Navigating a tax audit can be a daunting experience, but having the right representation can make all the difference. In our latest article, we delve into essential tips on how to choose an effective tax audit representative who understands your unique situation. We'll discuss the key traits to look for and the questions you should ask before making your decision. So, if you're ready to gain confidence in your tax audit journey, read on to learn more!

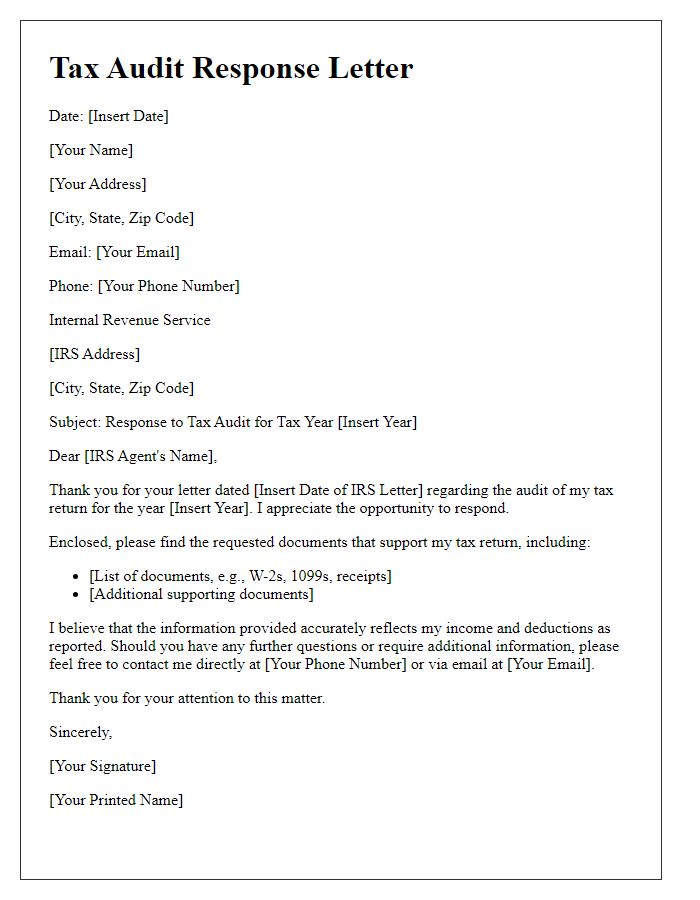

Taxpayer identification and audit reference details.

During a tax audit, accurate identification of the taxpayer is crucial. Each taxpayer is assigned a unique identification number, known as the Taxpayer Identification Number (TIN), which typically consists of nine digits in the United States. The audit reference details, including the audit year (e.g., 2022), must also be clearly stated. This information ensures that the auditor can correctly identify the specific case and assess the taxpayer's financial records accurately. Proper documentation, such as tax forms like the 1040 for individual taxpayers or the 1120 for corporate entities, should accompany this information for clarity and completeness during the audit process.

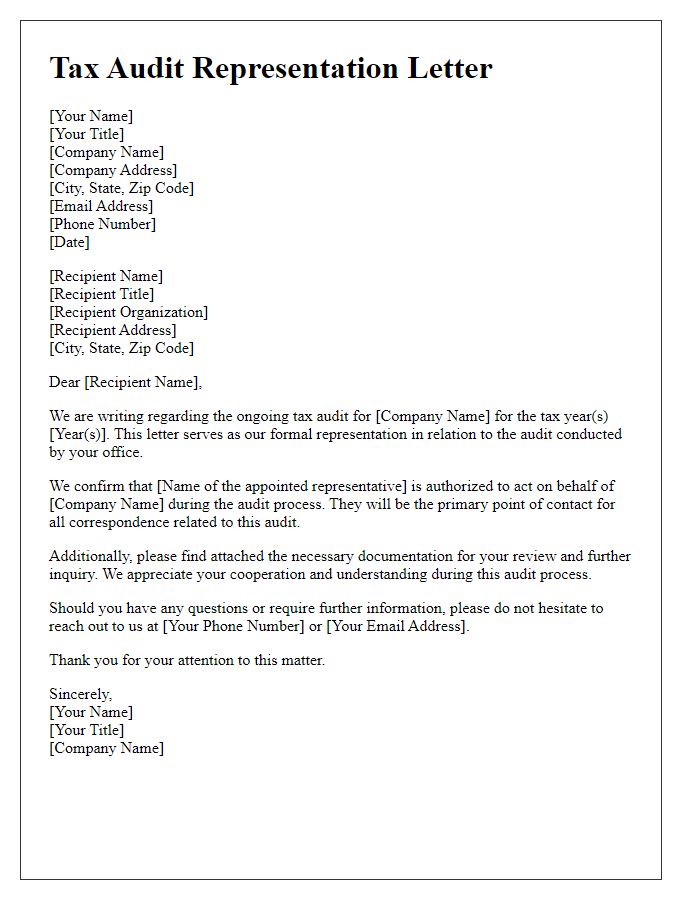

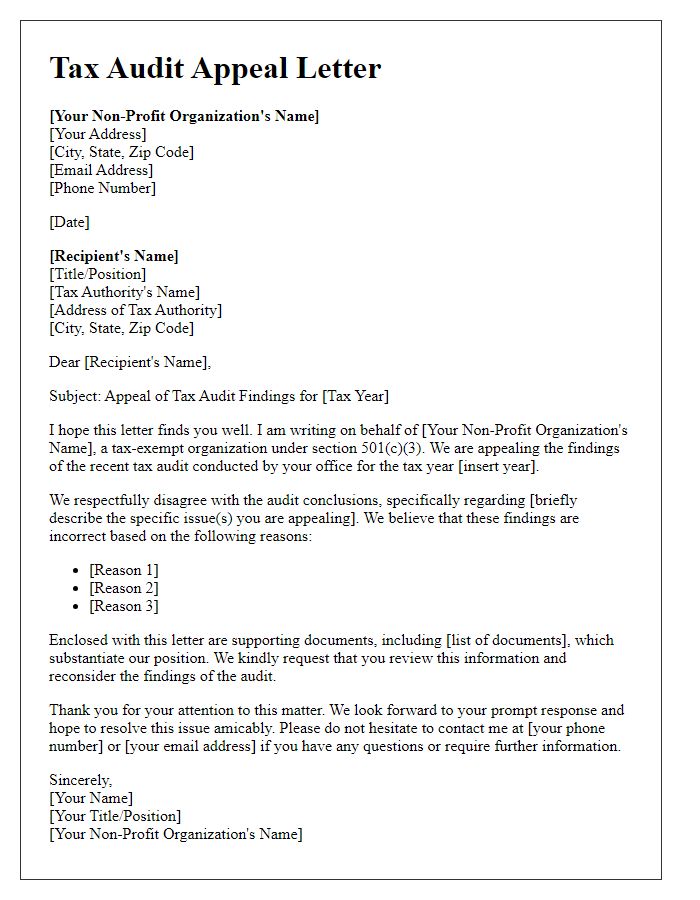

Statement of authority to represent.

A tax audit representation allows an authorized individual or organization to act on behalf of a taxpayer during an audit process conducted by the Internal Revenue Service (IRS). This written statement of authority designates the representative, often a Certified Public Accountant (CPA) or tax attorney, to handle correspondence, provide documents, and make decisions related to the audit. Essential details in this statement include the taxpayer's identification number, such as a Social Security Number (SSN) or Employer Identification Number (EIN), the representative's credentials, and the scope of authority granted. By submitting this statement, the taxpayer ensures that their interests are adequately represented, streamlining communication with the IRS and facilitating a more efficient audit process. Ensuring compliance with IRS regulations is critical, as it helps to safeguard the taxpayer's rights and ensures proper representation.

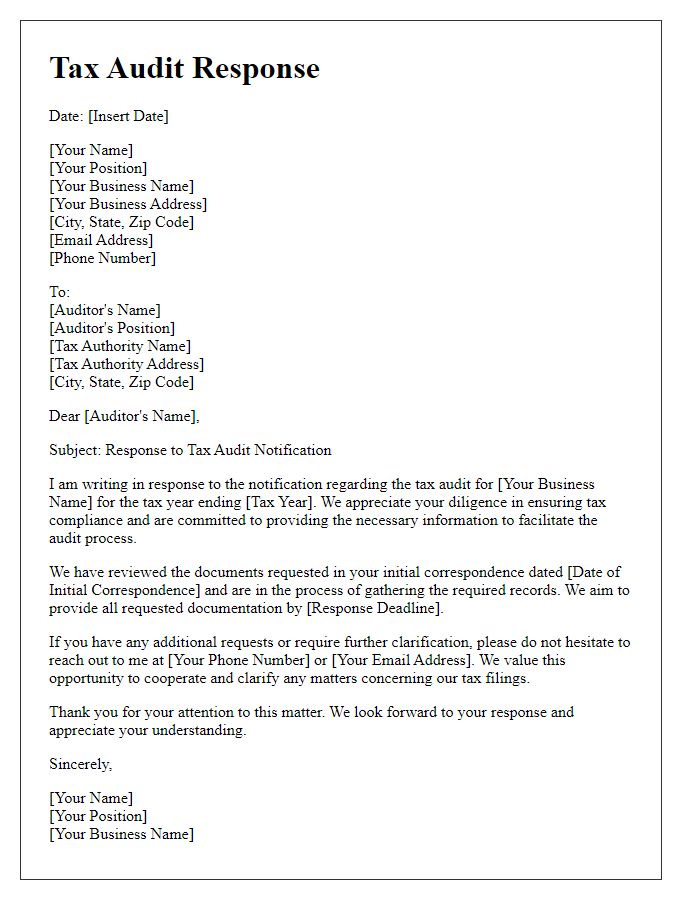

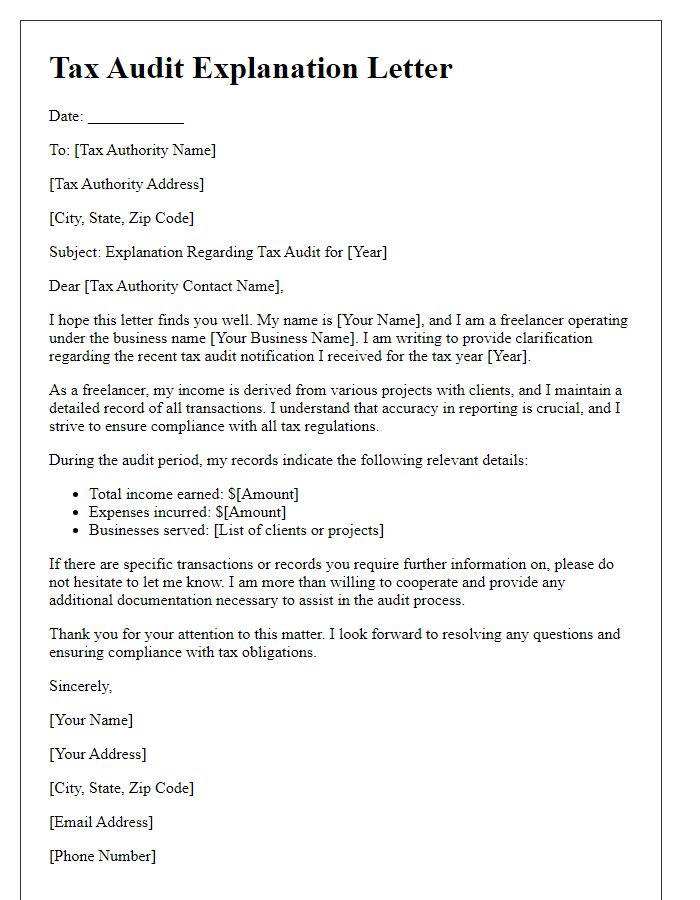

Overview of issues under audit and responses.

Tax audits can raise complex issues requiring careful representation. Common issues include discrepancies in reported income from sources such as wages, self-employment income, and interest earnings. Complications may arise from deductions claimed on Schedule A, including mortgage interest (potentially over $10,000), charitable contributions, and medical expenses (which must exceed 7.5% of adjusted gross income). In addition, businesses may face scrutiny regarding expense deductions for travel, meals, and home office claims. Each issue necessitates a well-documented response supported by relevant documentation, such as W-2 forms, 1099 forms, and receipts. Understanding IRS regulations, particularly Section 167 concerning depreciation, is crucial for accurate representation. Timely communication and organized record-keeping play vital roles in effective audit representation.

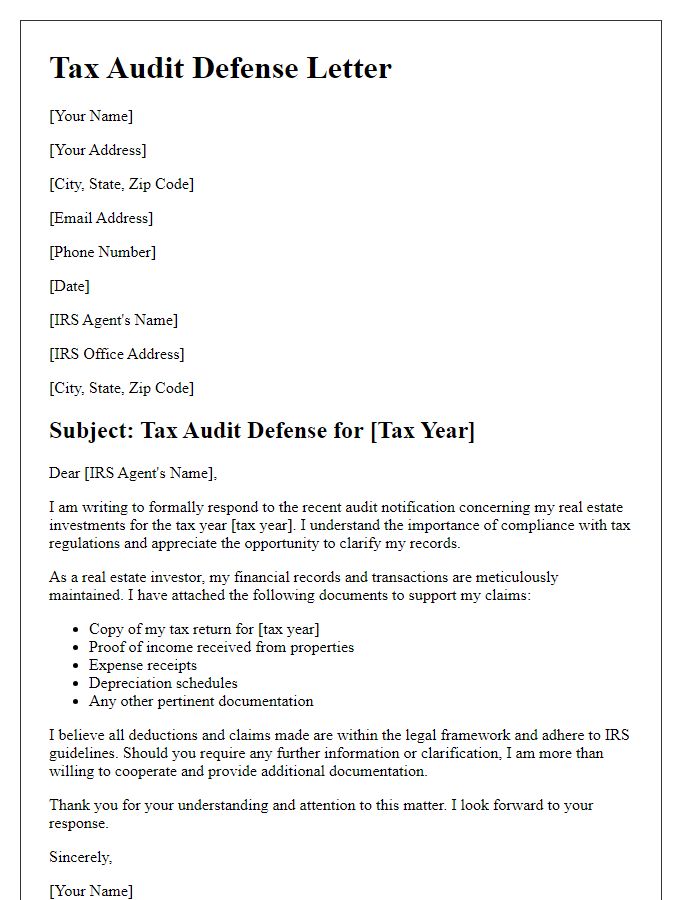

Relevant tax codes, regulations, or precedents.

Tax audit representation involves understanding and navigating complex regulations and codes, such as the Internal Revenue Code (IRC) Sections 6001 to 6109, which outline taxpayer record-keeping and reporting requirements. Essential regulations include IRS Circular 230, which governs the practice of tax professionals before the Internal Revenue Service and emphasizes ethical standards in tax advice. Precedents established in court cases like *Chevrolet Motor Co. v. United States* (1943) can significantly influence audit decisions, particularly regarding proper record maintenance and substantiation of expenses. Furthermore, guidance from IRS Revenue Rulings and Notices provides additional frameworks for compliance and potential defenses during an audit. Knowledge of these entities is crucial for effectively representing clients during tax audits.

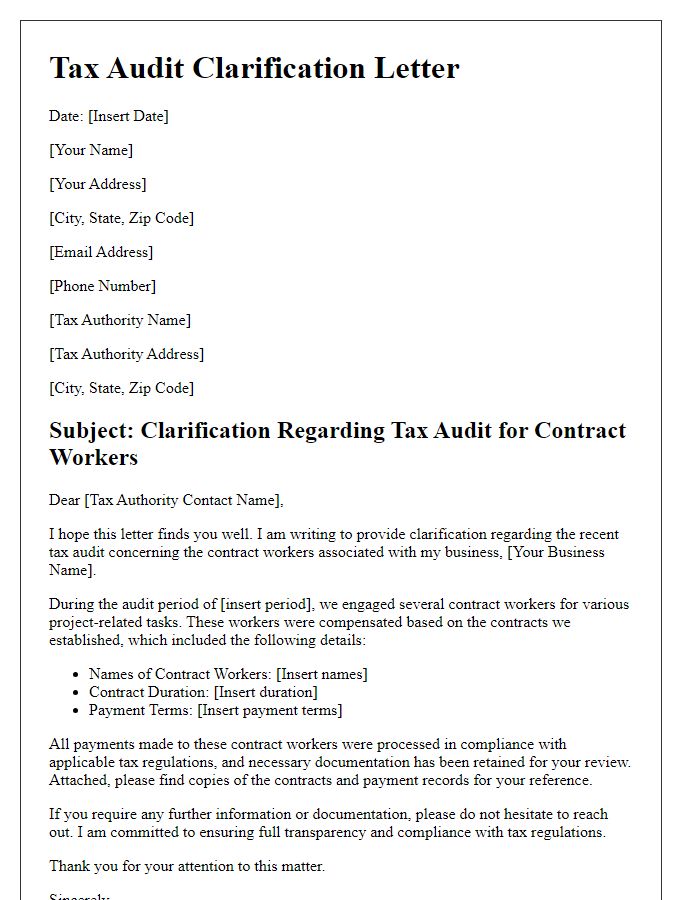

Contact information for follow-up and communication.

Tax audits can lead to significant stress for individuals and businesses, especially during the scrutiny of financial records and compliance with tax laws. In these situations, having reliable contact information for follow-up and communication is essential. Relevant parties may include tax professionals such as certified public accountants (CPAs), tax attorneys specializing in audit defense, or designated representatives from the Internal Revenue Service (IRS) such as the auditor overseeing the case. Accuracy in providing phone numbers, email addresses, and mailing addresses for all involved is crucial, ensuring that timely updates and information requests can be exchanged without delay. Effective communication can greatly influence the resolution of the audit process, minimizing potential fines or penalties.

Comments