Are you struggling to manage outstanding debts and seeking effective solutions to reclaim owed funds? Navigating the world of debt collection can be daunting, but with the right approaches, you can improve your success rate. In this article, we'll explore essential strategies and templates for drafting a compelling debt collection letter that prompts action. So, if you're ready to take control of your financial situation, keep reading to learn more!

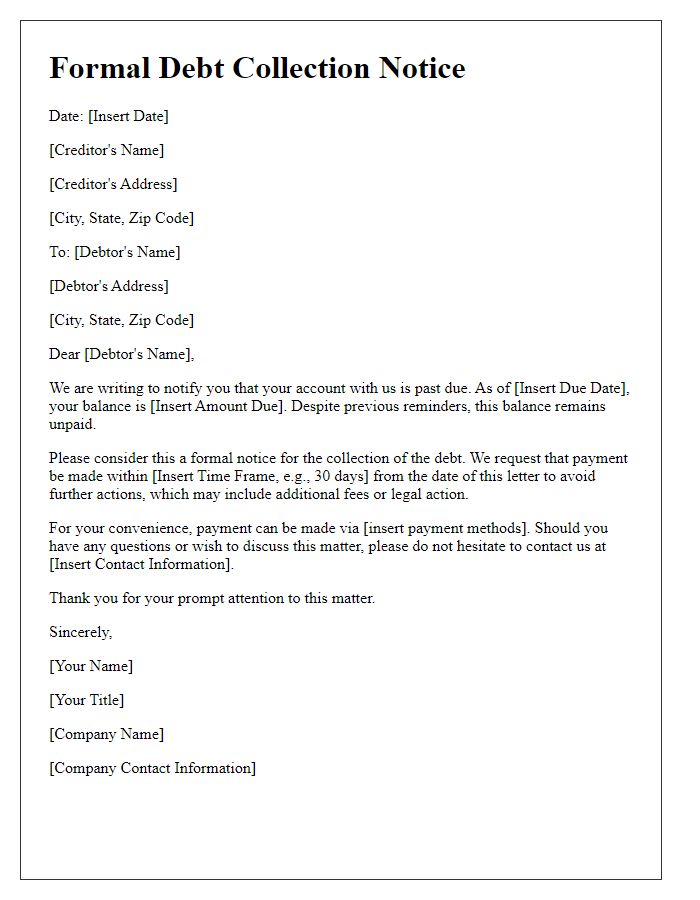

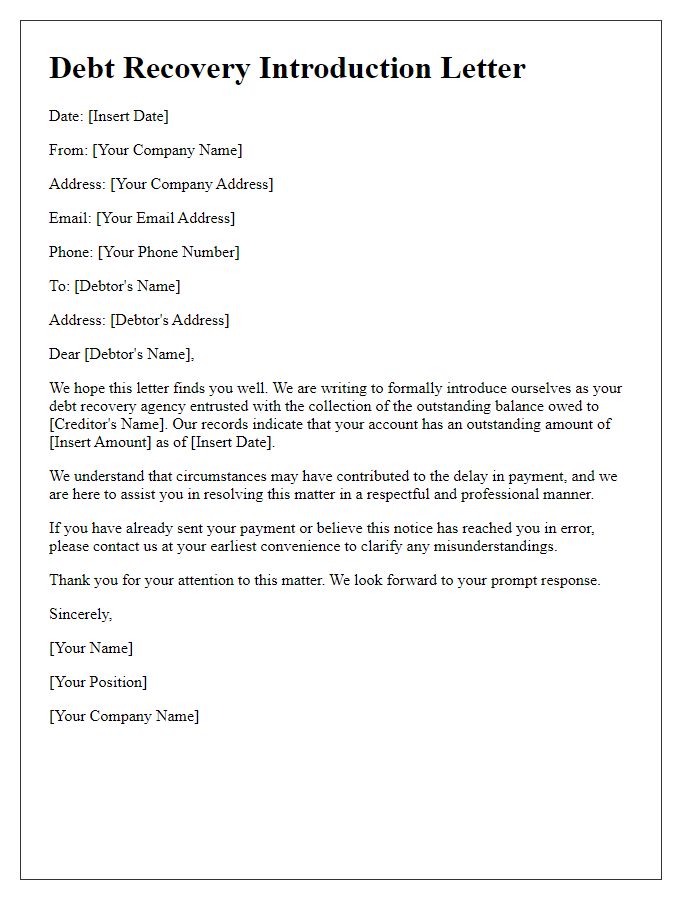

Creditor's Details

In debt collection enforcement, creditor details play a crucial role in establishing credibility and facilitating communication. Creditor's name, such as XYZ Financial Services, provides the identity needed for proper identification. The registered address, often listed as 123 Business Avenue, Suite 100, Cityville, State, ZIP Code, ensures accurate delivery of correspondence. Contact information, including phone number (555-123-4567) and email address (contact@xyzfinancial.com), allows for immediate inquiries. Additionally, account numbers associated with the debtor can enhance clarity, streamlining reference during dispute resolution. The inclusion of regulatory compliance information, referring to the Fair Debt Collection Practices Act (FDCPA), emphasizes the adherence to legal standards in the collection process.

Debtor's Information

The debtor's information includes essential details such as full name, current address (for accurate communication), phone number (for direct contact), email address (for electronic correspondence), account number (specific to the debt in question), and outstanding balance (total amount owed). Additionally, this section may highlight the type of debt, such as credit card debt or medical bills, and any relevant dates, such as the original due date and the last payment date. Accurate and comprehensive debtor information is crucial for effective collection efforts and legal compliance.

Outstanding Amount

Debt collection is a critical process for recovering outstanding amounts owed by individuals or businesses. An outstanding amount refers to money that has not been paid by a debtor for goods or services rendered, which can include invoices from vendors such as suppliers or contractors. The total outstanding amount can accumulate over time, affecting the cash flow of businesses. In many cases, collection agencies or debt collectors, acting on behalf of creditors, may engage in enforcement action to recover these debts, which often involves sending formal notices to the debtor's provided address. Legal principles governing debt collection can vary significantly by region or country, impacting processes and strategies employed for recovery. The involvement of regulatory bodies, such as the Federal Trade Commission (FTC) in the United States, ensures that collection practices remain fair and ethical.

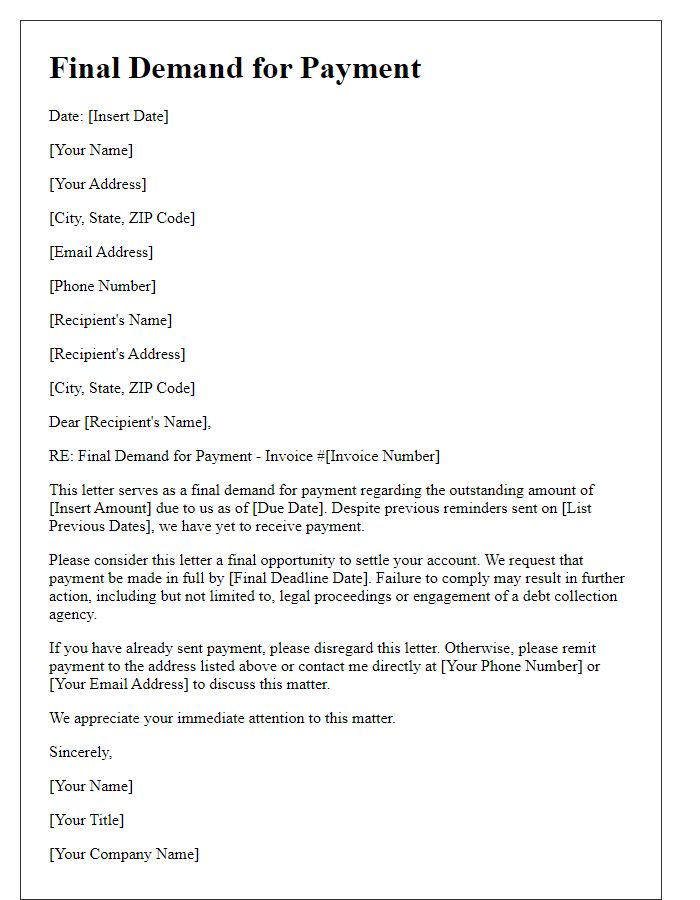

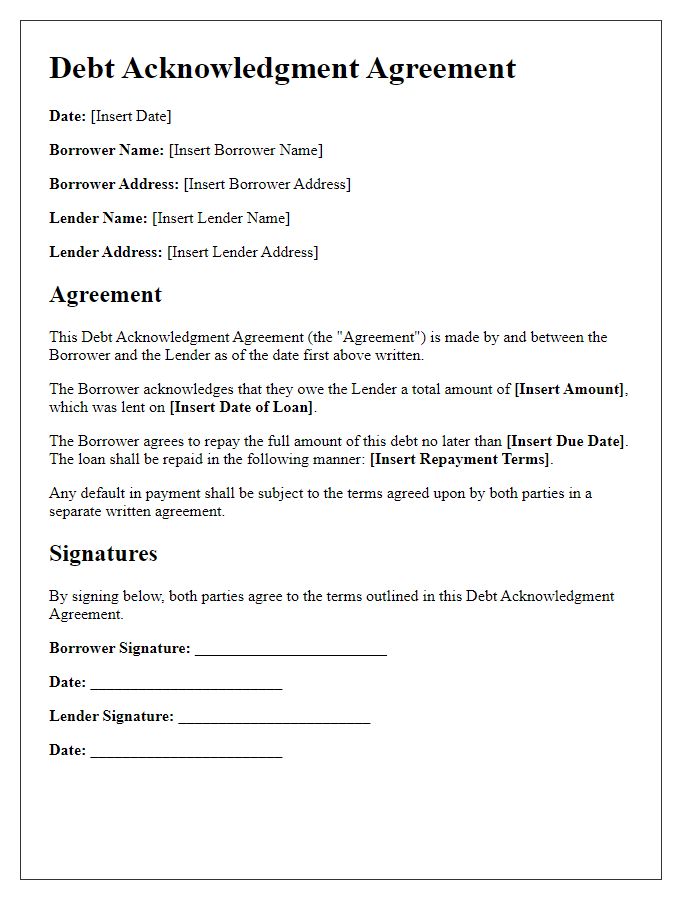

Payment Deadline

Unpaid debts can exacerbate financial strain for individuals and businesses, leading to potential legal actions. A payment deadline often signifies a critical date by which an outstanding balance must be settled to avoid further penalties. For example, a notice may specify a final payment due by November 30, 2023, for a $2,500 balance originating from services rendered in June 2022. Failure to adhere to this deadline may trigger debt collection measures, such as garnishment of wages or legal proceedings in small claims court. Effective communication regarding payment deadlines is essential to prompt resolution of overdue accounts and mitigate the risk of additional charges.

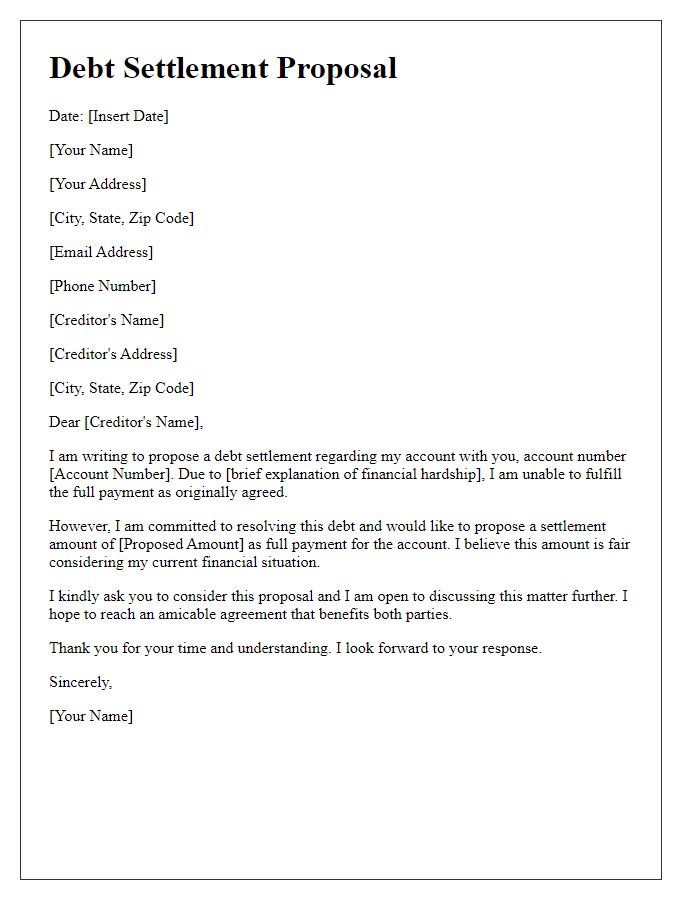

Legal Consequences

Debt collection enforcement refers to the methods used by creditors to recover overdue debts from individuals or businesses. Such processes can include legal actions, which may result in court judgments against the debtor, affecting their credit score and financial standing. In many jurisdictions, collections can involve additional costs, such as court fees and interest rates that compound the original debt. If the debt remains unpaid, creditors may pursue garnishment of wages, where a portion of an individual's paycheck is withheld to repay the debt. This enforcement can lead to serious financial consequences, including bankruptcy, which can remain on a credit report for up to ten years, greatly impacting future borrowing capabilities. Understanding these legal ramifications is crucial for individuals facing debt issues, as proactive communication with creditors can often result in more favorable arrangements than facing enforcement actions.

Comments