Are you feeling overwhelmed by unpaid debts and unsure of how to approach the situation? Writing a debt collection demand letter can be an effective way to communicate your expectations clearly and professionally. In this article, we'll guide you through the essential elements to include in your letter to ensure it captures the attention of the debtor while conveying your message assertively. Stick around to discover practical tips and a customizable template that will make the process easier!

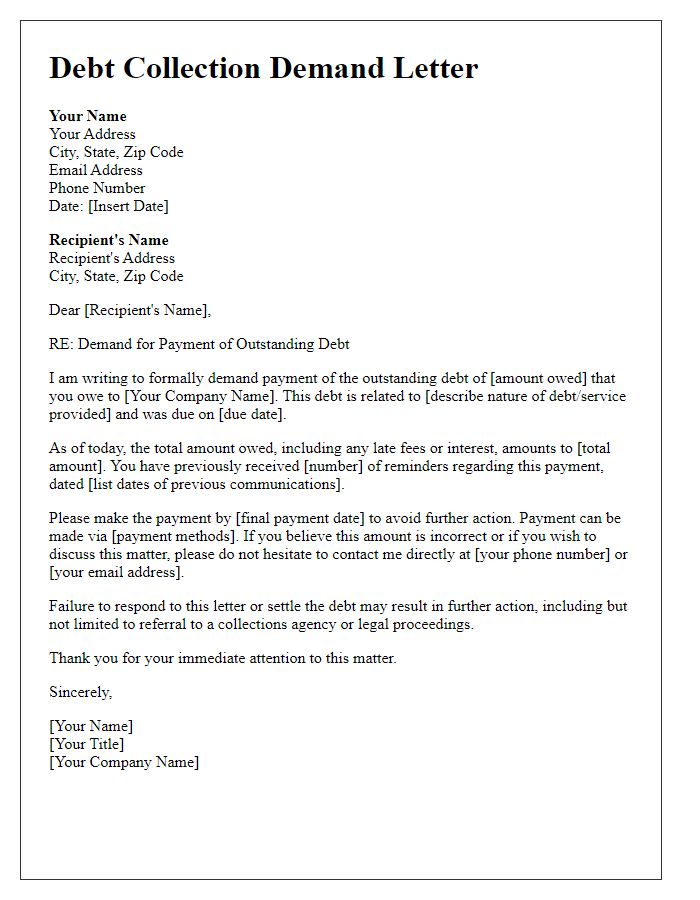

Clear identification of creditor and debtor

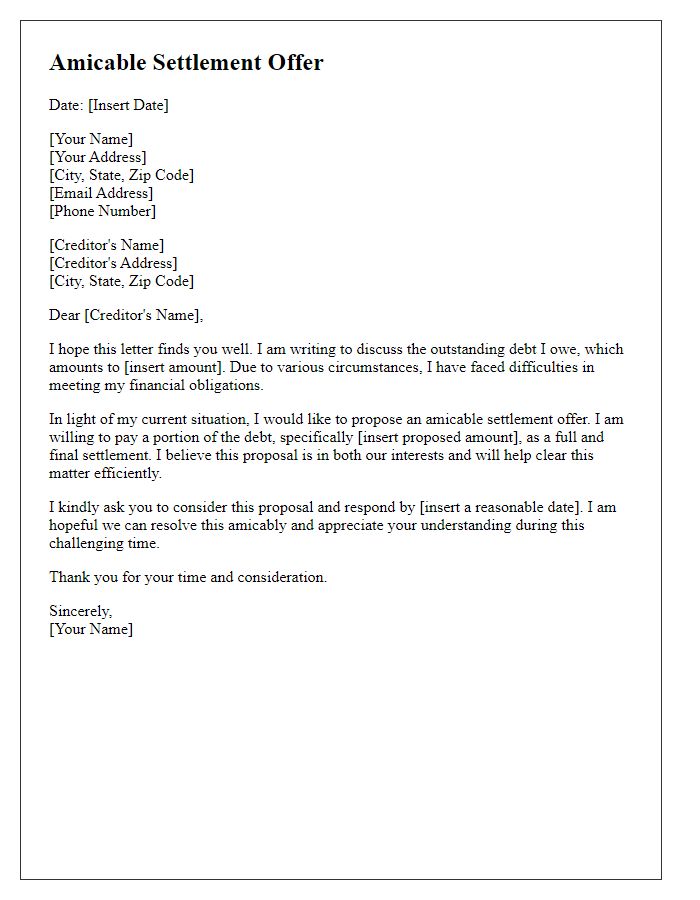

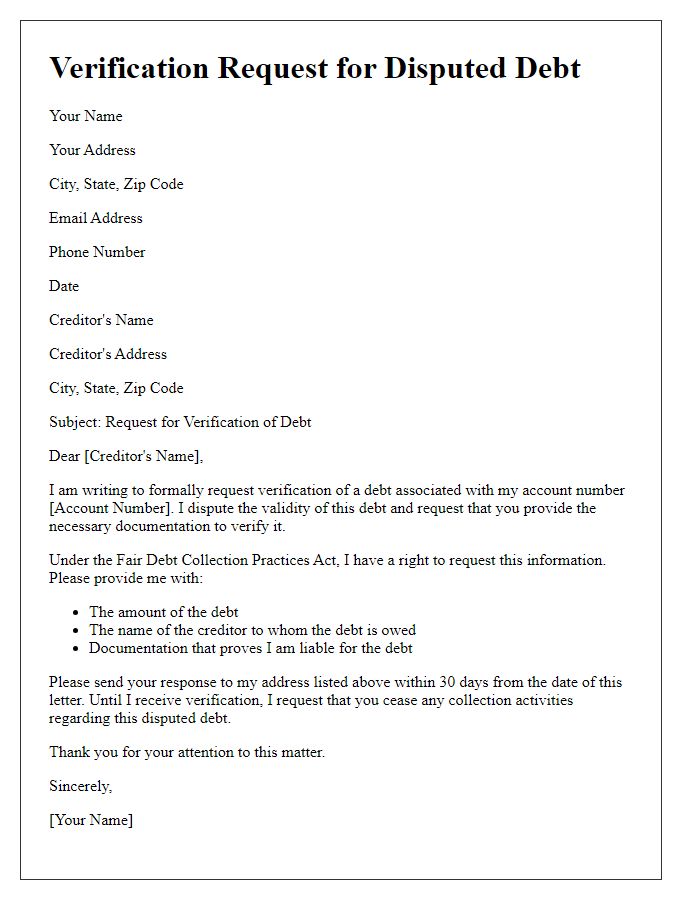

A debt collection demand must clearly identify both the creditor (the entity seeking repayment, often a bank or financial institution) and the debtor (the individual or business owing the money). Essential details include the creditor's full legal name, address, and contact information, alongside the debtor's full legal name, address, and account number if applicable. The demand should outline the original amount owed, any accrued interest or fees, and the due date for repayment. For instance, a bank may demand payment from a borrower who has defaulted on a personal loan without stipulating terms, while a landlord might seek overdue rent from a tenant who has failed to pay for several months. Such clarity reduces ambiguity and sets a professional tone for potential resolution.

Details of the outstanding debt

Unfulfilled financial obligations can lead to significant repercussions for both lenders and borrowers. An outstanding debt amounting to $2,500 was incurred due to unpaid invoices from March to June 2023, related to services rendered by ABC Marketing LLC in New York City. The initial payment was due on July 1, 2023, but has not been received despite multiple reminders, leading to an accumulation of late fees and increased overall liability. The account has been flagged for potential collection action if payment is not remitted within 15 days from the demand date, with further legal implications outlined in the Fair Debt Collection Practices Act.

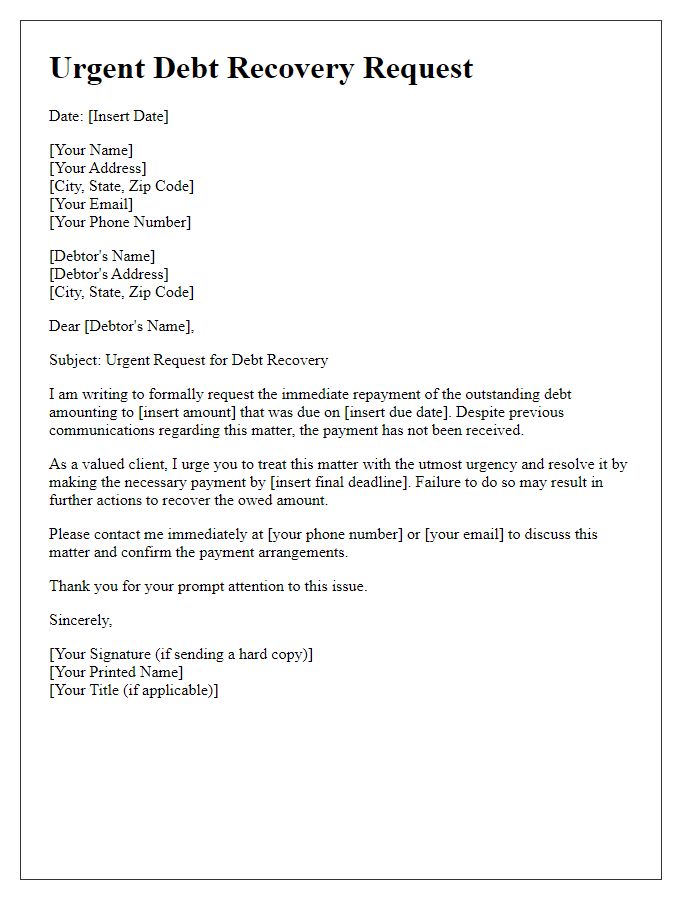

Payment instructions and deadline

The demand for debt collection highlights the specified amount owed, necessitating prompt action by the debtor. A typical scenario involves a sum of $2,500, originally due on September 1, 2023. Detailed instructions for payment should outline acceptable methods such as bank transfers to specified accounts, checks payable to the creditor's name, or secure online payment options. A strict deadline, typically within 14 days from the date of the letter, emphasizes the urgency of compliance to avoid additional fees or legal actions. The communication may also include the consequences of non-payment, such as potential referral to a collection agency or initiation of legal proceedings in civil court, underscoring the importance of addressing financial obligations swiftly.

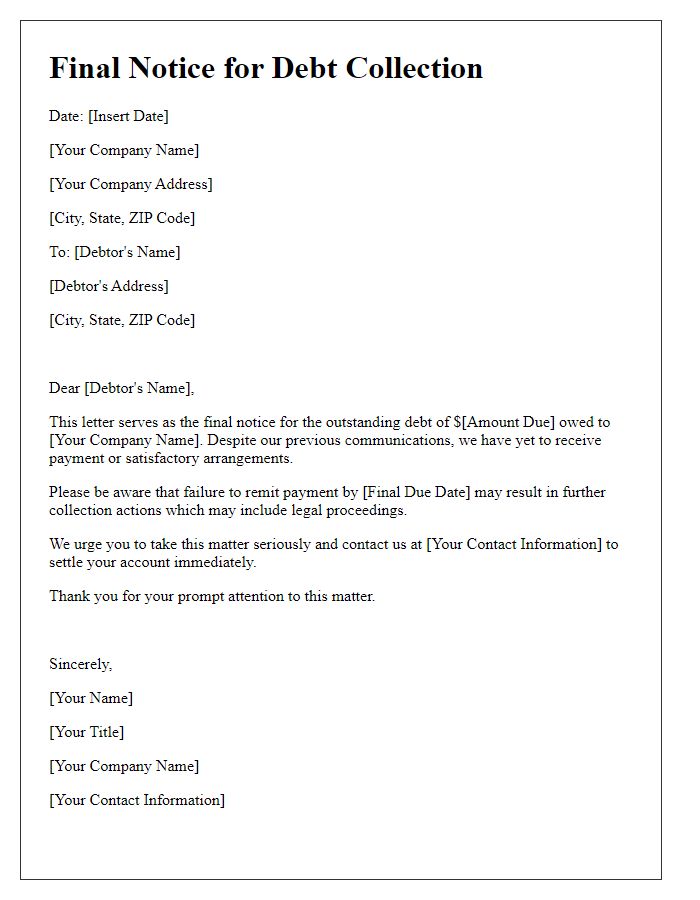

Consequences of non-payment

Failure to settle outstanding debts can lead to serious repercussions, impacting both personal finance and credit ratings. Lenders, such as credit card companies or banks, may report late payments (often after 30 days), resulting in a decreased credit score, which averages around 700 for individuals with good credit. Legal actions may ensue, including lawsuits filed in local courts, potentially leading to wage garnishment or bank levies. In extreme cases, outstanding debts may be transferred to collection agencies, which can impact one's ability to secure loans, mortgages, or rental agreements. Furthermore, ongoing non-payment can incur additional fees and interest, compounding the total owed over time, leading to financial strain and limited access to future credit opportunities.

Contact information for queries

In debt collection processes, effective communication is crucial. Including clear contact information streamlines queries related to outstanding balances. Essential details include a dedicated phone number (e.g., 1-800-555-0199), an email address (e.g., support@collectionsagency.com), and a physical mailing address (e.g., 123 Main St, Suite 400, Springfield, IL, 62701) for formal correspondence. Additionally, ensuring business hours are stated (e.g., Monday to Friday, 9 AM to 5 PM) assists debtors in reaching the agency during peak operational times. Prompt responses to queries about invoices, payment plans, or legal actions help maintain professionalism and enable smooth resolution processes within the debt collection landscape.

Comments