Are you navigating the complex world of customs compliance? Whether you're an importer or exporter, understanding the nuances of customs regulations is essential for smooth international trade. In this article, we'll explore the importance of adhering to customs compliance notices and how they can impact your business operations. So, grab a cup of coffee and join us as we dive deeper into this crucial topic!

Proper Salutation

Customs compliance notices are crucial in ensuring that imported and exported goods adhere to legal and regulatory requirements. Companies engaging in international trade must address proper salutations to organizations like the U.S. Customs and Border Protection or international customs agencies. For correspondence, generic salutations like "Dear Customs Officer" or specific titles such as "Dear Import Compliance Manager" can maintain professionalism. Including the recipient's name and position, when known, adds a personal touch. Additionally, using respectful language aligns with business etiquette, enhancing effective communication in compliance matters.

Detailed Description of Goods

The compliance notice for customs should include a detailed description of goods, specifying the exact nature of the items. For example, electronic gadgets like smartphones (typically valued between $200 to $1,000) must detail brand names, model numbers, and specifications such as storage capacity (e.g., 128GB to 512GB). Textiles like silk garments (originating from countries like China or India), should include fabric composition percentage (e.g., 100% silk) and intended use (e.g., fashion apparel). Kitchen appliances, such as electric blenders (known for wattage, around 300W to 1,000W), must indicate energy efficiency ratings and safety certifications (like CE or UL marks). All items must also include the country of origin, matching import regulations set by customs authorities in the destination country (e.g., United States Customs and Border Protection). Pricing details, including unit price and total value, are essential for duty calculation purposes and compliance verification.

Applicable Regulations and Laws

Customs compliance involves adherence to relevant regulations and laws governing the importation and exportation of goods across international borders. Key regulations include the Harmonized Tariff Schedule, which dictates appropriate duties and tariffs on imported products, and the Customs and Border Protection (CBP) rules in the United States, which emphasize accurate documentation and declaration of goods. Additional international agreements, such as the World Trade Organization guidelines, provide a framework for cross-border trade practices. It is crucial for businesses engaged in international trade to remain informed about regulations specific to regions, such as the European Union Customs Code, which consolidates customs legislation for member states. Non-compliance can lead to severe penalties, including fines and seizure of goods, underscoring the importance of a thorough understanding of applicable regulations in ensuring smooth customs operations.

Compliance Instructions and Deadlines

Customs compliance notices require strict adherence to regulations governing international trade. Entities engaged in import and export activities must meticulously follow guidelines outlined by customs authorities, such as the U.S. Customs and Border Protection (CBP). Deadlines for compliance submissions are typically set within 30 days of notification, necessitating prompt action to avoid penalties. Relevant documentation includes invoices, bills of lading, and certificates of origin, which must be accurately completed and submitted electronically through platforms like ACE (Automated Commercial Environment). Non-compliance could lead to fines, extended delays at ports like the Port of Los Angeles or the Port of New York and New Jersey, and potential seizure of goods. Understanding specific Harmonized Tariff Schedule (HTS) codes associated with products is crucial for correct duty calculations. Engaging legal counsel experienced in customs laws can facilitate adherence to regulations and streamline the import/export process.

Contact Information for Queries

A customs compliance notice is a crucial document for international shipping, encompassing details such as contact information for queries. Accurate contact information (including phone numbers and email addresses) ensures seamless communication between importers and customs authorities. Timely inquiries regarding documentation or tariff classifications can prevent delays in goods release at ports like Los Angeles International Airport or JFK International Airport. Compliance teams typically include designated representatives with specific expertise, enhancing the resolution process related to customs requirements. Notably, effective communication can significantly reduce fines or penalties associated with non-compliance, fostering smoother business operations in global trade.

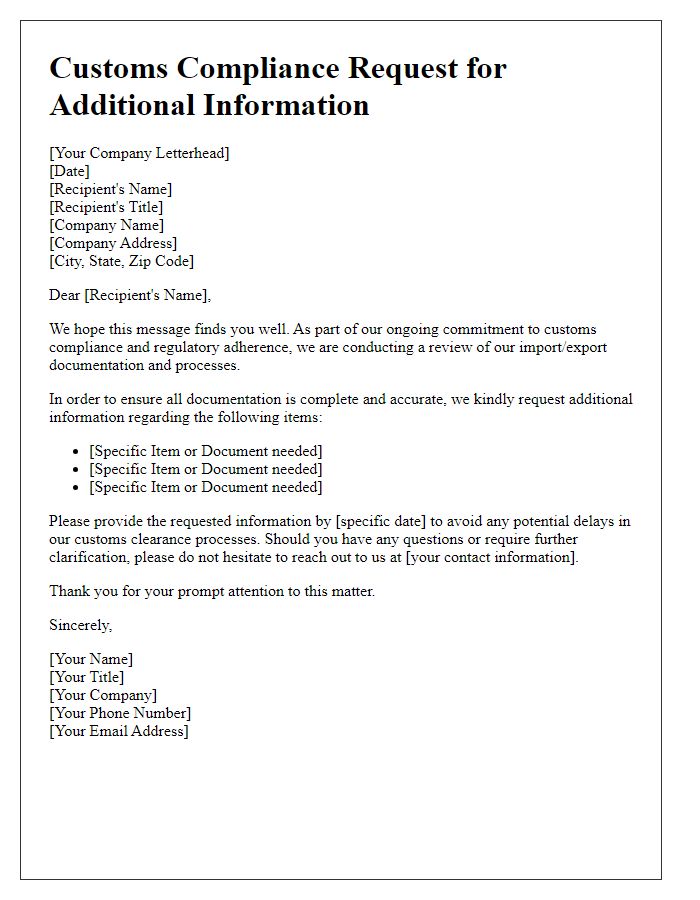

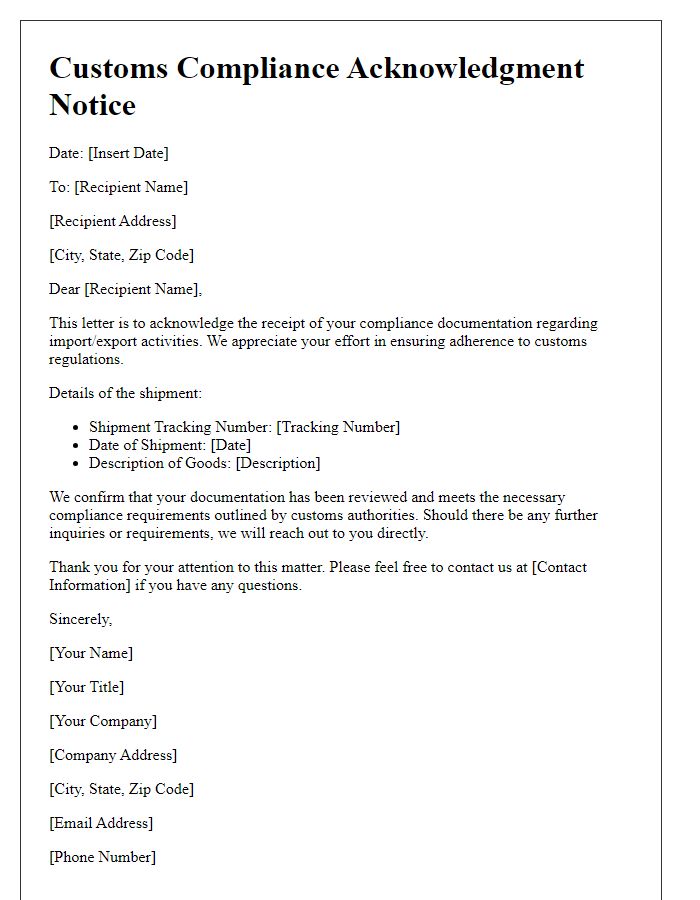

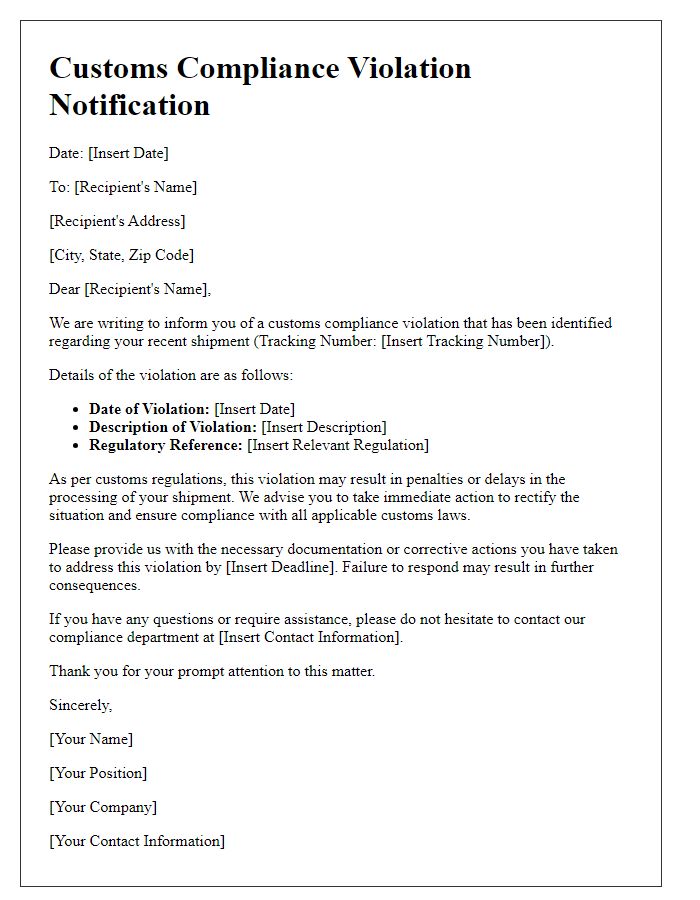

Letter Template For Customs Compliance Notice Samples

Letter template of customs compliance request for additional information

Comments