In today's fast-paced business world, safeguarding shareholder rights has become more critical than ever. Understanding the importance of transparency and accountability can empower you, as a shareholder, to take an active role in shaping the future of your investments. From voicing concerns to participating in crucial decisions, there are many ways you can advocate for your interests. Join us as we explore essential strategies and tips for protecting your rights as a valued shareholder!

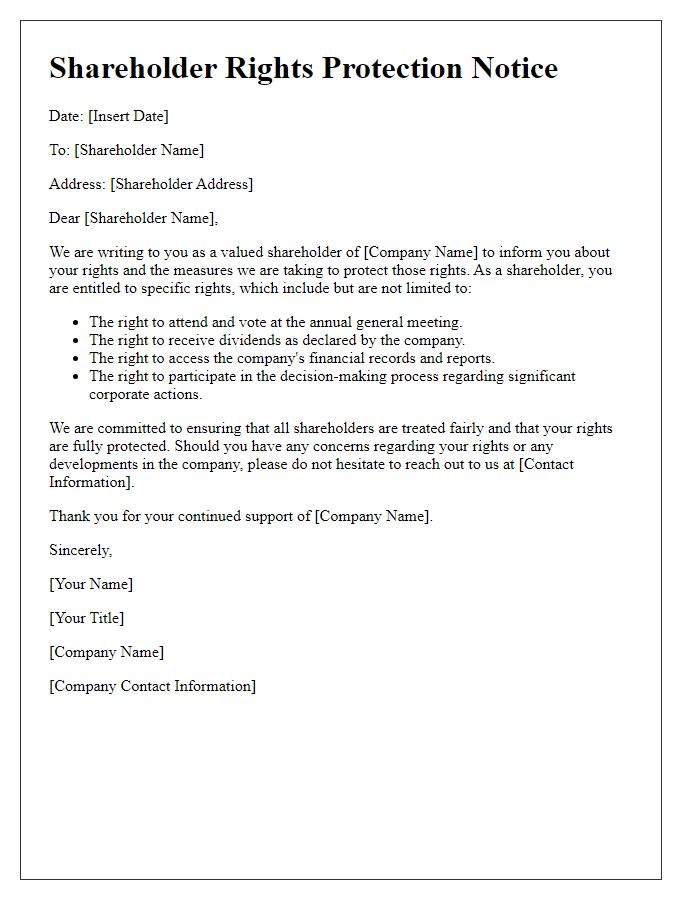

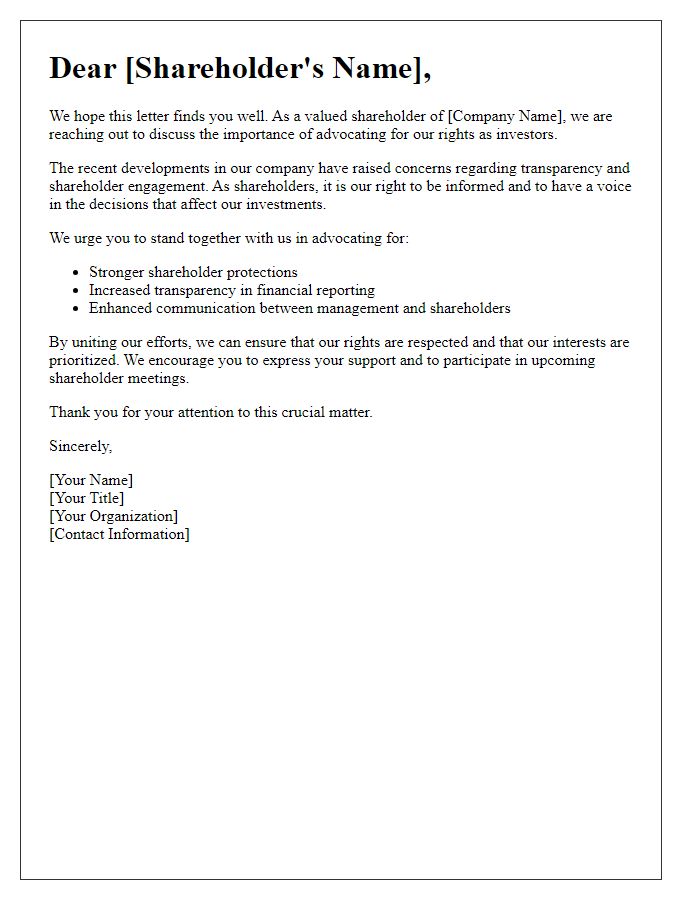

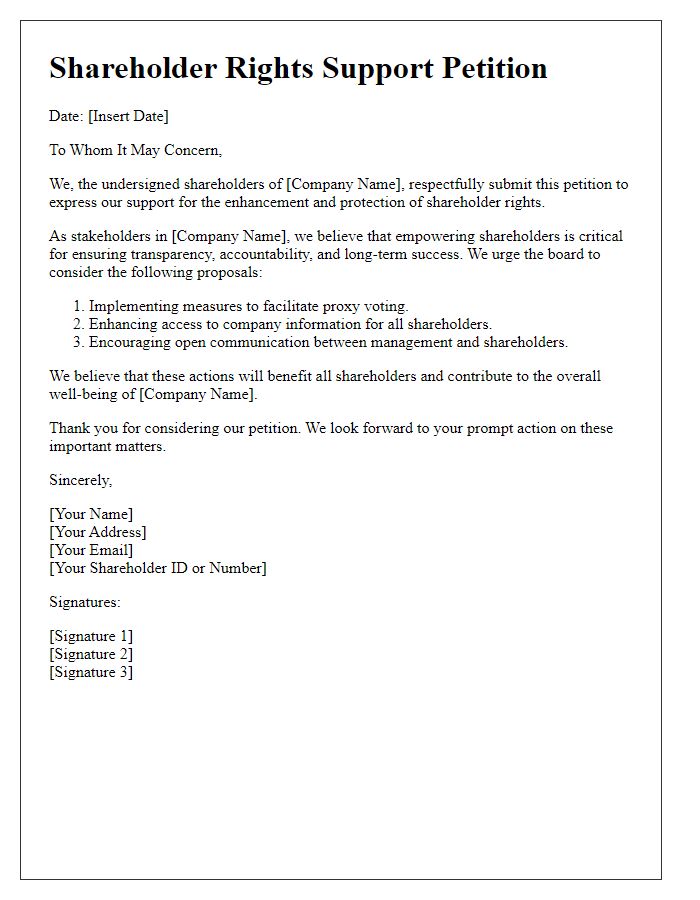

Clear communication of shareholder rights

Shareholder rights protection is essential for maintaining trust and transparency in corporate governance. Clear communication regarding shareholder rights ensures that all stakeholders understand their entitlements, including voting rights, the right to receive dividends, and access to financial statements. In jurisdictions like the United States, legislation such as the Sarbanes-Oxley Act of 2002 mandates that public companies provide detailed disclosures, fostering accountability. Regular updates through investor relations websites and annual general meetings (AGMs) facilitate interactions between management and shareholders, strengthening engagement. Additionally, shareholder advocacy organizations play a crucial role in educating investors about their rights, enabling them to make informed decisions. Effective communication channels also allow shareholders to voice concerns or raise issues regarding board decisions, reinforcing the principles of transparency and fairness within the corporate structure.

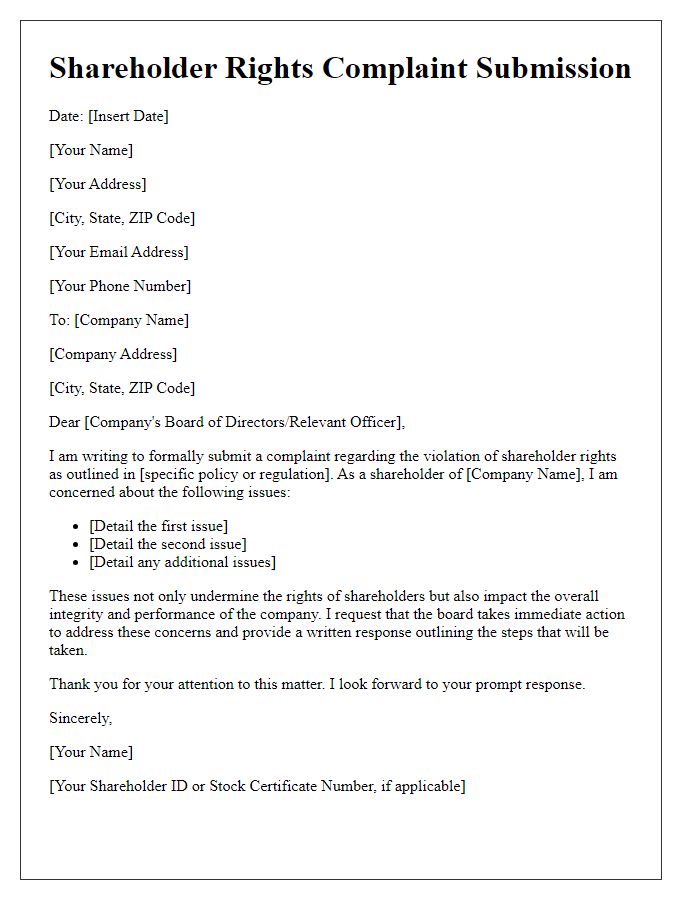

Procedures for addressing grievances

Shareholder rights protection ensures that investors maintain their interests and receive fair treatment within corporate governance. Grievance procedures include structured channels for reporting issues, emphasizing confidentiality and prompt responses. For example, shareholders may submit written complaints to the investor relations department (commonly situated in corporate headquarters) detailing specific concerns about management decisions or policy violations. The company must initiate a formal investigation, often led by the compliance officer, within a defined timeframe, typically set at 30 days. Regular communication is important, with updates provided to shareholders throughout the process. Furthermore, an independent review board can be established to assess complex grievances, ensuring impartiality in resolving disputes while reinforcing trust in corporate practices. Effective grievance procedures ultimately protect shareholder rights and uphold a transparent corporate environment.

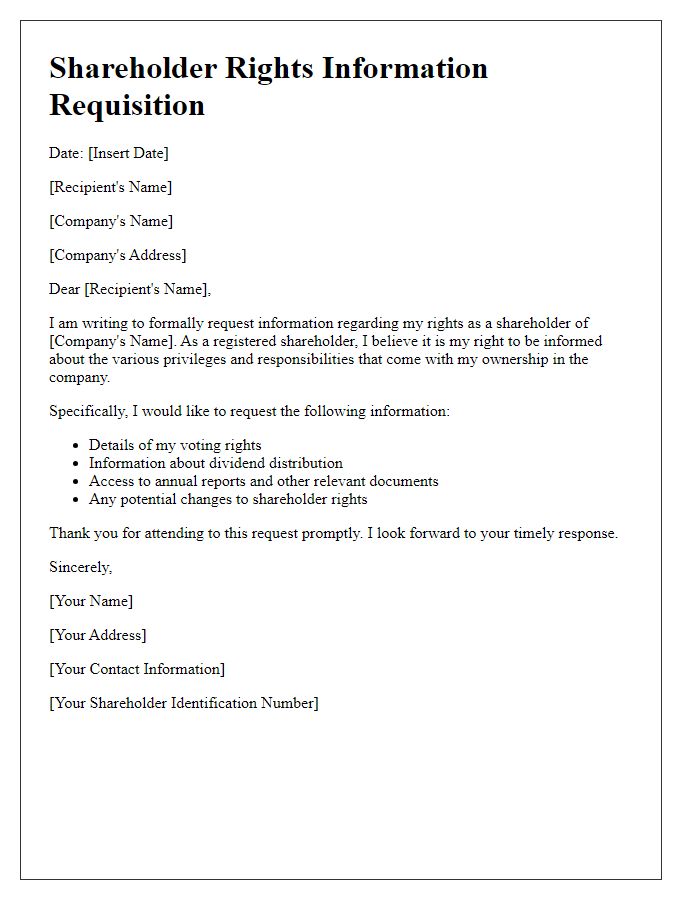

Contact information for questions or concerns

Shareholders play a vital role in corporate governance, ensuring their rights are protected and their voices heard. When questions or concerns arise regarding shareholder rights, it's crucial to have clear contact information available for direct communication. This includes email addresses, phone numbers, and office addresses of appropriate representatives, such as the Investor Relations team or a designated legal department. Transparency facilitates trust, enabling shareholders to efficiently address issues related to voting rights, dividend distribution, or corporate actions. Providing a dedicated hotline or online form assists in streamlining inquiries and ensuring responsive engagement.

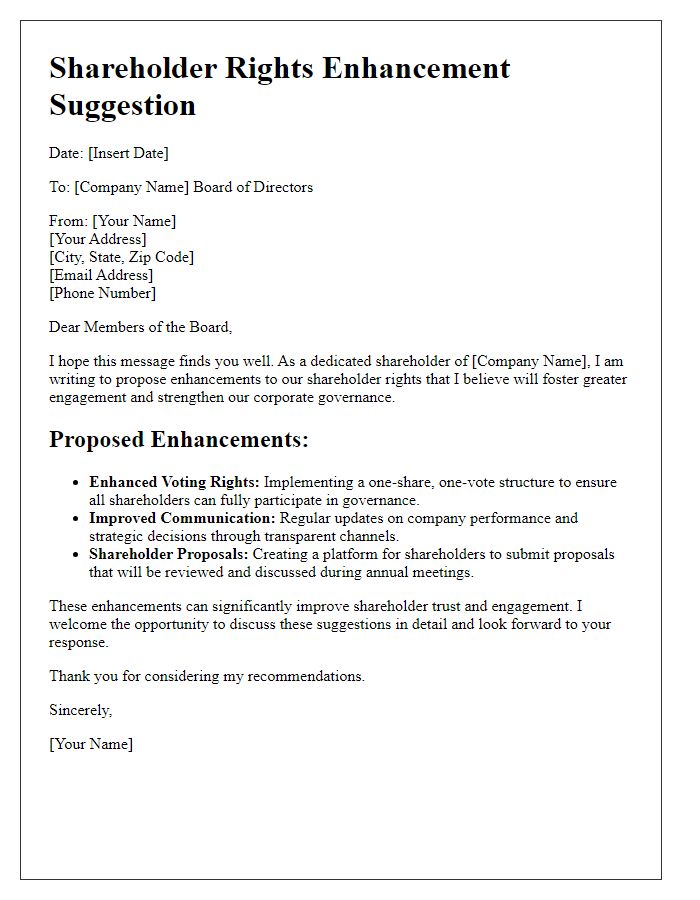

Deadlines for submission of shareholder proposals

Shareholder proposals play a crucial role in corporate governance by enabling shareholders to influence company policies and practices related to shareholder rights. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, have established specific deadlines for submitting these proposals, which typically fall within 120 days before a company's annual meeting. For example, if a company's annual meeting is scheduled for May 30, the deadline for submitting proposals would likely be around January 30. These proposals, which must adhere to prescribed guidelines, often address themes including executive compensation, sustainability practices, and board diversity. Failure to meet these submission deadlines can result in proposals being excluded from inclusion in the official proxy materials distributed to shareholders, underscoring the importance of timely and compliant submissions. Shareholders should regularly consult the official investor relations website of the company and review SEC's rules to stay informed about applicable timelines and procedural requirements.

Steps for voting on company resolutions

Shareholder rights protection involves several critical steps for voting on company resolutions. First, shareholders must review the Annual General Meeting (AGM) notice, typically sent by the company, which outlines the agenda (including important resolutions) and voting procedures. Next, shareholders should assess the proxy statement, providing detailed insights on each proposal, including independent auditor reports and board recommendations. Following this, shareholders need to register, ensuring their eligibility to vote, which may involve confirming their ownership status by registering with the company's registry, especially significant for shareholders of major corporations like Apple Inc. or Tesla Inc. Subsequently, shareholders cast their votes either in-person during the AGM, through mail-in ballots, or via online platforms, reflecting their preferences for each resolution, such as electing board members or approving mergers. Finally, shareholders should review post-meeting results, which disclose voting outcomes, revealing the level of shareholder support for significant decisions impacting company governance and direction.

Comments