When it comes to certifying your financial statements, having the right template can make all the difference. A well-structured letter not only ensures clarity but also communicates professionalism to stakeholders. Whether you're preparing for an audit or seeking external validation, this guide will walk you through the essential elements of a financial statement certification letter. Curious to learn how to create your own? Read more to discover a comprehensive template and valuable tips!

Accurate Financial Data Representation

Accurate financial data representation is crucial for businesses, especially for stakeholders like investors and auditors, relying on these figures for decision-making. A financial statement certification ensures compliance with regulations like the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Certified public accountants (CPAs) or auditors verify numbers such as total revenue (often exceeding millions for large corporations) and net income, providing assurance against misstatements. Furthermore, transparency in documents such as balance sheets and income statements builds trust among clients and regulatory bodies, reinforcing the organization's credibility. Ensuring accuracy can prevent severe repercussions like financial fraud investigations or penalties from authorities such as the Securities and Exchange Commission (SEC). Implementing meticulous audit trails, detailed accounting policies, and extensive internal controls becomes necessary for businesses seeking to maintain integrity and accountability in their financial reporting.

Compliance with Accounting Standards

Financial statement certification demonstrates adherence to accounting standards like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Certified public accountants (CPAs) verify financial documentation, ensuring accuracy and transparency in reporting. Key figures such as total revenue, net income, and operating expenses are meticulously reviewed to confirm compliance. Rigorous audits are conducted annually, often by external auditors, to ensure integrity and reliability. Certifications typically include details regarding the fiscal year under review and the organization's specific financial practices, bolstering stakeholder confidence in the presented statements.

Management Responsibility Acknowledgment

The Management Responsibility Acknowledgment serves as a formal statement regarding the accountability of company leadership, typically within an organization such as a corporation or publicly traded entity. This document emphasizes transparency in financial practices, affirming that management adheres to the standards set forth by regulatory bodies, such as the Financial Accounting Standards Board (FASB) in the United States. Management explicitly acknowledges its responsibility for the preparation and fair presentation of financial statements, which reflect the organization's financial position and operating results for fiscal periods, usually quarterly or annually. It also denotes the importance of internal controls to ensure accuracy and compliance with applicable laws, promoting investor confidence in the reported figures. Details regarding independent auditor assessments might be included, highlighting the examination of financial reports, and compliance with the Sarbanes-Oxley Act, enacted in response to corporate scandals to enhance accountability.

Confirmation of Internal Controls

A financial statement certification process involves the assessment of internal controls that ensure accuracy and reliability in financial reporting. Key components include the evaluation of control environment elements, such as organizational culture and management oversight, which enforce compliance with regulations like the Sarbanes-Oxley Act, enacted in 2002 in the United States. The identification of risks surrounding financial reporting, particularly focusing on significant accounts and transactions, is crucial. An organization should maintain robust documentation, including flowcharts of processes relevant to financial reporting and evidence of periodic assessments. Regular training programs for employees enhance awareness and adherence to established controls. Effective monitoring practices, such as regular audits and feedback mechanisms, contribute significantly to the continuous improvement of internal controls, ultimately ensuring integrity in the financial statements produced by corporations.

Assurance of Ethical Financial Practices

A financial statement certification serves to assure stakeholders of accurate representation and ethical practices within an organization's financial documentation. This certification often originates from a certified public accountant (CPA) or financial auditor, highlighting adherence to generally accepted accounting principles (GAAP) and regulatory compliance within frameworks set by organizations like the Financial Accounting Standards Board (FASB). The certification commonly encompasses details such as the assessment period, typically spanning fiscal years, and includes key financial metrics like revenue figures, expense reports, and net income calculations. Furthermore, ethical financial practices ensure transparency in reporting, safeguarding against malpractices like fraud or misrepresentation, thus maintaining investor trust and fulfilling fiduciary responsibilities to shareholders.

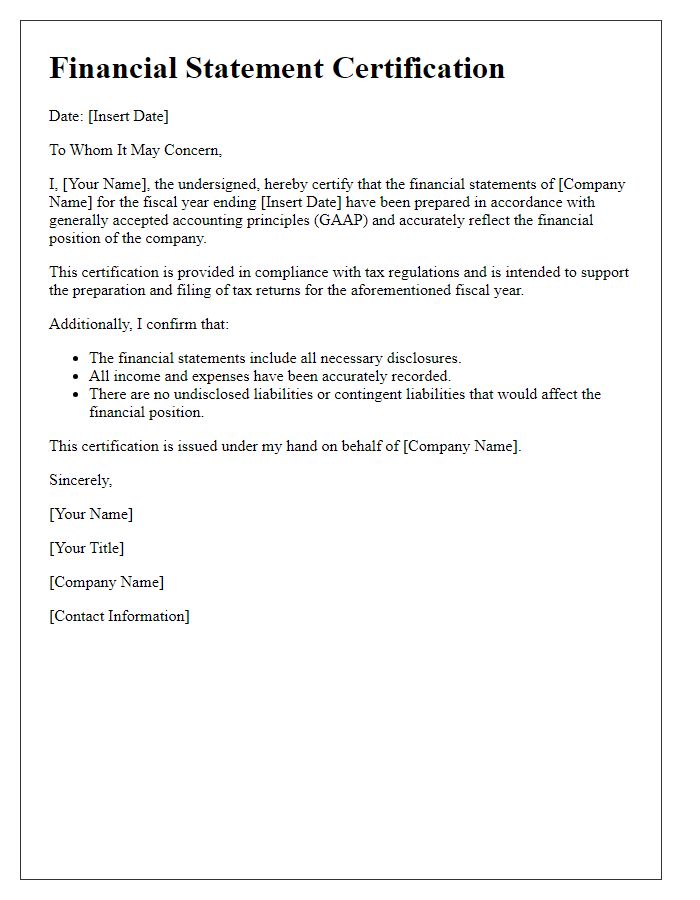

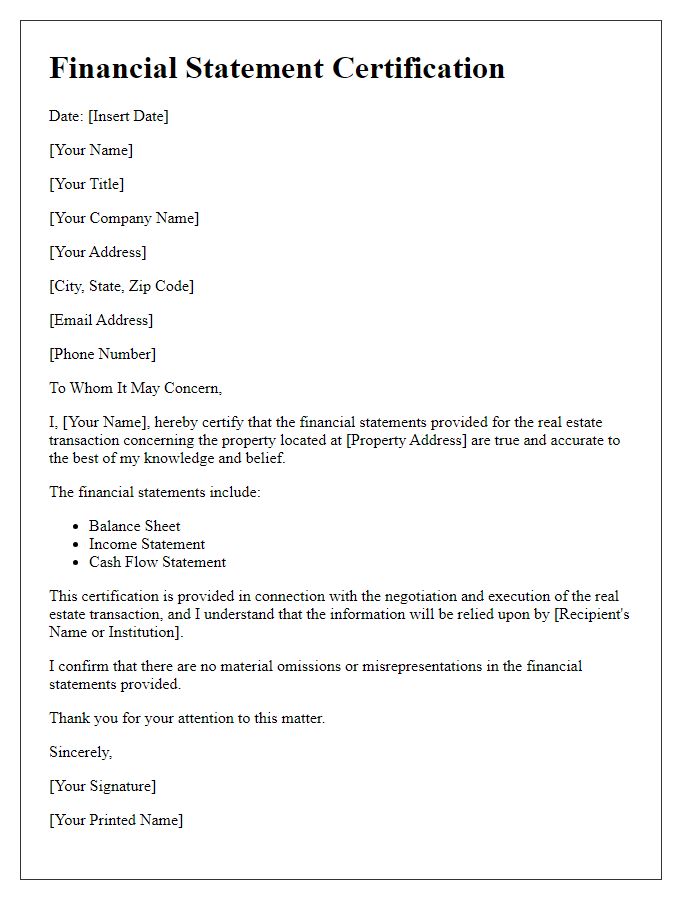

Letter Template For Financial Statement Certification Samples

Letter template of Financial Statement Certification for Loan Application

Letter template of Financial Statement Certification for Business Partnership

Letter template of Financial Statement Certification for Auditing Purposes

Letter template of Financial Statement Certification for Investment Proposal

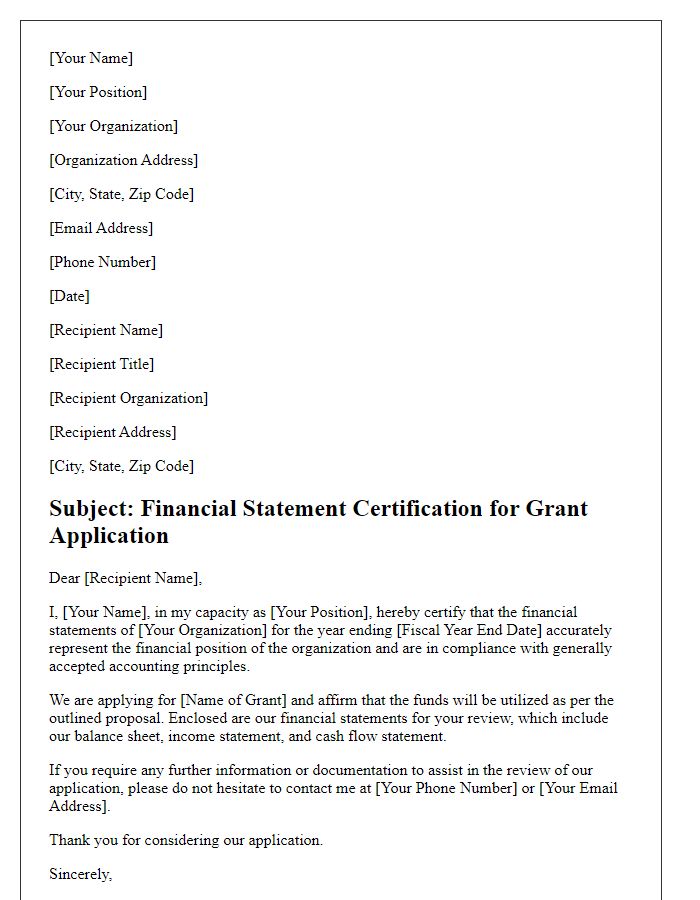

Letter template of Financial Statement Certification for Grant Application

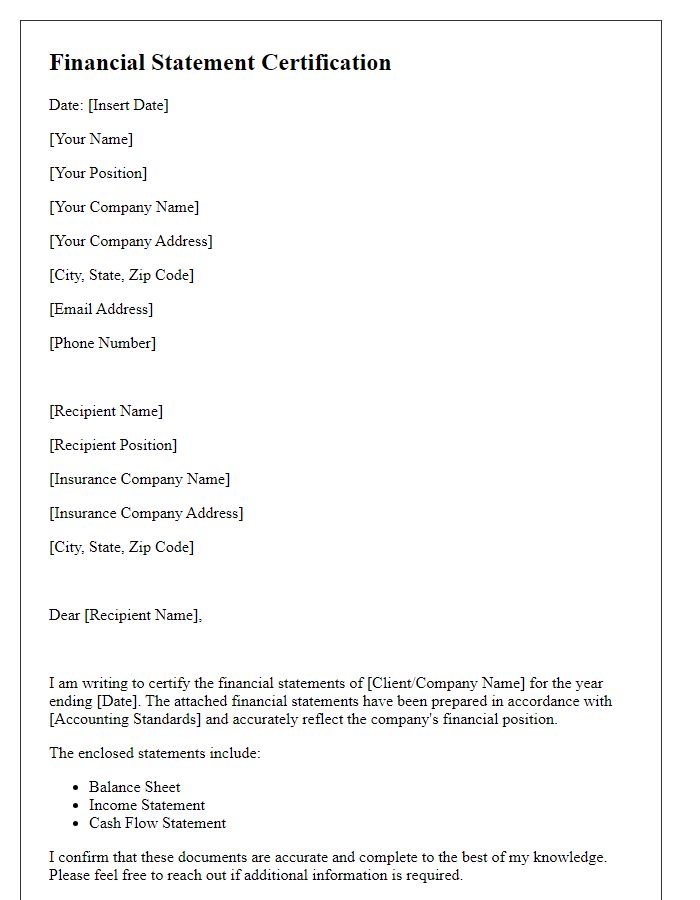

Letter template of Financial Statement Certification for Insurance Underwriting

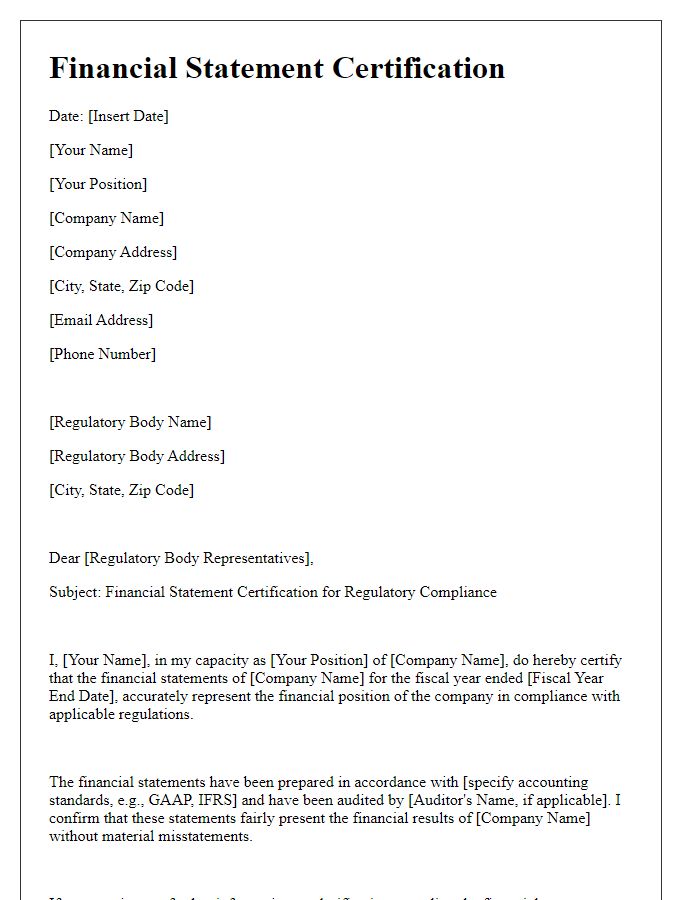

Letter template of Financial Statement Certification for Regulatory Compliance

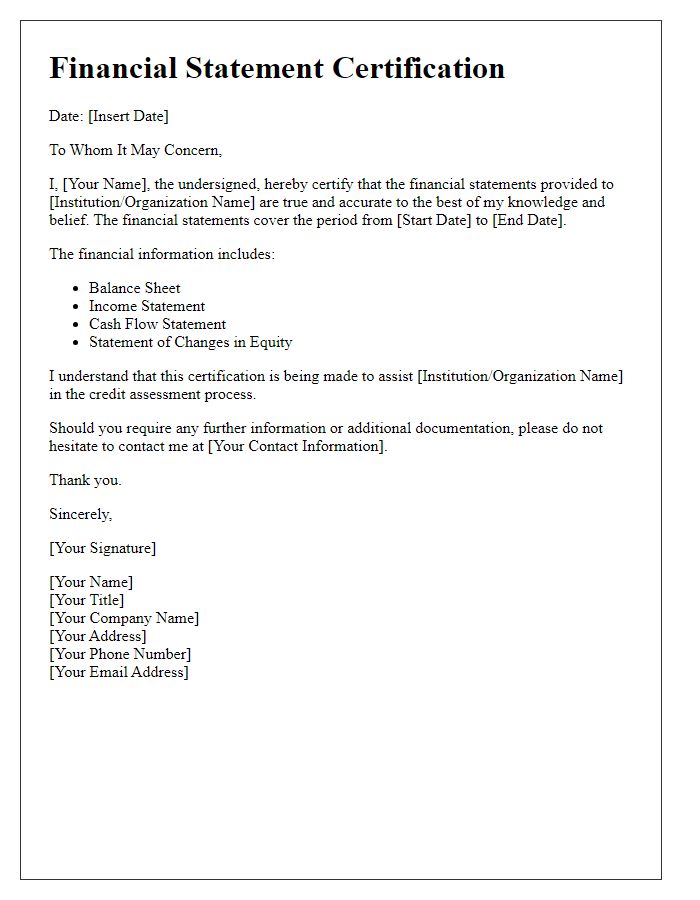

Letter template of Financial Statement Certification for Credit Assessment

Comments