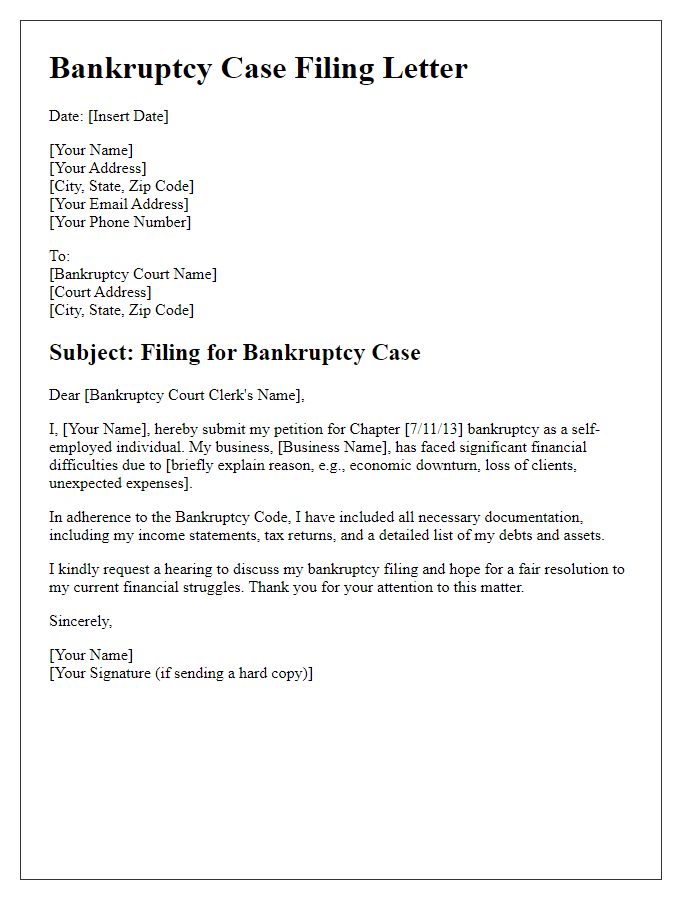

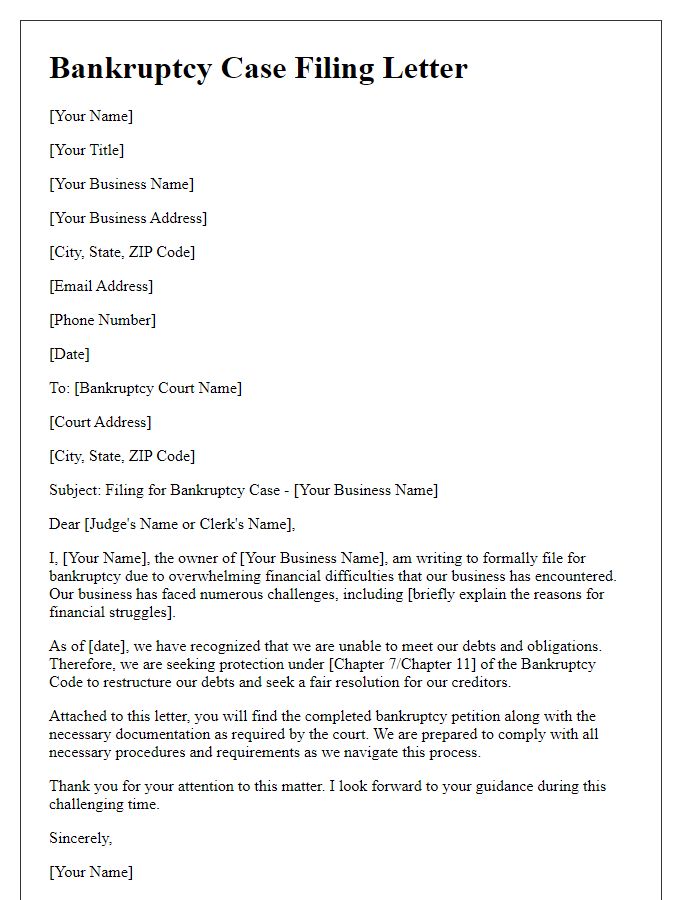

Filing for bankruptcy can be a daunting process, but having the right letter template can make it a bit easier to navigate. This article will guide you through creating a clear and effective letter that outlines your situation and intentions, ensuring you communicate your needs to the court properly. Understanding the nuances of this document can significantly impact your case, so it's important to pay attention to the details. Ready to take the next step? Read on for more insights!

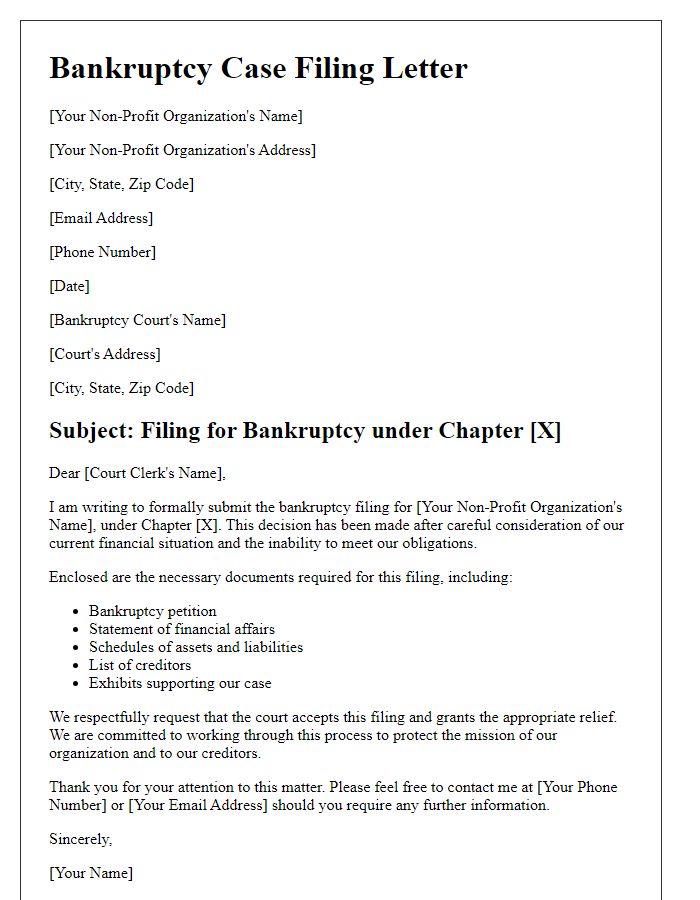

Case Title & Number

Bankruptcy case filings involve complex legal processes essential for individuals or businesses seeking relief from debts. The case title typically includes the name of the debtor, such as John Doe, along with a designation indicating the type of bankruptcy, like Chapter 7 or Chapter 13. The case number is a unique identifier assigned by the bankruptcy court, necessary for tracking and managing the case throughout proceedings. For instance, in a court located in Chicago, Illinois, the case might be filed under a number like 23-12345. Proper organization and accurate details in these filings are crucial for successful navigation through the bankruptcy process, impacting the discharge of debts and overall financial recovery.

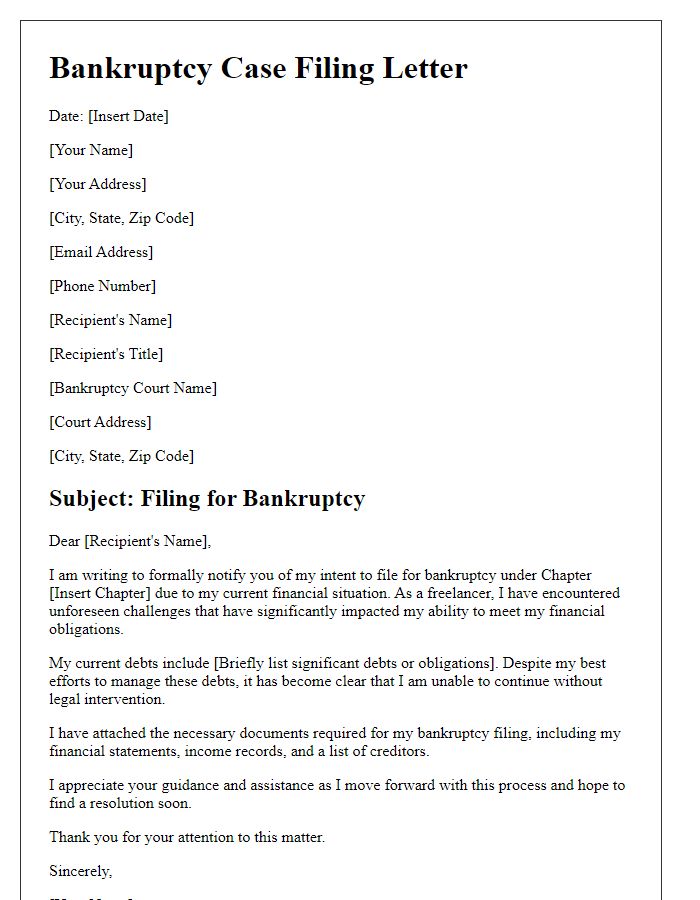

Debtor's Information

The debtor's information section in a bankruptcy case filing comprises essential details that provide insight into the individual's financial circumstances. Each debtor is required to provide their full legal name, commonly recognized as the "debtor," along with their residential address, which is crucial for court communications. Accurate social security numbers (SSN) must be included for identification purposes, while the date of birth offers additional verification. In instances where a business entity is filing, the business name, type (LLC, Corporation), and the state of incorporation become necessary. Additionally, any previous bankruptcies filed, along with case numbers and dates, will facilitate the court's assessment of the debtor's history concerning financial obligations. Each of these details plays a pivotal role in the transparency and efficiency of the bankruptcy process.

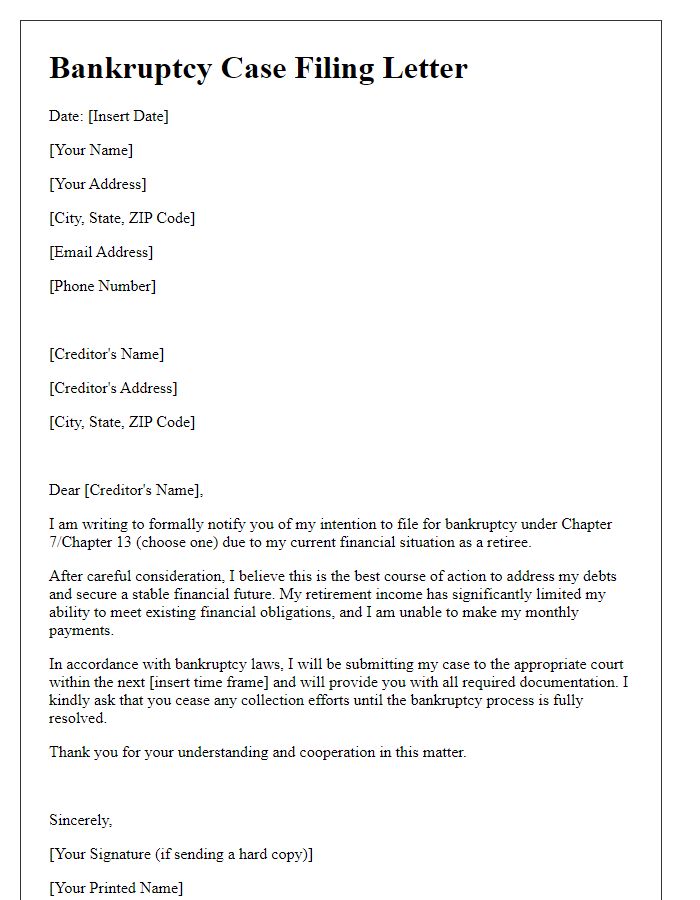

Creditor's Claims

Filing for bankruptcy often involves submitting detailed documentation of creditor's claims, ensuring that all debts are accurately reported. The process begins with the completion of official forms such as Form 2 - Schedule of Creditors, which lists names, addresses, and outstanding amounts owed to creditors, typically exceeding $10,000 in total liabilities. Creditors must be categorized by type, such as secured creditors (those with collateral backing their loans) and unsecured creditors (those without collateral). The bankruptcy court, such as the U.S. Bankruptcy Court in New York City, will review these claims during proceedings. Accurate and thorough documentation is crucial for the court's assessment and can influence the outcome of the bankruptcy discharge, a legal elimination of certain debts post-filing. Deadlines for claims submission often vary, but typically fall within 90 days after the initial bankruptcy filing.

Description of Assets

In a bankruptcy case filing, a comprehensive description of assets is crucial for an accurate assessment of an individual's financial situation. Important assets include real estate properties such as a primary residence located at 123 Maple Street, valued at $250,000, and a vacation cabin in Lake Tahoe worth approximately $150,000. Personal items encompass vehicles like a 2018 Toyota Camry, valued at $20,000, and a vintage 1965 Mustang, potentially valued at $30,000 depending on market demand. Financial assets include bank accounts, for instance, a checking account with a balance of $5,000 and a savings account holding $15,000. Additionally, retirement accounts such as a 401(k) plan with a balance of $50,000 and an IRA valued at $25,000 add to the overall asset portfolio. Lastly, personal belongings such as electronics and furniture, collectively estimated at $10,000, round out the asset description, providing a vivid snapshot of the financial landscape prior to bankruptcy proceedings.

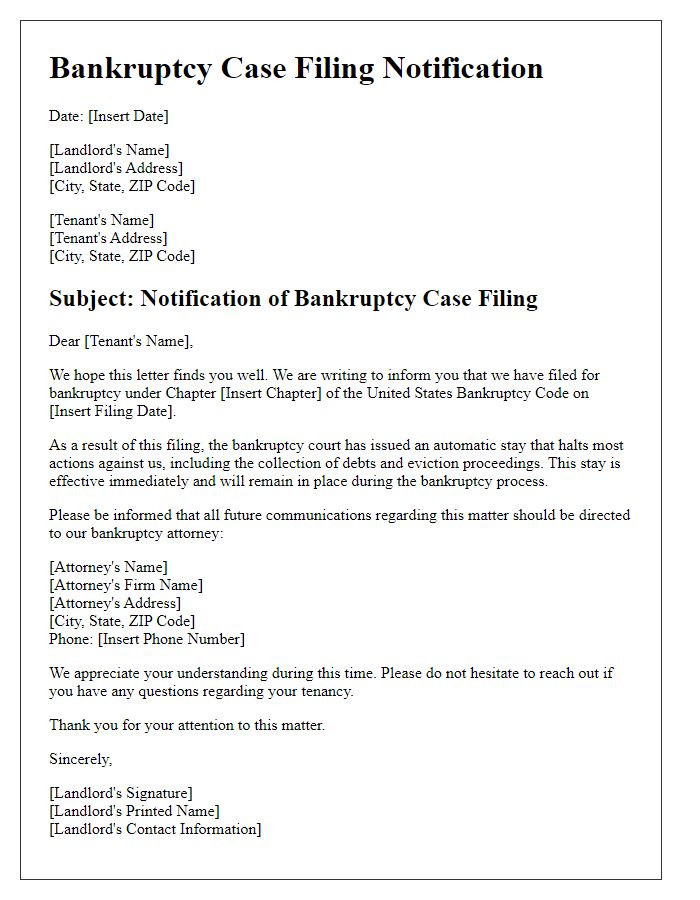

Legal Representatives Information

During a bankruptcy case filing, the inclusion of legal representatives' information is critical for establishing proper communication and representation. Essential details often consist of the attorney's name, typically a certified bankruptcy attorney specializing in Chapter 7 or Chapter 13 filings, along with law firm name, office address, phone number, and email address. Accurate state bar license numbers must also be provided to confirm legal standing. Representation should include a thorough understanding of the jurisdiction, such as the Bankruptcy Court for the Southern District of New York, to ensure adherence to specific procedural rules. Effective representation often ensures smoother proceedings and proper filing of necessary documentation.

Comments