Are you navigating the world of professional liability insurance and feeling a bit overwhelmed? You're not alone! Many professionals find themselves in search of clarity when it comes to confirming their coverage details. In this article, we'll break down a simple letter template that will help you communicate effectively with your insurance providerâlet's dive in and make the process smoother for you!

Company Name and Address

Professional liability insurance serves as a critical safeguard for businesses against claims of negligence or inadequate performance. Healthcare institutions, such as hospitals or clinics, typically require this insurance to protect against potential lawsuits arising from malpractice. Legal professionals, including attorneys and consultants, must also secure such coverage to manage risk related to client representation or advisory services. The insurance often covers defense costs, settlements, or judgments, which can amount to substantial financial liabilities. Different sectors may have specific coverage limits and exclusions tailored to their unique operational risks. Proper documentation confirming the insurance can enhance credibility when engaging with clients or regulatory bodies.

Policyholder Name and Details

Professional liability insurance provides essential coverage for professionals, protecting against claims of negligence or inadequate work. A policyholder, such as a licensed architect or physician (specific professions defined by state regulations), must have essential documentation, including the policy number and effective dates (typically ranging from one to three years). Claims made during this period are covered, offering peace of mind against lawsuits that may arise from services rendered. Coverage limits often specified in the policy (e.g., $1 million per occurrence, $3 million aggregate) indicate the maximum amount the insurer will pay for a claim, emphasizing the importance of understanding policy details. Annual premiums vary significantly based on the field (with higher risks in professions like surgery or construction), reflecting the unique liabilities associated with each profession. Always review policy endorsements and exclusions for a comprehensive understanding of the coverage provided.

Insurance Coverage Description

Professional liability insurance, often referred to as errors and omissions (E&O) insurance, provides coverage for professionals in various fields, including healthcare practitioners, architects, and financial advisors. This insurance protects against claims of negligence, misuse of professional skills, or failure to deliver services as promised. Coverage typically includes legal defense costs, settlements, and judgments, which may range from $1 million to $10 million, depending on policy limits. Notable incidents, such as the 2015 high-profile case involving a technology consultant who faced a $2 million claim due to poor project management, underscore the necessity of this coverage. Policies vary by provider, with reputable firms such as Hiscox and The Hartford offering tailored options based on specific industry risks, ensuring businesses remain protected while maintaining their professional reputations.

Policy Number and Effective Dates

Professional liability insurance provides essential coverage for professionals, safeguarding them against claims of negligence, malpractice, or errors in professional services. A policy number, a unique identifier for the insurance agreement, is critical for reference and ensuring the accuracy of the coverage. Effective dates, usually specified as start and end dates, indicate the duration of the policy's validity, reinforcing the importance of active coverage during professional engagements. Such insurance is indispensable for professions such as medical practitioners, lawyers, and consultants, as it not only protects personal assets but also enhances credibility in the industry. Coverage limits, defined by specific monetary amounts, further delineate the extent of protection provided, often considered vital by professionals working in high-stakes environments.

Contact Information for Further Inquiries

Professional liability insurance provides essential coverage for professionals against claims of negligence or inadequate work. Businesses in industries such as healthcare, finance, and legal services can face significant risks; hence, maintaining insurance is crucial. The policy may include coverage limits, with some policies extending up to $5 million per claim. It typically includes provisions for defense costs and settlements. Insurers often require specific documentation, such as proof of professional qualifications and a history of claims, to assess risk accurately before issuing coverage. For further inquiries, individuals or organizations can contact the underwriting department directly or visit the insurance provider's official website for detailed policy information.

Letter Template For Professional Liability Insurance Confirmation Samples

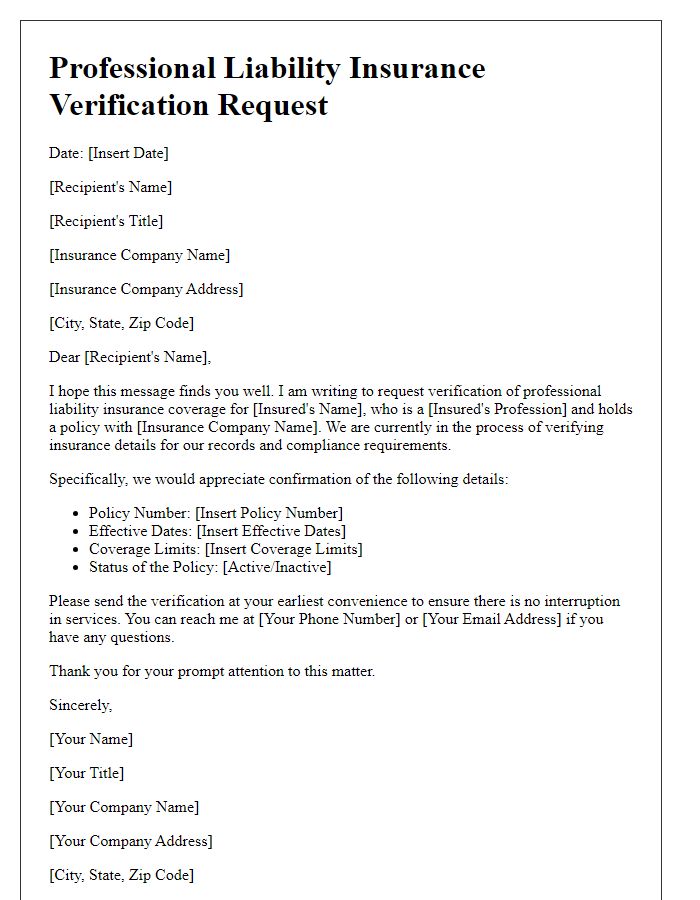

Letter template of professional liability insurance verification request

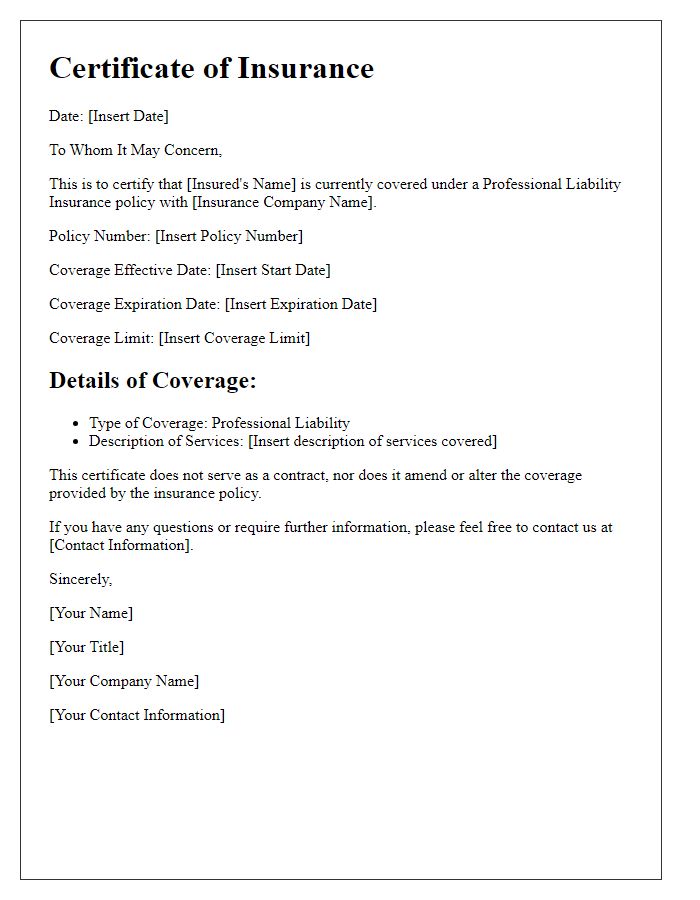

Letter template of professional liability insurance certificate issuance

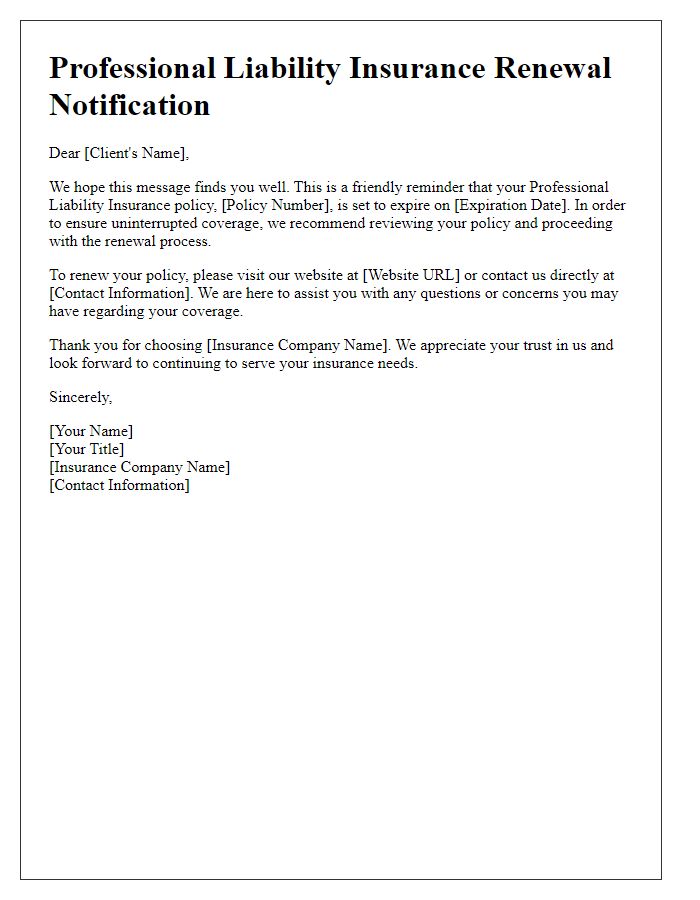

Letter template of professional liability insurance renewal notification

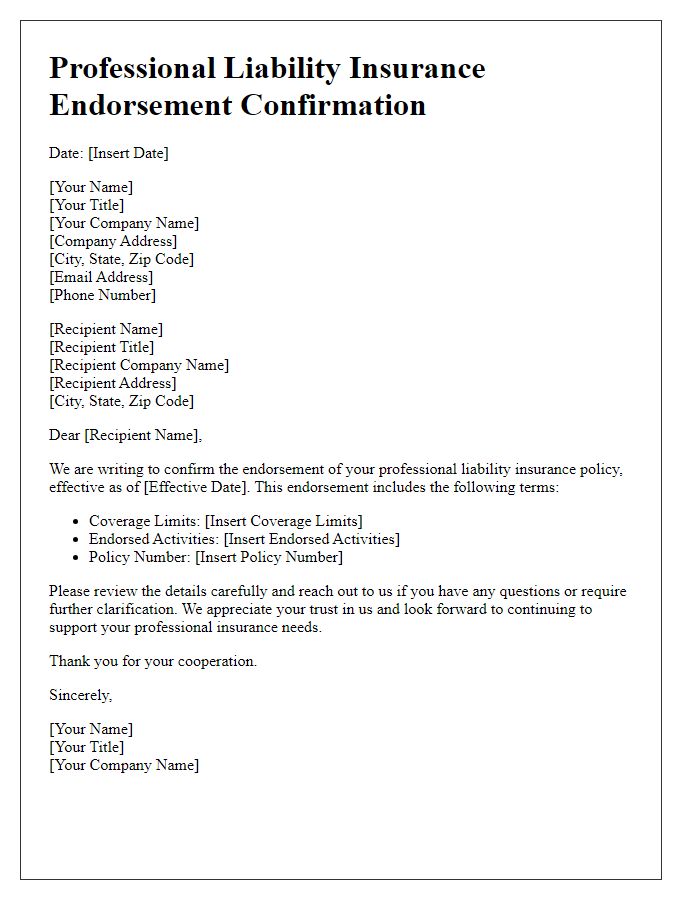

Letter template of professional liability insurance endorsement confirmation

Letter template of professional liability insurance premium payment confirmation

Letter template of professional liability insurance provider information

Comments