In the world of business transactions, ensuring invoice accuracy is crucial for maintaining strong relationships and healthy cash flow. It's not just about numbers; it's about trust and transparency between parties. Confirming the details of an invoice can save time, prevent disputes, and foster a smoother collaboration. To dive deeper into this essential practice and discover a simple template to streamline your invoice confirmation process, read on!

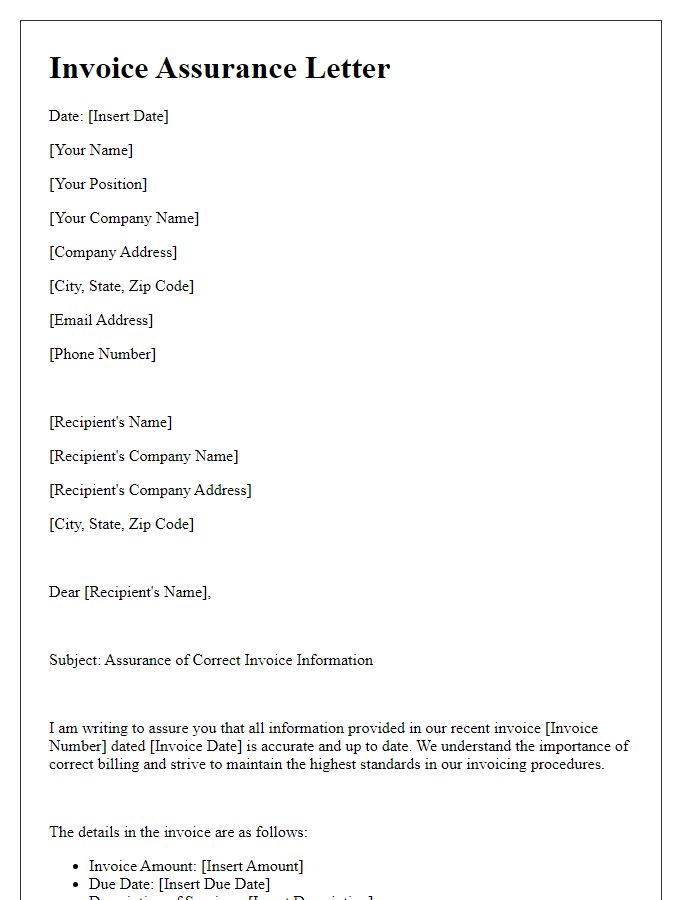

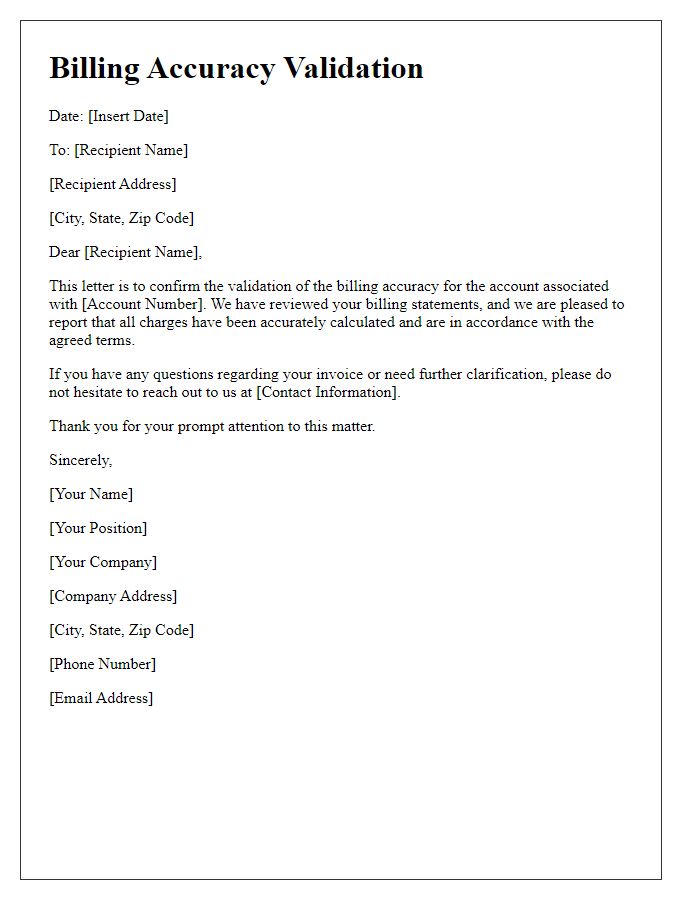

Company Details

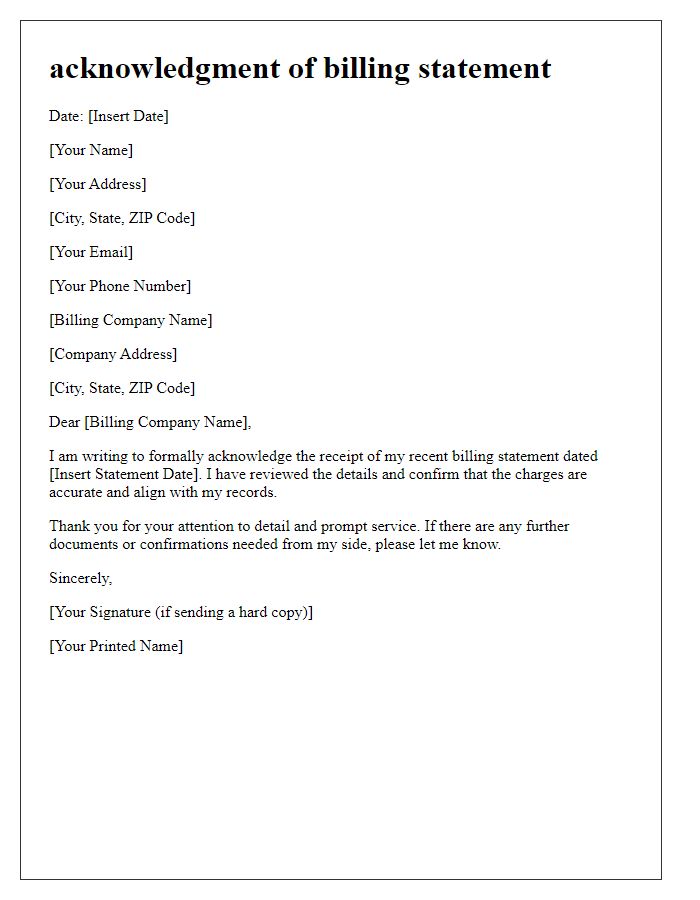

Accurate invoicing is essential for maintaining financial integrity in business transactions. Company details, including the name of the organization, tax identification number (TIN), address, and contact information, must be thoroughly verified for precision. Inaccuracies in these details can lead to delays in payment processing and potential legal complications. For example, a missing or incorrect TIN can result in tax compliance issues, while an incorrect address may prevent timely receipt of payment. Moreover, having accurate company details enhances professionalism and builds trust with clients, ensuring effective communication during the billing process.

Invoice Number

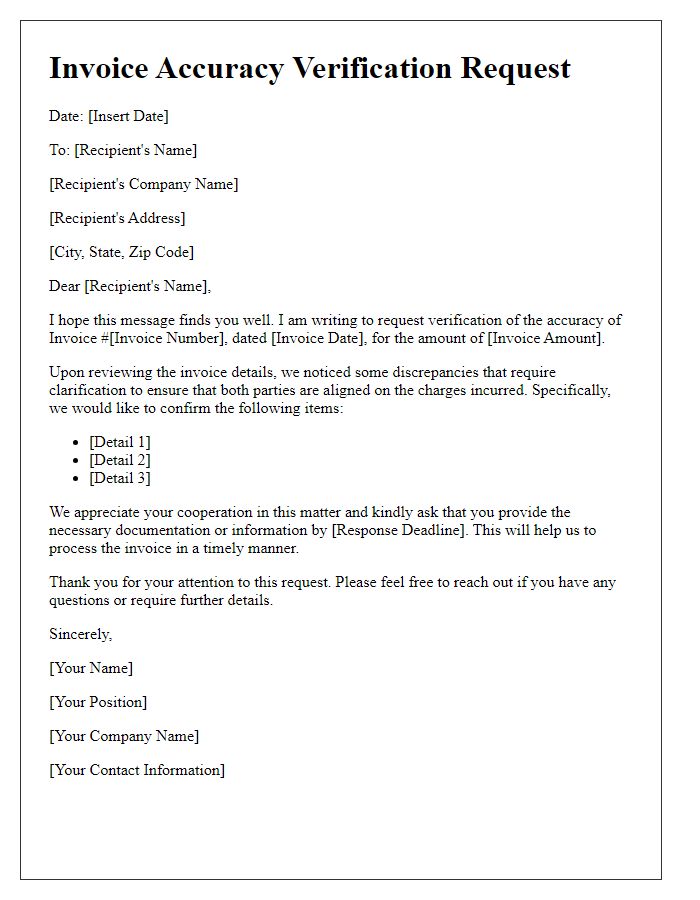

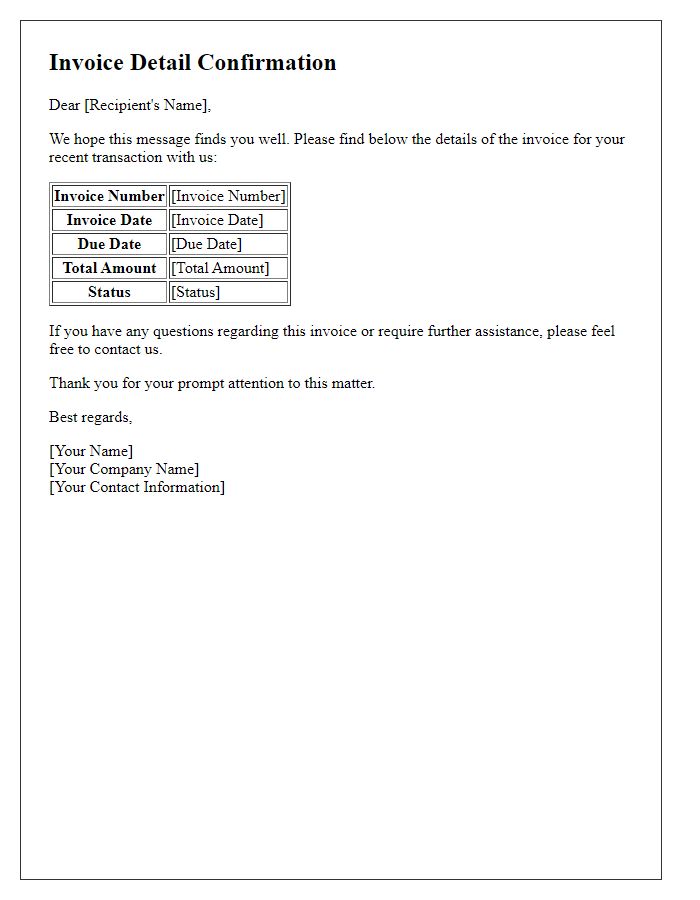

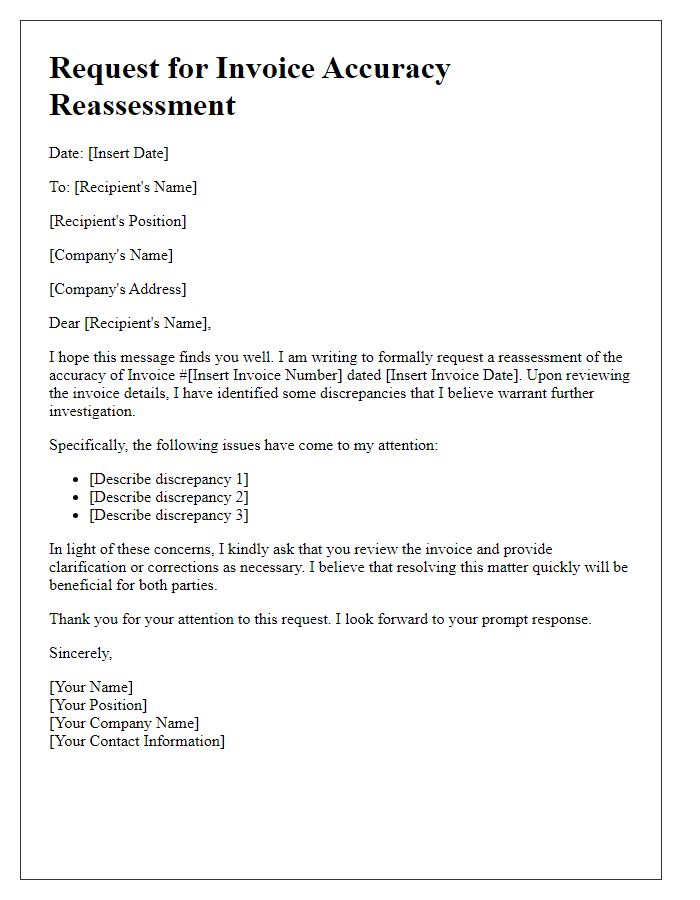

Invoice accuracy confirmation is crucial for maintaining financial integrity and transparent business transactions. The Invoice Number, a unique identifier assigned to each document, ensures precise tracking and referencing within accounting systems. Discrepancies in invoice amounts or services rendered can lead to delays in payment processing and can disrupt cash flow for companies. Clear communication regarding the invoice details, including line items, totals, and payment terms, is essential during this confirmation process. A structured approach to confirming accuracy can significantly enhance vendor relations and foster trustworthiness in financial dealings.

Itemized List of Services/Products

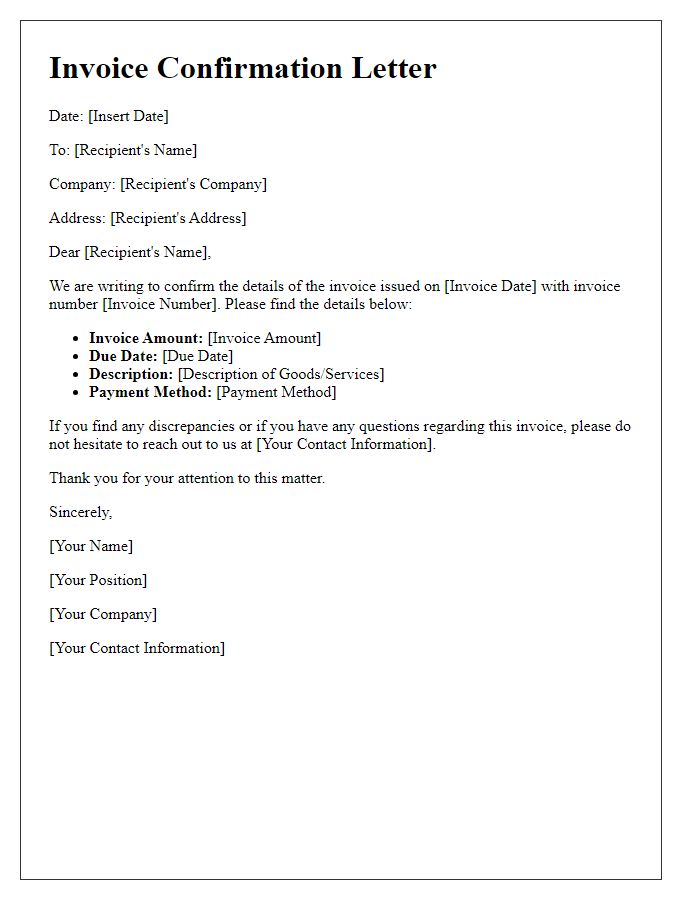

Accurate invoices play a crucial role in financial record-keeping and facilitating smooth transactions in businesses. An itemized list of services or products should include precise descriptions, quantities, and unit prices to ensure transparency between vendors and clients. Each entry may denote specific services, such as graphic design for branding (e.g., logo creation), consulting services (e.g., hourly rate), or tangible goods like office furniture (e.g., ergonomic chairs). Detailed information prevents misunderstandings and disputes post-invoice submission. Regular reviews of pricing agreements and service contracts help maintain accuracy in future invoices, which is essential for fostering trust and long-term business relationships.

Payment Terms and Methods

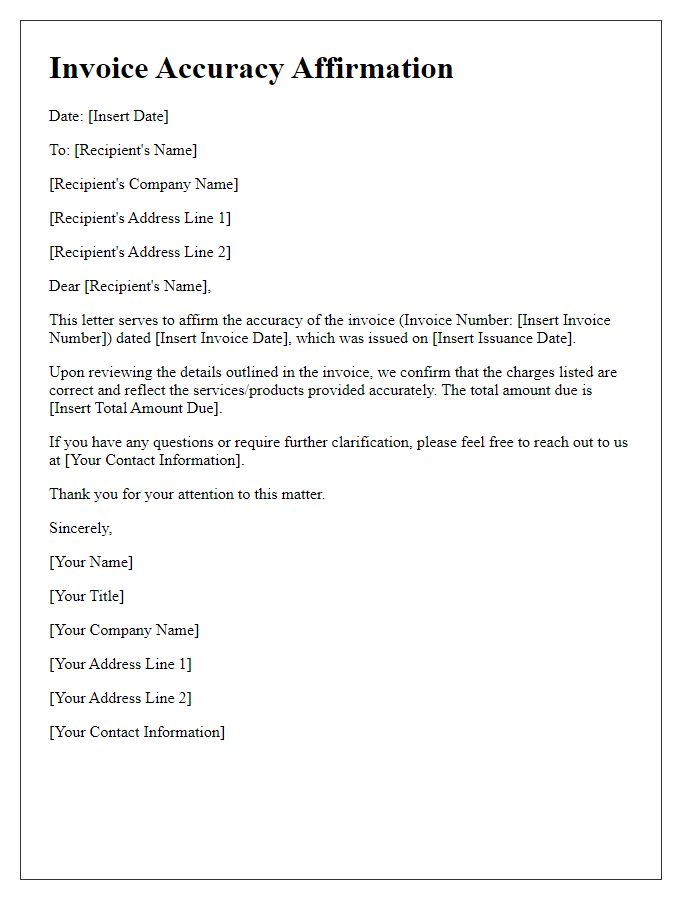

Ensuring accurate confirmation of payment terms and methods is crucial for the smooth processing of invoices within business transactions. Payment terms, such as Net 30 or Net 60, define the period in which the full payment must be made, establishing a clear deadline for financial obligations. Payment methods, including bank transfers, credit cards, or digital wallets like PayPal, offer various options for settling invoices. Precise alignment of these details with accompanying documentation promotes transparency and decreases the likelihood of disputes. Furthermore, accurate information regarding any early payment discounts or late fees enhances clarity, ultimately facilitating prompt and correct payments.

Contact Information for Queries

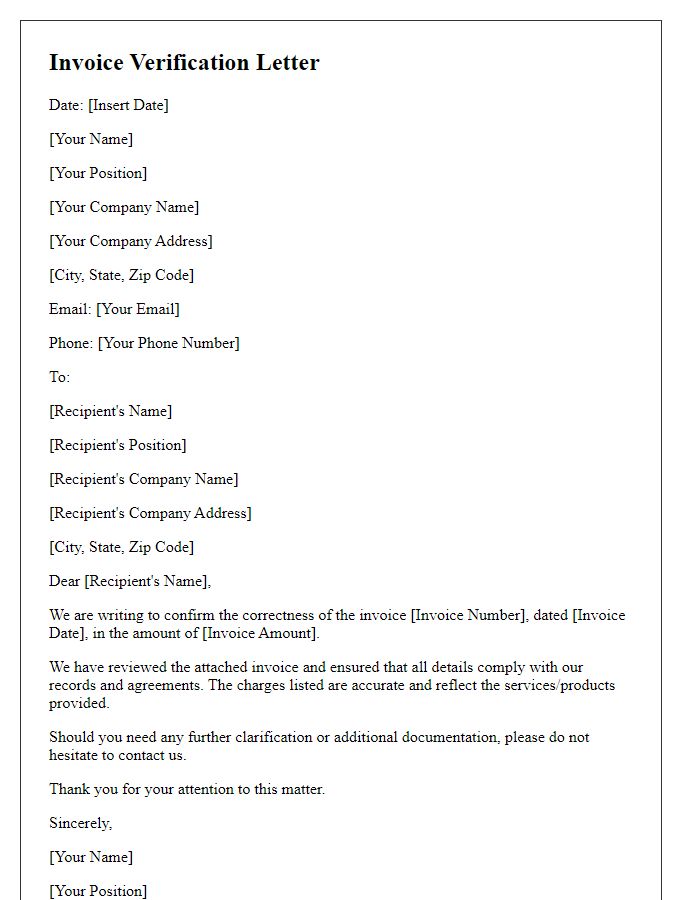

Contact information plays a crucial role in facilitating efficient resolution of queries regarding invoice accuracy. Businesses often include specific details such as a dedicated email address (e.g., billing@company.com) and a direct telephone line (e.g., +1-800-555-0199) for this purpose. Including the name of the billing department manager (e.g., John Doe) adds a personal touch, enhancing trust and clarity. Availability hours (e.g., Monday to Friday, 9 AM to 5 PM EST) ensure that clients know when they can expect timely assistance. Also, adding physical mailing addresses (e.g., 123 Business Rd, City, State, ZIP) can provide an alternative communication method, which can be critical for formal correspondence and documentation.

Comments