Are you navigating the world of real estate transactions and feeling a bit overwhelmed? You're not aloneâmany find the process intricate and challenging, but with the right tools and templates, it can become straightforward. A well-crafted letter template can streamline your communication, whether you're making an offer, requesting information, or finalizing details. So, if you're ready to simplify your real estate journey, read on for some essential tips and templates!

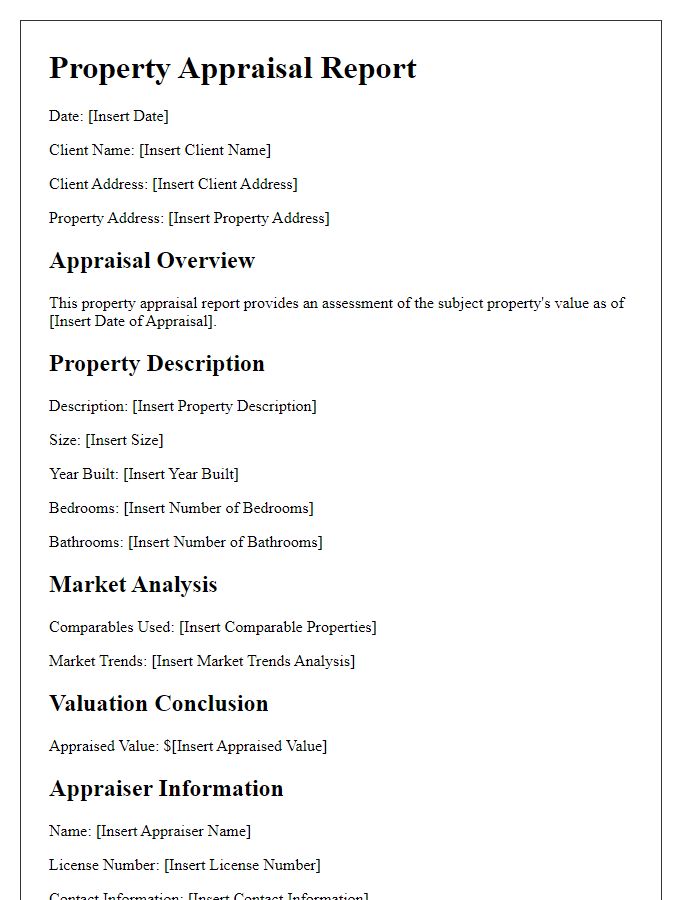

Property Details and Description

The prime location of the expansive three-bedroom residential property at 123 Maple Lane, Springfield, offers a blend of modern amenities and classic charm, constructed in 2015. Featuring an open floor plan, the spacious living area measures 450 square feet, providing ample space for family gatherings and entertaining. The gourmet kitchen, equipped with stainless steel appliances and granite countertops, easily accommodates culinary activities, while the backyard measures 600 square feet, perfect for outdoor relaxation and barbecues. Additionally, the master suite includes a walk-in closet and an en-suite bathroom showcasing a luxurious soaking tub. Proximity to Springfield Elementary School and Maple Park enhances the property's appeal, ensuring a family-friendly environment with access to green spaces. Recent renovations in 2023 added energy-efficient windows and landscaping improvements, making the property not only aesthetically pleasing but also cost-effective in terms of utility expenses.

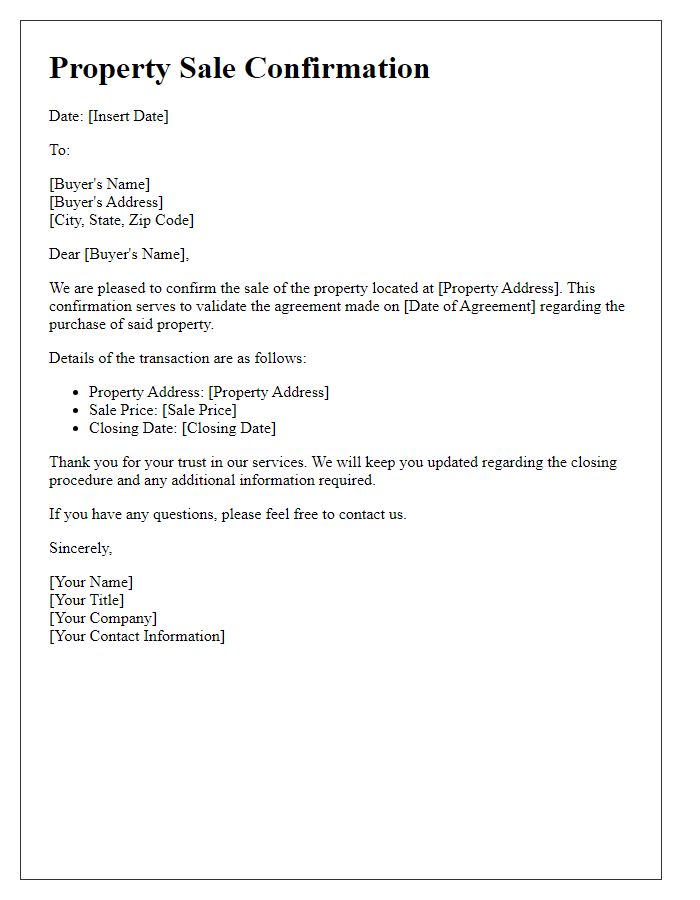

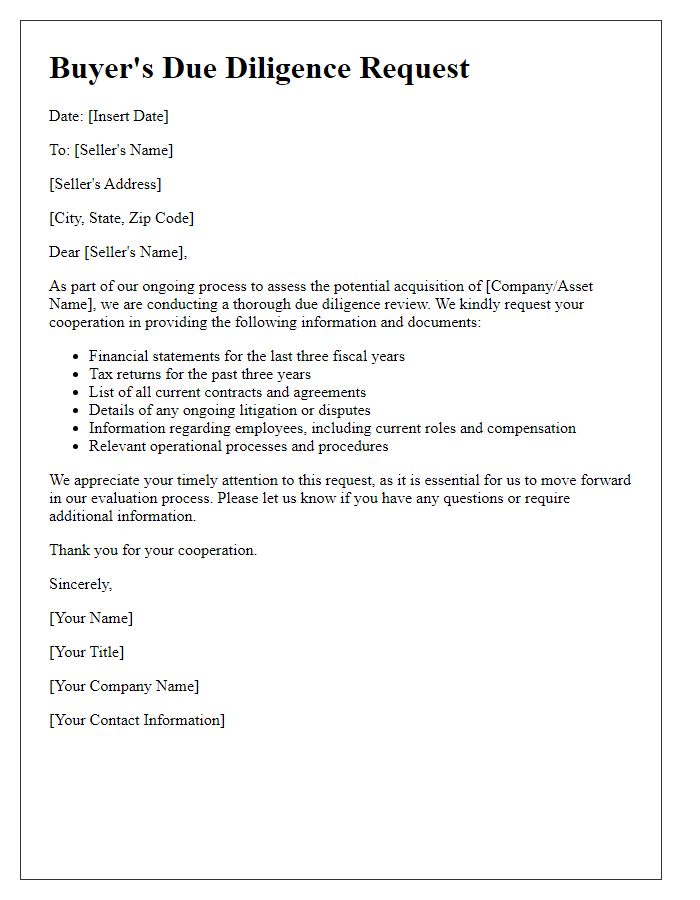

Buyer and Seller Information

In real estate transactions, buyer information encompasses essential details such as the full legal name, contact information, and financial qualifications, which include a pre-approval letter from a recognized lender, typically a bank or credit union. Seller information involves including the property owner's name, their contact details, and specifics about the property being sold, such as the address, legal description, and any unique features that may enhance market value, such as a recently renovated kitchen or extensive landscaping. Additionally, both parties must be aware of the closing date, which is often set 30 to 60 days after the acceptance of the purchase agreement, along with any contingencies that might affect the sale, such as inspections, appraisals, or financing approvals.

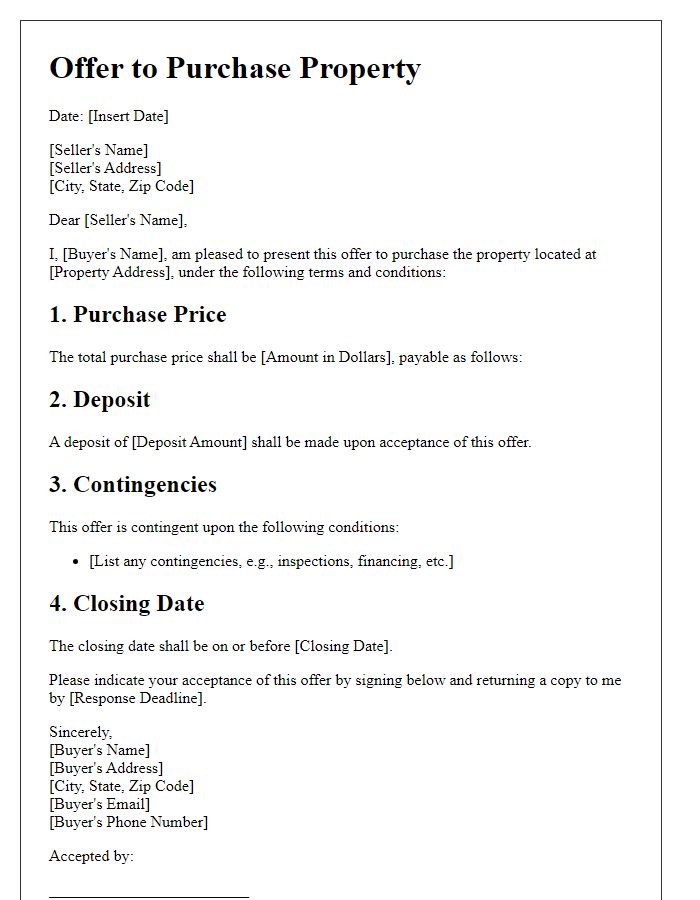

Transaction Terms and Conditions

In a real estate transaction, clearly outlined terms and conditions are critical for both buyers and sellers to understand their rights and obligations. Transaction details typically include the purchase price, often determined by local market conditions and appraisals conducted by licensed professionals. Important dates, such as the closing date, inspections, and contingencies, must be specified to ensure transparency. The property address (including city, state, and zip code) and specific legal descriptions are essential to identify the real estate involved. Additionally, contingencies pertaining to financing, inspections, or specific buyer criteria provide protective measures for both parties. Any included items, such as appliances or fixtures, should be listed to avoid future disputes. Compliance with local laws and procedures, as established by the state's real estate commission, is also necessary to ensure valid and enforceable agreements.

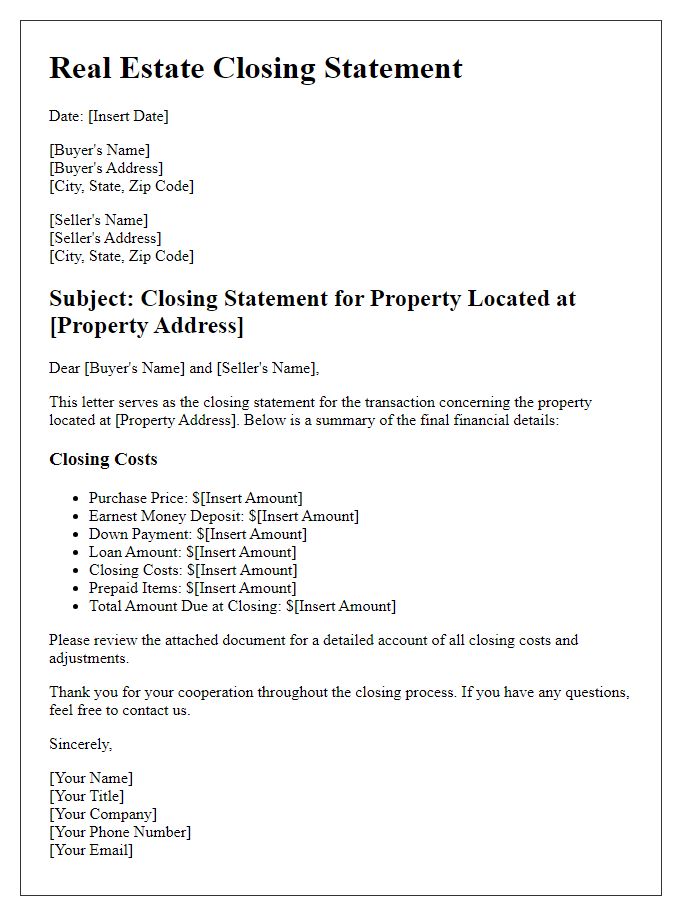

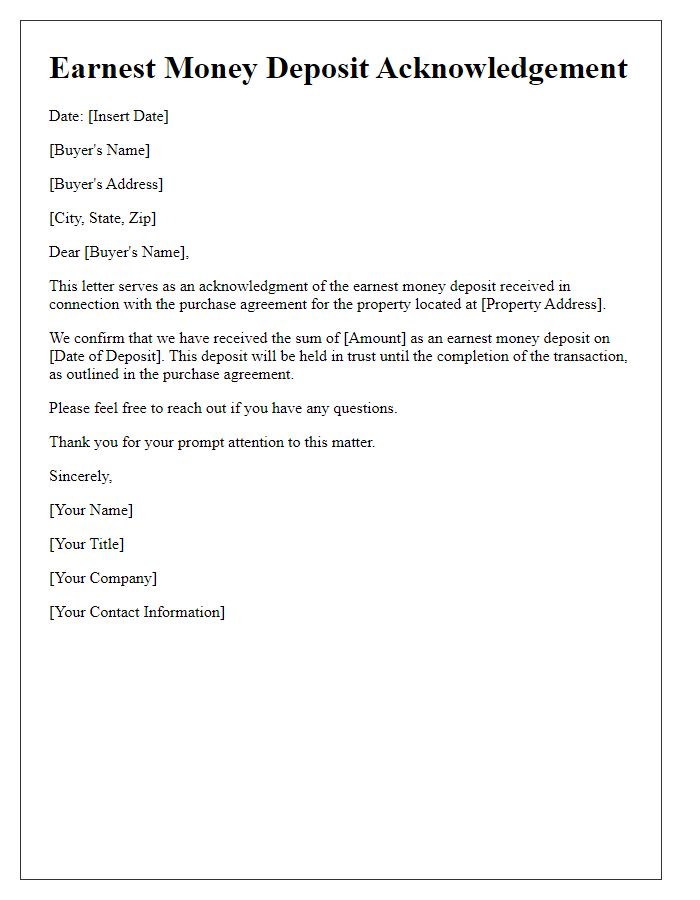

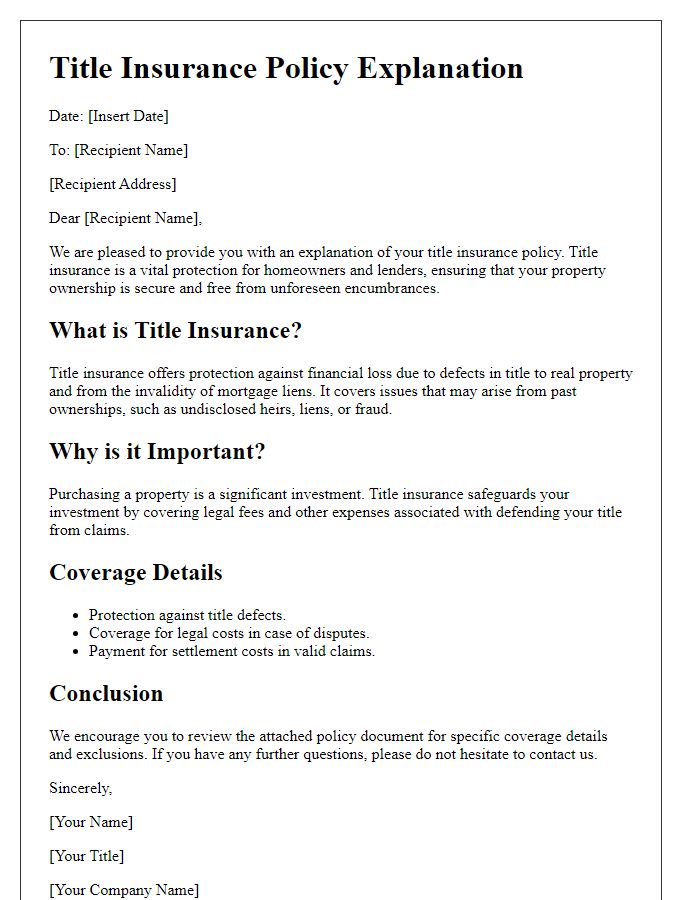

Payment and Financing Information

Payment methods for real estate transactions frequently include conventional mortgages, which are loans provided by banks or credit unions, FHA loans, insured by the Federal Housing Administration designed for low-to-moderate income borrowers, and cash payments, where buyers directly pay the full purchase price without financing. Down payments often range from 3% to 20% of the purchase price, significantly impacting loan terms and monthly payments. Closing costs, typically 2% to 5% of the home's price, may include appraisal fees, title insurance, and attorney fees. It is crucial for buyers to pre-approve financing, often involving documentation of income, credit scores, and employment history. Buyers should also consider interest rates, currently averaging around 6.5% for a 30-year fixed mortgage as of late 2023, which can significantly influence overall costs.

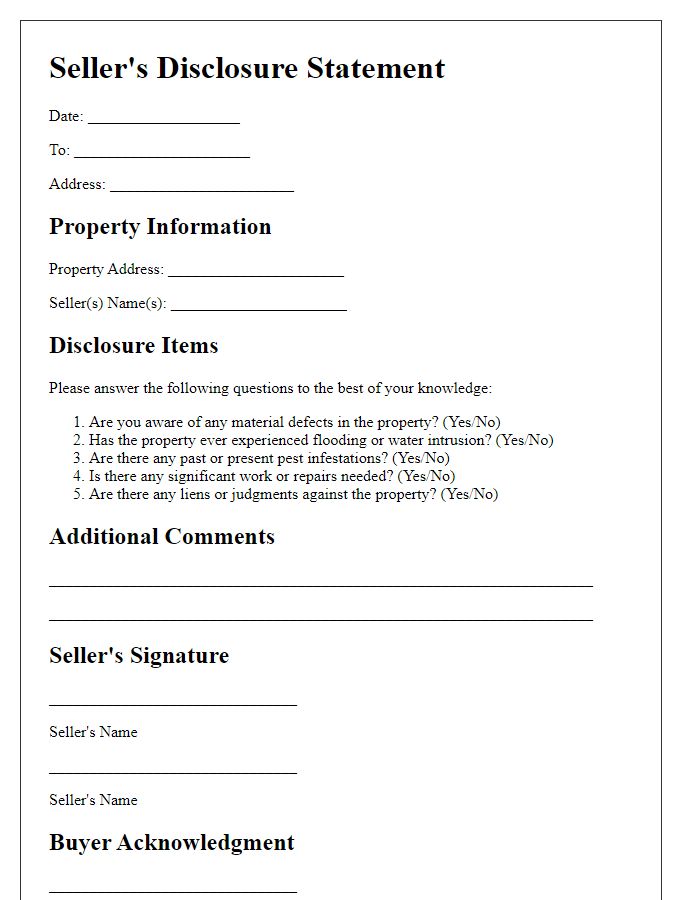

Closing and Contingency Clauses

Closing in real estate transactions marks the formal transfer of property ownership. Items such as closing costs (typically 2-5% of the purchase price), title insurance (protects against claims on the property), and transfer taxes (government fee for transferring property) are crucial components in this phase. Contingency clauses serve as protection mechanisms for buyers and sellers, stipulating conditions that must be met before the sale is finalized. Common contingencies include financing (buyer securing a mortgage), inspection (property condition assessment), and appraisal (determining property value). Each clause influences the timeline, as delays in satisfying contingencies can postpone the closing date, impacting all parties involved in the transaction. Real estate professionals often use specific legal language to draft these clauses, ensuring clarity and compliance with local real estate laws.

Comments