We all know that life can sometimes throw unexpected challenges our way, impacting our usual routines. If you've recently encountered a delay in receiving an invoice from us, we genuinely apologize for any inconvenience this may have caused. Our team is committed to ensuring timely communication and accuracy, and we appreciate your understanding as we resolve this issue. Let's dive into some best practices for crafting effective apology letters and how to maintain strong client relationships moving forward.

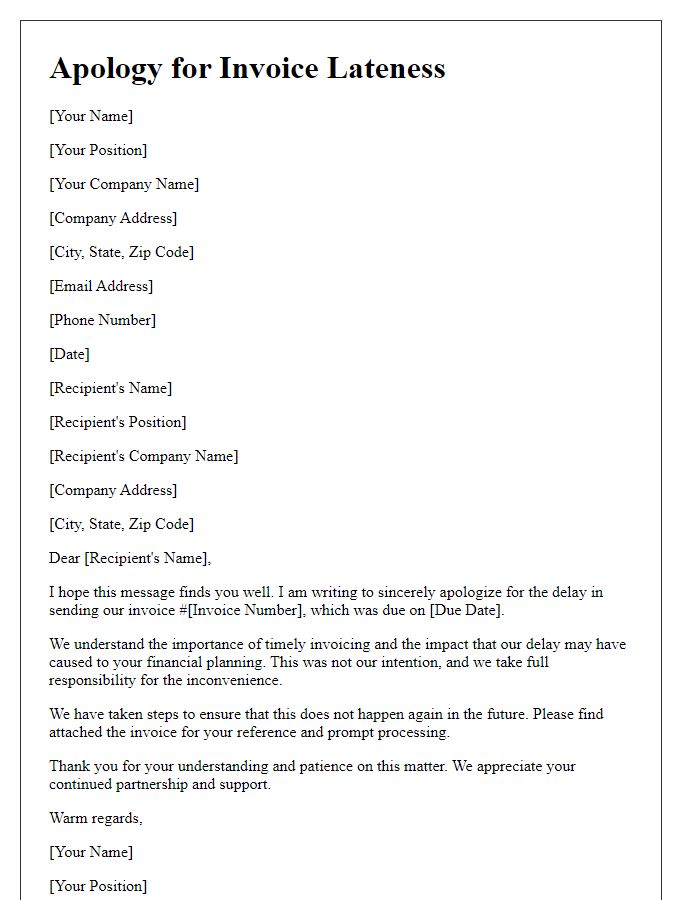

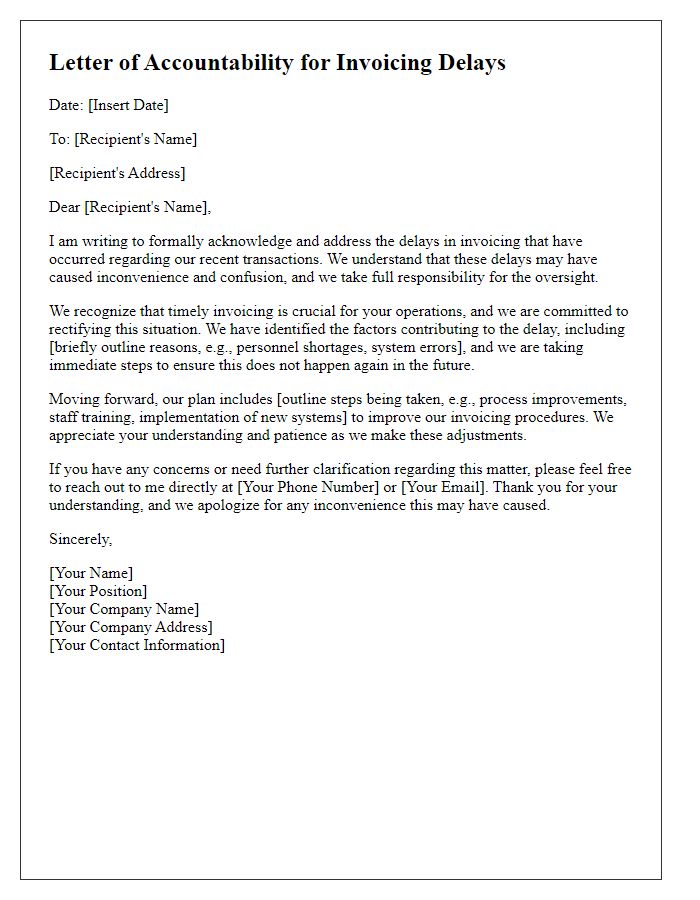

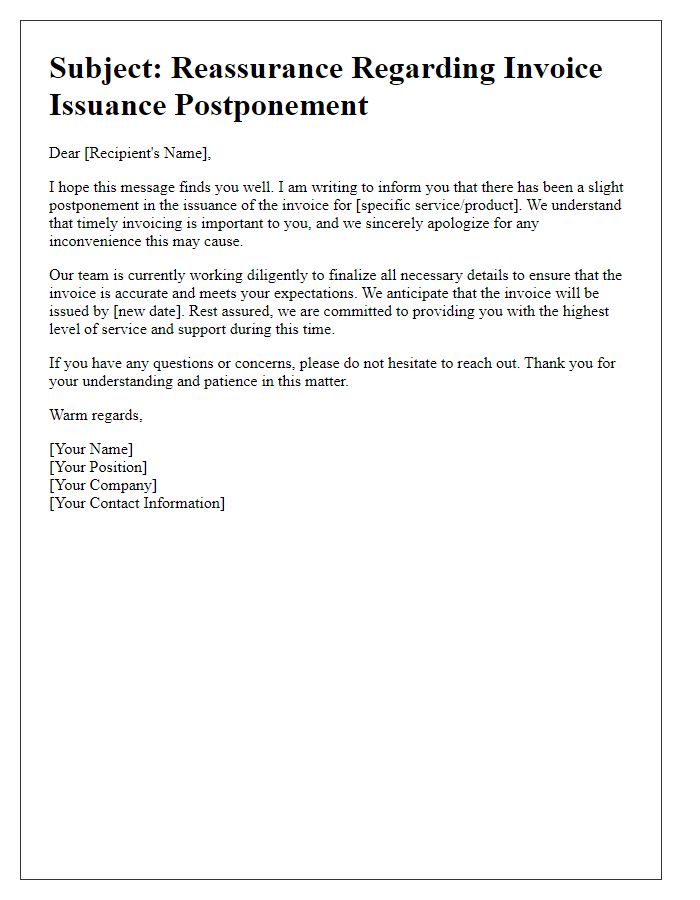

Professional Tone and Language

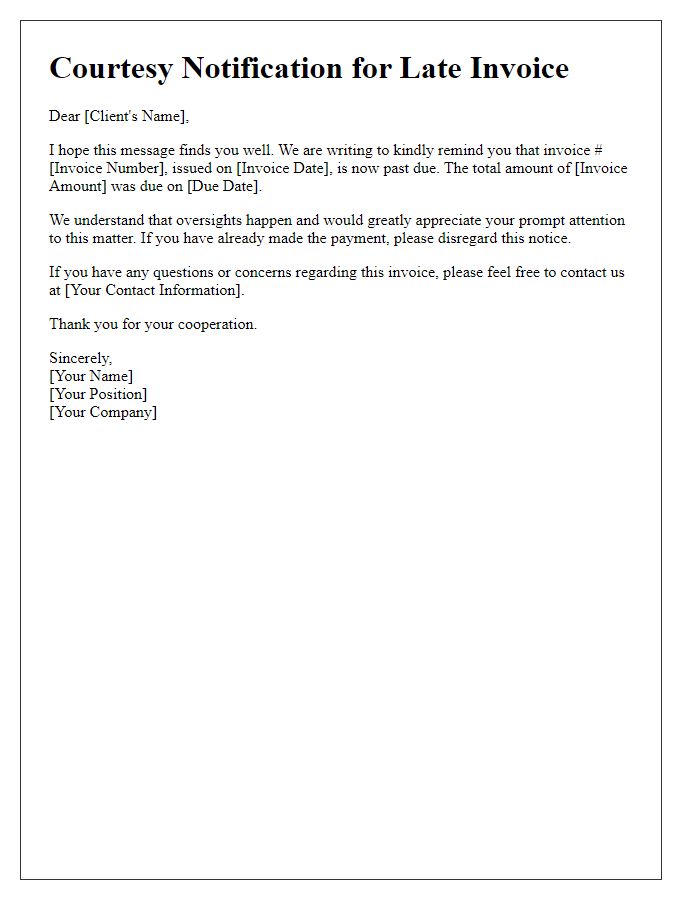

Delayed invoice issuance can impact cash flow for businesses, leading to financial strain. In some cases, such as those occurring in the technology sector or service industries, clients may experience inconveniences due to delayed payments. Timely invoice processing typically ensures that companies receive payments within a standard period of 30 days. However, unexpected delays can arise from administrative errors, software malfunctions, or miscommunication between departments. Prompt communication with clients regarding these delays is essential to maintain trust and professionalism in any industry, whether in retail, manufacturing, or consulting sectors. An apology for the inconvenience caused, along with reassurance of corrective measures implemented, can foster goodwill and facilitate smoother payment processes in the future.

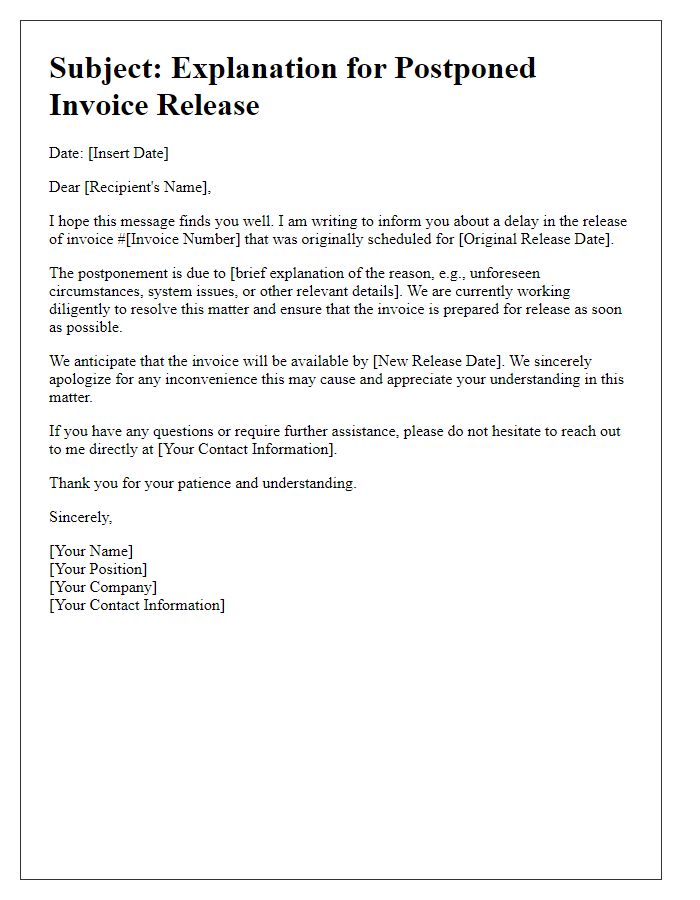

Clear Explanation of Delay

Delayed invoice issuance can create complications for both businesses and clients. Factors such as system errors, staffing shortages, or unexpected changes in business processes can impede timely billing. For example, if a software update leads to discrepancies in billing information, it may take additional time to reconcile accounts. In instances where staff turnover occurs, the transition may delay invoice generation as new employees require training. Compounding issues with communication breakdowns between departments can further extend the resolution time, resulting in unwanted delays for clients waiting to process payments. Understanding these dynamics can foster better relationships with clients, ensuring they are informed about any delays and assured that corrective measures are in place.

Acknowledgment of Impact

Delayed invoice issuance can disrupt business cash flow and strain vendor relationships. Invoices often serve as essential documents for financial planning and budget allocation, making prompt delivery crucial. Late invoices could result in payment delays, potentially affecting supplier transactions and ongoing projects. Businesses operating under tight financial margins (for instance, those in construction, retail, or service industries) may face heightened risks due to these disruptions. Apologizing sincerely for any inconvenience this delay may have caused can help to restore trust and reinforce partnerships. Acknowledging the specific impact, such as affecting payroll or project timelines, demonstrates empathy and understanding of the recipient's position.

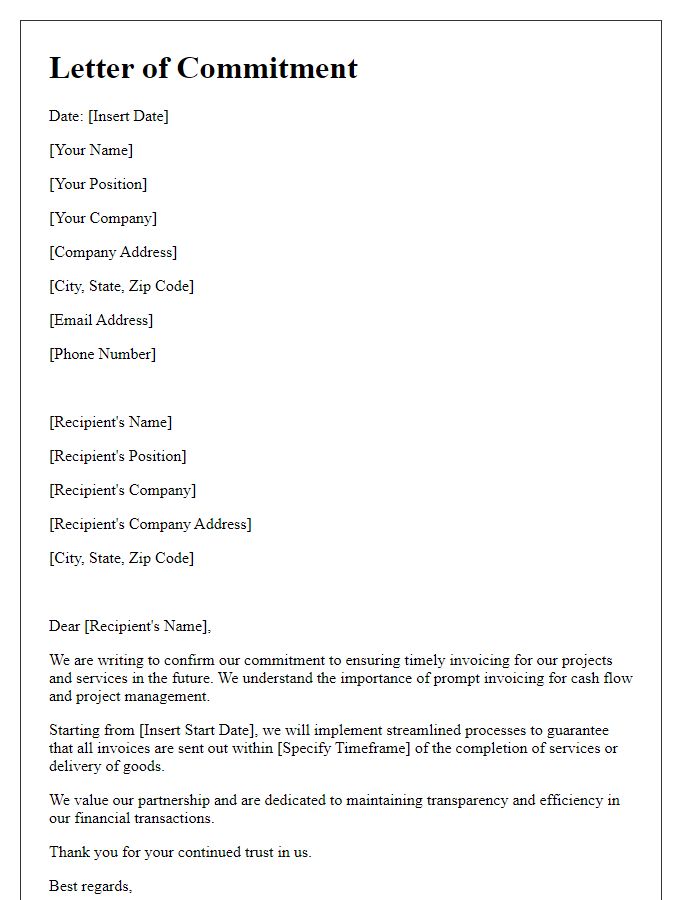

Assurance of Resolution

The delayed issuance of invoices can significantly impact financial operations, especially for businesses relying on timely payments. Recent studies show that late invoices account for over 30% of cash flow issues in small and medium-sized enterprises (SMEs). In situations concerning delayed invoices, companies must acknowledge the inconvenience caused to clients and assure them of prompt resolution. Implementing automated invoicing systems can enhance efficiency and reduce future delays. This commitment to improving processes, coupled with consistent communication regarding payment timelines, establishes trust and strengthens client relationships, as seen in best practices across various industries.

Contact Information for Further Assistance

Businesses often encounter situations where invoice issuance may be delayed, which can lead to inconvenience for clients. Timely communication is essential to maintain professionalism. Providing contact information ensures clients can seek assistance effortlessly. Include a clear phone number, such as (+1) 555-123-4567, and an email address, like support@businessname.com, for prompt responses. This information allows clients to resolve any concerns related to their invoices efficiently. Emphasizing available support channels reinforces the commitment to client satisfaction and transparency in financial transactions.

Comments