Hey there! If you're renting a home or apartment, you know how important it is to protect your belongings, and that's where tenant insurance comes into play. This essential coverage can safeguard your personal items from unexpected events like theft or fire, providing you with peace of mind. As your lease progresses, we want to gently remind you about the importance of maintaining your tenant insurance to ensure you're well-protected. Ready to learn more about how tenant insurance can benefit you? Let's dive in!

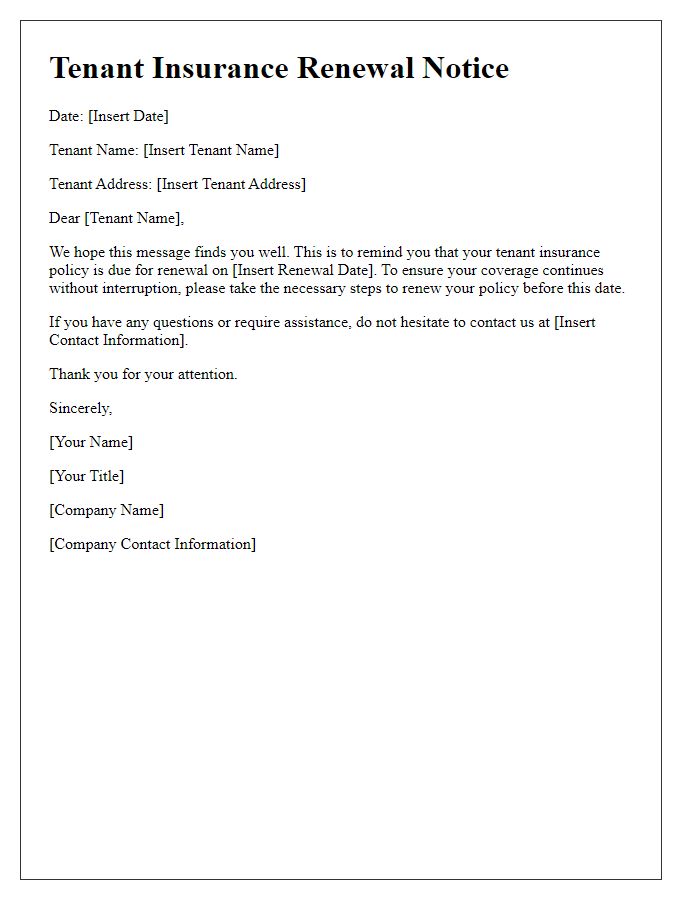

Clear subject line

Tenant insurance offers essential protection for personal belongings against unforeseen events such as theft, fire, or water damage. Policies often cover personal property (valued up to $50,000 or more), liability (amounting to $100,000 or higher), and additional living expenses for temporary housing during repairs. Renewal dates typically range from one year to the next, with reminders sent 30 days prior to the expiration to ensure continuous coverage. Many landlords require proof of valid tenant insurance before lease agreements are finalized, especially in metropolitan areas with higher crime rates, such as New York City or Los Angeles. Keeping a copy of the insurance policy accessible can provide peace of mind while navigating rental responsibilities.

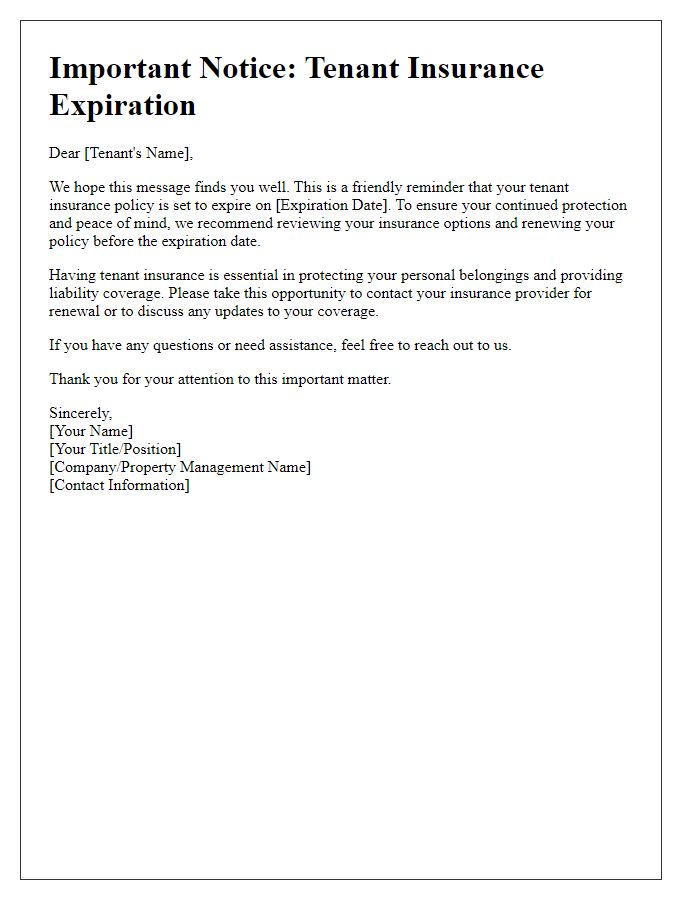

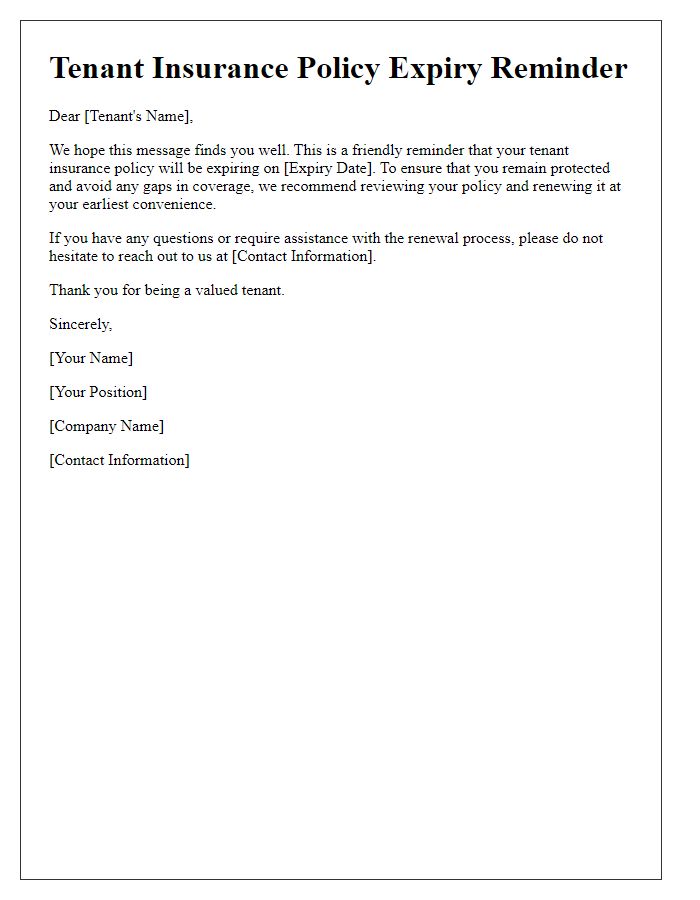

Personalized greeting

Personalized tenant insurance reminders play a crucial role in communicating the importance of maintaining an active policy. Tenant insurance, specifically renters insurance, safeguards personal belongings in rental properties from unforeseen events like theft, fire, or natural disasters. Coverage typically includes liability protection, which ensures financial support in case of accidents, with average premiums ranging from $15 to $30 monthly, depending on policy limits and coverage options. Regular reminders can be tailored not only to each tenant but also highlight specific risks relevant to the local area, such as flooding in coastal regions or high burglary rates in urban environments, ensuring tenants stay informed about their responsibilities and the protection their policy offers.

Overview of policy details

Tenant insurance provides crucial financial protection for individuals renting residential properties, covering personal belongings against theft, damage, or loss due to events like fire or water damage. Policies typically have limits on coverage amounts for specific items, such as electronics or jewelry, often ranging from $10,000 to $50,000. Additionally, tenant insurance often includes liability coverage, protecting against legal claims for injuries or damages that occur within the rented space, commonly starting at $100,000. In metropolitan areas like New York City or Los Angeles, rental agreements may mandate proof of tenant insurance, ensuring both tenants and landlords are safeguarded against unexpected incidents. Regular reviews of coverage limits and deductibles can help maintain adequate protection as rental values and personal asset inventories change.

Renewal deadline

Tenant insurance policies provide essential coverage for personal belongings and liability protection in case of accidents. Renewal deadlines are critical, typically occurring annually, often on the same date as the initial policy start date. Many insurance providers send reminders, advising tenants to review their coverage, update personal property valuations, and ensure compliance with any landlord requirements. Missing the renewal deadline can lead to a lapse in coverage, increasing vulnerability to potential loss or damage. Renewal processes may involve providing updated information and making necessary payments to secure uninterrupted insurance protection. Being proactive in renewing tenant insurance safeguards against unforeseen circumstances, such as theft or fire damage, ensuring personal security and peace of mind.

Contact information for queries

A tenant insurance reminder highlights the importance of securing coverage for personal belongings against potential risks like theft, fire, or water damage. Policies typically cover personal property valued at thousands of dollars, providing peace of mind against unexpected events. For tenants residing in multifamily units, such as apartments in urban areas, coverage can also safeguard against liability claims if someone is injured on the premises. It's crucial for tenants to review their policies annually to ensure adequate coverage levels and compare rates from various insurers. Tenants can reach out to their insurance agent or customer service department for queries or clarification about their policy details, premium payments, or claims procedures.

Comments