Are you looking to navigate the shares transfer process smoothly? Writing a shares transfer authorization letter doesn't have to be complicated; it simply requires a few key elements to ensure everything is in order. In this article, we'll break down the essential components of a well-structured letter and provide you with a handy template to guide you along the way. So, let's dive in and make your shares transfer hassle-free!

Transferor and Transferee Details

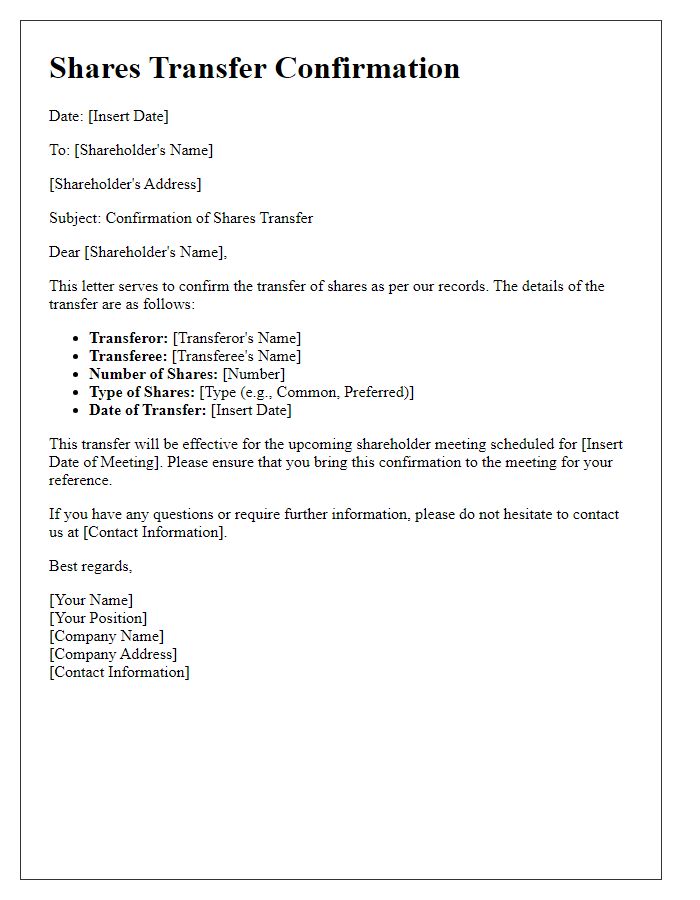

The transfer of shares requires clear identification of the parties involved. The Transferor details include the full name, residential address, and shareholder identification number (SHN) to ensure precise record-keeping. For example, a Transferor may be John Smith, residing at 123 Elm Street, Springfield, with SHN 456789. The Transferee details must similarly encompass their full name, residential address, and SHN. For instance, the Transferee could be Jane Doe, living at 456 Oak Avenue, Springfield, with SHN 987654. This information is essential for completing the share transfer documentation accurately and efficiently, aligning with corporate governance standards and ensuring seamless transfer of ownership.

Share Details and Quantity

Shares represent ownership in a corporation, often issued in specific amounts known as share quantity, which can range from a single share to thousands. Each share serves as a unit of ownership, providing shareholders (individuals or entities that own shares) with voting rights, dividends, and potential capital appreciation. When shares are transferred, it involves a detailed process including authorization documentation, ensuring legality and proper record-keeping. The company's share registry, typically maintained by a transfer agent, records the transfer to reflect the new ownership accurately and securely. Most jurisdictions require a transfer form that includes vital share details such as company name, type of shares (common, preferred), and specific quantities to facilitate a smooth transition of ownership rights.

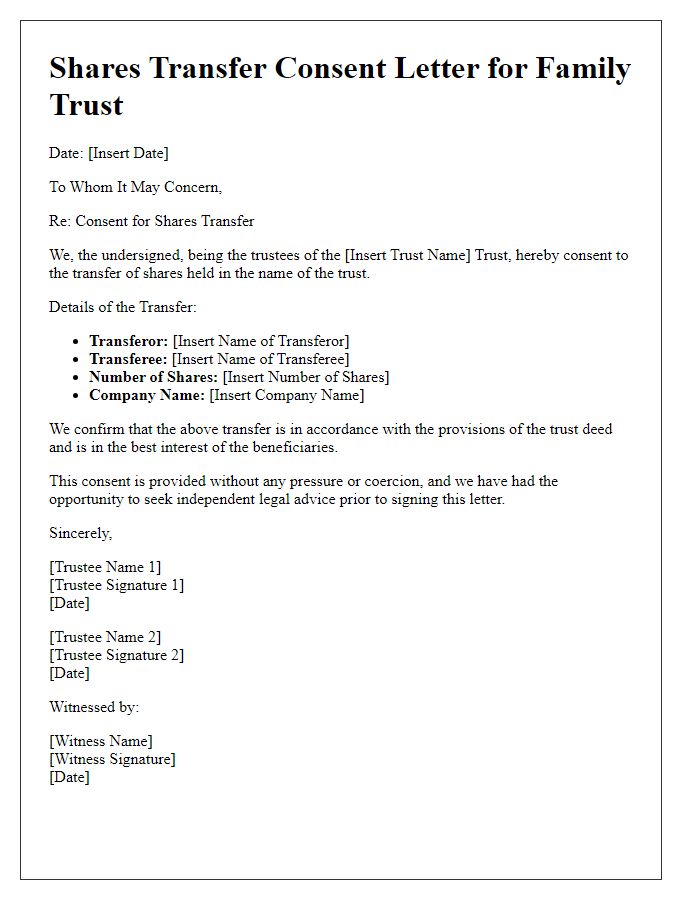

Authorization and Consent Statements

The shares transfer process involves a formal Authorization and Consent Statement, which is essential for the seamless transfer of ownership of equity in a company, following regulations in securities law. This document specifies the transferor's (current shareholder's) consent for the designated transferee (new shareholder) to receive the shares, often clarified within the realm of corporate governance policies. Accurate identification of share classes, such as common or preferred shares, and reference to the share certificate numbers are critical. Inclusion of the company's registration details, such as the corporate ID and registered office address, ensures legal validity. Compliance with local laws, such as those outlined by the Securities and Exchange Commission (SEC) in the United States, must also be adhered to in this signed agreement, which is typically witnessed to affirm authenticity.

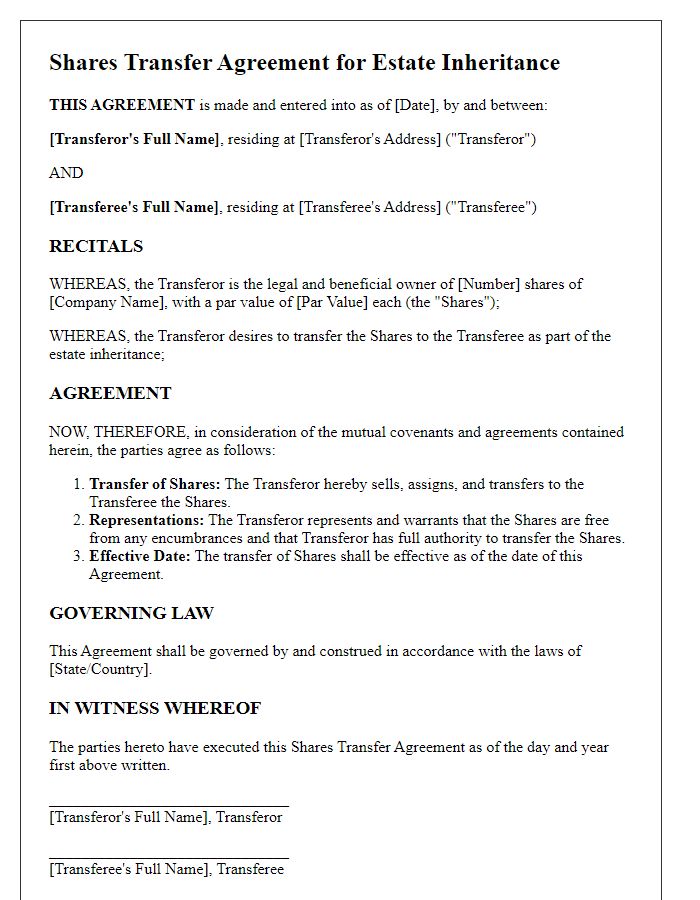

Legal and Regulatory Compliance

A shares transfer authorization, often required in corporate governance, facilitates the legal transfer of ownership from one shareholder to another. This process typically involves individuals or entities, such as corporations or limited liability companies, ensuring adherence to regulatory frameworks under securities laws, like the Securities Act of 1933 in the United States. Necessary documentation may include a completed transfer form, appropriate stock certificates, and possibly board resolutions affirming the transfer's legitimacy. Compliance with state laws, such as those in Delaware (a popular state for incorporation), is crucial, as failure to meet requirements could result in disputes or invalid transactions. The tax implications, including potential capital gains tax, also warrant consideration during these transfers to ensure both parties understand their financial responsibilities.

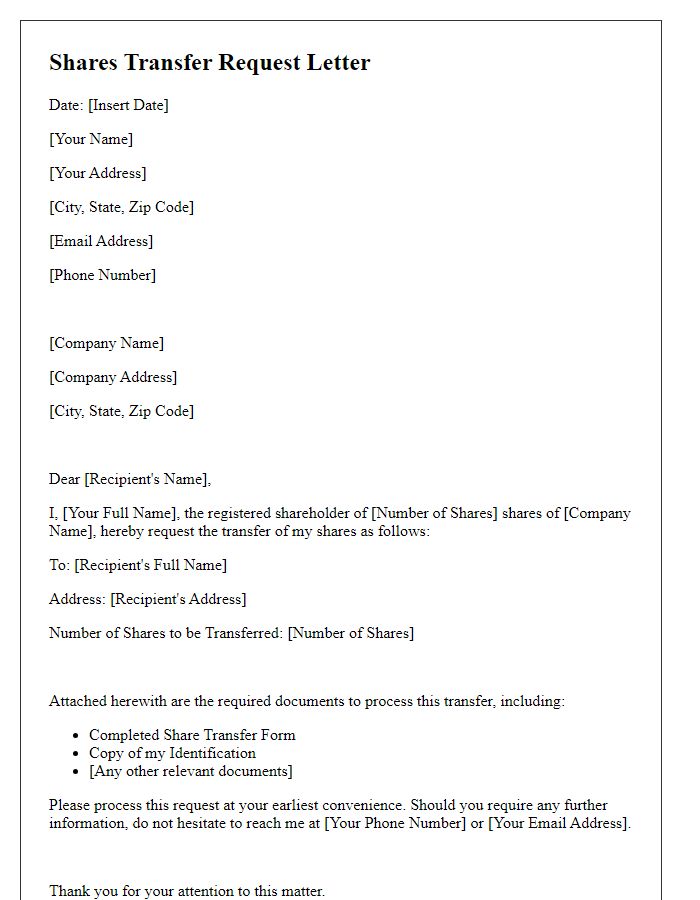

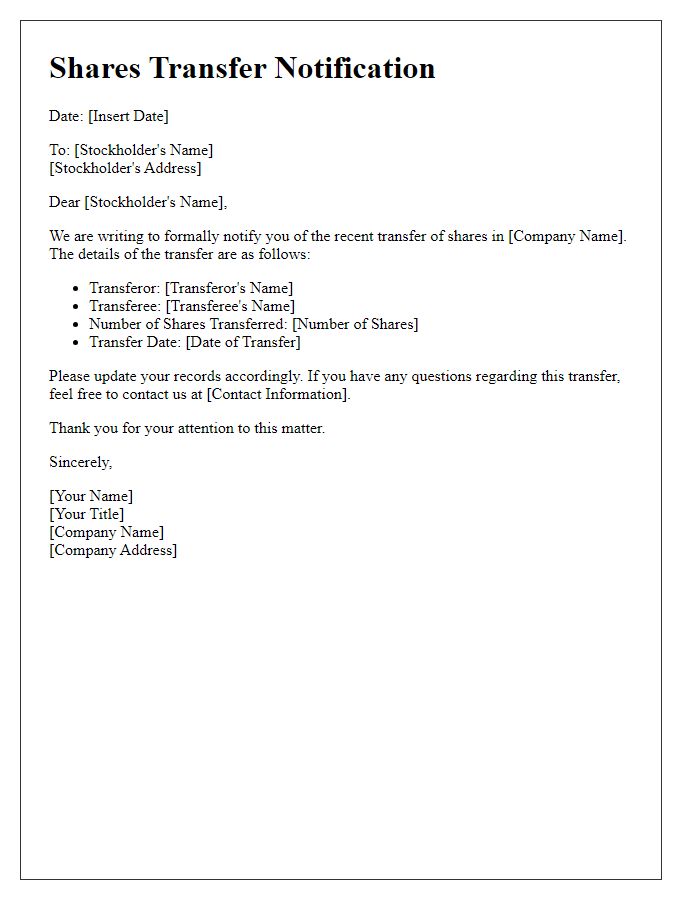

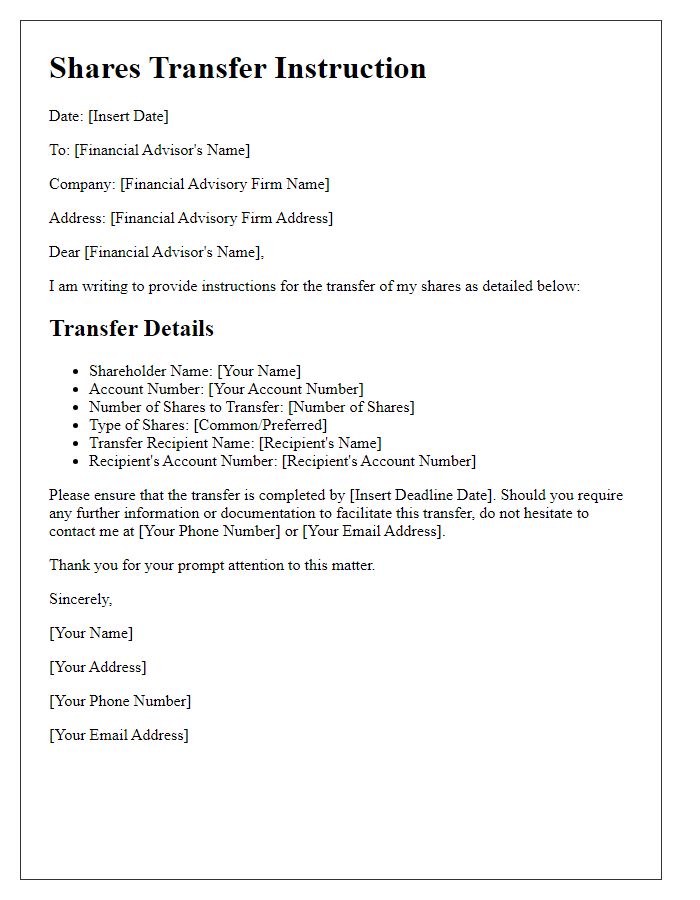

Contact Information for Queries

Share transfer authorization involves the legal process of transferring ownership of shares from one party to another. It typically requires specific documents, such as a share transfer form, which outlines the details of the transaction, including the names of the transferor and transferee, the number of shares, and the relevant share certificate numbers. This process may also require compliance with corporate bylaws and local regulations. For queries related to share transfer authorization, it is advisable to contact the company's registrar or a financial advisor, providing accurate contact information for direct communication, including phone numbers, email addresses, and office hours to ensure prompt assistance.

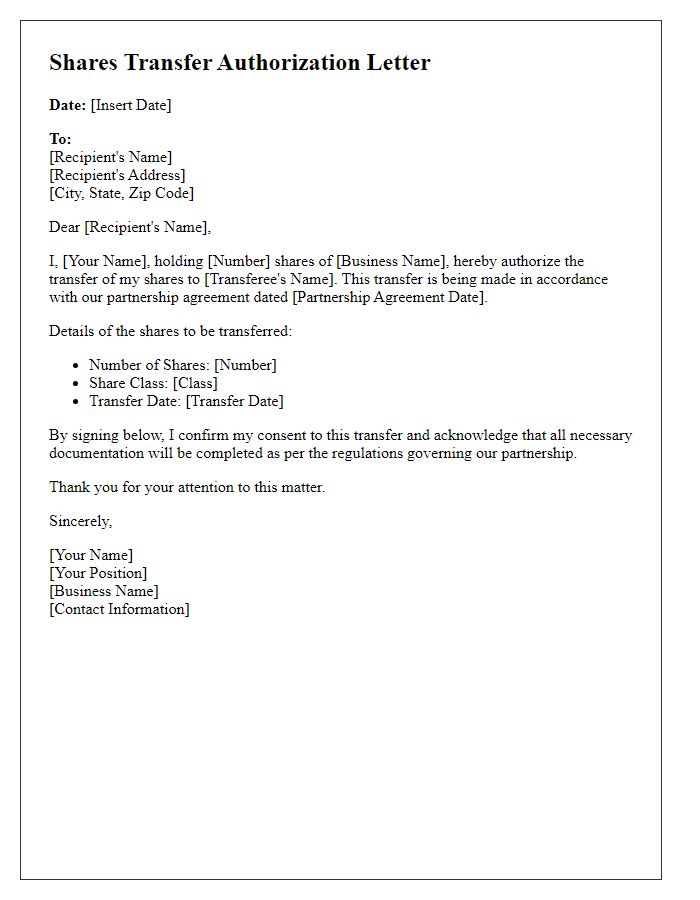

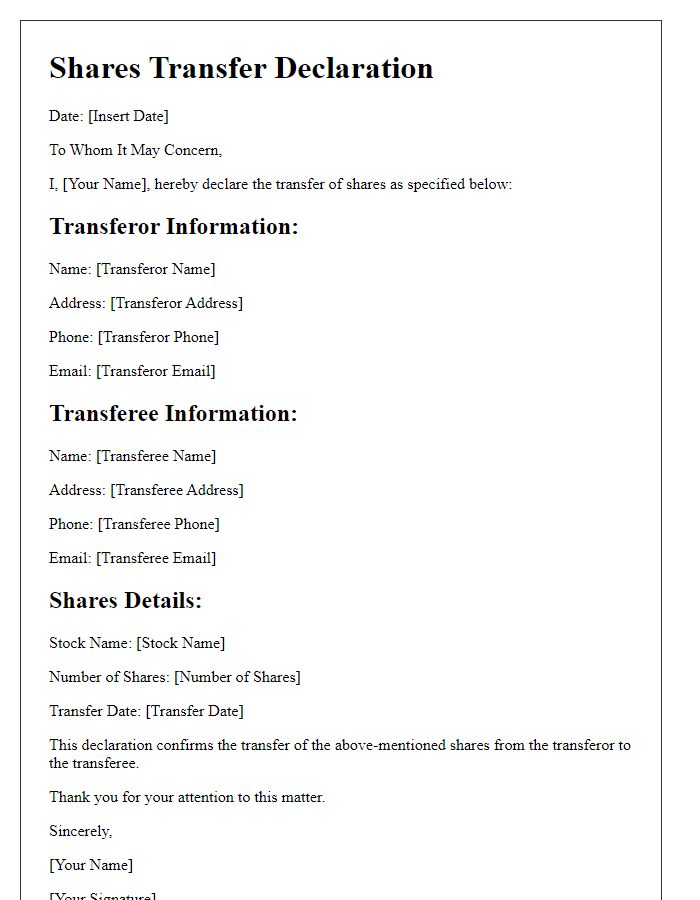

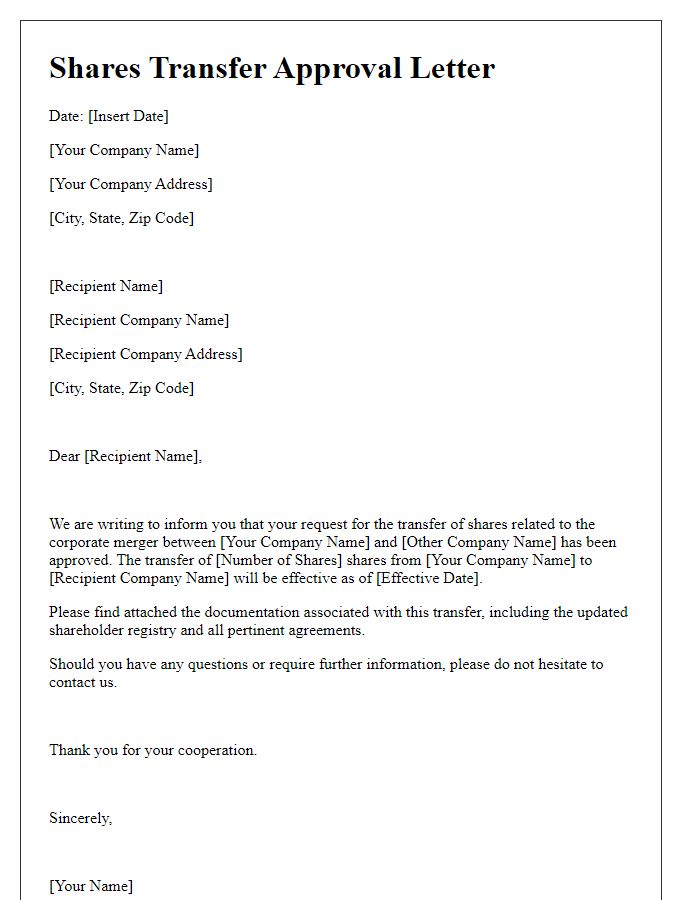

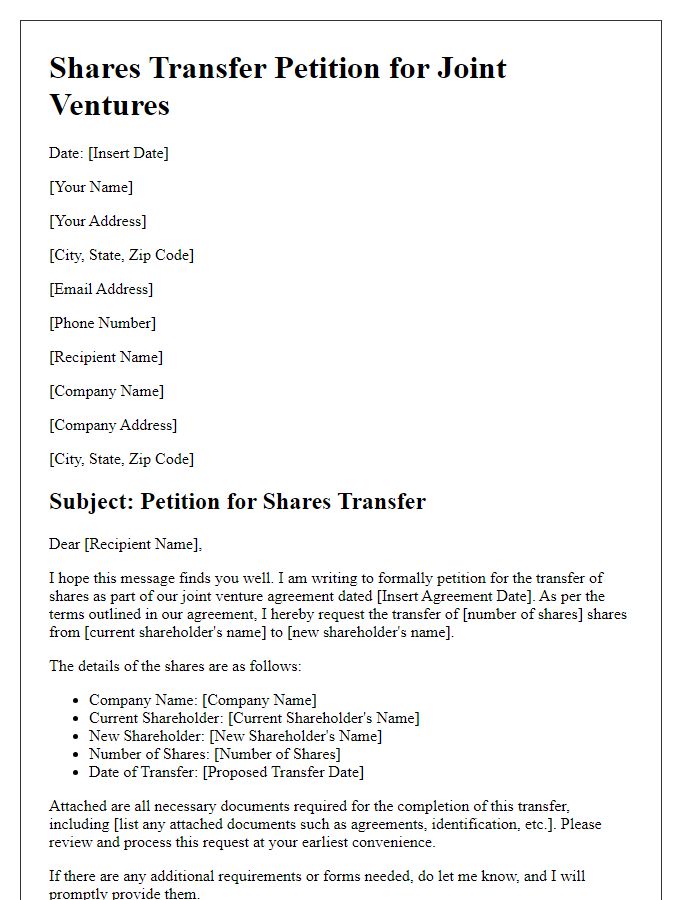

Letter Template For Shares Transfer Authorization Samples

Letter template of shares transfer authorization for business partnerships

Letter template of shares transfer declaration for investment portfolios

Comments