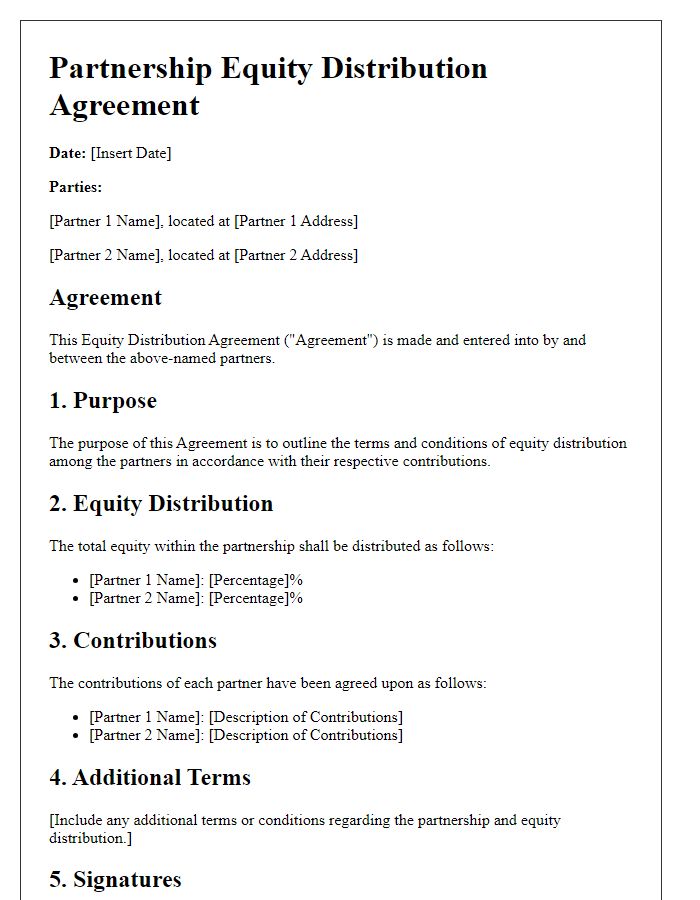

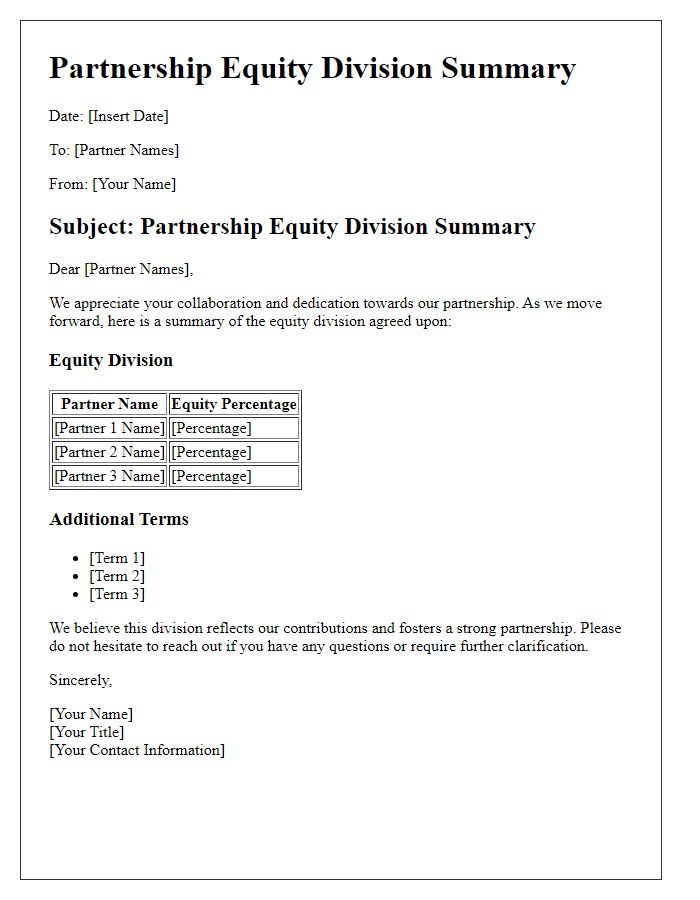

Partnership equity distribution is crucial for defining the ownership percentage among partners in a business venture. Each partner's contributions, whether financial investments or sweat equity, significantly impact the allocation of ownership stakes. In a typical scenario, partners might negotiate percentages based on initial capital investments, ongoing roles, or specific skill sets brought to the table. For instance, if three partners contribute $60,000, $40,000, and $20,000 respectively, the ownership distribution could reflect these investments, leading to a 60%, 30%, and 10% distribution. It is essential to formalize this understanding through documents like partnership agreements or operating agreements to ensure clarity and prevent future disputes, particularly during events like profit-sharing or exit strategies.

Roles and responsibilities

In a partnership, equity distribution plays a crucial role in defining the ownership stakes among partners, impacting their financial returns from the entity, typically outlined through a legal agreement. Clear roles and responsibilities are essential to ensure that each partner understands their contributions, which may include capital investment, skill set, time commitment, and specific tasks within the organization, such as managing operations, overseeing marketing strategies, or handling financial records. The percentage of equity assigned to each partner often reflects these roles, ensuring alignment with the partnership's goals and fostering collaboration. Valuation methods to determine each partner's contribution, such as cash valuation, asset appraisal, or future earning potential, should be specified in a transparent partnership agreement to prevent conflicts. Additionally, guidelines for decision-making processes and profit distribution can enhance accountability and streamline operations, leading to a successful and sustainable business partnership.

Vesting schedule

The partnership equity distribution often involves a vesting schedule that outlines ownership percentages and the timeline for achieving full equity ownership. Typically structured over a four-year period with a one-year cliff, this schedule incentivizes long-term commitment and contribution to the partnership. For instance, if a partner contributes 25% equity, they would earn 6.25% equity for each quarter after the first year, achieving full ownership by the end of the fourth year. This method fosters stability and encourages active participation in the partnership's growth. Specific terms can include performance milestones or additional contributions that may accelerate the vesting process. Legal documentation often verifies these agreements to ensure clarity and mutual understanding among partners.

Profit sharing methods

Effective profit-sharing methods are essential for equitable partnership equity distribution. In many partnerships, profit-sharing can be implemented through various approaches like equal distribution, where all partners receive the same percentage regardless of investment, promoting unity. Alternatively, partners might choose to allocate profits based on capital contributions, rewarding those who invested more in the business. Performance-based sharing ties profit distribution to individual contributions, incentivizing higher productivity among partners. Lastly, hybrid models combine elements of different methods, accommodating both initial investment and ongoing contributions. These methods are crucial in partnership agreements, ensuring transparency and fairness in financial operations, whether in small businesses or larger corporations.

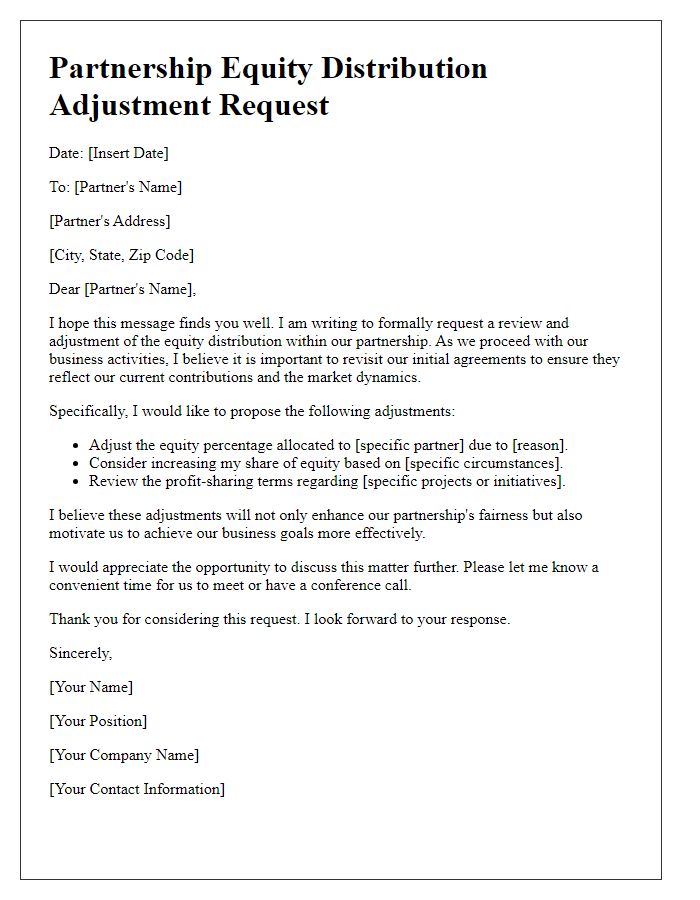

Exit strategy and buyout terms

In a strategic partnership, equity distribution plays a critical role during an exit strategy and potential buyout terms. Equity distribution typically delineates ownership percentages among partners, which can fluctuate based on contributions (financial, intellectual, or material resources). For exit strategies, partners often outline specific scenarios such as voluntary exit, retirement, or involuntary separation to ensure a structured transition. A well-defined buyout process, often articulated in legal agreements, might stipulate a valuation method for the business, such as fair market value or a multiple of earnings before interest, taxes, depreciation, and amortization (EBITDA). Furthermore, timelines for the buyout and payment structures, such as lump-sum or installments, can significantly affect partner relationships. Important considerations also include potential tax implications and access to third-party financing to facilitate the purchase. Understanding these dynamics can foster transparency and maintain positive relations within partnerships.

Comments