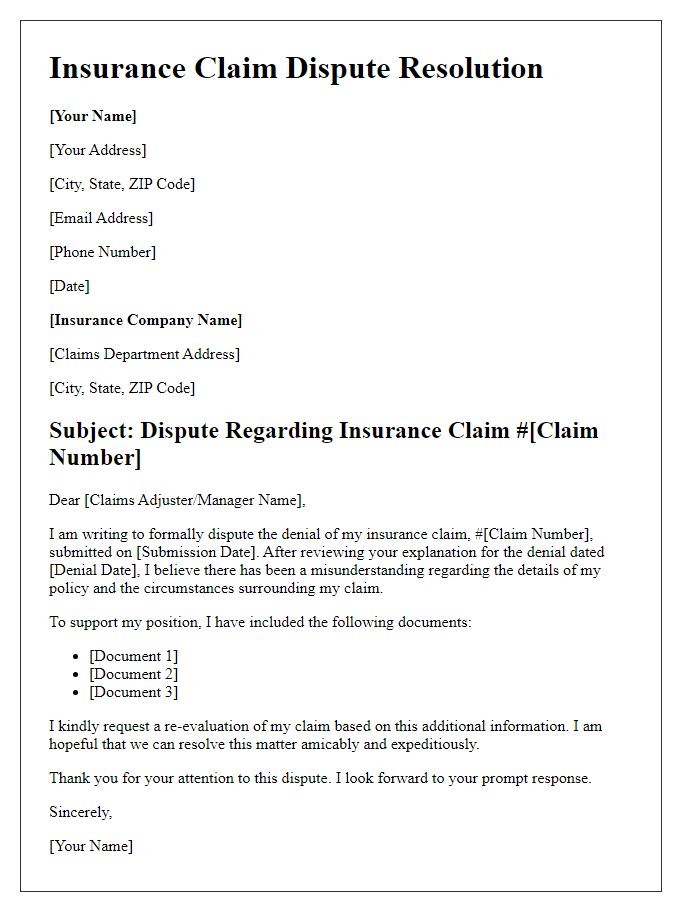

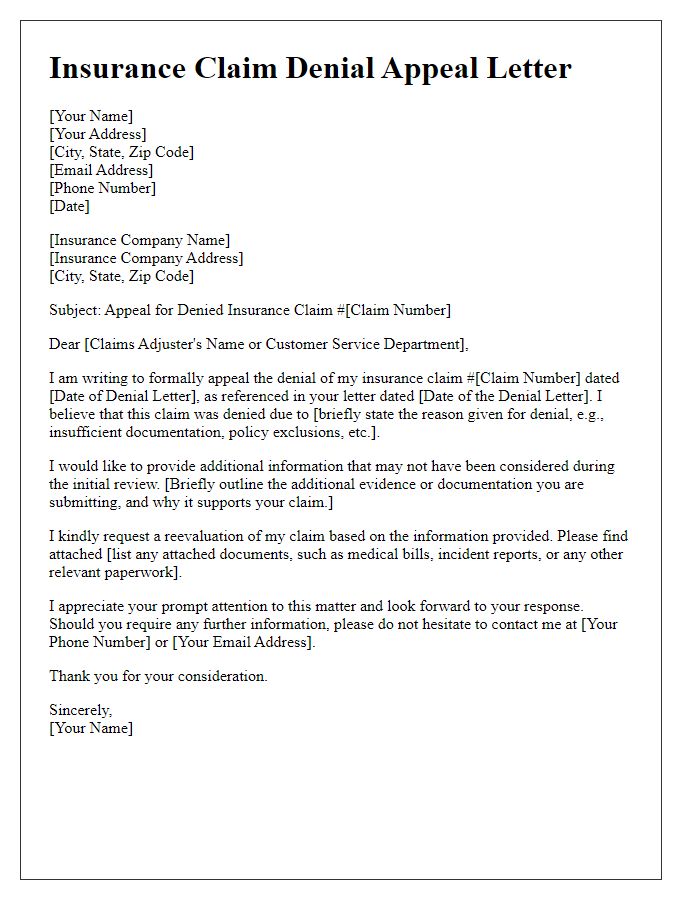

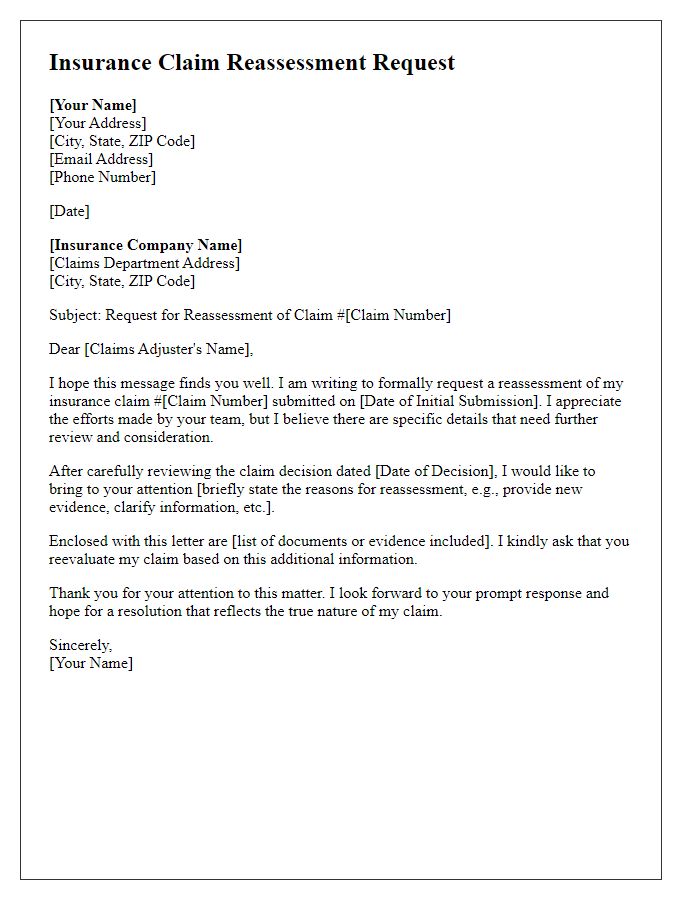

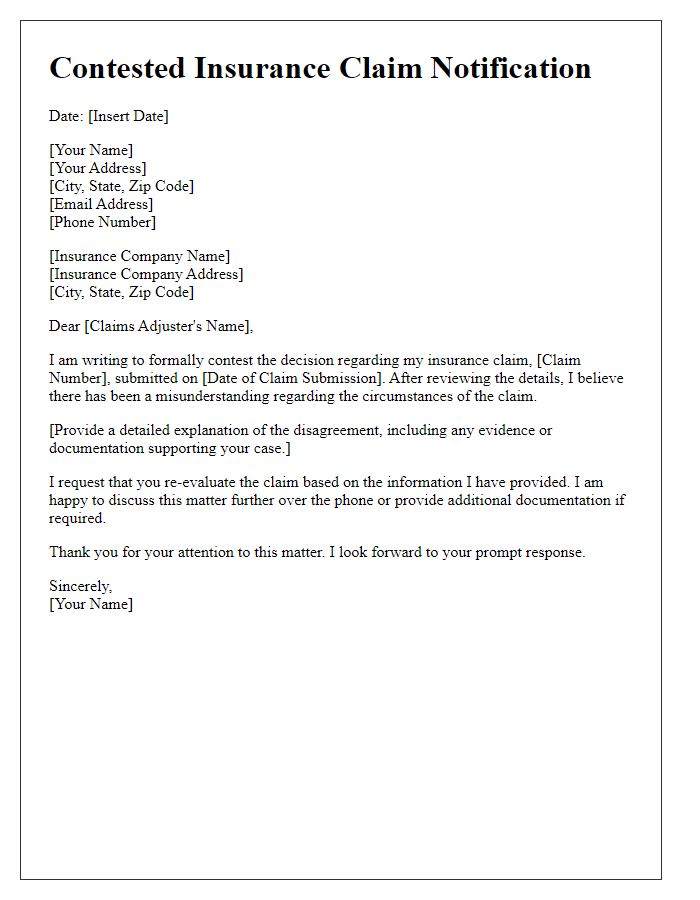

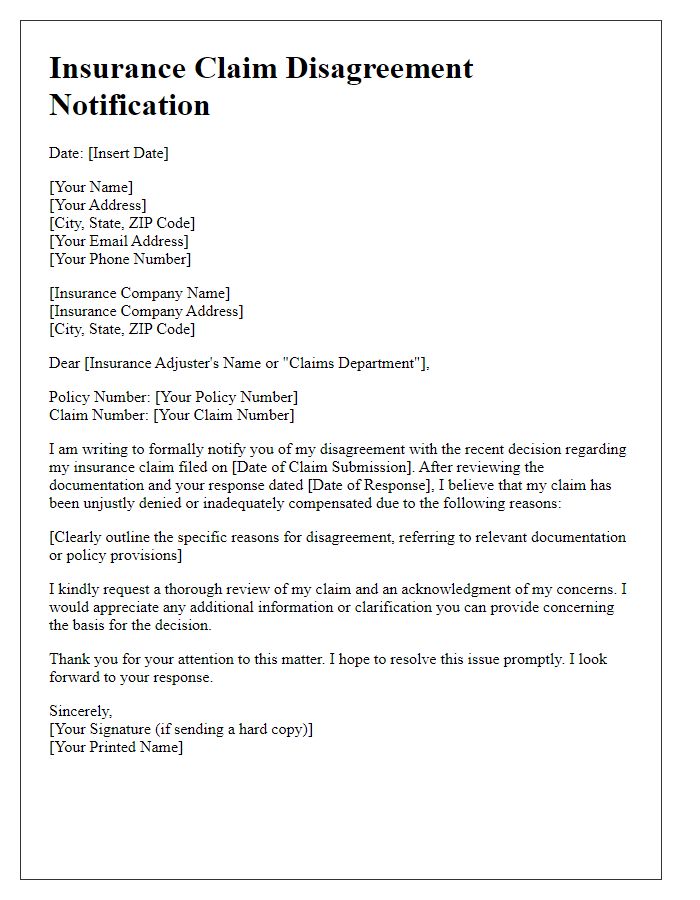

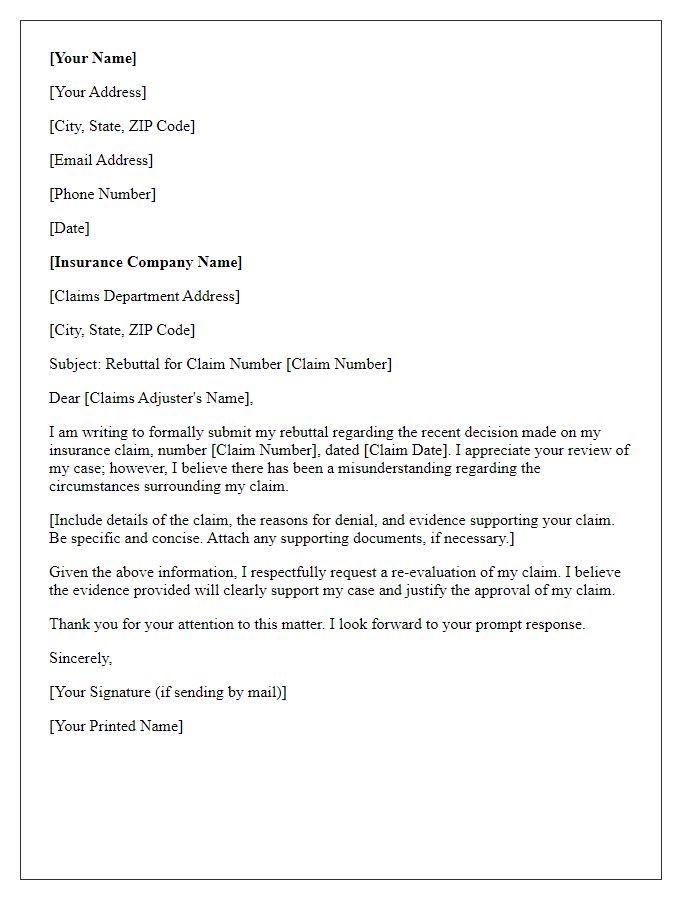

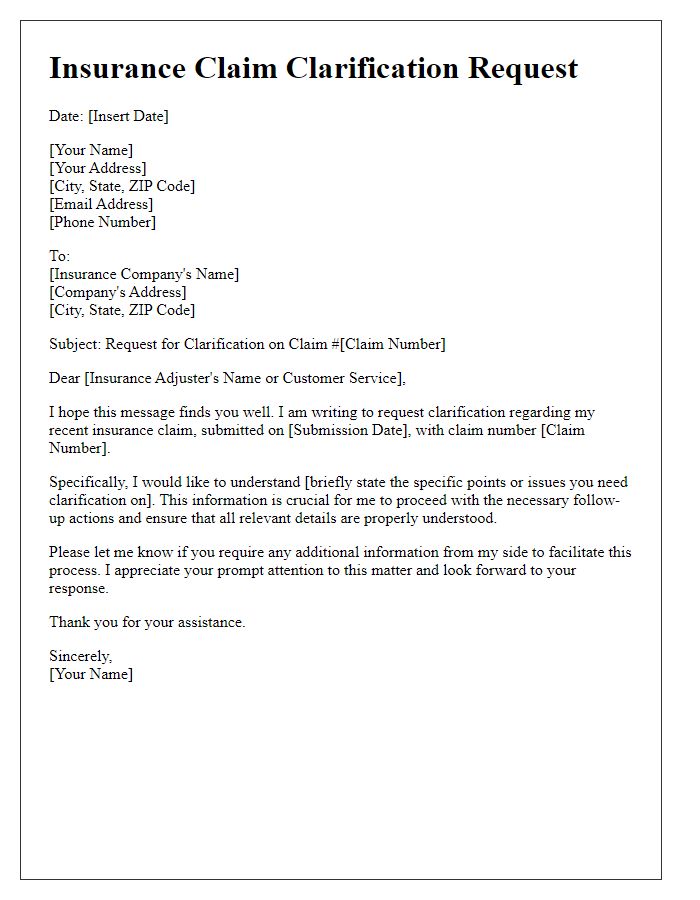

Are you facing a challenging insurance claim dispute and unsure where to turn? Navigating the intricacies of insurance policies and claims can be overwhelming, but having the right resources can make a significant difference. In this article, we'll explore a comprehensive letter template designed to help you clearly articulate your concerns and streamline the process of resolving your dispute. Join us as we delve into effective strategies to reclaim what's rightfully yours!

Policy Details and Coverage Information

Insurance policy details play a critical role in claim disputes, particularly in sectors such as health, auto, or property insurance. Each policy, identified by a unique policy number, outlines specific coverage limits, deductibles, and exclusions that apply, all tailored to individual needs in a contractual agreement between the insurer, such as Aetna or State Farm, and the policyholder. The coverage information details the scope of protection against potential losses, including but not limited to medical expenses, vehicle damages, or property losses, which collectively could amount to thousands or even millions of dollars depending on the nature of the claim. Keeping documentation such as policy summaries, endorsement papers, and previous correspondence is vital, especially during the dispute process where claims might be evaluated based on the fine print of the policy and any applicable statutes unique to jurisdictions like California or New York.

Detailed Description of the Incident

A detailed description of the incident provides crucial context for insurance claim disputes. On June 15, 2023, at approximately 3:30 PM, a severe thunderstorm struck downtown Chicago, Illinois, leading to extensive property damage. The high winds, recorded at 70 miles per hour, uprooted trees and caused extensive flooding, particularly in the River North neighborhood. My residence, located at 456 North State Street, suffered significant water intrusion due to clogged storm drains overflowing onto the street. Rainfall exceeded 3 inches within a two-hour period, inundating the basement and damaging personal property, including home electronics and furniture. Emergency services reported over 500 similar incidents in the area that day. Photographic evidence and witness statements from neighbors further support claims of severe weather impact. Insurance policy number 789456123 should cover the damages incurred as per the terms outlined.

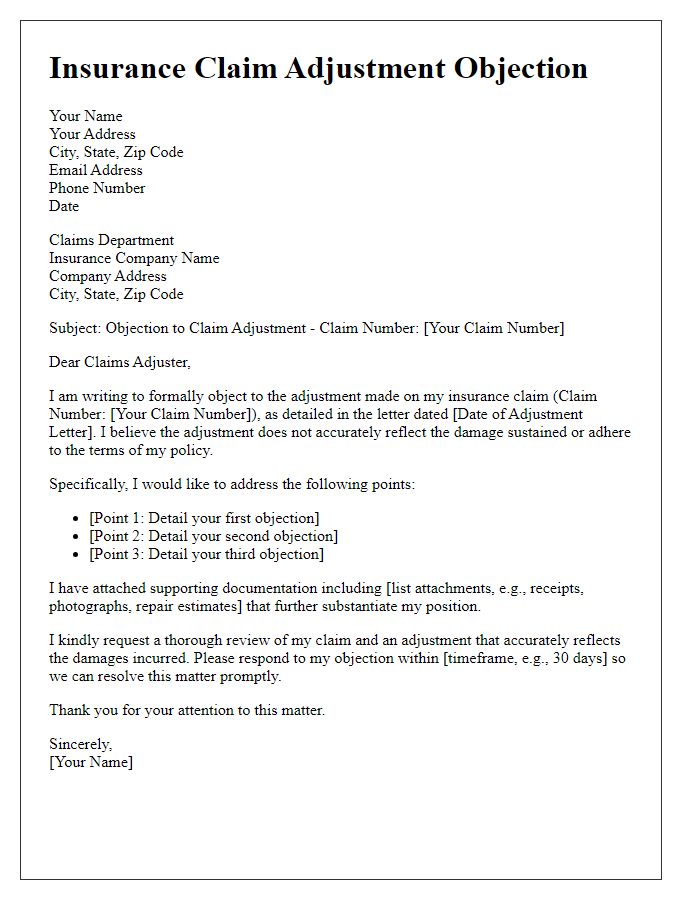

Reference to Relevant Policy Clauses

Insurance claim disputes often revolve around specific policy clauses that outline the coverage terms and required procedures. Policyholders should reference sections such as "Coverage Limitations" which specify the maximum payout for certain circumstances, typically expressed in numerical terms. Additionally, clauses regarding "Claim Filing Procedures" detail the timeline, often within 30 days, that policyholders must adhere to when submitting claims, ensuring compliance. An understanding of "Exclusions" is critical, as these define situations or damages that the policy does not cover, often including acts of nature like earthquakes or floods. The "Dispute Resolution" process is another vital aspect, usually requiring mediation or arbitration before pursuing litigation, providing a structured pathway for resolving differences efficiently. These clauses are essential for navigating the complexities of an insurance claim dispute and for building a strong case based on the agreed-upon terms in the legal policy document.

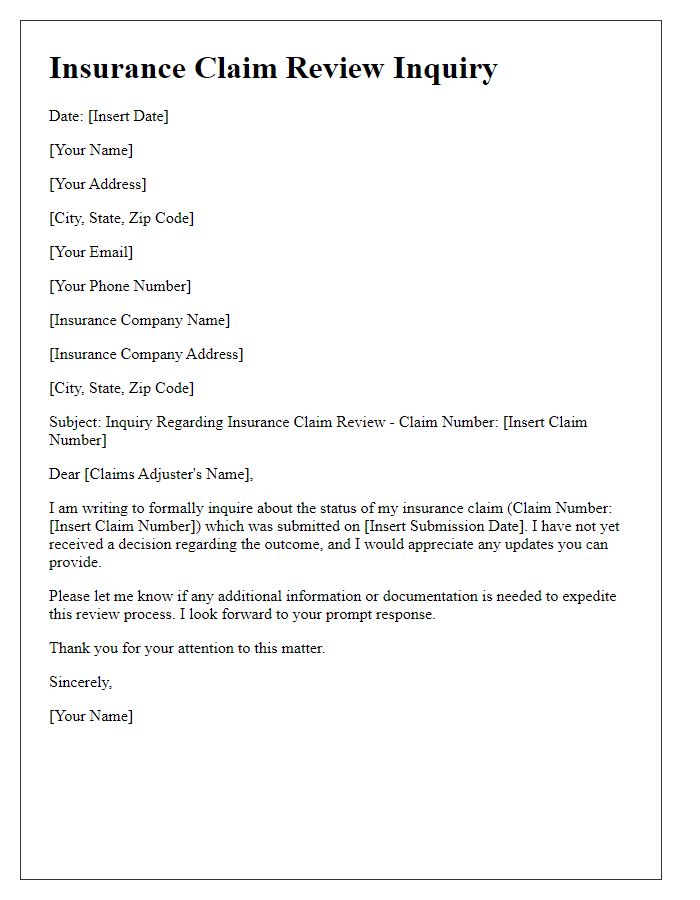

Documentation and Evidence Submission

Documenting an insurance claim dispute requires meticulous attention to detail and clarity in presentation. Comprehensive documentation should include policy numbers associated with the claim, specific dates relevant to the incident--such as the date of loss or claim filing--and correspondence records with the insurance company, including any denial letters or adjustment notes from claims adjusters. Photographic evidence of damages, such as water or fire damage in a residential space like a house or vehicle, enhances credibility, while any repair estimates from licensed contractors provide tangible proof of incurred expenses. Legal references relevant to insurance policy terms, such as state regulations governing claims, bolster the argument's strength, ensuring proper context and substantiation as to why the initial claim decision may have been erroneous. Properly organized exhibits, labeled and described, facilitate efficient processing by the claims department, increasing the likelihood of a favorable resolution.

Clear and Concise Resolution Request

Disputes in insurance claims often arise from discrepancies in coverage determination or payment amounts. Understanding policy details is crucial, as documented, clear communication can facilitate resolutions. For example, when an incident occurs in a specific location, such as water damage from a burst pipe in a New York City apartment, providing the date of occurrence, reference to policy numbers, and a detailed account of incurred damages is essential. Attach supporting documentation, including photos of the damage and repair estimates from licensed contractors, to strengthen the claim. Aim for a prompt response from the insurance company, as resolution periods may vary, generally ranging from 30 to 60 days depending on the policy terms.

Comments