Are you tired of managing confusing invoice payment terms? Navigating the financial maze can be a hassle, especially when terms suddenly change. In this article, we'll break down the essentials of switched invoice payment terms, offering clarity and strategies to adapt seamlessly. Join us as we dive deeper into what these changes mean for your business and how to handle them effectively!

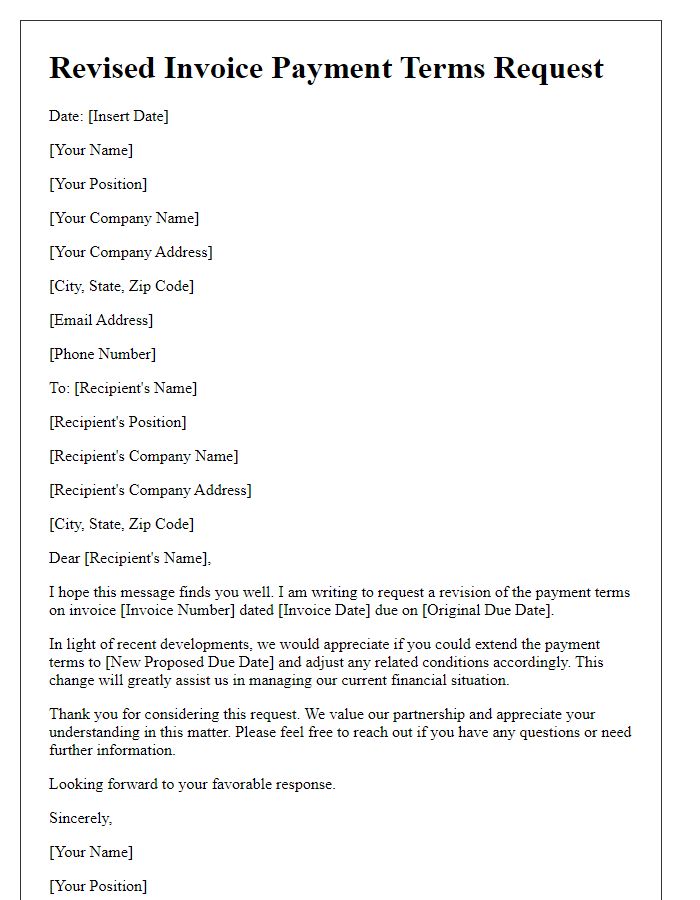

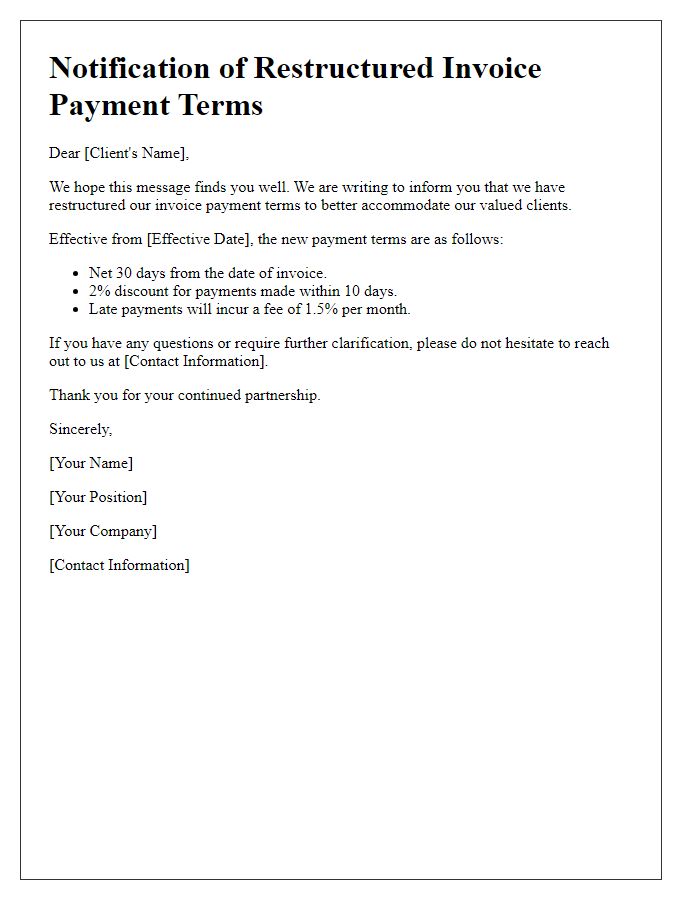

Clear Subject Line

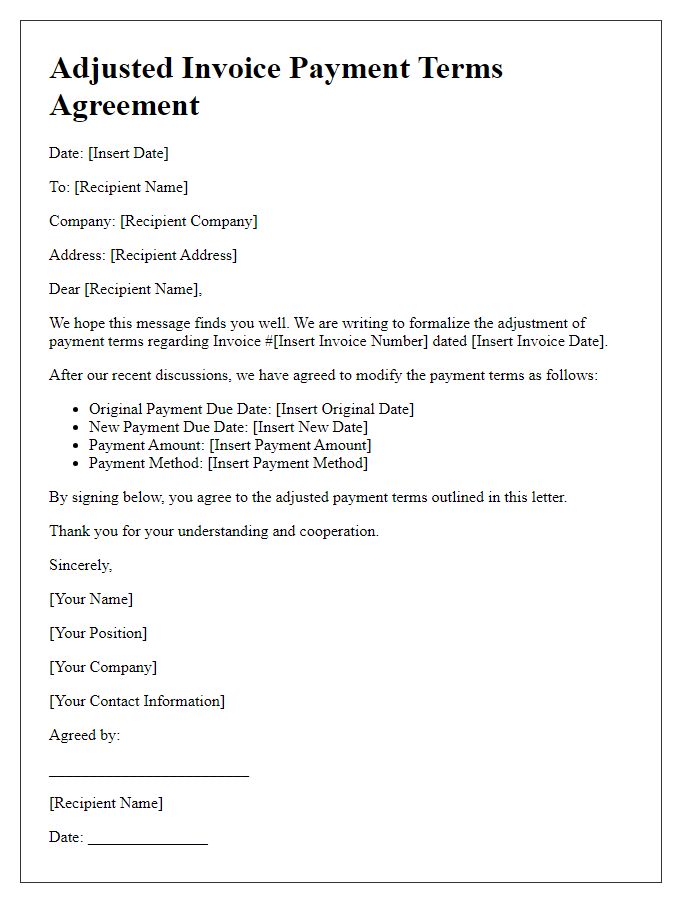

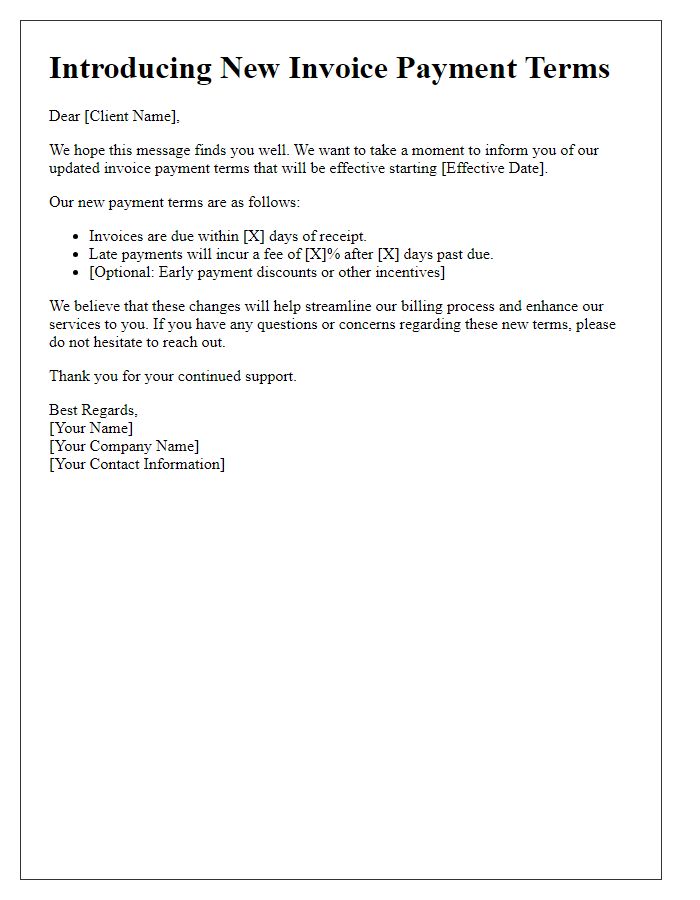

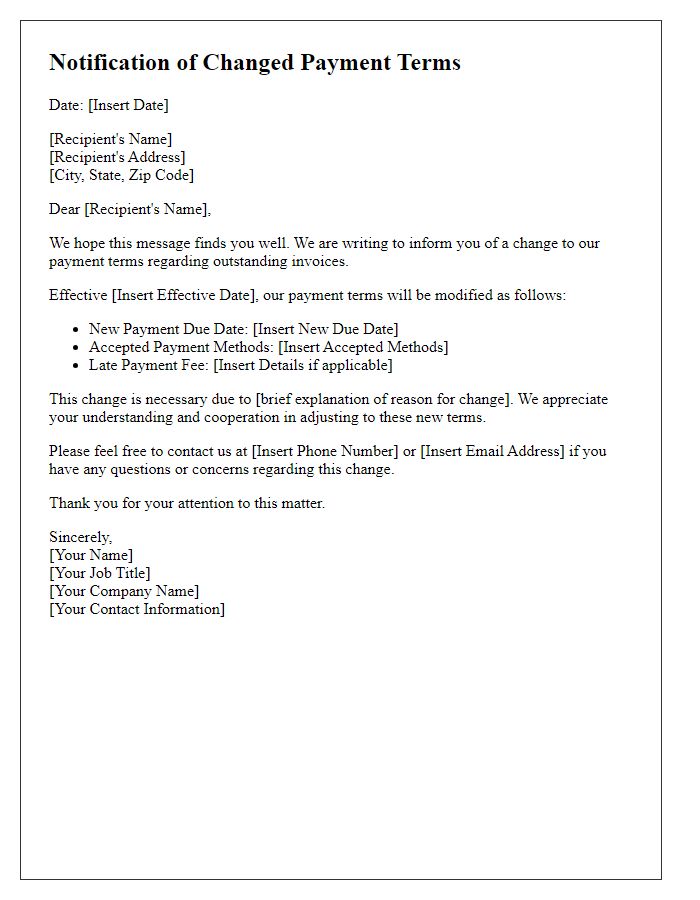

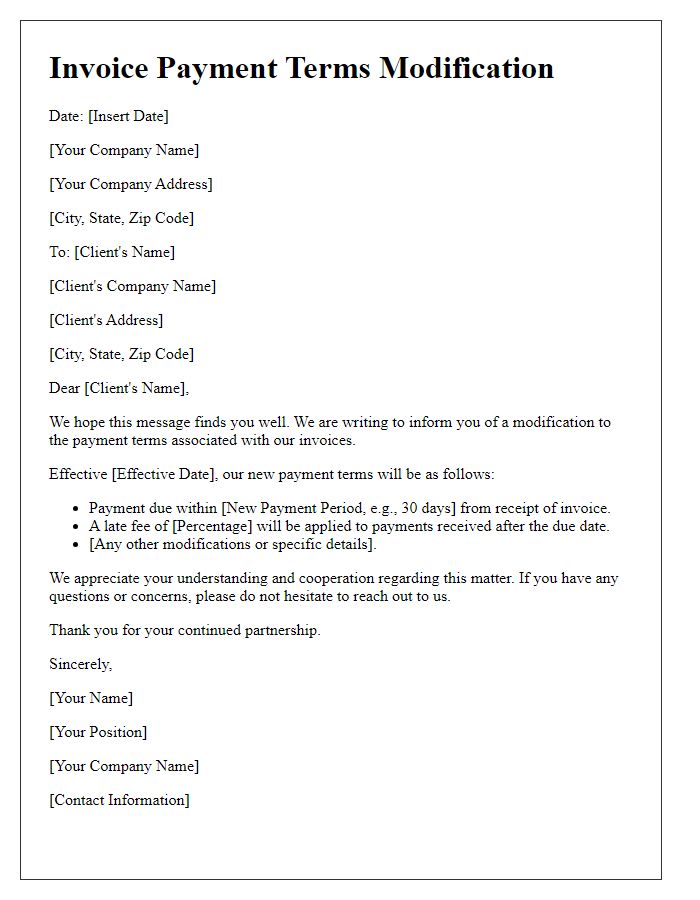

Switched invoice payment terms can significantly impact cash flow for businesses. Updated terms may include alterations such as Net 30 or Net 60 payment guidelines, which specify the number of days clients have to settle invoices. Clear communication regarding these terms is crucial to avoid misunderstandings and ensure timely payments. For example, companies may specify a 2% discount on payments made within 10 days, incentivizing early settlement and enhancing financial flexibility. Additionally, adherence to these revised terms can strengthen client relationships and build trust while fostering a mutually beneficial financial ecosystem.

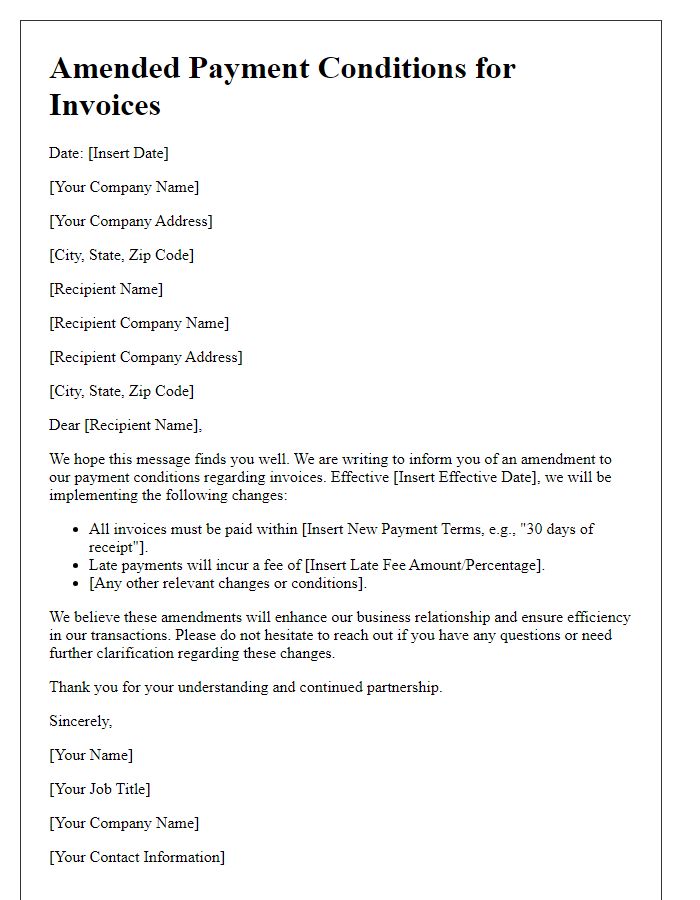

Concise Explanation of Change

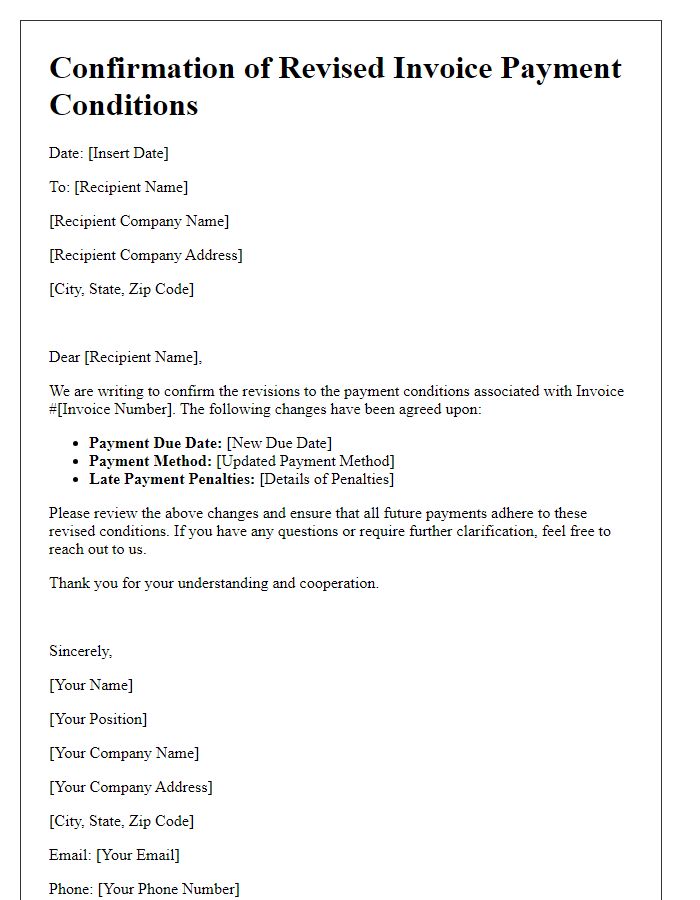

The amendment to invoice payment terms reflects a transition from 30-day net terms to immediate payment upon receipt. This change aims to enhance cash flow and streamline financial operations. Clients are encouraged to ensure prompt remittance to avoid service disruptions. Invoices will be issued bi-weekly, with detailed line items for transparency. Adopting this new policy reinforces our commitment to timely service delivery and operational efficiency.

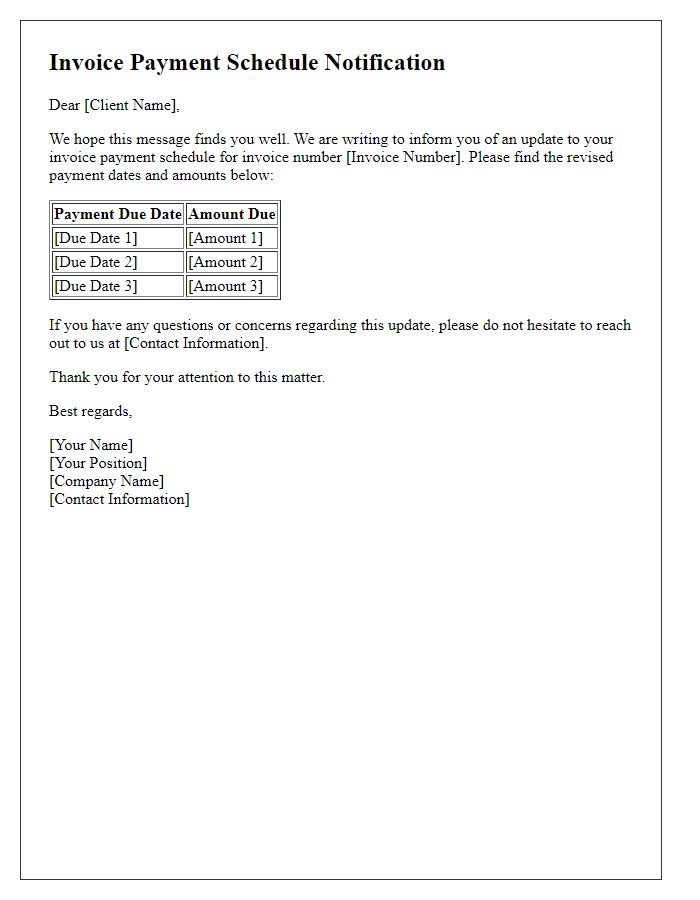

New Payment Terms Details

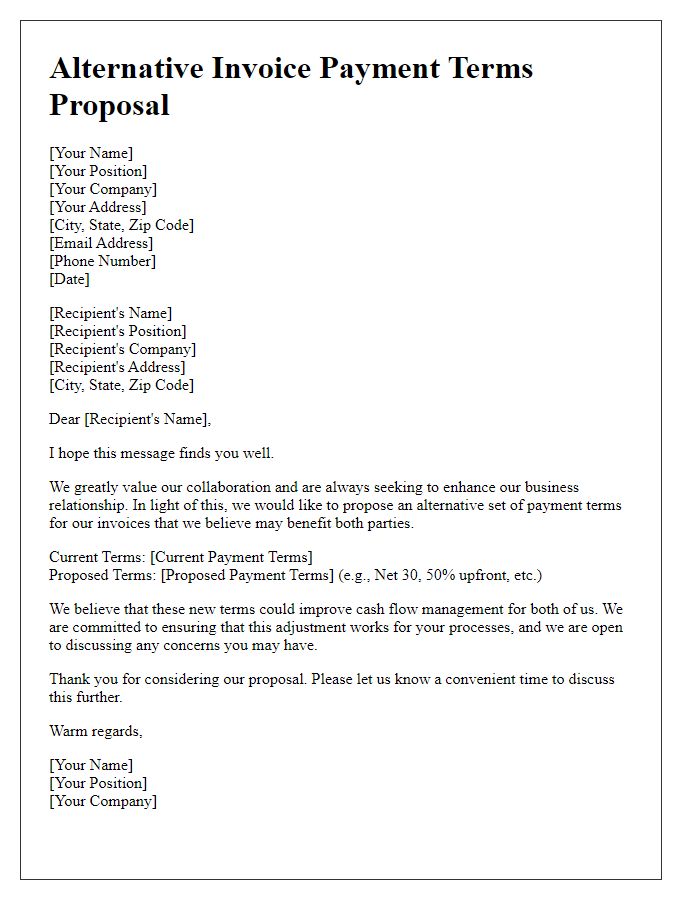

The recent update to payment terms affects invoices issued by businesses, notably impacting cash flow management. New payment terms, such as Net 30 or Net 60, represent the timeframe allowed for payment after invoice receipt. Companies like Square and PayPal implement these adjustments to enhance transaction efficiency and align with industry standards. These revised terms may necessitate adjustments in budgeting and financial planning for both suppliers and clients. Parties involved must remain vigilant regarding specific cutoff dates and any associated penalties for late payments, which can range from 1%-5% monthly, ensuring compliance and maintaining positive supplier relationships.

Contact Information for Queries

Businesses often need to adjust invoice payment terms to accommodate changing financial conditions or improve cash flow management. Prompt communication regarding these changes is crucial for maintaining positive relationships with clients. Contact information should include specific details such as the designated department handling payment inquiries, an email address for digital correspondence, and a direct phone line for immediate assistance. Clients should also be informed about the business hours during which queries can be addressed, ensuring timely responses. Providing clear contact information enhances transparency and fosters better communication between the business and its clients, reducing the chances of payment delays or misunderstandings.

Expression of Appreciation or Apology

Switching invoice payment terms can significantly impact cash flow management for businesses. A well-crafted communication expressing appreciation or apology can help maintain positive relationships between vendors and clients. In situations where changes occur, an acknowledgment of the current terms and clarification of the new conditions, such as transition to net 30 days or net 60 days, enhances transparency. Emphasizing the reason for the adjustment--such as changes in business strategy, economic factors, or operational needs--can foster understanding. Personal touches, such as recognition of the client's loyalty or partnership, further strengthen rapport. Additionally, offering a point of contact for any questions or concerns access can reassure clients during the transition.

Comments