Are you ready to take control of your future and safeguard your loved ones' financial well-being? Estate planning might seem daunting, but it's an essential step in ensuring your wishes are honored after you're gone. From creating wills to setting up trusts, understanding your options can make a significant difference in the outcomes for your estate. Join me as we explore effective estate planning strategies that can provide peace of mind for you and your familyâread on to learn more!

Personal Details and Beneficiaries

Creating an effective estate planning strategy involves meticulous documentation of personal details and the identification of beneficiaries. Personal details encompass essential information, such as full name, date of birth, social security number, and current residence in a state like California or New York. Beneficiaries must be precisely designated, including family members such as spouse, children, or grandchildren, as well as any organizations, such as the American Red Cross or local charities, intended to receive assets. Specific percentages or asset delineation for each beneficiary aids in clear distribution, reducing potential conflicts. This thorough approach ensures that valuables, such as real estate in Florida or investment accounts, are allocated according to individual wishes, providing peace of mind and clarity for loved ones during a difficult time.

Asset Inventory and Valuation

Creating a thorough asset inventory and valuation is essential for effective estate planning. Personal assets such as real estate, including residential properties in urban centers like New York City or Los Angeles, should be listed along with their current market values, which can fluctuate significantly based on location and market trends. Financial assets, including stocks (e.g., shares in companies like Apple or Tesla), bonds, and retirement accounts need detailed assessment to determine their worth and ensure accurate representation of your total net worth. Additionally, tangible assets such as art collections, antique furniture, or valuable jewelry require appraisals by certified professionals to establish their current value. This comprehensive approach aids in addressing tax implications and facilitates a smoother transition of wealth to beneficiaries, ensuring that all assets are accounted for and correctly valued.

Estate Distribution Plan

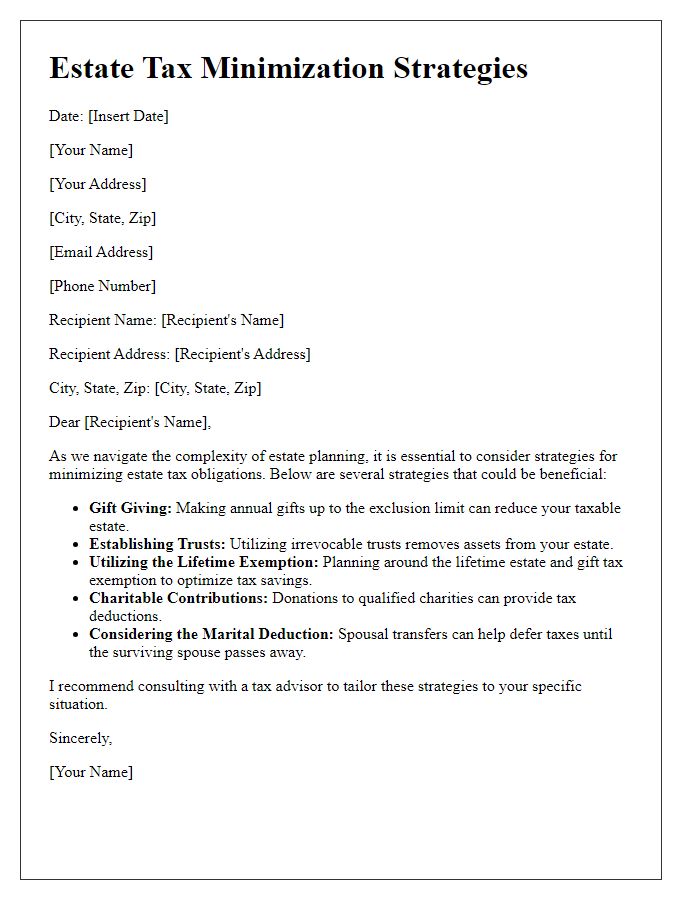

An estate distribution plan encompasses the systematic arrangement of an individual's assets and liabilities, ensuring a clear and methodical approach to the allocation of property upon death. Key components include the designation of beneficiaries, who may be family members, friends, or charitable organizations, as well as the formulation of a wills and trusts framework, critical for probate avoidance and tax efficiency. Specific assets, such as real estate in New York valued at $500,000 and investment portfolios totaling $250,000, should be meticulously itemized. Additional considerations encompass guardianship arrangements for minor children, healthcare directives outlining preferences for medical interventions, and the appointment of an executor, responsible for the administration of the estate. Tax implications, especially relating to estate tax thresholds set at $12 million for individuals in 2023, should also be factored into the planning process to optimize the financial legacy left behind. Each element plays a crucial role in ensuring the individual's wishes are honored and the transition of wealth is seamless for heirs.

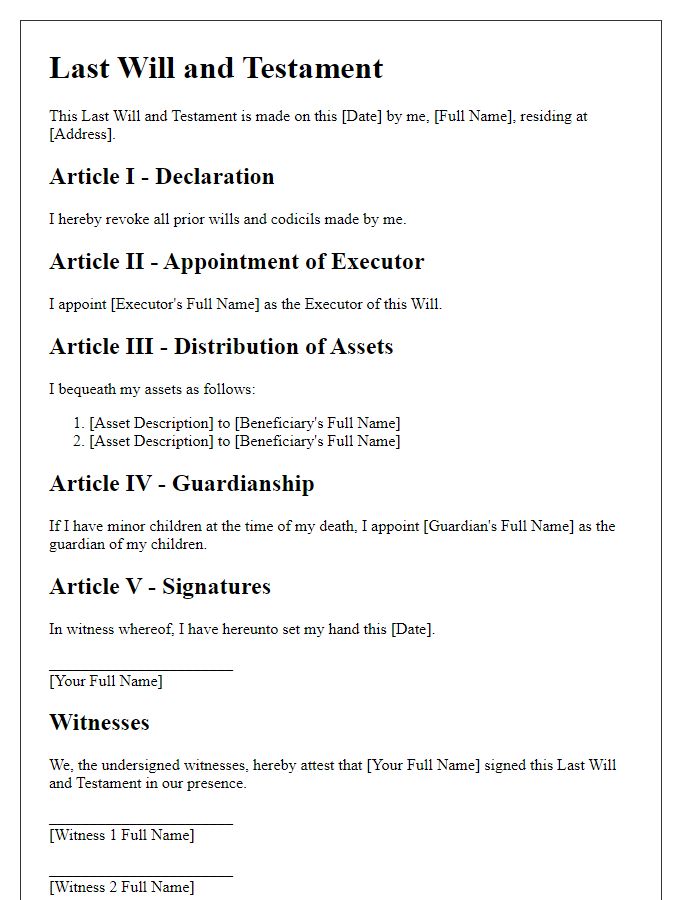

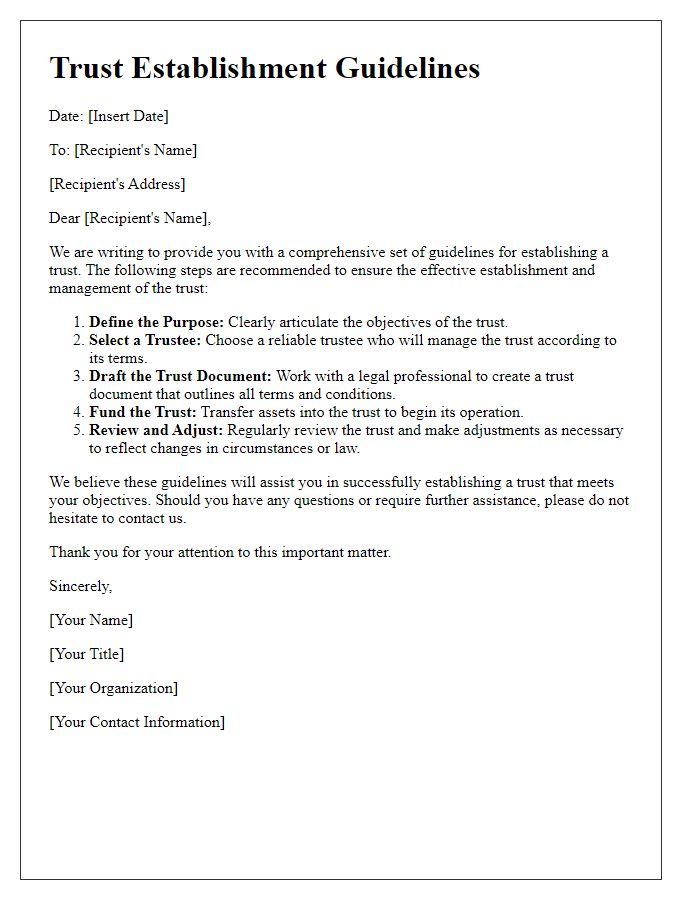

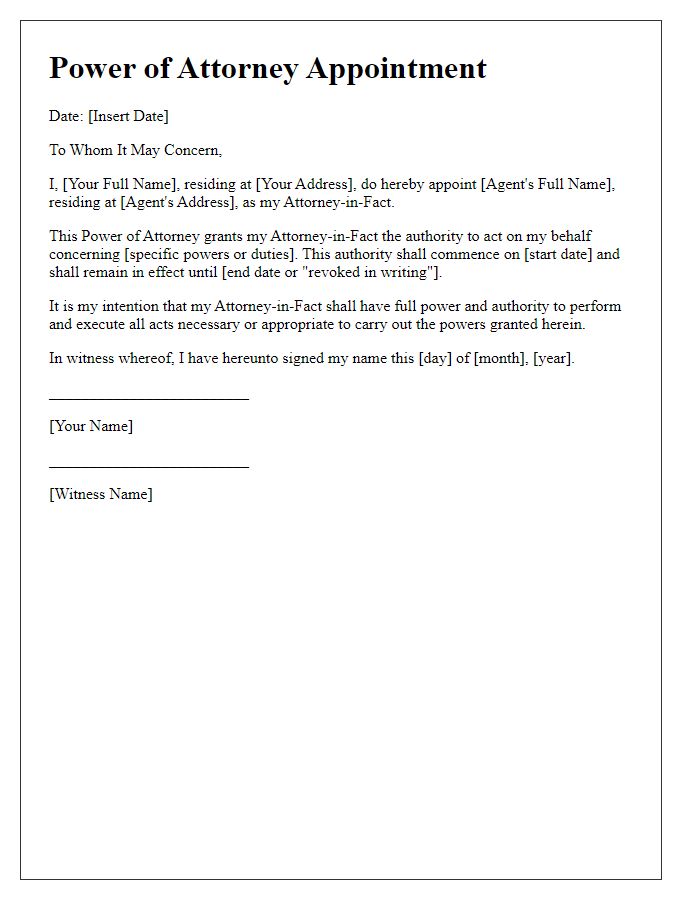

Legal Instruments and Documentation

Creating an effective estate planning strategy requires a variety of legal instruments and documentation tailored to individual goals. Key documents include a last will and testament, which outlines how assets will be distributed upon death, and a durable power of attorney, granting someone authority to manage financial affairs if incapacitated. Trusts, such as revocable living trusts, offer a way to avoid probate and can provide tax benefits, protecting assets for future generations. Additionally, healthcare proxies and living wills ensure that medical decisions align with personal wishes in critical situations. Each of these documents must meet local state laws and should be regularly reviewed to reflect any changes in personal circumstances, such as marriage or inheritance. Consultation with a qualified estate planning attorney is crucial for proper formulation and execution of these instruments.

Expert Consultation and Review

Effective estate planning strategies require expert consultation and thorough review to ensure the distribution of assets aligns with the wishes of the individual. Engaging a qualified estate planning attorney can provide insights into important documents such as wills, trusts, and power of attorney agreements, often involving complex regulations and state laws. Furthermore, a comprehensive review may involve evaluating current assets, including real estate properties, bank accounts, and investment portfolios, all of which have a significant impact on tax implications and potential probate processes. Regular updates to estate plans can safeguard against changes in personal circumstances, family dynamics, and evolving legal frameworks, ensuring clarity and reducing delays during the transition of estate ownership.

Comments