Have you ever experienced the headache of sorting through invoices that don't quite add up? It's a common challenge for businesses and freelancers alike, often leading to confusion and delayed payments. That's why having a clear and effective invoice verification request letter can save you both time and effort. If you're looking to streamline your invoicing process, keep reading for a practical template that will help you communicate your needs effectively!

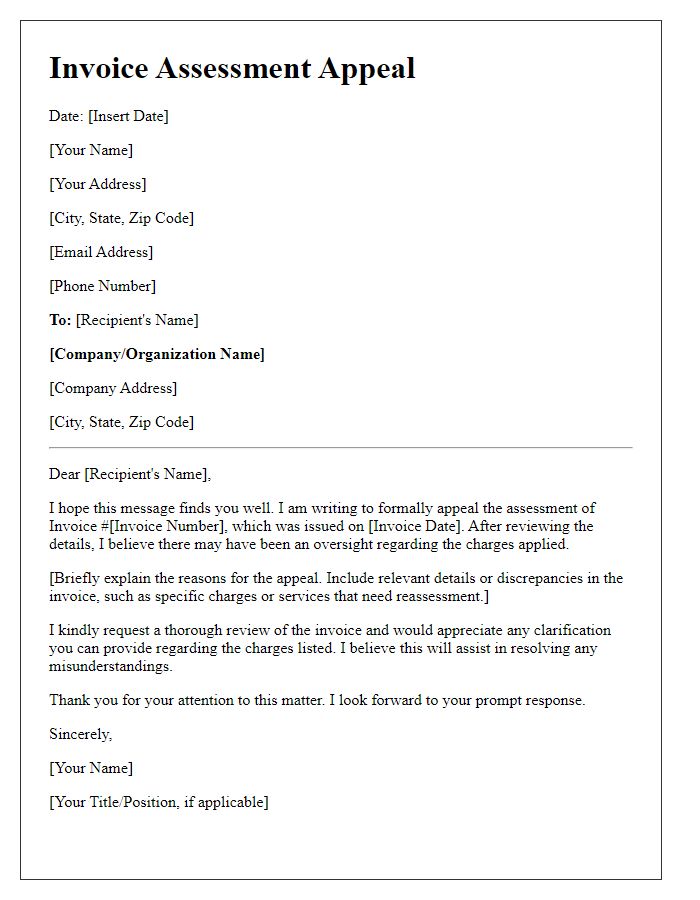

Sender and recipient contact information

An invoice verification request typically includes essential contact information for both the sender and recipient to facilitate clear communication and ensure the request is processed efficiently. The sender's contact details should include the business name, address, phone number, email address, and possibly a contact person's name to establish a point of communication. The recipient's contact information should similarly feature the company name, address, primary phone number, and email address to confirm they receive the request. Including an invoice number or reference code related to the transaction will aid in quick identification and verification of the invoice in question, expediting any necessary inquiries or resolutions.

Invoice details (number, date, amount)

The invoice with the identification number 123456, dated October 5, 2023, shows a total amount of $1,250.00. This document must be verified for accurate processing and record-keeping purposes. Validation ensures the alignment of services rendered to the billed amount, preventing potential discrepancies in financial reporting. Accurate invoicing is crucial for maintaining healthy business relationships and ensuring timely payment from clients or vendors. It is essential to confirm that all details match the contractual agreements established.

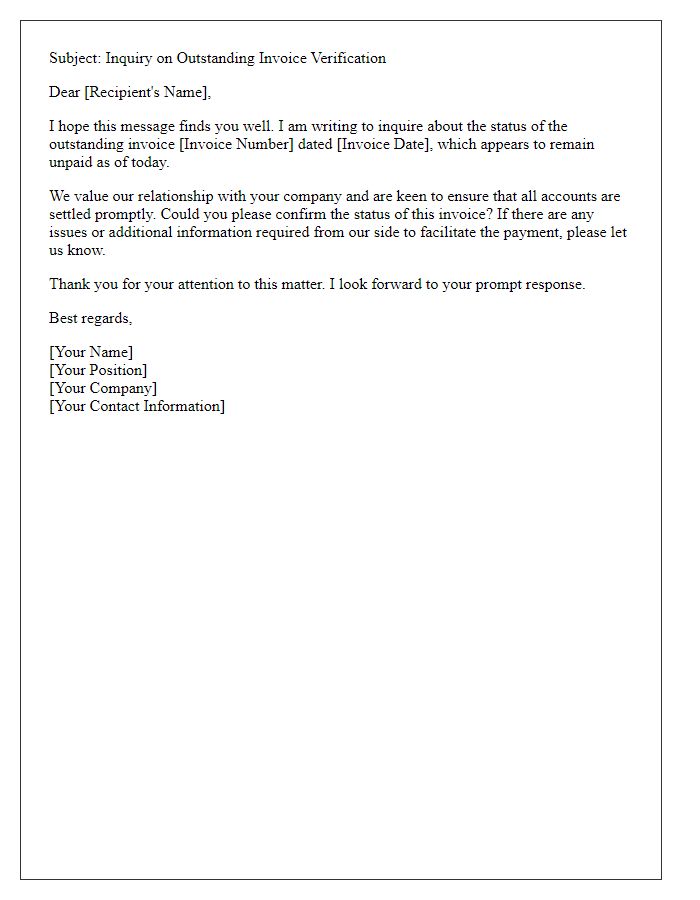

Reason for verification request

When businesses submit invoices for services or products, they sometimes require verification to ensure accuracy and authenticity. This verification request may arise due to discrepancies in billed amounts, incorrect dates of service, or lack of supporting documentation. For example, an invoice amount may appear unusually high compared to previous billings from the same vendor, prompting a review of the charges. Additionally, verification might be necessary when invoices lack references to purchase orders (PO), thereby complicating the approval process. Accuracy in these transactions is crucial as businesses aim to maintain strong relationships with vendors while ensuring financial integrity and compliance with accounting standards.

Supporting documentation or attachments

An invoice verification request requires supporting documentation to ensure accuracy and transparency. Key documents include original invoices detailing services rendered or goods delivered, which should specify the date, description, and amount. Additionally, purchase orders, if applicable, should match the invoices to verify agreement in terms of quantity and price. Supply chain documents, such as shipment tracking information or delivery receipts, can further substantiate claims made in the invoice. Any prior correspondence involving negotiations or agreements aids in clarifying expectations. Comprehensive documentation allows for efficient verification, ensuring proper financial processing and preventing discrepancies.

Contact details for further communication

In order to ensure accurate processing of invoices, it is essential to provide contact details for further communication regarding any verification inquiries. This includes a designated contact name (preferably the accounts payable manager or financial officer), their phone number (including area code for clarity), and email address (for quick, written correspondence). Additionally, a physical address for the business office may be included to facilitate any required documentation or correspondence. Clear communication is critical to resolve any discrepancies promptly and maintain healthy business relationships.

Comments