Are you struggling with managing debts and feeling overwhelmed by collection calls? You're not aloneâmany individuals find themselves in similar situations, wondering how to negotiate settlements that provide relief from financial stress. In this article, we'll explore effective strategies for crafting a compelling letter to propose a debt collection settlement, ensuring you communicate your needs clearly and professionally. Dive into our tips and examples to find out how you can take control of your debt situation and achieve a successful resolution!

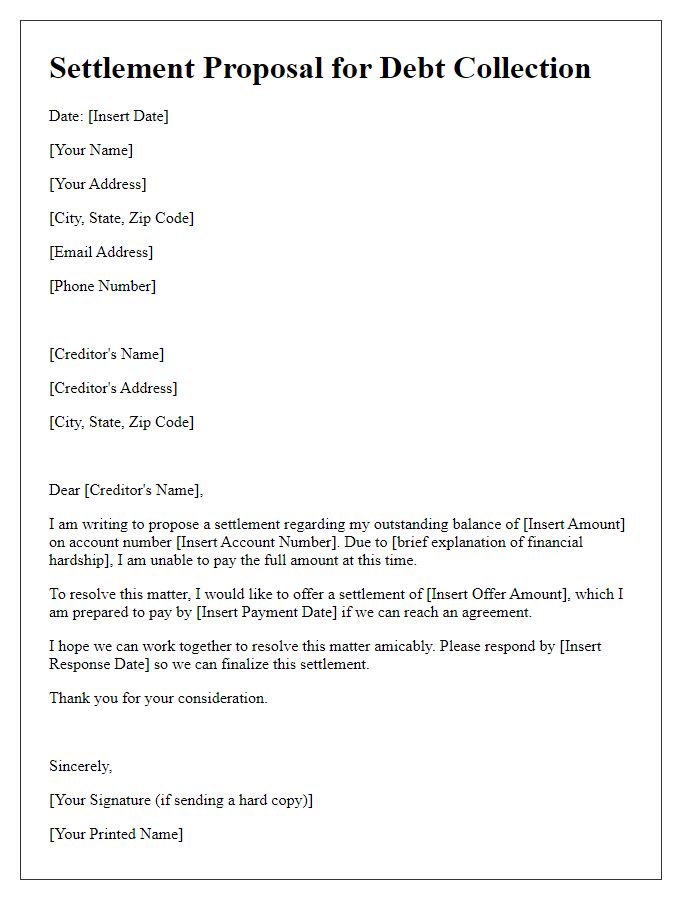

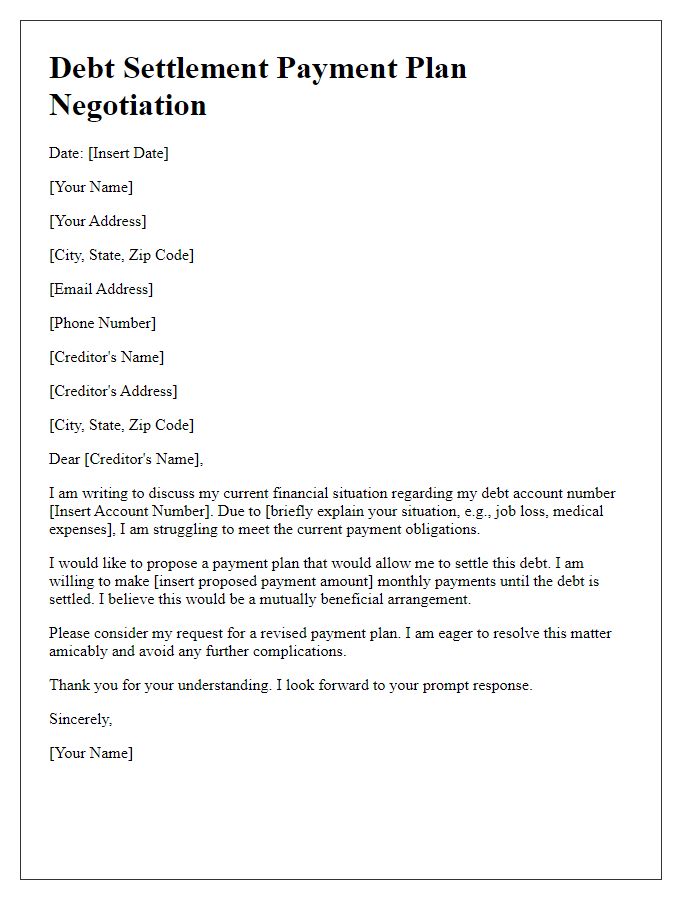

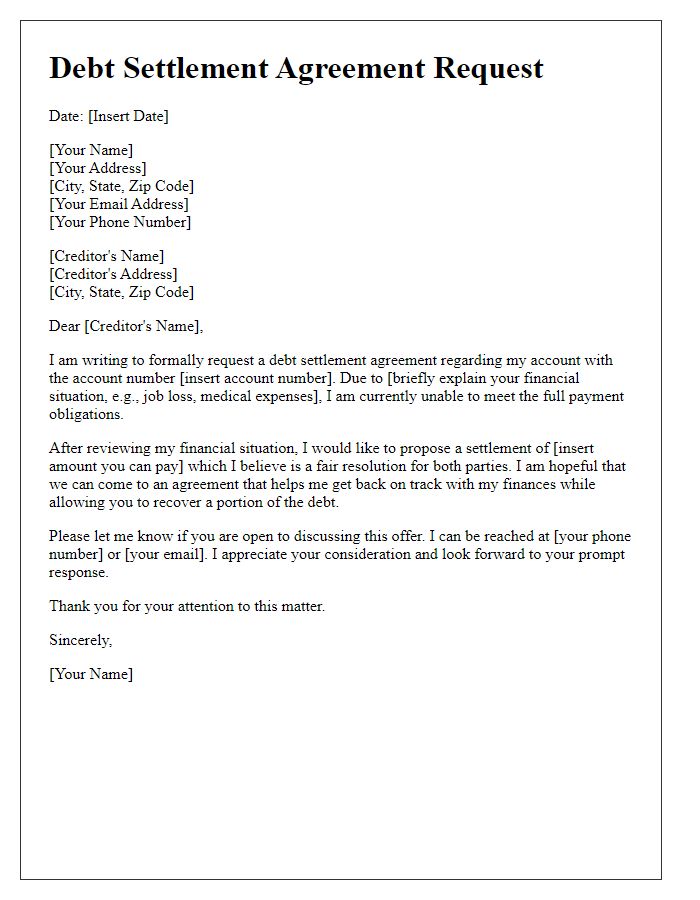

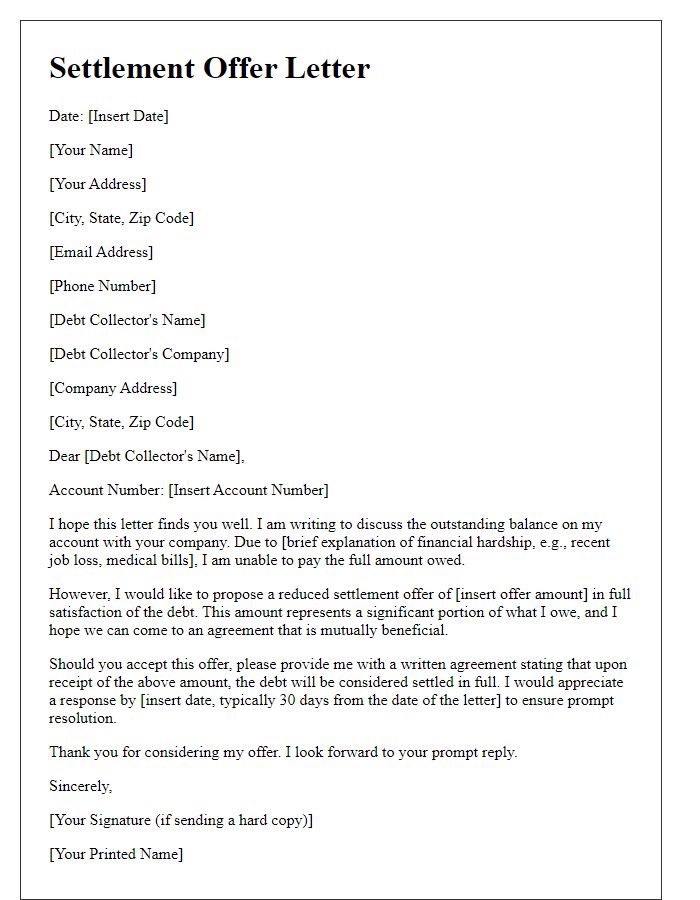

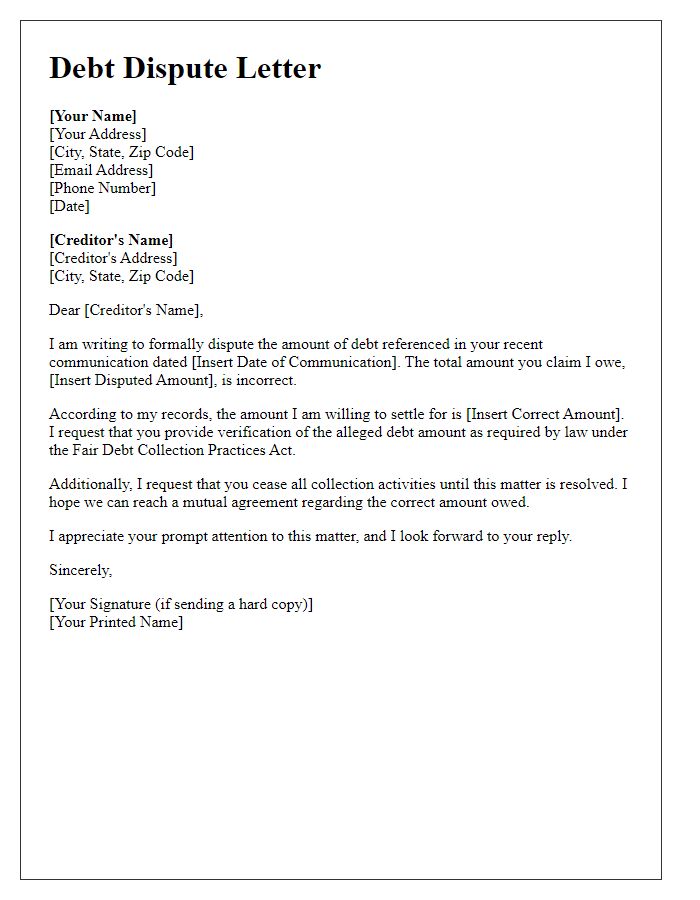

Clear Identification of Parties Involved

The debt settlement negotiation process can significantly benefit from the clear identification of all parties involved. This includes the creditor, often a financial institution like a bank or credit card company, and the debtor, which can be an individual or a business entity with outstanding obligations. A detailed description of the account in question, including account numbers, outstanding balances, and the nature of the debt, ensures transparency. Geographic locations may also play a role, as state-specific regulations can influence settlement terms. Additionally, including contact information for representatives from both parties may streamline communication and facilitate the negotiation process. Establishing a timeline for resolution can also be critical, especially if a payment plan is proposed, ensuring both parties are aligned on expectations and obligations.

Detailed Description of Outstanding Debt

Outstanding debt can accumulate from various sources, often leading to financial strain on individuals or businesses. For instance, credit card debt (averaging about $6,000 per user in the United States) may arise from unplanned purchases or high-interest rates. Medical bills, which often exceed $1,000 for emergency room visits, contribute significantly to outstanding balances. Student loans, with the average borrower owing over $30,000, add to monthly financial burdens along with mortgage arrears on properties in cities like San Francisco, where home prices often exceed $1 million. In cases of default, late payment penalties typically apply, increasing the outstanding amount and leading to collection efforts by agencies. Effective communication with creditors is essential for safeguarding credit scores and negotiating potential settlement plans.

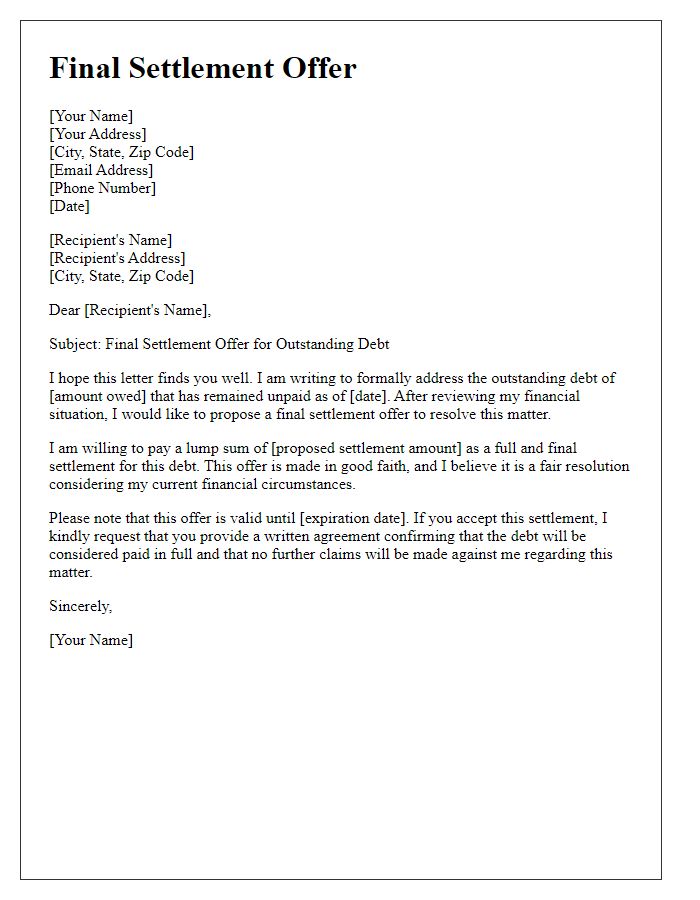

Proposed Settlement Amount and Terms

Proposed settlement agreements often involve negotiations between creditors and debtors regarding the repayment of outstanding debts. The proposed settlement amount typically represents a reduced figure that the debtor can afford to pay, compared to the original debt, which might include high interest or fees. When terms are discussed, they often involve structured payments over a specified timeframe, such as monthly installments spread over six months. These arrangements are usually formalized through a written agreement that outlines the responsibilities of both parties, including the stipulation that upon completion of the payment plan, the creditor will consider the debt fully satisfied, preventing further collection actions. Legal considerations may also arise when drafting the contract, ensuring compliance with relevant regulations such as the Fair Debt Collection Practices Act in the United States.

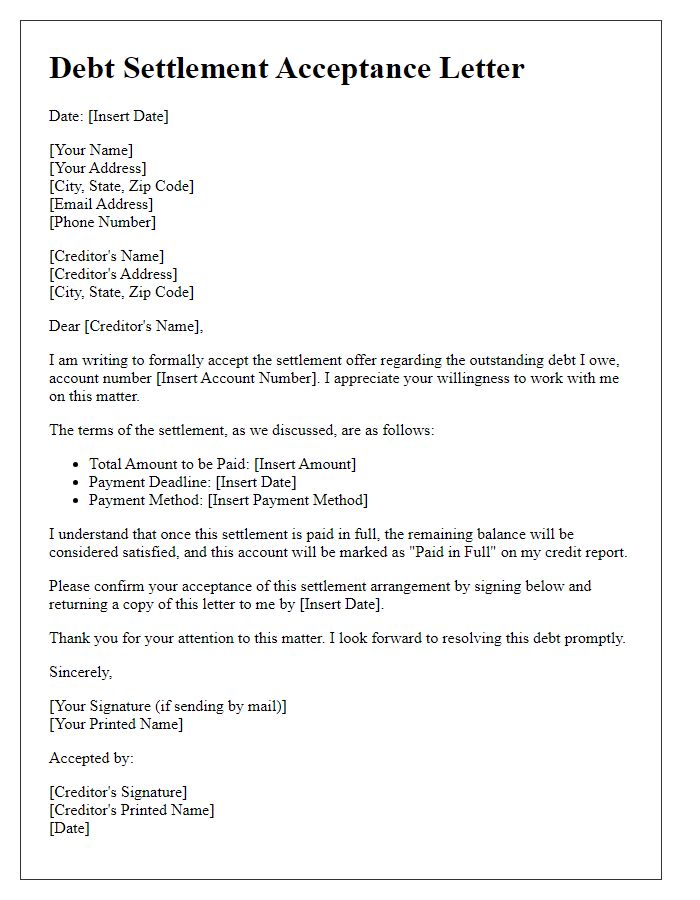

Deadline for Acceptance or Response

A debt collection settlement process often includes a specific deadline for acceptance or response from the debtor. Different entities may establish varying timelines based on the type and amount of debt; for instance, a common window might range from 15 to 30 days following the initial negotiation offer. During this timeframe, it is crucial for the debtor to review financial obligations thoroughly and assess any potential impact on credit ratings, particularly if the debt exceeds $1,000. Failure to respond by the deadline can result in the continuation of collection efforts, possibly including legal actions in jurisdictions such as New York, where debt collection laws are stringent and assess specific penalties for non-compliance. Timely communication with the collection agency or creditor can often result in more favorable settlement outcomes, allowing for options like reduced payoff amounts or payment plans that align with the debtor's financial capabilities.

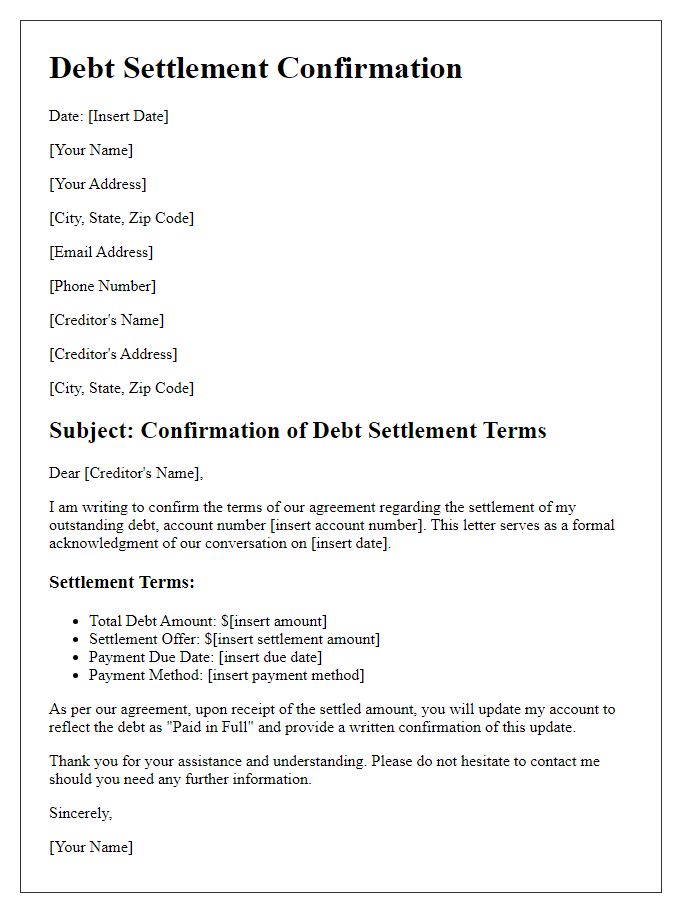

Contact Information for Further Communication

Debt collection agencies often rely on effective communication strategies to negotiate settlements. For continued dialogue, establish clear contact information that includes the agency's name, mailing address (e.g., 1234 Debt Recovery Lane, Suite 100, Financial District, San Francisco, CA), telephone number (e.g., 555-123-4567), and a dedicated email address (e.g., info@debtcollectionagency.com) for all settlement inquiries. This information ensures that both parties can promptly exchange necessary documentation, track payment terms effectively, and resolve any disputes efficiently. Timely communication is crucial in fostering a cooperative atmosphere that may lead to a favorable settlement outcome.

Comments