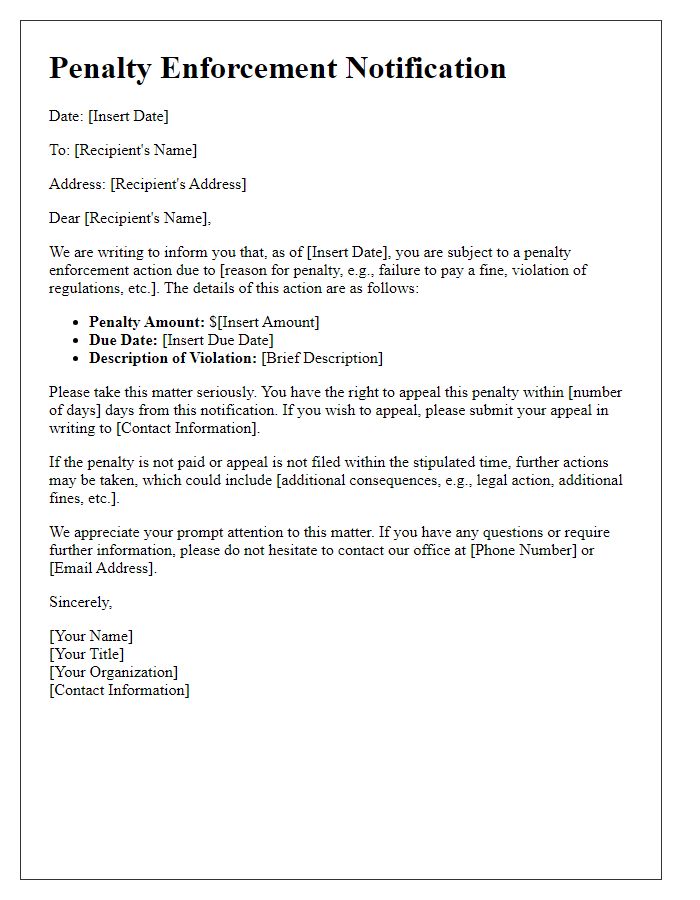

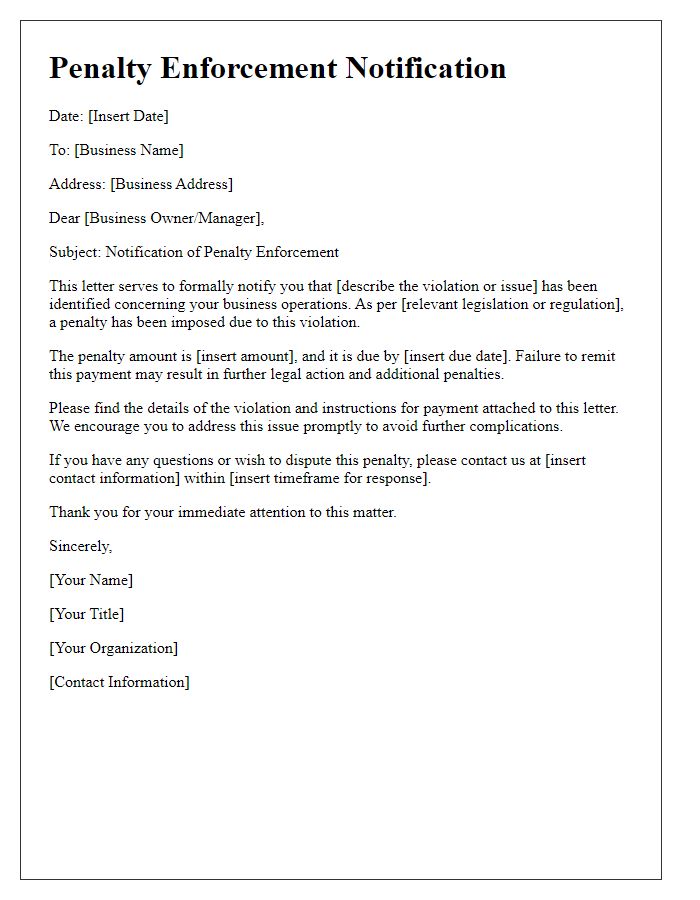

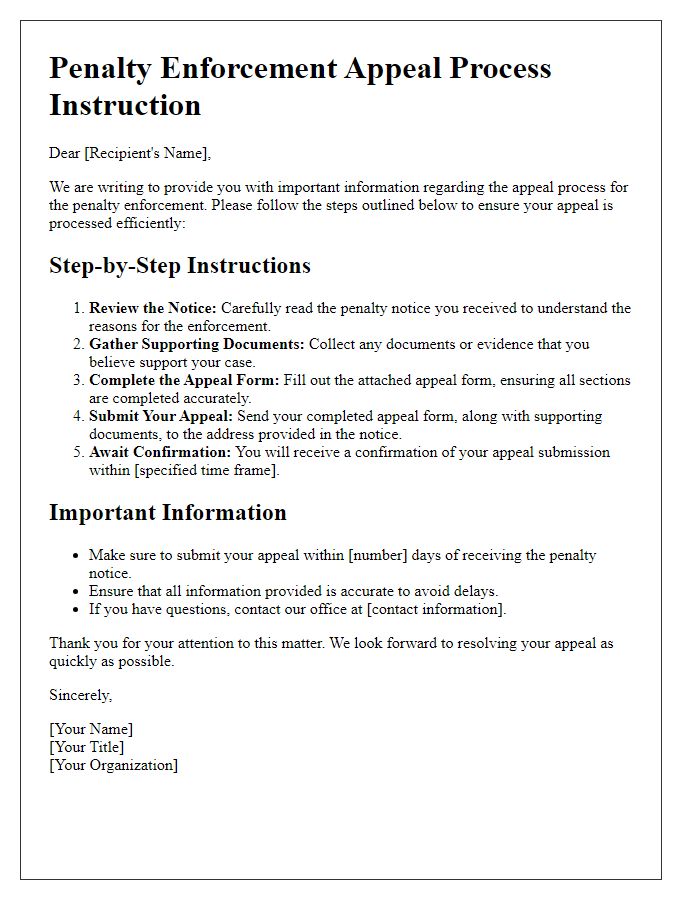

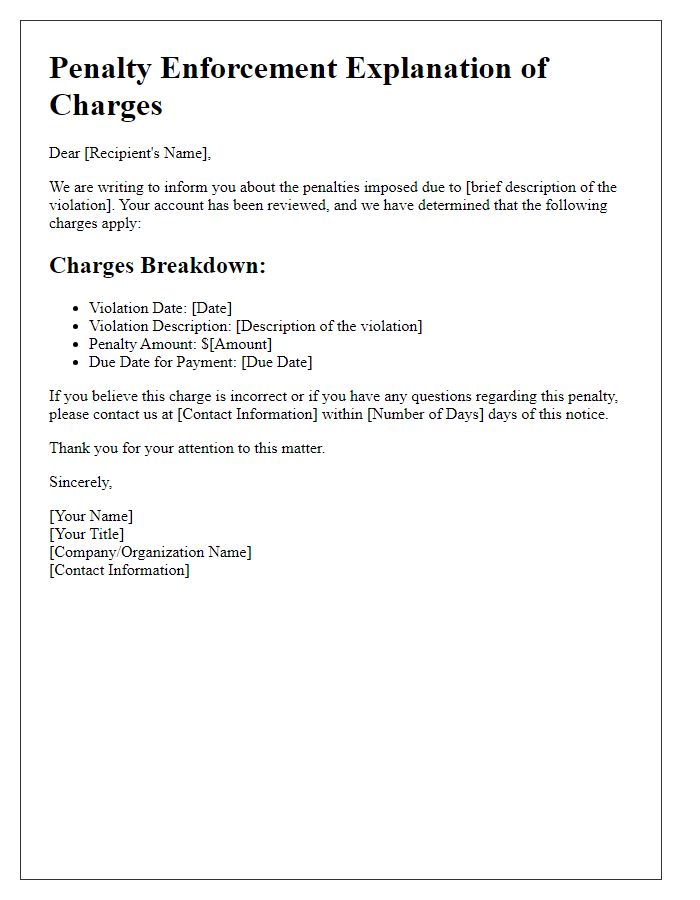

Are you facing the challenge of crafting a letter regarding penalty enforcement? Whether you're notifying someone about an outstanding fine or clarifying the consequences of non-compliance, clear and effective communication is essential. In this article, we'll explore a well-structured letter template that ensures the message is conveyed respectfully yet firmly. So, dive in to discover the nuances of creating a professional communication that sets the right tone and achieves your goals!

Clear explanation of the penalty reason

In municipal traffic management, swift identification of violations ensures road safety. For example, speeding violations (exceeding posted limits by more than 15 mph) can trigger penalties, which include fines averaging $150 in metropolitan areas. The enforcement of these penalties aims to deter reckless driving behavior, particularly in high-traffic zones and school areas where pedestrian safety is paramount. Accumulation of penalties can lead to license suspension, especially for repeat offenders, which emphasizes the importance of adhering to posted speed limits and traffic regulations. Addressing penalties promptly helps maintain public order and fosters a safer environment for all road users.

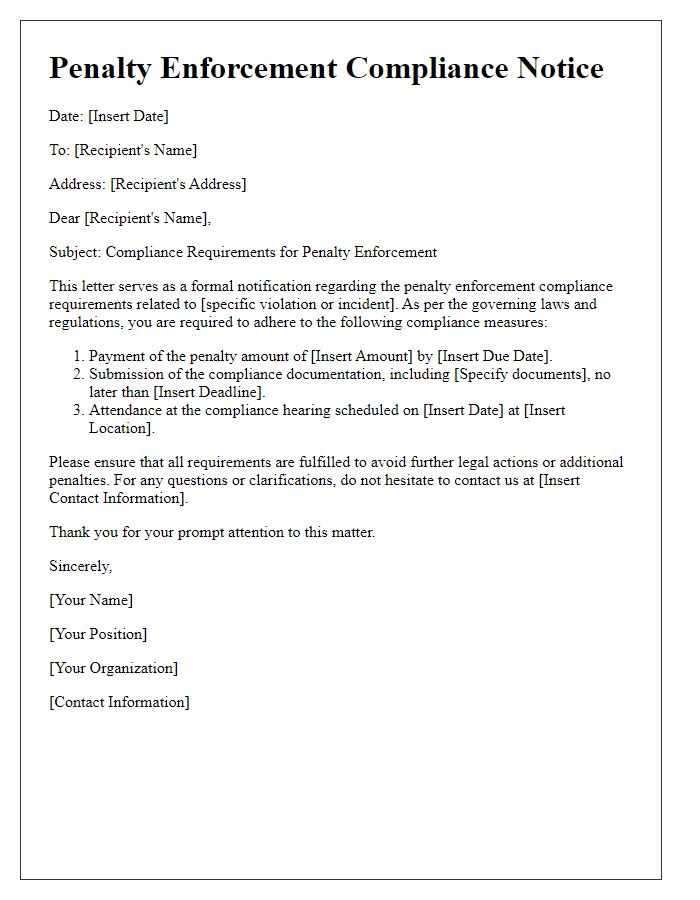

Legal references and regulations

The enforcement of penalties can involve various legal references and regulations, including the Fair Debt Collection Practices Act (FDCPA) and state-specific statutes such as California Civil Code Section 1788. The situation may pertain to unpaid fines or fees, with specific amounts outlined in the notice, such as $250 for municipal violations. Compliance with legal guidelines ensures that all communications adhere to the principles of transparency and due process. Regulatory bodies, like the Consumer Financial Protection Bureau (CFPB), oversee adherence to these laws, aiming to protect consumer rights and maintain fair practices during the penalty enforcement process. Documentation must be prepared meticulously, citing relevant laws and clearly outlining the responsibilities of the involved parties.

Specified penalty amounts or measures

Penalties for delayed payments can vary significantly depending on the jurisdiction and specific circumstances of the infraction. In many regions, financial penalties can range from 1% to 5% of the outstanding amount for each month of delay, while some municipalities may impose fixed fees, such as $50 for the first month and escalating amounts thereafter. Additionally, consistent late payment can lead to enhanced consequences such as increased interest rates up to 20% or even legal action potentially resulting in court fees or collection agency involvement. Understanding the implications of late payment is crucial for both individuals and businesses to avoid severe financial strain and legal complications.

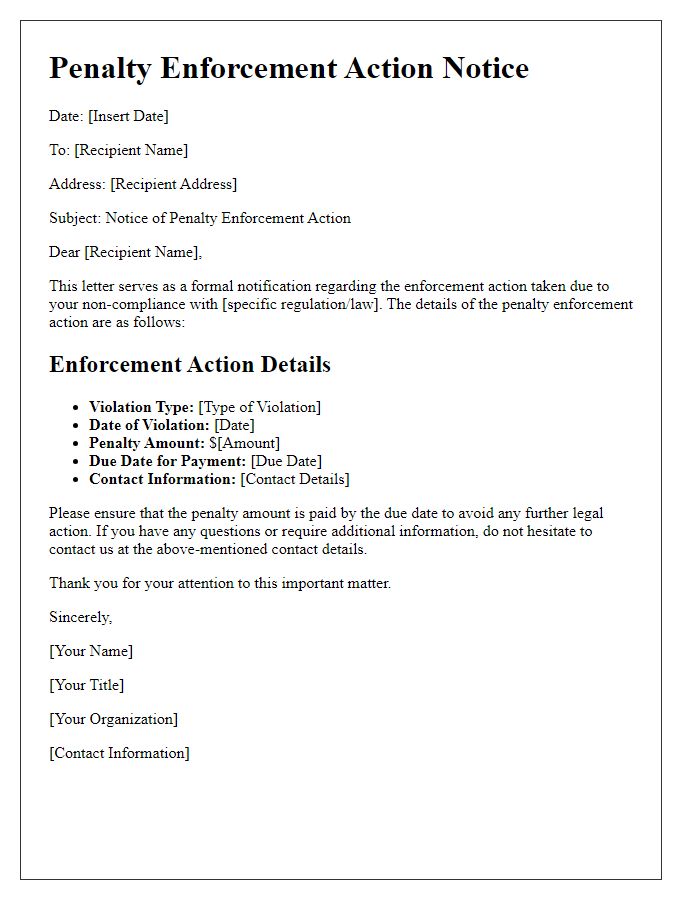

Deadline for compliance or payment

Enforcement of penalties requires clear communication regarding compliance deadlines and payment obligations. The specified deadline (e.g., October 15, 2023) serves as a crucial date for recipients to resolve any outstanding issues or payments. Non-compliance past this date may incur additional fees or legal action, depending on the governing regulations of the jurisdiction (e.g., local ordinances or state laws). Timely response ensures avoidance of penalties, which can include fines (ranging from $50 to $1,000) or additional notices for further legal action. Recipients should be aware of the impact on their records, which may influence credit scores or business licenses.

Contact information for inquiries and disputes

Inquiries regarding penalty enforcement can be directed to the designated customer service department at City Hall, located at 123 Main Street, Anytown, USA. The office operates Monday through Friday from 8:00 AM to 5:00 PM, excluding public holidays. For disputes, residents may submit a written appeal within 30 days of the penalty notice through the official website or by mail to the Appeals Board at P.O. Box 456, Anytown, USA. Contact number (555) 123-4567 provides access to a representative who can assist with specific questions regarding penalties or enforcement procedures. Email inquiries can be sent to compliance@anytown.gov, ensuring a prompt response within 48 hours.

Comments