Are you navigating the complexities of legal heir property matters? Whether you're dealing with inheritance disputes or simply need clarification on your rights, understanding the proper procedures is crucial. This article is designed to guide you through creating a comprehensive notice for legal heir property, ensuring you know what steps to take. Dive in to discover essential tips and templates that can make this process a lot smoother!

Proof of heirship and relationship to the deceased.

Proof of heirship is essential in legal matters concerning property rights, particularly in cases of inheritance following the death of an individual, referred to as the deceased. This documentation typically includes vital records such as a death certificate (issued by a government authority), birth certificates of heirs, and marriage certificates that establish the relationship to the deceased. In many jurisdictions, a legal heir must present evidence such as a family tree or genealogy report to support claims. Notary acknowledgments may also be required to formalize relationships. Furthermore, states may have regulations regarding the distribution of property through wills or intestacy laws (guidelines governing property distribution when no will exists), which further define the status of heirs in securing their rightful share of the decedent's estate.

Details of the deceased's property/assets.

The legal heir property notice outlines the assets of the deceased, who may have owned real estate in locations like Manhattan, New York, with an estimated value of $1.2 million. The deceased may also have held financial assets such as a bank account with a balance of $50,000 in Chase Bank, along with investments in stocks with a total worth of $30,000, primarily in technology companies like Apple and Microsoft. In addition, there might be personal property items, including jewelry valued at $10,000 and a classic car collection featuring a 1969 Ford Mustang and a 1967 Chevrolet Camaro, each worth approximately $25,000. This comprehensive inventory of the deceased's belongings serves as a crucial basis for the distribution of assets among legal heirs, ensuring all rightful claims are addressed according to state inheritance laws.

Legal reference to inheritance laws applicable.

Legal heirs must navigate inheritance laws, such as the Indian Succession Act of 1925 or the Probate Code in various jurisdictions, which dictate the distribution of property following a decedent's passing. These laws outline the rights and responsibilities of heirs, establishing legal entitlement to assets, including real estate, bank accounts, and personal belongings. Heirs must gather documents such as death certificates, wills (if available), and title deeds to initiate the transfer process. Conducting due diligence through public records can reveal claims or encumbrances on the property. Timely notice to all legal heirs is vital to prevent disputes and ensure equitable distribution of assets, adhering to provisions in both state and national inheritance statutes.

Contact information for further communication.

A legal heir property notice typically includes vital details about the property in question, like the identification of the deceased individual, property description, and legal rights of the heirs. The address of the property, often located in a specific city or neighborhood, should be noted, alongside the relevant legal jurisdiction that governs inheritance matters in that area. Additionally, contact information should be concise and clear, providing the phone number, email address, and possibly the physical address of the notifying heir or legal representative. These details facilitate further communication among the involved parties regarding any legal proceedings or claims related to the property.

Formal request for response or acknowledgment.

Property disputes involving legal heirs often require formal notices to ensure clarity and compliance with legal protocols. A notice should include essential details such as the property address (often located in a specific municipality), the names of the heirs (whether they are siblings, descendants, or other relatives), and the nature of the property interest (such as ownership share or entitlement). Additionally, it should clearly state the deadline for response (typically 14 to 30 days) and the method for acknowledgment (such as certified mail or registered post). Legal terminology should be used appropriately to convey importance and the potential consequences of non-response, including possible legal action or claims filed in jurisdictional court, which may be located in a specific county or state.

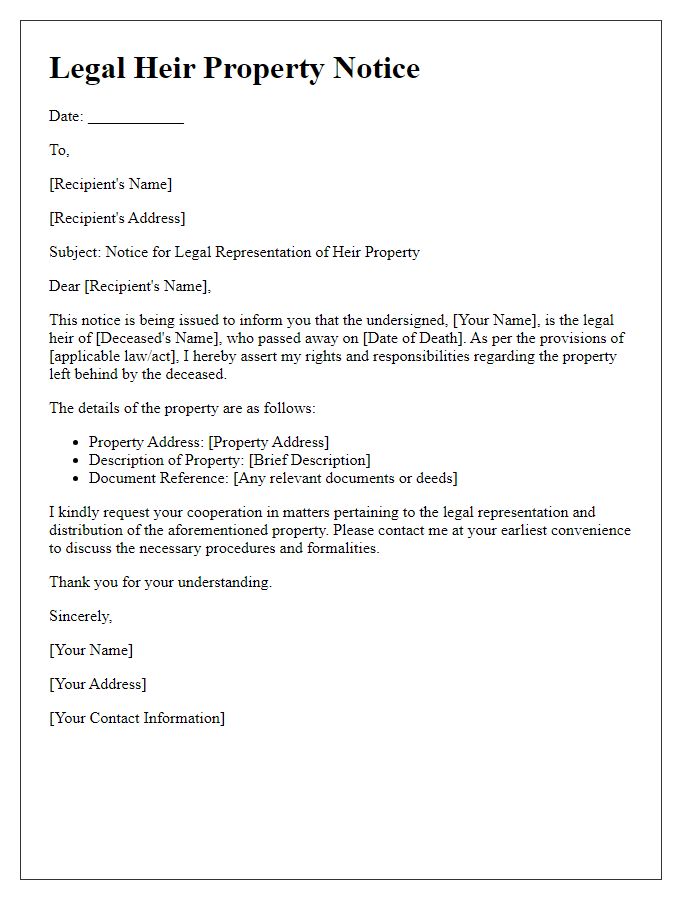

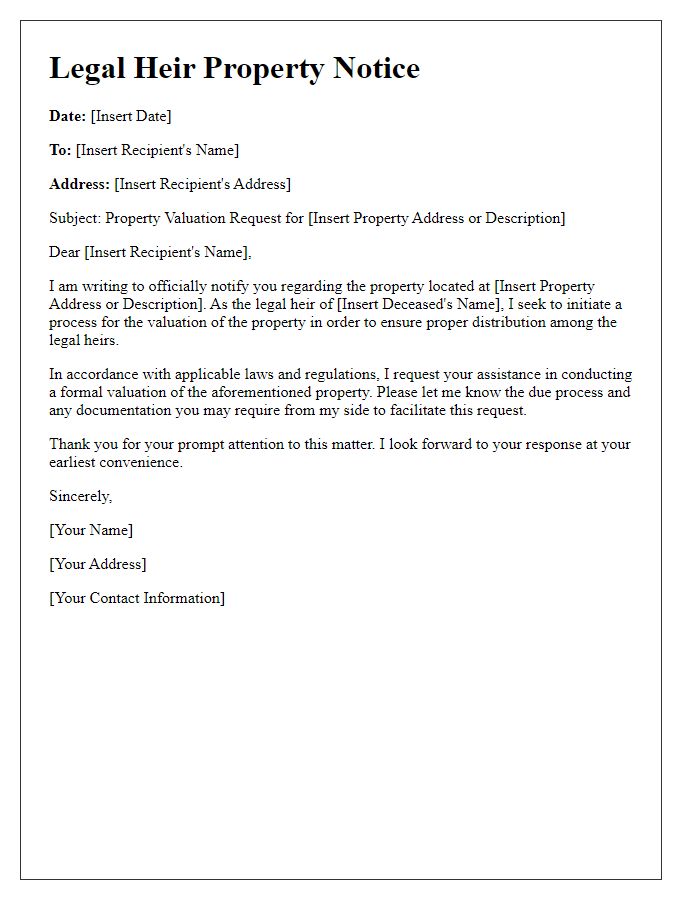

Letter Template For Legal Heir Property Notice Samples

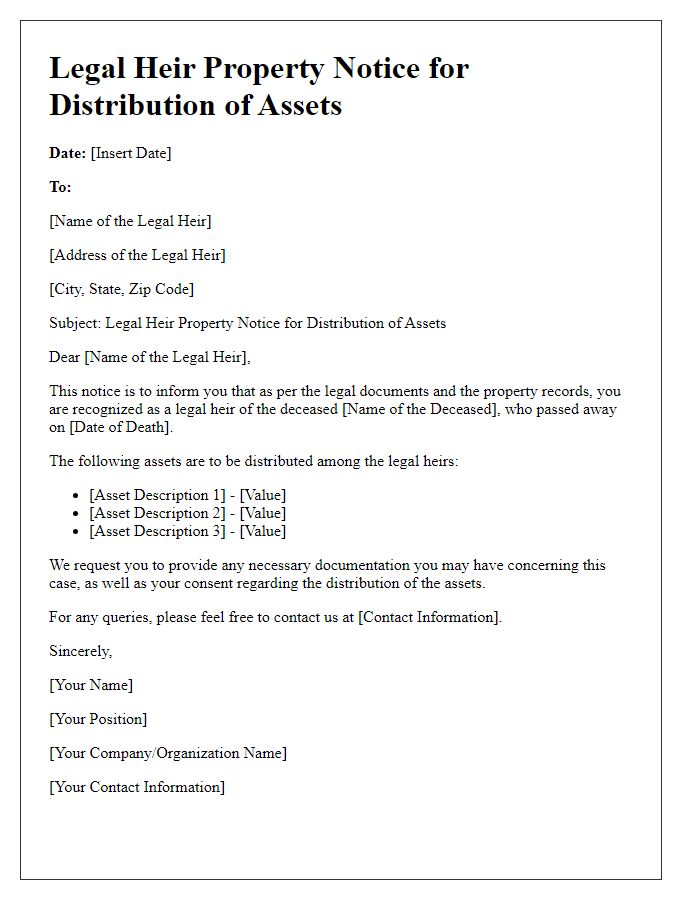

Letter template of Legal Heir Property Notice for Distribution of Assets

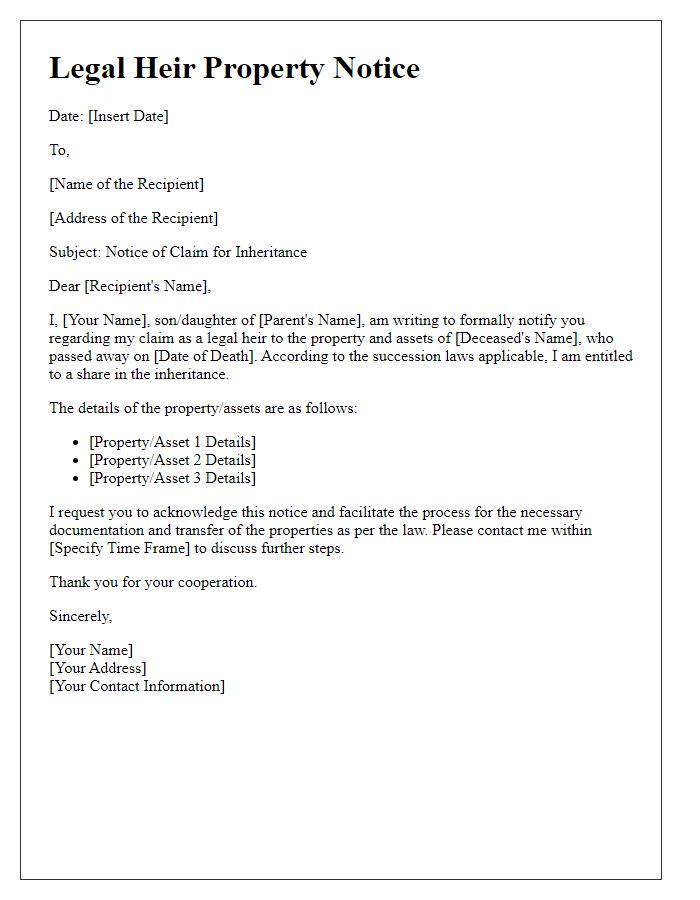

Letter template of Legal Heir Property Notice for Joint Ownership Proposal

Comments