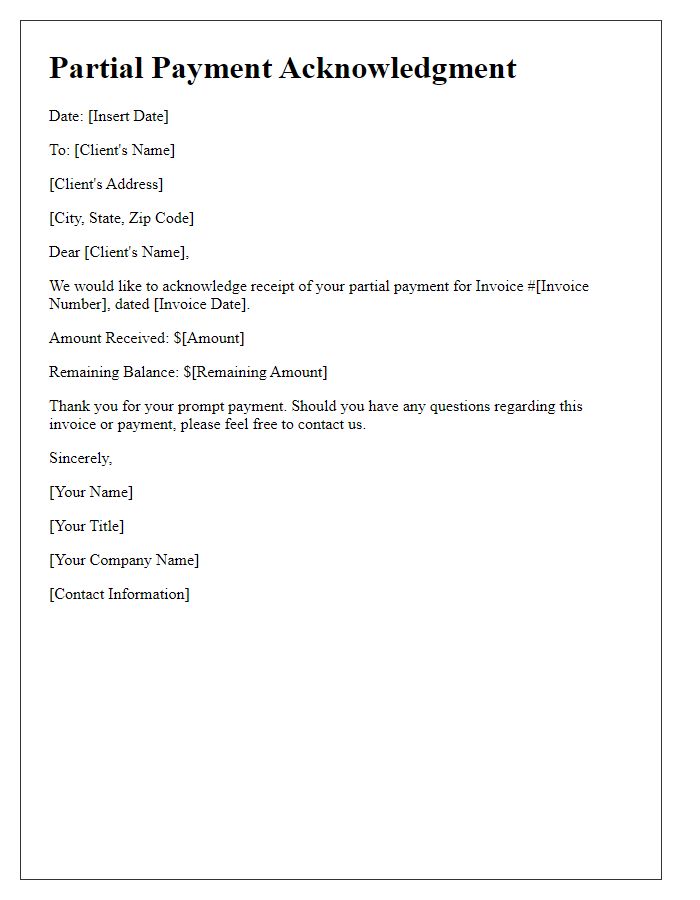

Are you facing challenges with partial payment invoices? You're not alone; many businesses find themselves navigating this tricky area of financial agreements. Crafting a clear and concise letter template for partial payment invoice agreements can help set the right expectations and maintain positive relationships with your clients. Dive deeper into this topic as we guide you through creating an effective template that suits your needs!

Payment terms and conditions

A partial payment invoice agreement outlines the payment terms and conditions relevant to a transaction involving a series of payments rather than a full upfront amount. This agreement typically specifies the total amount due, payment schedule, including specific installment dates, and accepted payment methods, such as electronic transfers or credit card payments. It emphasizes the responsibilities of both parties, ensuring timely payments to avoid late fees or penalties. Additionally, the agreement may detail the consequences of default, including potential legal actions or the suspension of services or products until payment is complete. Clear definitions of terms such as "default," "installment," and "services rendered" are essential for avoiding ambiguities. The agreement should also include contact information for invoicing inquiries and specify the governing laws of the jurisdiction where the transaction occurs, ensuring compliance with local regulations.

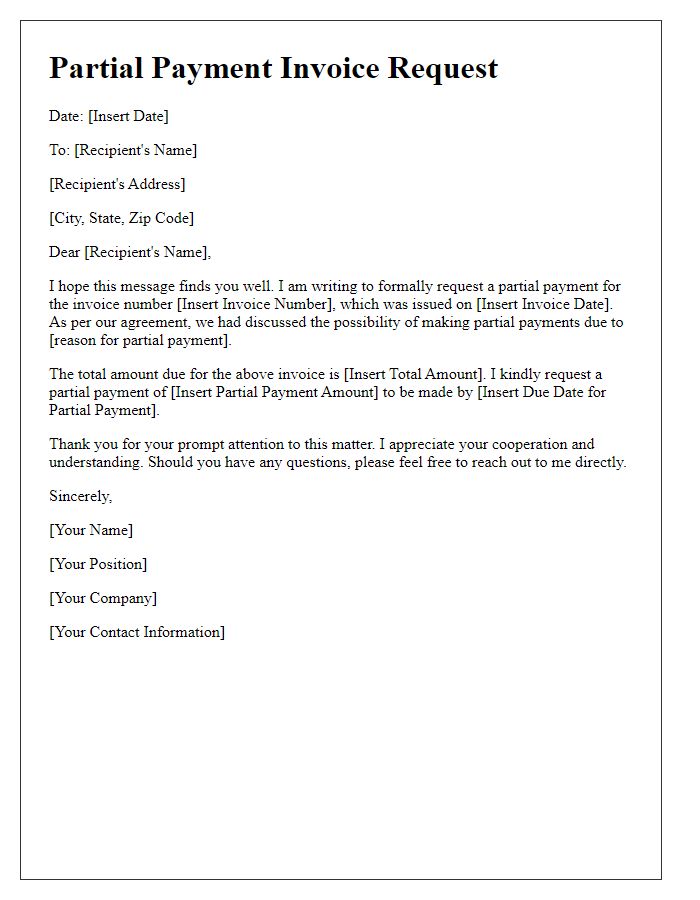

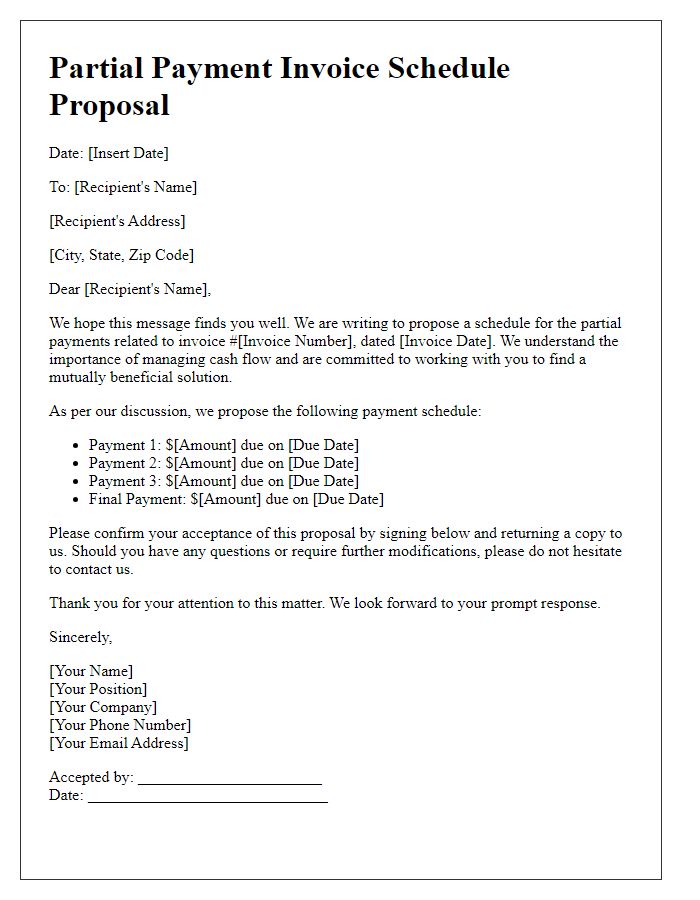

Due date and schedule

In the realm of financial management, a partial payment invoice agreement serves as a crucial document outlining the terms of payment for goods or services rendered. Industries, such as construction or freelance services, often utilize these agreements to facilitate cash flow stability. The due date typically specifies the final date by which payments must be completed, often detailed in specific terms like "30 days from invoice date" or a fixed date (e.g., December 15, 2023). Payment schedules may reveal milestones (30%, 40%, 30% breakdown) aligning with project phases or deliverable completion, ensuring both parties maintain clarity regarding outstanding balances and expectations. Clear definitions regarding late fees or penalties, usually expressed as a percentage (e.g., 2% per month), reinforce the significance of timely payments, safeguarding the financial interests of service providers.

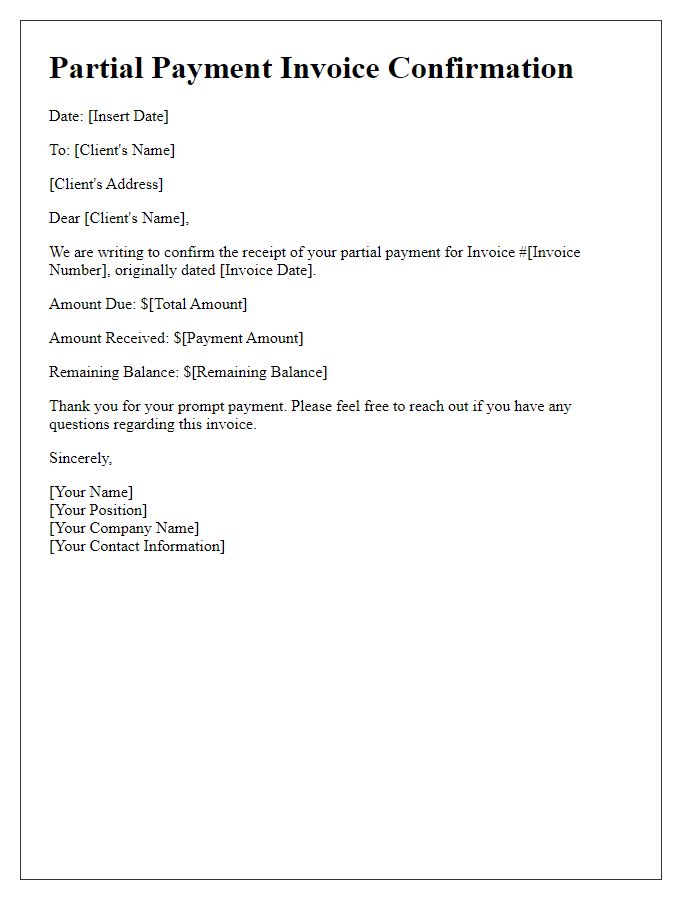

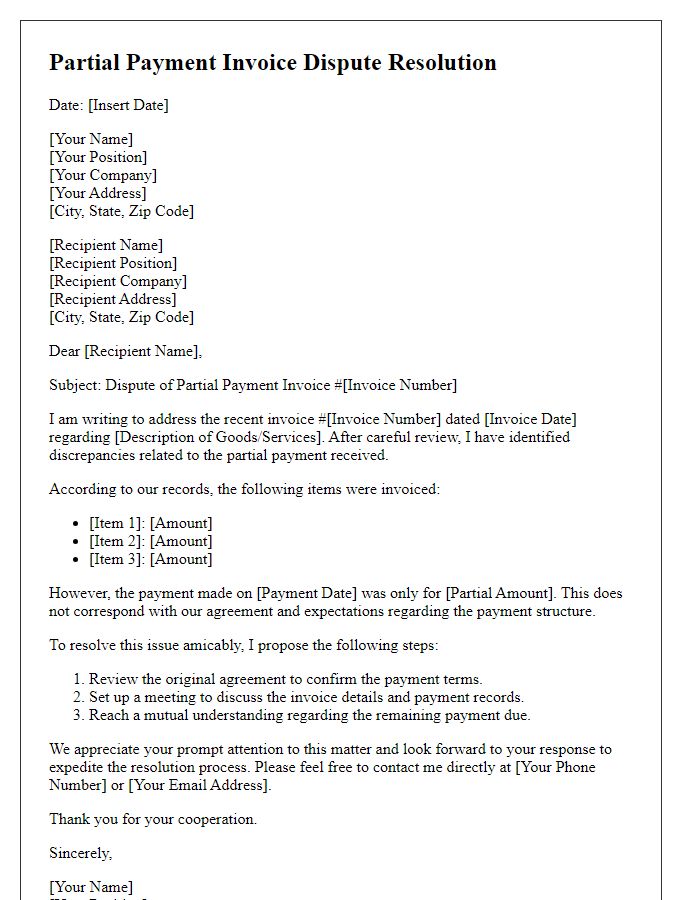

Penalties for late payment

A partial payment invoice agreement outlines terms where a debtor can make a reduced initial payment on an outstanding balance, often including stipulated penalties for late payments. Standard penalties may involve late fees calculated as a percentage of the overdue amount, typically ranging from 1% to 5% per month. Late payment penalties may also include interest rates exceeding typical credit card rates, potentially exceeding 20% annually. Additionally, the agreement should specify a grace period, commonly 15 to 30 days, before penalties are applied, ensuring transparency regarding timelines. Physical addresses where invoices are sent, due dates, and contact information for any inquiries should also be clearly noted to avoid confusion during the payment process. Legal jurisdictions may enforce specific rules regarding collection practices.

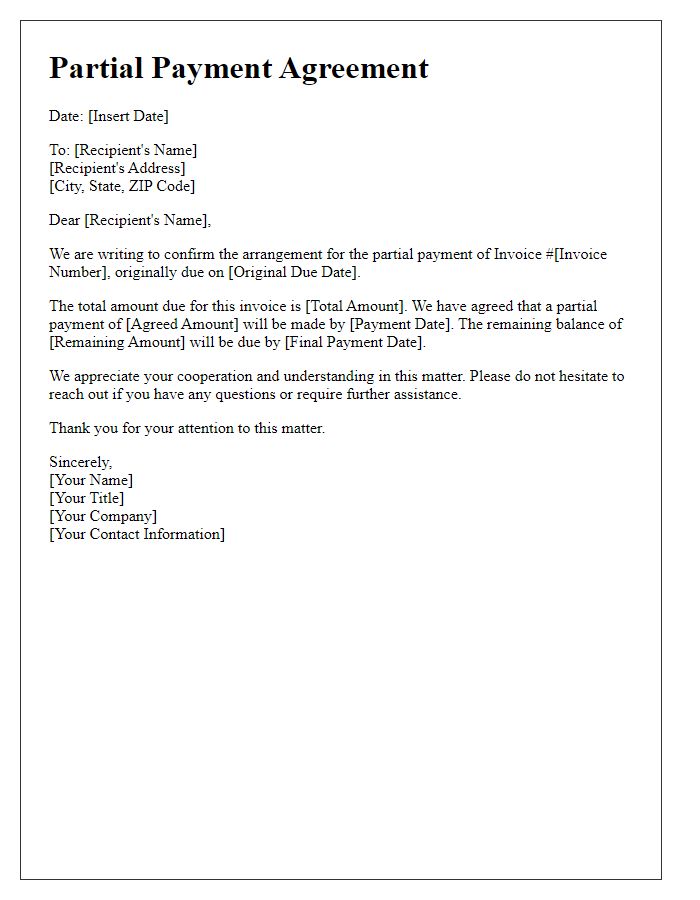

Payment methods accepted

Invoices for partial payment agreements often outline clear payment methods to facilitate transactions. Common accepted payment methods include bank transfers (often requiring routing numbers and account details), credit cards (Visa, MasterCard, American Express, typically processed via a secure payment gateway), PayPal (a popular online payment platform allowing quick transfers), and checks (which may require additional time for clearance). Each payment method should specify any associated fees, processing times, and necessary documentation, ensuring clarity and satisfaction for both parties in the agreement.

Contact information for inquiries

Inquiries regarding the partial payment invoice agreement can be directed to the finance department's dedicated email address, finance@companyname.com. For immediate assistance, please contact the hotline available at +1-800-555-0199 during regular business hours, Monday to Friday, from 9 AM to 5 PM (Eastern Standard Time). Additionally, customers can visit the corporate office located at 1234 Business St., Suite 100, Cityname, State, ZIP for face-to-face inquiries. Maintaining clear communication ensures a smooth transaction process and timely resolution of any payment-related concerns.

Comments