Hey there! If you're facing the tough situation of debt recovery, navigating the legal landscape can seem daunting, but it doesn't have to be. This article will break down the essentials of crafting a compelling debt recovery legal notice that captures attention and prompts a response. We'll explore important elements to include, the tone to adopt, and legal considerations to remember. So, let's dive in and empower you with the knowledge to take control of your debt recovery processâread on to learn more!

Debtor's Full Legal Name and Contact Information

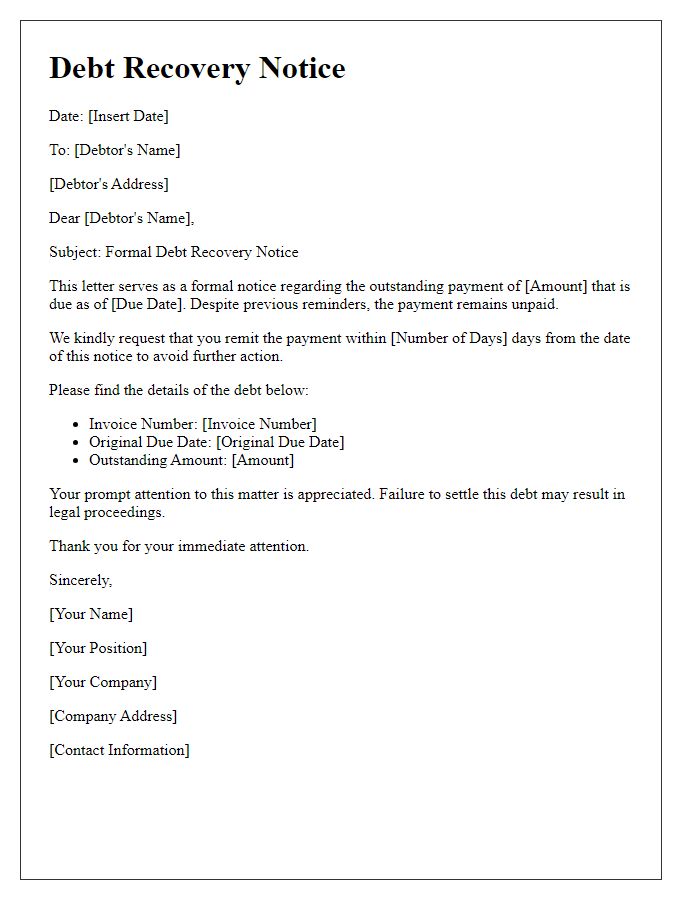

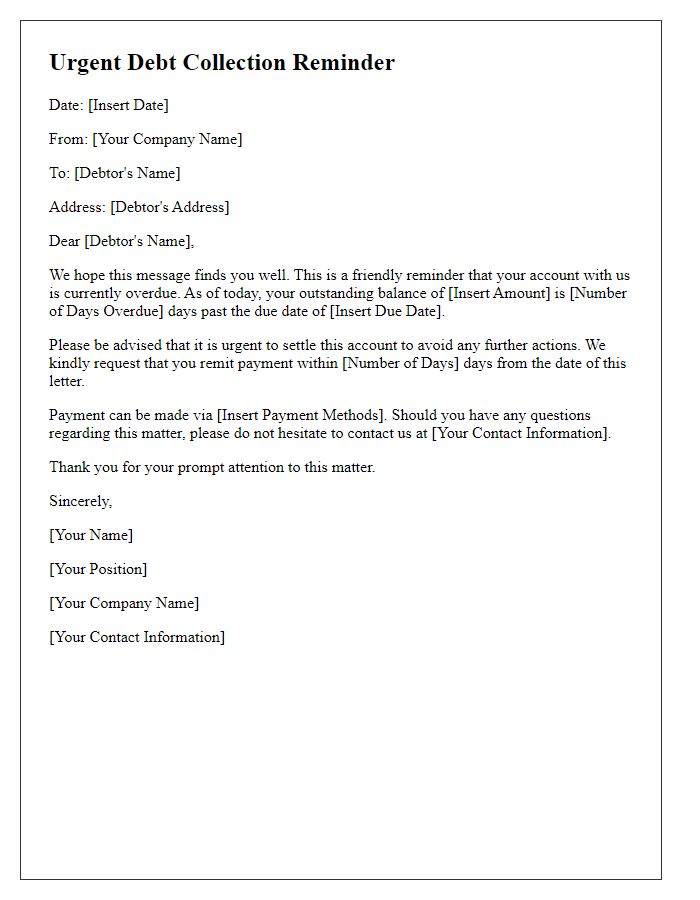

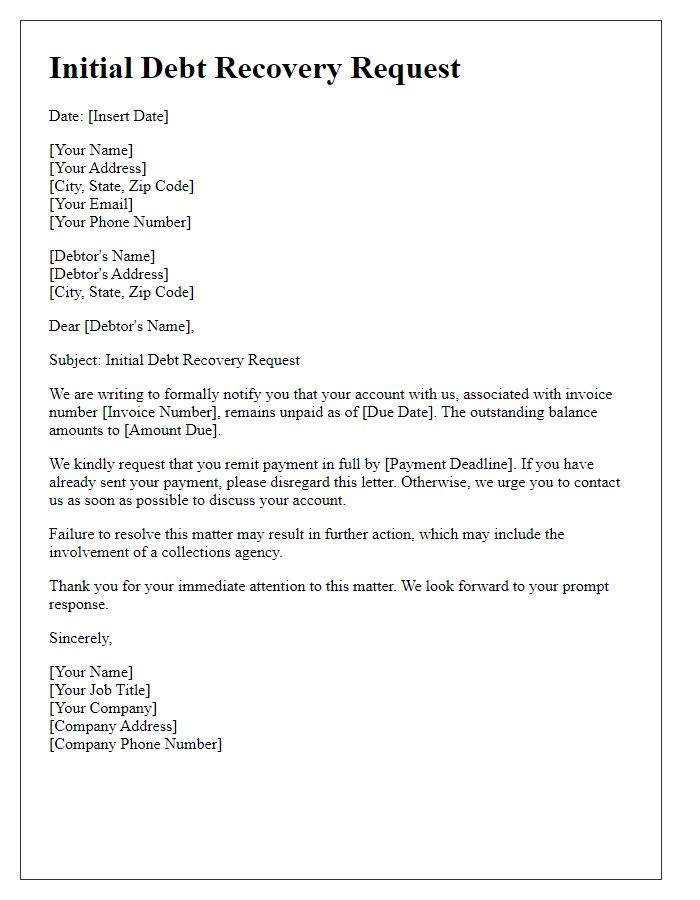

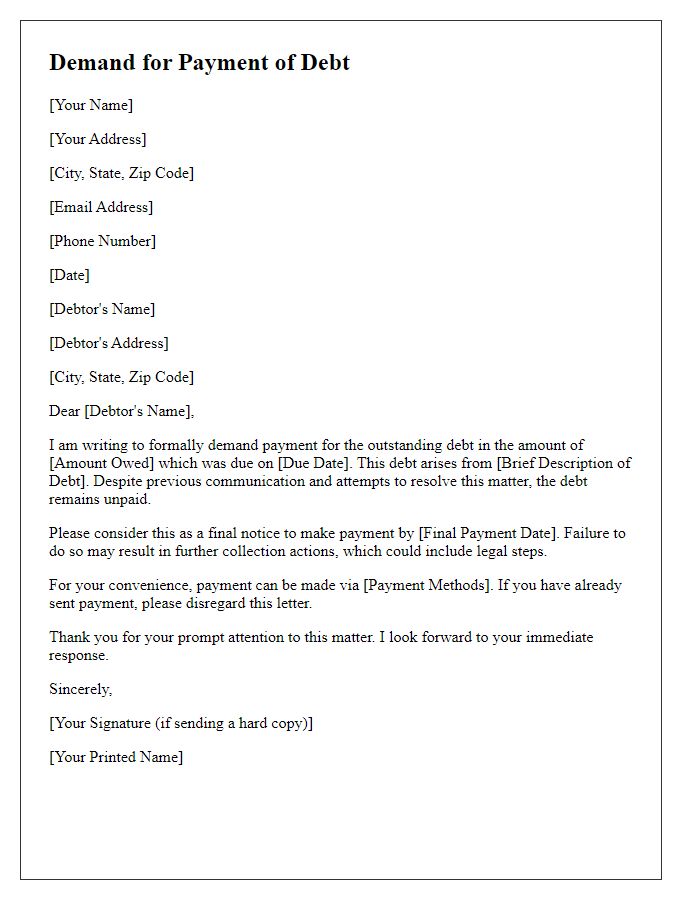

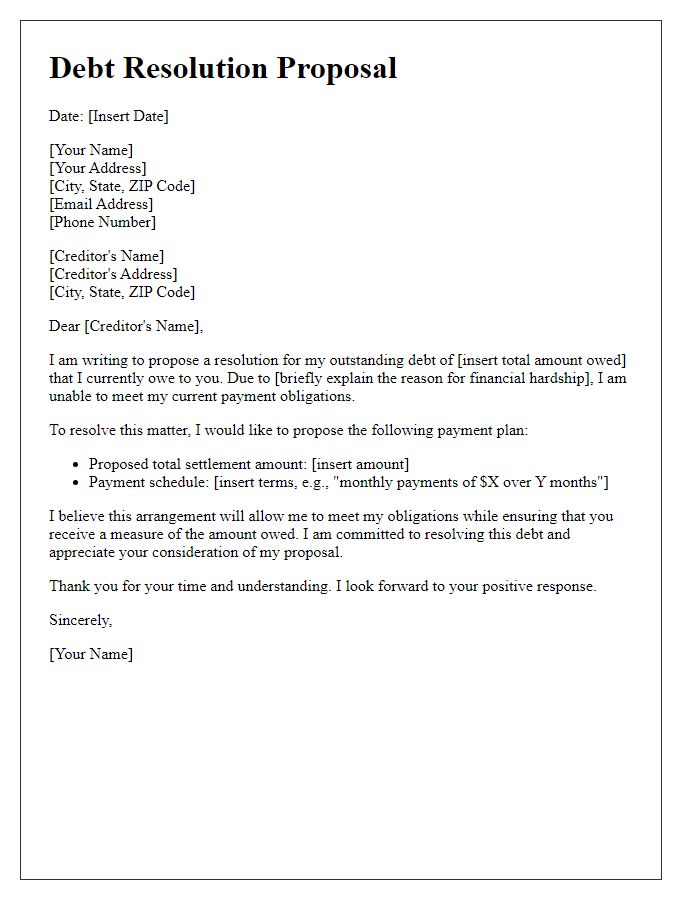

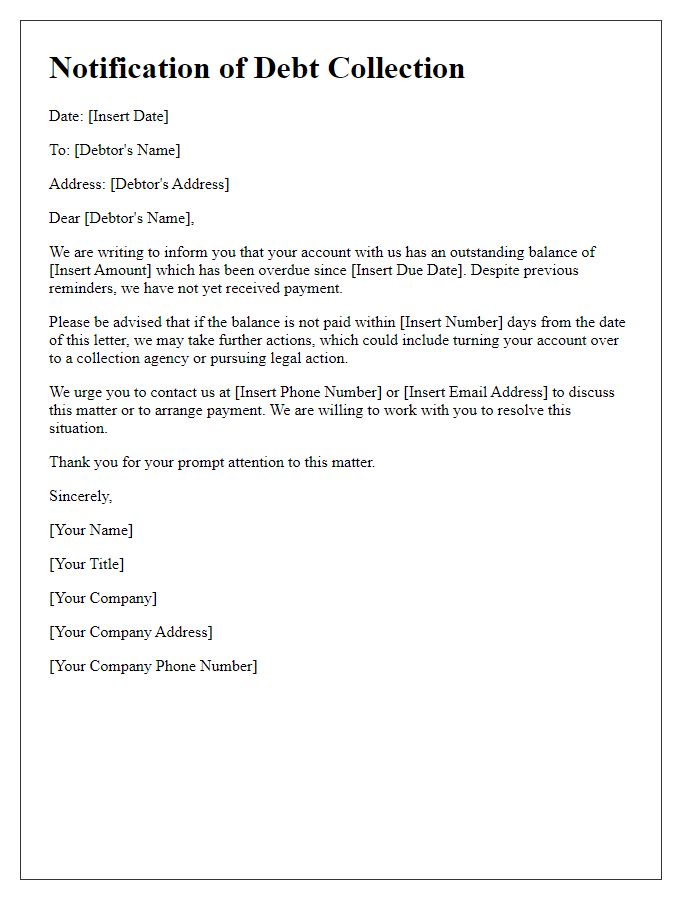

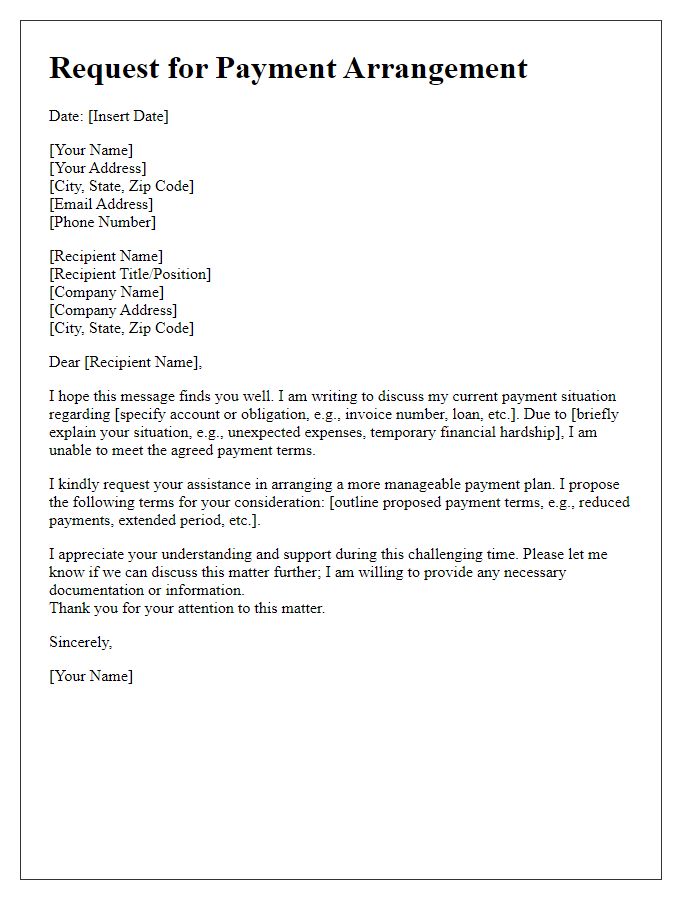

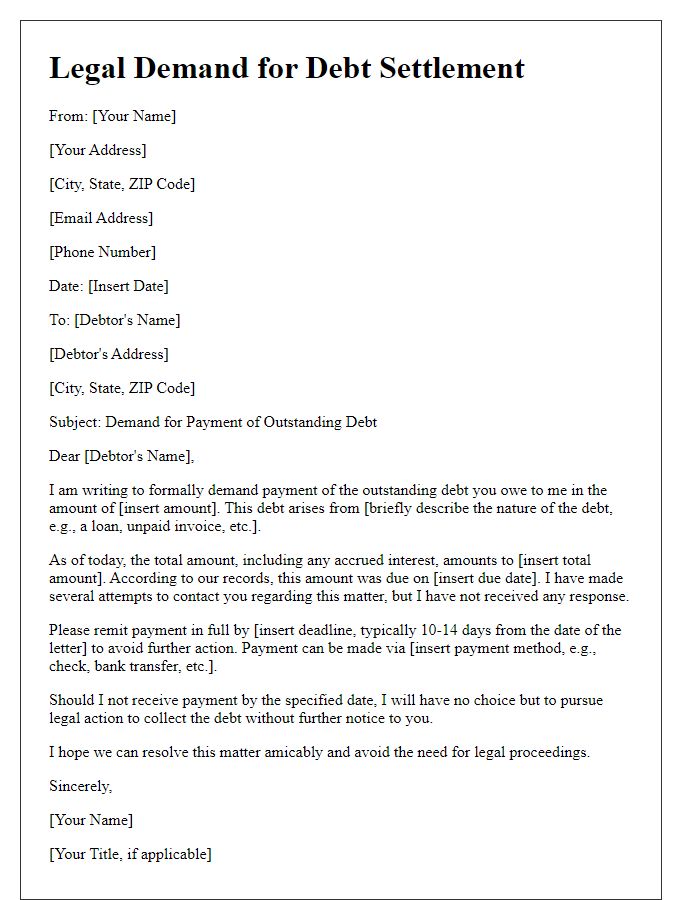

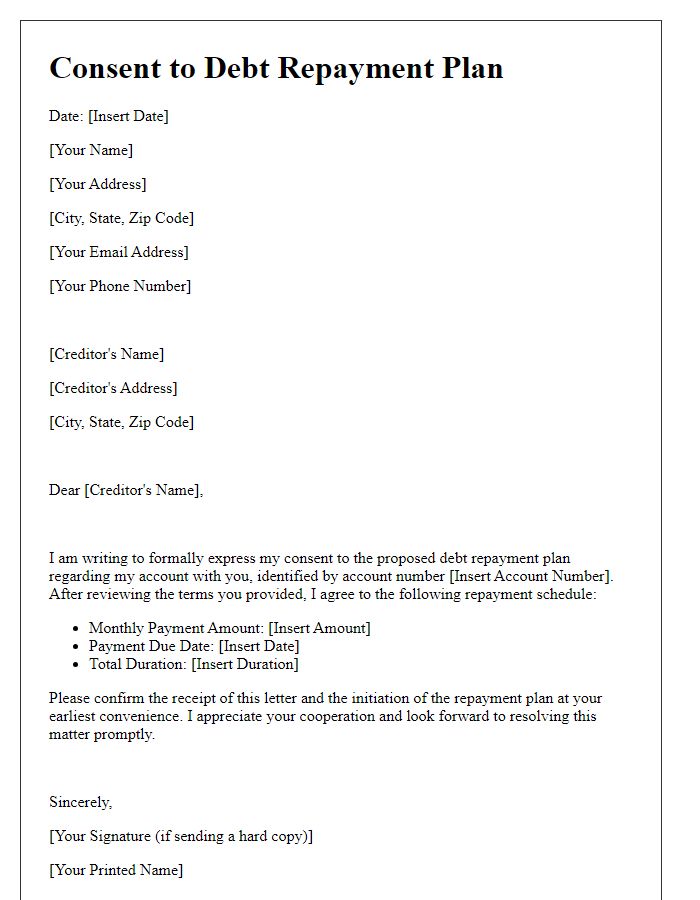

The process of debt recovery often involves sending a legal notice to the debtor. The notice should include key details such as the **debtor's full legal name**, which indicates their official identity for legal recognition, along with **contact information** including address, phone number, and email. This information ensures that the debtor can be reached and is essential for formal communication. Accurate identification of the debtor is crucial to avoid misunderstandings and complications during recovery. The legal notice serves as a formal reminder of the outstanding debt and outlines specific amounts owed, due dates, and consequences of non-payment, often referring to relevant debt recovery laws applicable in jurisdictions like the **United States** or the **United Kingdom**.

Description of Outstanding Debt and Payment Deadline

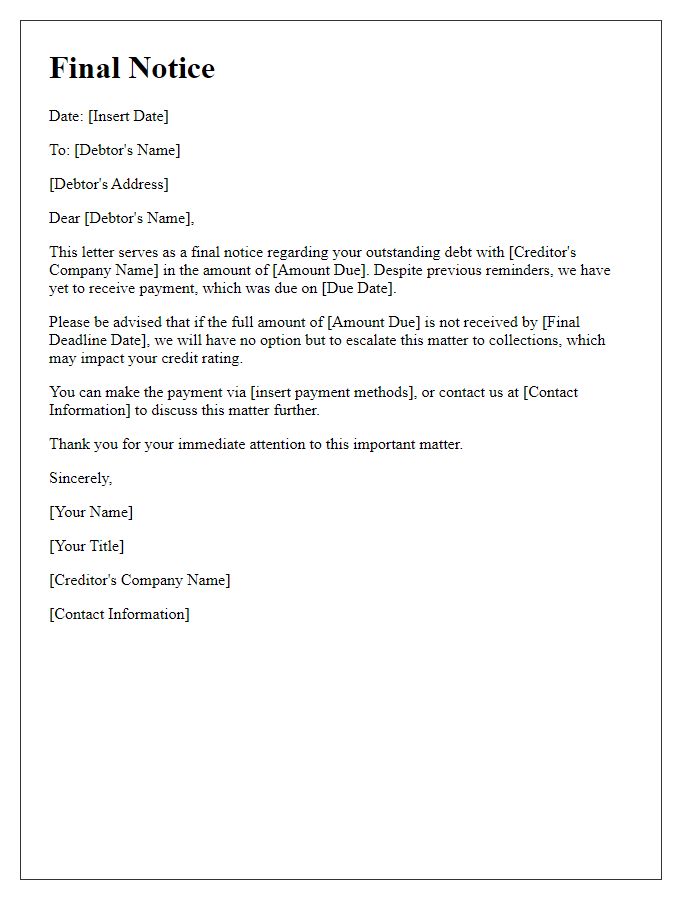

An outstanding debt of $5,000, incurred due to unpaid services rendered on July 15, 2023, remains unresolved. The services were provided by XYZ Consulting located at 123 Business Avenue, Cityville. Failure to remit payment by October 30, 2023, will obligate the creditor to pursue legal action through the court system, potentially leading to additional fees or penalties. The account originally became overdue on August 15, 2023, and subsequent reminders have not resulted in payment. It is crucial to address this matter promptly to avoid further escalation.

Legal Consequences and Actions if Debt Remains Unpaid

A debt recovery legal notice serves as a crucial communication to inform the debtor of the outstanding amount, emphasizing the legal implications of continued non-payment. Specific details such as the total owed amount (e.g., $5,000), the due date (e.g., June 30, 2023), and reference to any relevant contracts or agreements (e.g., Loan Agreement dated January 15, 2022) should be explicitly stated. The notice may outline potential legal actions (e.g., filing a lawsuit in civil court) and the possible consequences (e.g., accumulated interest, additional fees, impact on credit score). Furthermore, it may also reference specific laws applicable in the region, such as the Fair Debt Collection Practices Act (FDCPA) in the United States, which governs the behavior of debt collectors. The intent is to create a sense of urgency and highlight the seriousness of the matter while maintaining professional tone and clarity.

Reference to Relevant Laws, Regulations, and Contract Terms

In the realm of debt recovery, a legal notice serves as a formal notification to a debtor regarding an outstanding obligation. This process typically references relevant laws, such as the Fair Debt Collection Practices Act (FDCPA) in the United States, which outlines the legal standards for debt collection practices. The notice may also cite specific regulations and contract terms, emphasizing obligations established in the signed agreement. For instance, under the contract, due date stipulations, interest rates, and payment schedules are crucial elements highlighted in this formal communication. Failure to address the debt may escalate the situation to legal action, potentially leading to court proceedings. This serves as a critical reminder for debtors to assess and resolve their financial responsibilities promptly.

Contact Details for Resolution or Payment Arrangements

A debt recovery legal notice typically includes critical contact details to facilitate resolution or payment arrangements. This notice should prominently display the name of the creditor (for instance, ABC Financial Group), address (123 Main Street, Suite 400, New York, NY 10001), and phone number (555-123-4567) for direct communication. Additionally, providing an email address (contact@abcfinancial.com) can enhance accessibility for debtors seeking clarification or negotiating terms. Clear instructions on how a debtor can proceed with payment, such as accepted payment methods (credit card, bank transfer), and deadlines for resolution (e.g., within 30 days from the date of the notice), ensure that all parties understand the urgency and importance of addressing the outstanding debt.

Comments