Are you looking to request a distribution from a trust fund but unsure how to start? Writing a clear and concise letter can make all the difference in ensuring your request is handled properly. In this article, we'll provide a helpful template and tips to guide you through the process, making it as straightforward as possible. So, let's dive in and get you the assistance you need to move forward!

Recipient and Trustee Details

Trust fund distribution requests must include comprehensive information regarding the intended recipients and trustees involved in the transaction. The recipient details should encompass full legal names, permanent addresses, and Social Security numbers to ensure accurate identification. Additionally, the trustee details require the full legal name, address, and contact information of the individual or institution responsible for managing the trust fund. Precise identification of both parties is crucial to prevent any legal complications during the distribution process and to maintain compliance with trust regulations stipulated in the trust document. In some cases, documents such as birth certificates or court orders may be necessary to corroborate the relationship between recipients and the trust.

Account and Trust Information

A trust fund distribution request involves submitting details about the trust account, which may include information about the trustee, beneficiaries, and specific distribution amounts. Important elements like the trust's name, identification number, and the date of establishment provide essential context. The trustee's contact information ensures efficient communication regarding the distribution process. Beneficiaries' names and their respective shares clarify who is entitled to what portion of the trust assets. Additional pertinent details such as distribution instructions and reasons for the request enhance transparency, promoting a smooth handling of the request. Proper documentation ensures compliance with legal protocols surrounding trust disbursement, vital for maintaining trust integrity and security.

Distribution Purpose and Justification

Trust fund distributions often serve specific purposes, such as education funding, healthcare support, or financial assistance during emergencies. For instance, a distribution request for $5,000 may be justified as necessary for a college tuition payment at a recognized institution like the University of California, which has a current annual tuition of approximately $14,000. In contrast, a request for $2,000 could be aimed at covering medical expenses related to hospitalization, documented by invoices from a local hospital, such as General Hospital in Springfield. Each request should detail the beneficiary's current financial situation, including income, expenses, and any other relevant financial obligations, thereby providing a comprehensive rationale for the distribution and ensuring compliance with the trust's stipulations.

Requested Amount and Allocation

A trust fund distribution request outlines the specified amount and intended allocation for the distribution of assets held within a trust. For instance, a beneficiary may request a sum of $50,000 from a family trust established in 1995 to fund educational expenses at a university, such as Stanford University in California, with an allocation plan detailing $30,000 for tuition fees, $10,000 for living expenses, and $10,000 for study materials, ensuring that the funds are utilized effectively according to the trust's provisions. Proper documentation, such as a completed distribution form outlining the beneficiary's name and the legal reference of the trust agreement, is critical for a successful distribution process.

Legal Compliance and Documentation

A trust fund distribution request requires careful attention to legal compliance and documentation. Details such as the trust's name, established in 1995, and specific clauses relating to fund distribution must be adhered to. The requestor, typically a beneficiary, must provide valid identification, such as a driver's license, and documentation verifying their relationship to the trust. Additionally, obtaining a copy of the trust agreement, along with any amendments since inception, is crucial. Relevant financial statements, outlining the trust's assets--valued at over $1 million--as of December 2022, must accompany the request. Legal counsel may review all documents to ensure compliance with state laws, which can vary significantly; for instance, California may have different regulations compared to New York. All submissions should be directed to the designated trustee's office, ensuring a complete record for future reference.

Letter Template For Trust Fund Distribution Request Samples

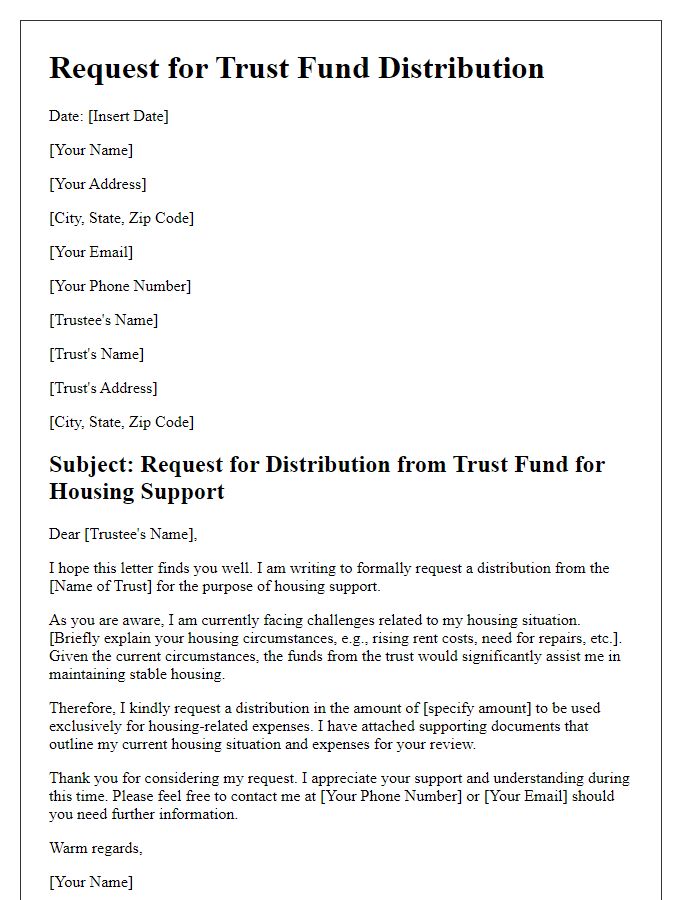

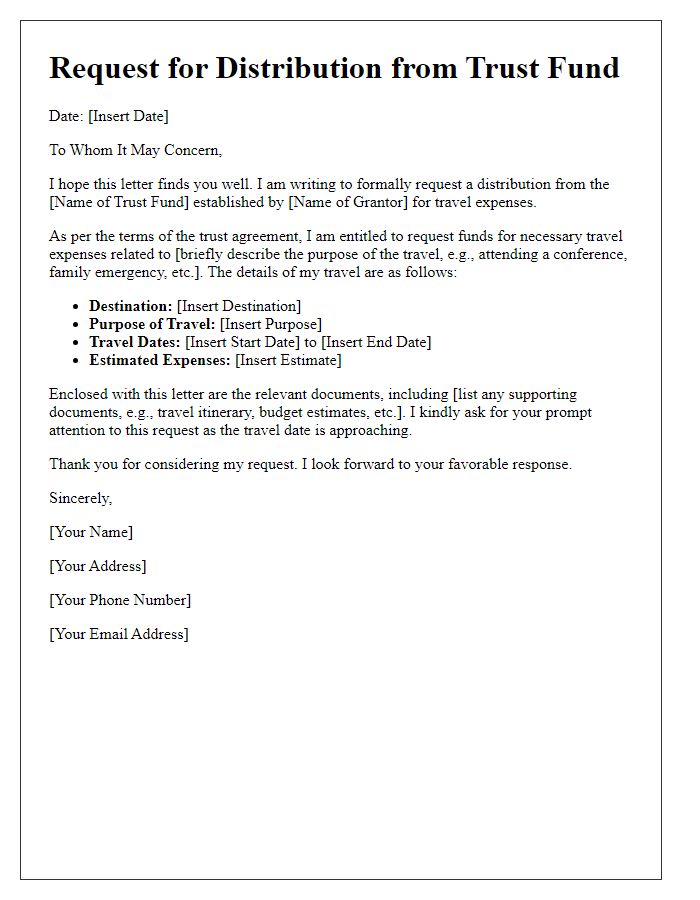

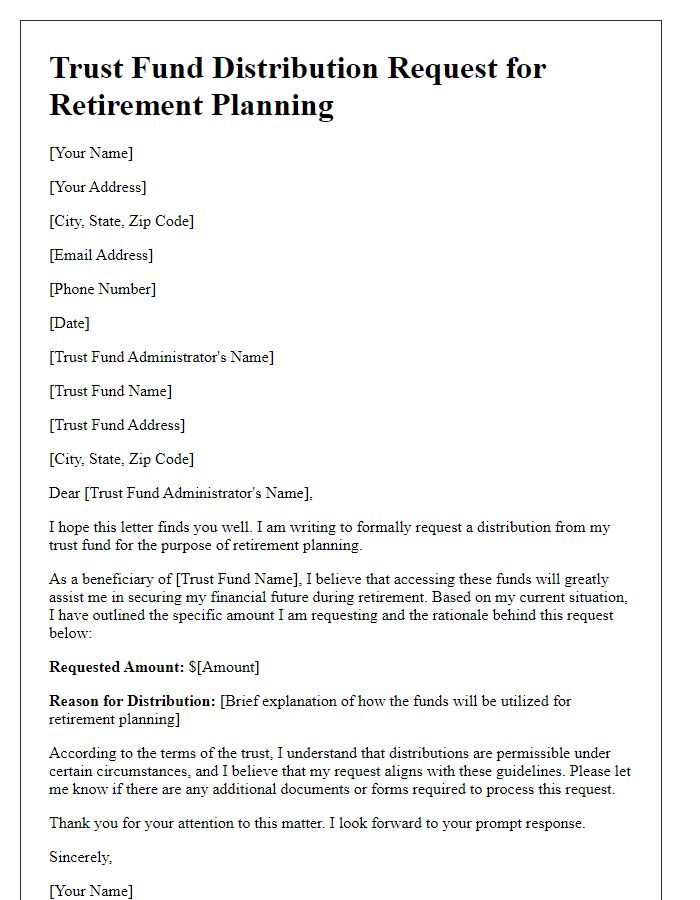

Letter template of trust fund distribution request for educational expenses

Letter template of trust fund distribution request for investment purposes

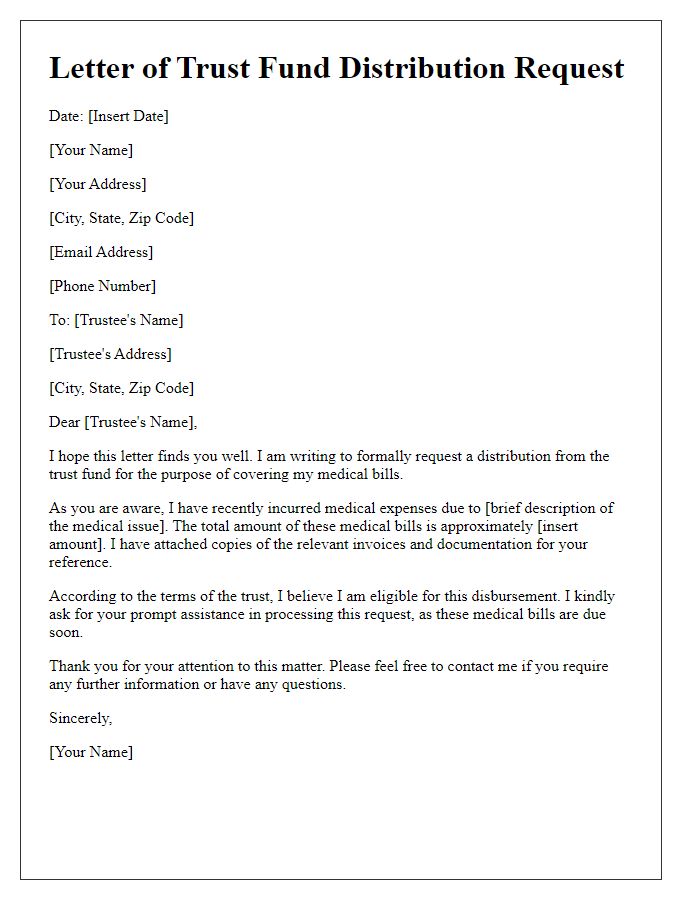

Letter template of trust fund distribution request for emergency financial assistance

Letter template of trust fund distribution request for business startup funding

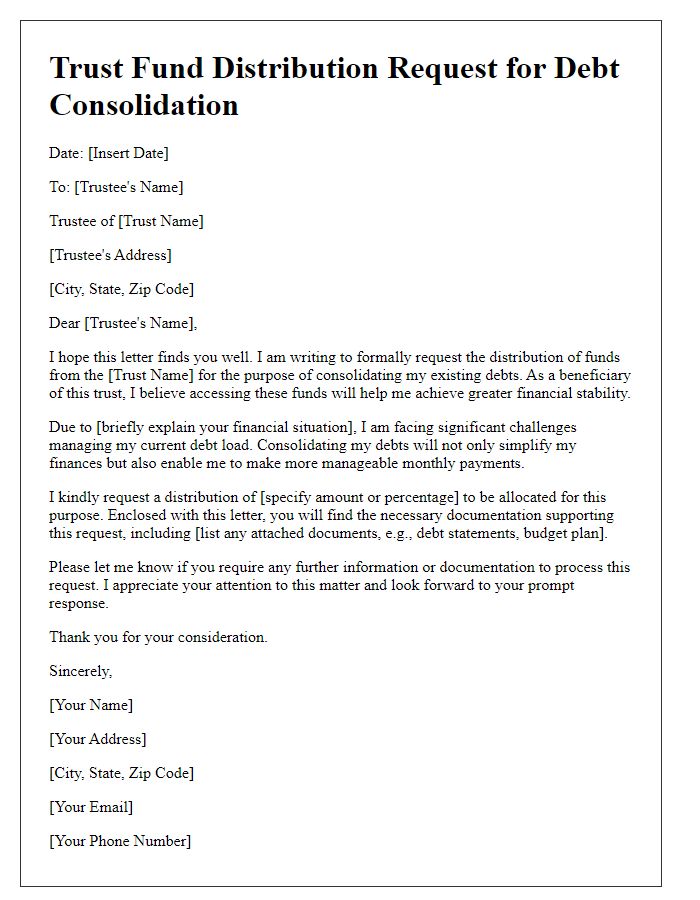

Letter template of trust fund distribution request for debt consolidation

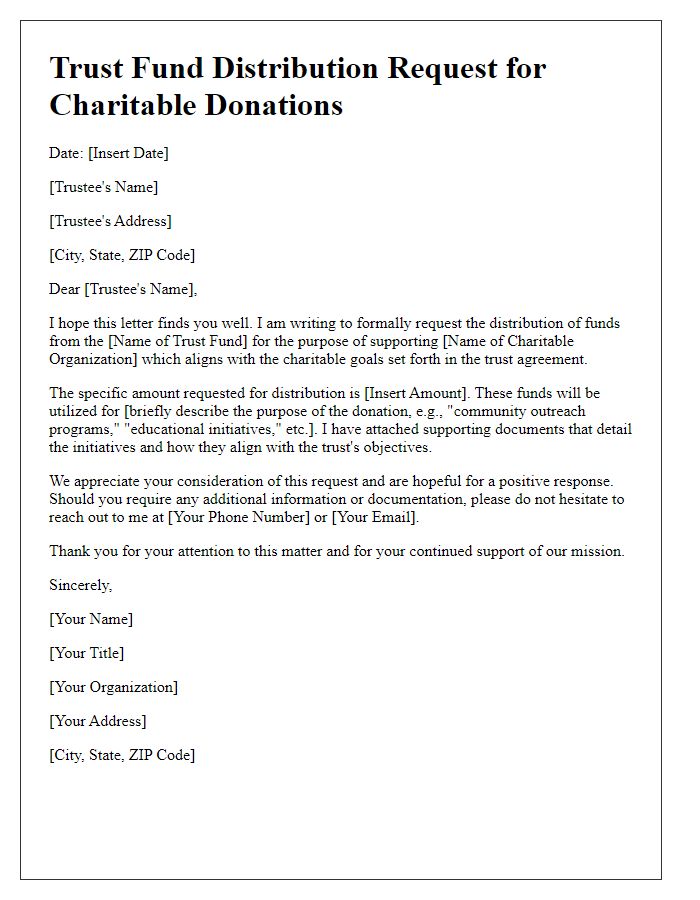

Letter template of trust fund distribution request for charitable donations

Comments