Are you struggling with overdue invoices and looking for a way to manage your cash flow more effectively? Creating a settlement plan for these outstanding payments can not only help you regain financial stability but also strengthen your relationships with clients. In this article, we'll explore practical strategies to craft a clear and compassionate letter template that communicates your terms while maintaining professionalism. Ready to dive in and discover how to make the process smoother for everyone involved?

Clear subject line

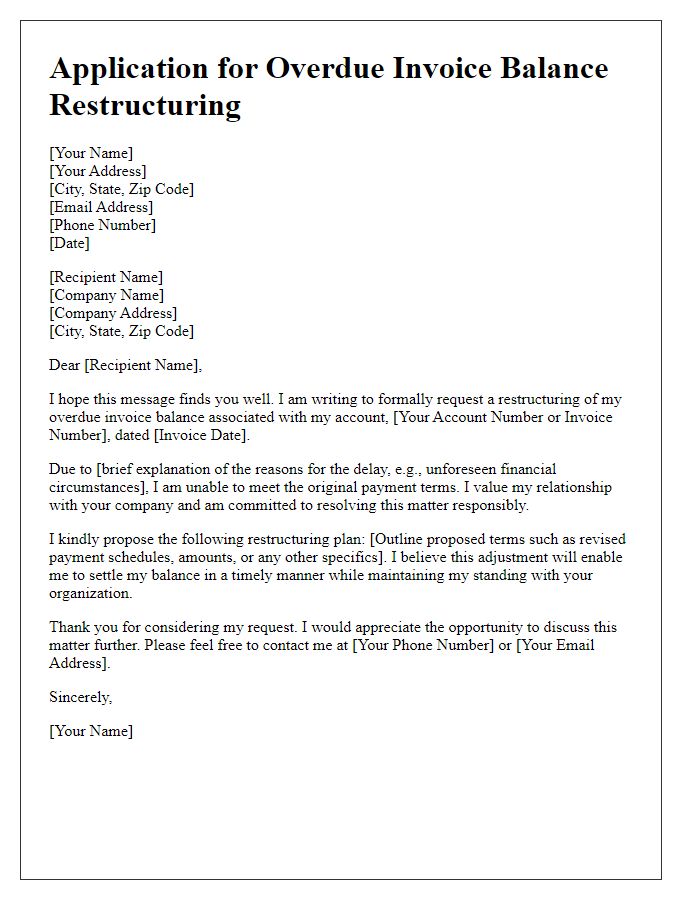

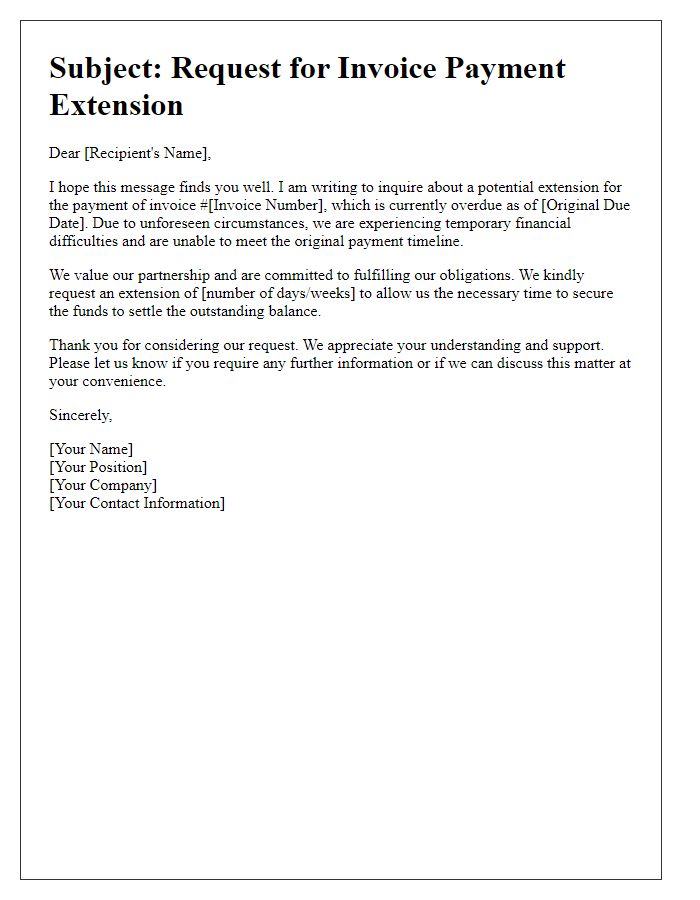

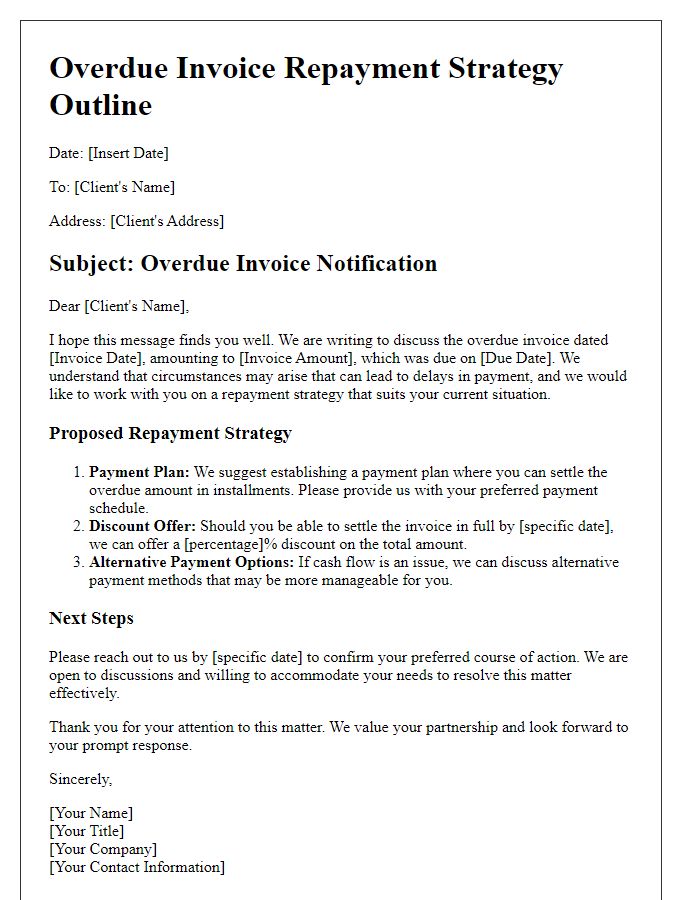

Overdue invoices can impact cash flow for businesses. An overdue invoice refers to a bill or payment request that has not been settled by the agreed due date, typically 30, 60, or 90 days after issuance. Effective communication regarding overdue invoices is crucial, often involving a formal letter or email. Clarity in subject lines, such as "Request for Overdue Invoice Settlement Plan," helps recipients understand the urgency and content of the message. Including specific invoice numbers, amounts due, and due dates ensures that all parties are aligned on the outstanding financial obligations, facilitating a more efficient resolution process. Maintaining a professional tone while outlining the next steps or offering flexible payment options can enhance the likelihood of a successful settlement.

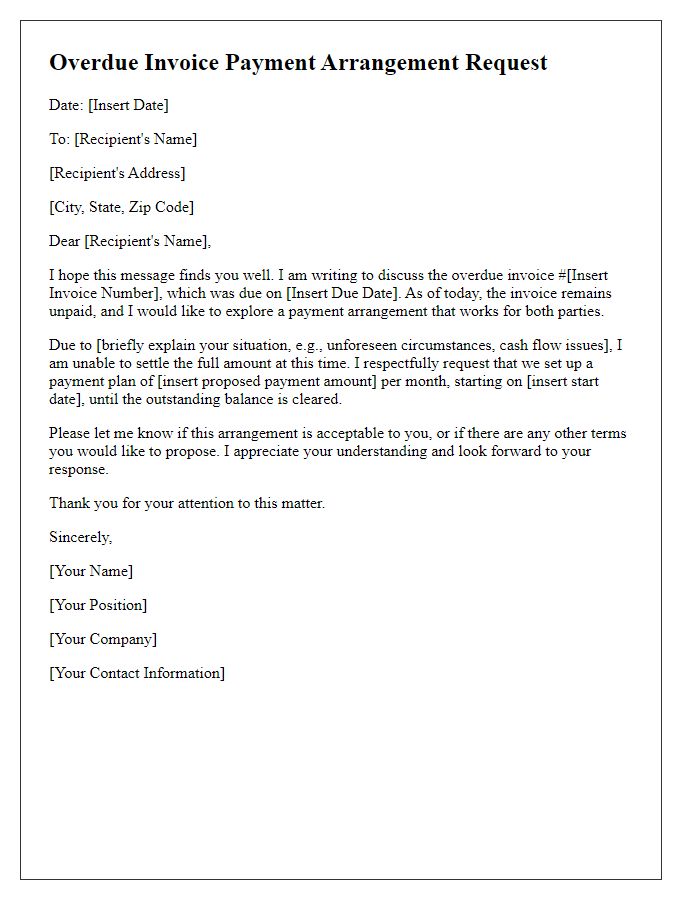

Polite opening and acknowledgement of the customer's situation

To maintain healthy cash flow, it is essential to manage overdue invoices effectively. An overdue invoice refers to an outstanding payment that has surpassed its due date, often leading to a strain in supplier-customer relationships. Engaging customers regarding their unique situations can foster understanding and encourage prompt payment resolutions. A polished invoice settlement plan should be clear about the original invoice amount, due date, and clear terms for repayment. Offering flexible payment options and personalized communication can also increase the chances of recovering outstanding debts, which might typically range from 30 to 90 days past due. At the same time, acknowledging the customer's financial difficulties with empathy and understanding helps reinforce a positive relationship, significantly aiding future transactions.

Specific details of the overdue invoice

An overdue invoice can significantly impact cash flow for businesses, especially when amounts exceed $1,000, such as Invoice #1542 dated June 15, 2023, for consulting services provided. The invoice remains unpaid beyond the 30-day period, triggering late fees outlined in the service agreement. Company XYZ, located at 123 Business Rd, Springfield, relies on timely payments to maintain operations and fulfill payroll obligations. As of August 15, 2023, this outstanding balance represents a financial strain, necessitating a structured settlement plan to facilitate payment without further delay. Payment options could involve installments over six months to alleviate immediate financial burdens, keeping the lines of communication open for a positive resolution.

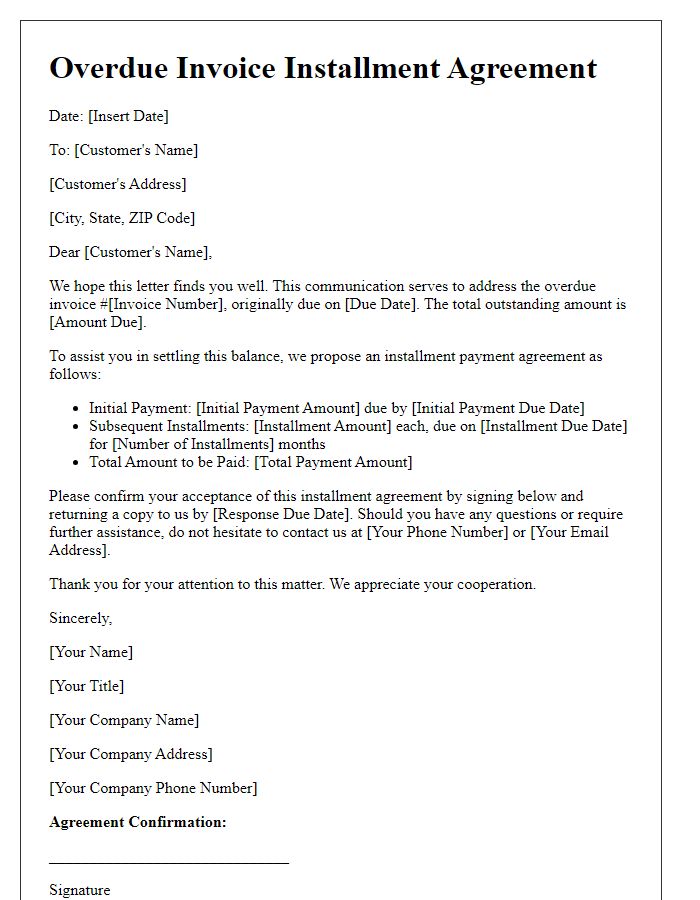

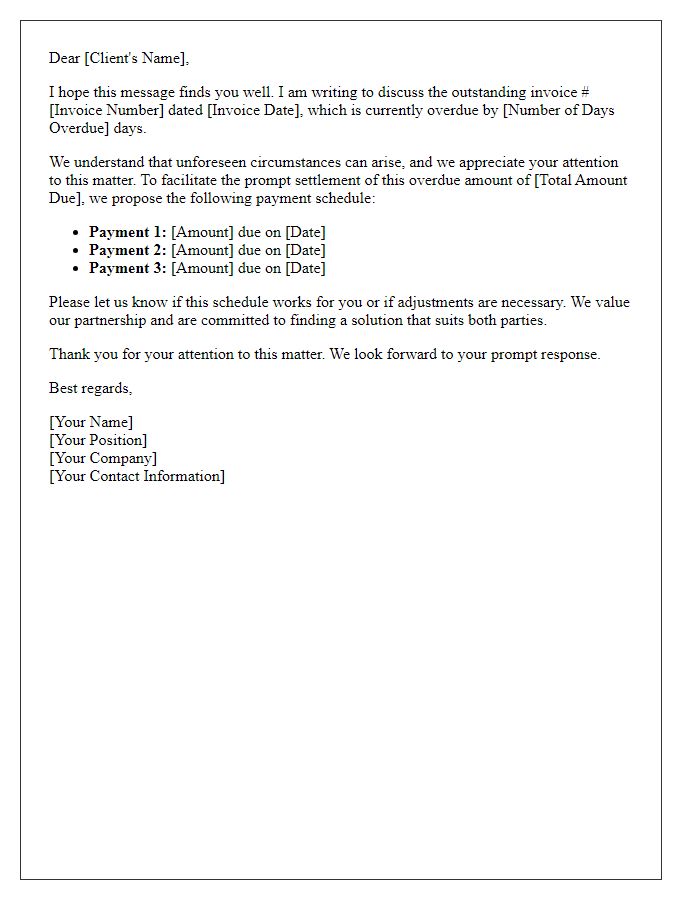

Outline of the proposed settlement plan

An overdue invoice settlement plan outlines a structured approach to resolving outstanding payments for services rendered or products delivered. This plan typically includes key details such as the total outstanding amount, which might amount to thousands of dollars, a proposed payment schedule, including specific dates (e.g., monthly installments beginning on the 15th of each month), and the preferred payment methods (e.g., bank transfer, credit card). It may also highlight any potential early payment discounts or penalties for late payments to incentivize promptness. Furthermore, clear communication channels are established for any queries regarding the invoice to ensure smooth transactions, often involving dedicated team members from the accounting department who oversee this process.

Contact information for further communication

Overdue invoices frequently arise in business transactions, affecting cash flow management for companies. Effective communication regarding payment plans can alleviate financial strain. Contact information, including an official email address (usually formatted as info@companyname.com) and a direct phone number (typically a regional area code followed by seven digits), is crucial for timely discussions. Businesses often assign dedicated account managers to handle overdue invoices, ensuring personalized assistance. Setting up a payment schedule, such as weekly or monthly installments, enhances the likelihood of settling the outstanding balance. However, transparent and consistent communication remains vital to maintaining positive client relationships throughout the settlement process.

Comments