Are you facing challenges in recovering outstanding debts? Writing a debt recovery demand letter can be a crucial step toward reclaiming what is rightfully yours. With the right tone and structure, you can clearly communicate your expectations and prompt a response from your debtor. Dive into our article to discover effective tips and templates for crafting the perfect debt recovery letter that gets results!

Creditor's Contact Information

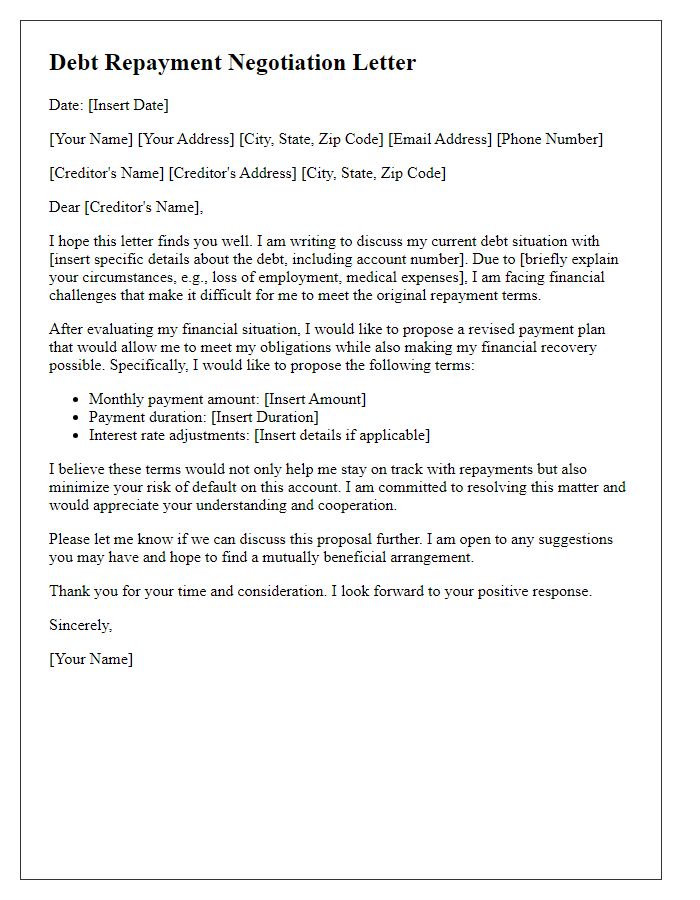

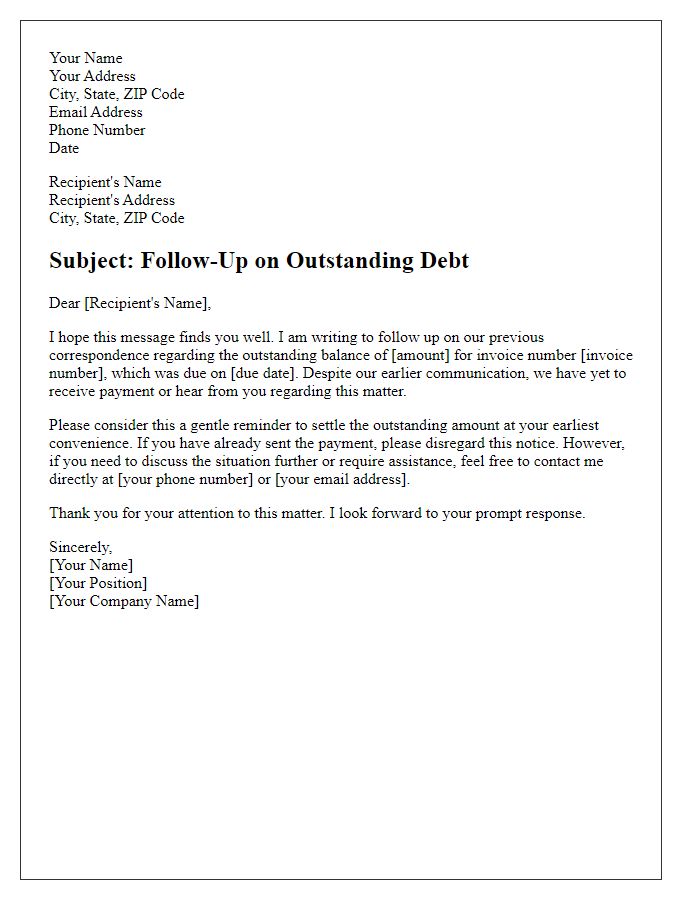

Debt recovery involves the process of collecting outstanding payments from individuals or businesses. Typically, creditors utilize demand letters as formal requests for payment, outlining the amount owed, due dates, and penalties for non-payment. These letters often include the creditor's contact information, which is critical for establishing a direct line of communication. This enables the debtor to address any disputes, seek payment arrangements, or clarify their financial situation. Including specific details such as account numbers, previous communications, and payment methods can further enhance the effectiveness of the demand letter. By ensuring accuracy in the provided contact information, creditors set a professional tone and promote prompt resolution of outstanding debts.

Debtor's Contact Information

A debt recovery demand letter is essential for initiating communication regarding an outstanding financial obligation. The debtor's contact information should include full name, residential address (such as 123 Main Street, Springfield), phone number (for direct communication), and email address. Providing accurate information allows for effective follow-ups and ensures the debtor receives the demand notice promptly. Additionally, including any relevant details related to the debt, such as the account number (56789), outstanding amount ($2,000), and the original creditor's name (ABC Financial Services), provides clarity and strengthens the case for recovery.

Outstanding Debt Details

An outstanding debt can lead to significant financial strain on both individuals and companies. In the United States, the total consumer debt reached approximately $14.96 trillion by mid-2023, with credit card debts contributing over $1 trillion to that figure. Defaulting on debts can result in serious consequences, including damage to credit scores (which can drop by 70-100 points), additional interest charges, and potential legal action. Effective recovery strategies often involve communication through formal demand letters, clearly stating the amount due, the original creditor, and the payment deadline, typically ranging from 30 to 60 days. Legal entities such as collection agencies or law firms often become involved after this period, escalating the recovery process. Clear documentation and understanding of relevant regulations, including the Fair Debt Collection Practices Act (FDCPA), are crucial in ensuring fair treatment throughout the recovery process.

Payment Instructions and Deadline

Payment instructions for debt recovery usually include details such as the total amount owed, accepted payment methods (bank transfer, credit card, etc.), account information, and any relevant payment reference numbers. A clear deadline is essential, typically advised as 14 days from the receipt of the letter to create urgency. Specific dates should be provided, indicating the last day for the payment to avoid further actions. Additionally, it's important to mention potential consequences of non-payment, like late fees or receiving further collection efforts, ensuring the recipient understands the seriousness of the matter.

Legal Consequences/Actions

A debt recovery demand letter serves as a formal notification to debtors regarding outstanding financial obligations. Clarity in communication is essential, outlining the total amount owed, often including specifics such as principal sum, interest rates (typically accruing from 30 to 90 days overdue), and any applicable fees. The letter usually stipulates a clear deadline for payment, often within 10 to 30 days, to avoid escalation. Failure to respond may lead to legal actions, which could involve filing a claim in court (described in relevant jurisdictional laws, e.g., small claims procedures in various U.S. states) and potential credit report ramifications. Including references to specific statutes, such as the Fair Debt Collection Practices Act, emphasizes the legal responsibilities. Ultimately, the letter aims to encourage prompt payment while clearly outlining the ramifications of non-compliance.

Comments