Have you ever found yourself sifting through mountains of paperwork, trying to reconcile a missing invoice? It can be a frustrating experience, especially when your accounts just don't seem to balance. In this article, we'll explore a straightforward letter template that will help you communicate efficiently with your vendors and streamline the reconciliation process. So, if you're ready to take the stress out of missing invoices, read on for some practical tips!

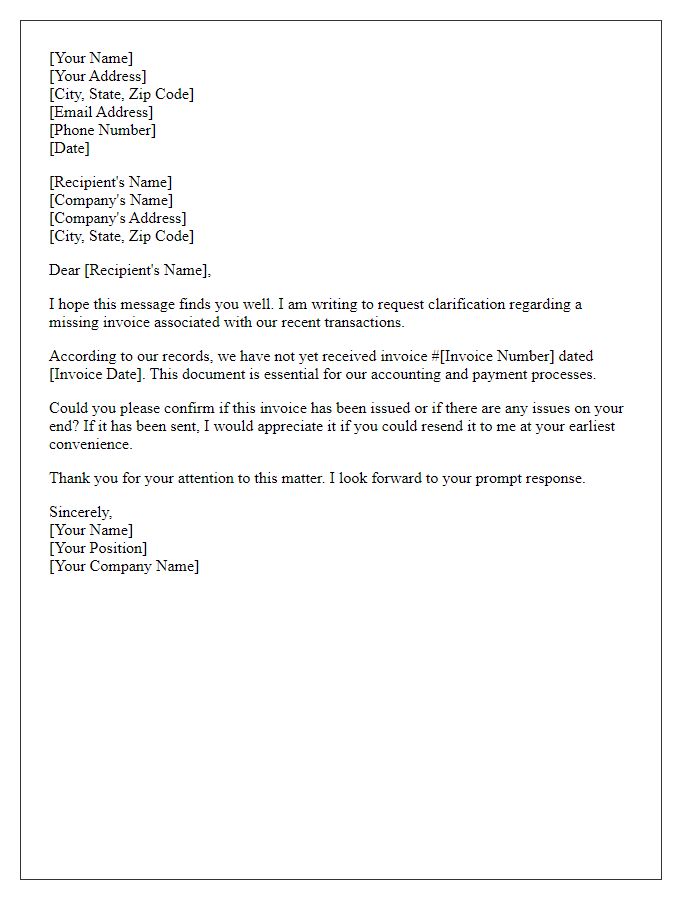

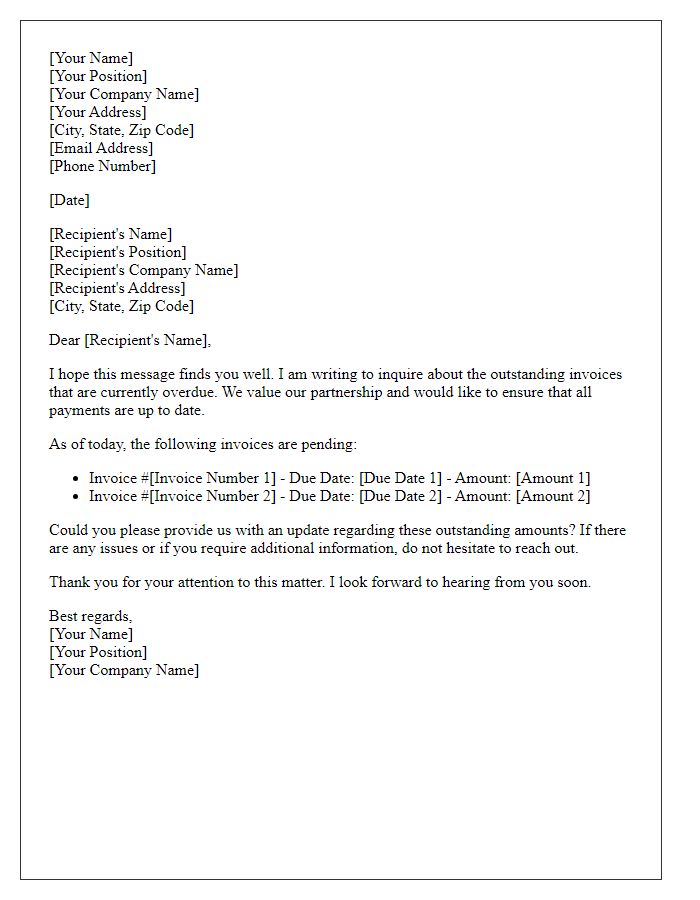

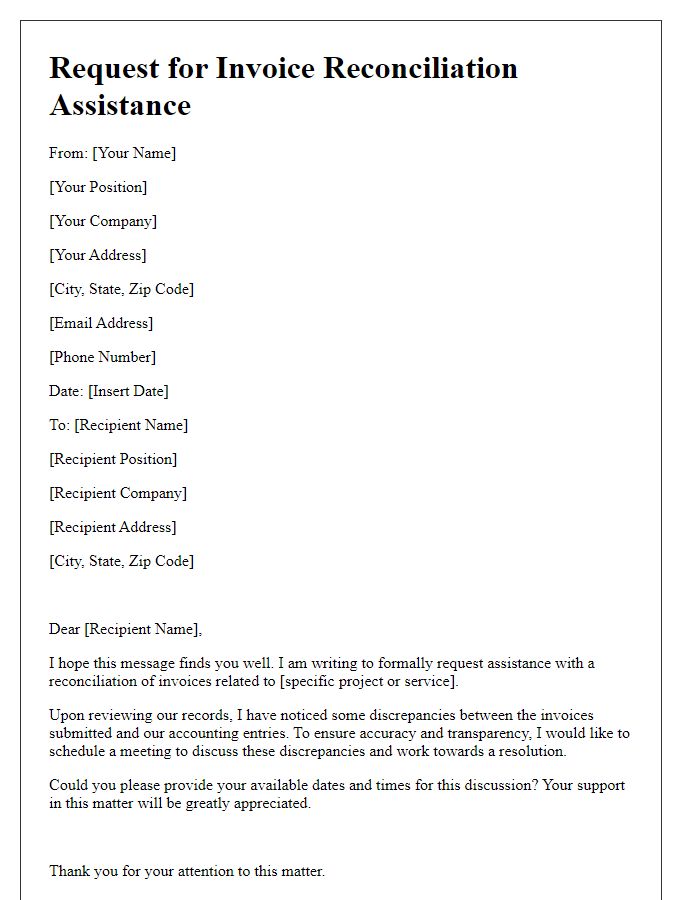

Clear Identification Details

Missing invoice reconciliation requires clear identification details to ensure accurate tracking within financial systems. Invoice number (a unique identifier assigned to each transaction) should be boldly listed for reference. Dates (issuance date and due date) are crucial, typically formatted as month/day/year for clarity. Vendor name (the business providing goods or services) must be clearly stated, alongside contact information, to facilitate follow-up. Payment terms (the conditions under which payment should be made, e.g., Net 30 or Due on Receipt) should be outlined, as they impact cash flow analysis. Also, including the total amount due, broken down into line items (specific charges or costs), provides transparency in the reconciliation process for ensuring all financial records align correctly.

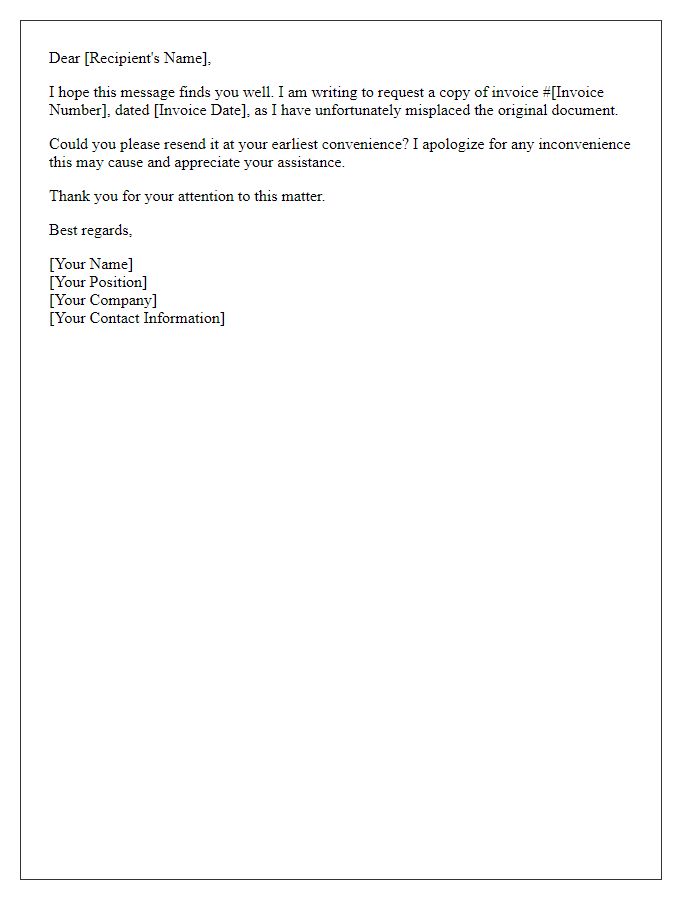

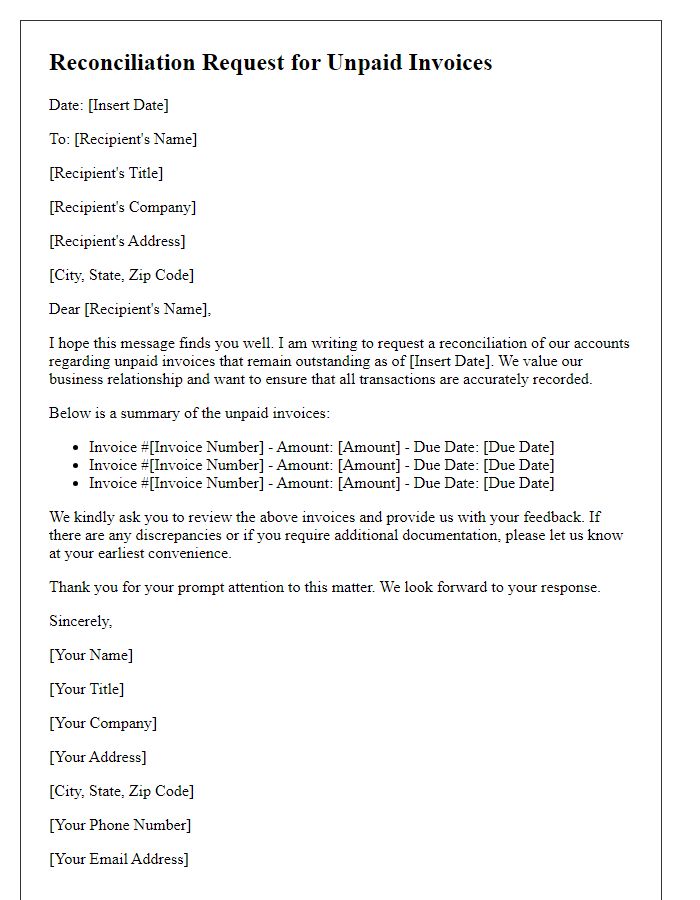

Detailed Invoice Description

A detailed invoice reconciliation process involves analyzing and matching financial statements to ensure all transactions are accurately recorded and accounted for. Missing invoices can disrupt this process, leading to discrepancies in accounting records. The invoices should contain critical details such as Invoice Number (unique identifier for each transaction), Date of Issue (when the invoice was generated), Total Amount Due (the financial obligation owed), Line Item Descriptions (specific details on products or services sold), Payment Terms (conditions under which payment is expected), and Vendor Information (contact details and tax identification number). In cases of missing documentation, businesses may face challenges in tracking expenses, leading to potential cash flow issues and difficulties in vendor relationships. Conducting regular reconciliations (monthly or quarterly) can enhance accuracy and prevent such discrepancies in financial reporting.

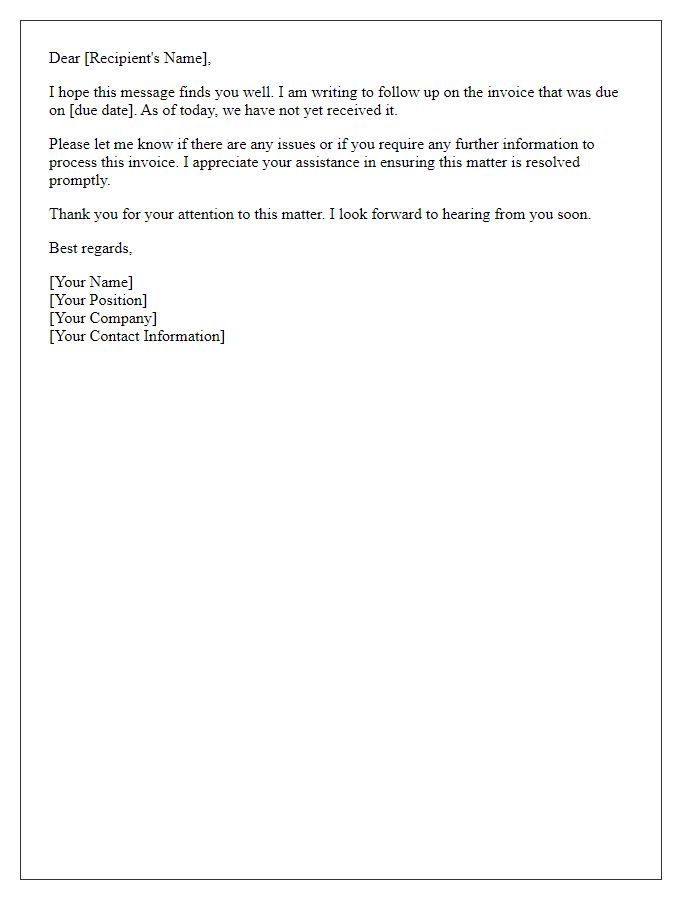

Reconciliation Request

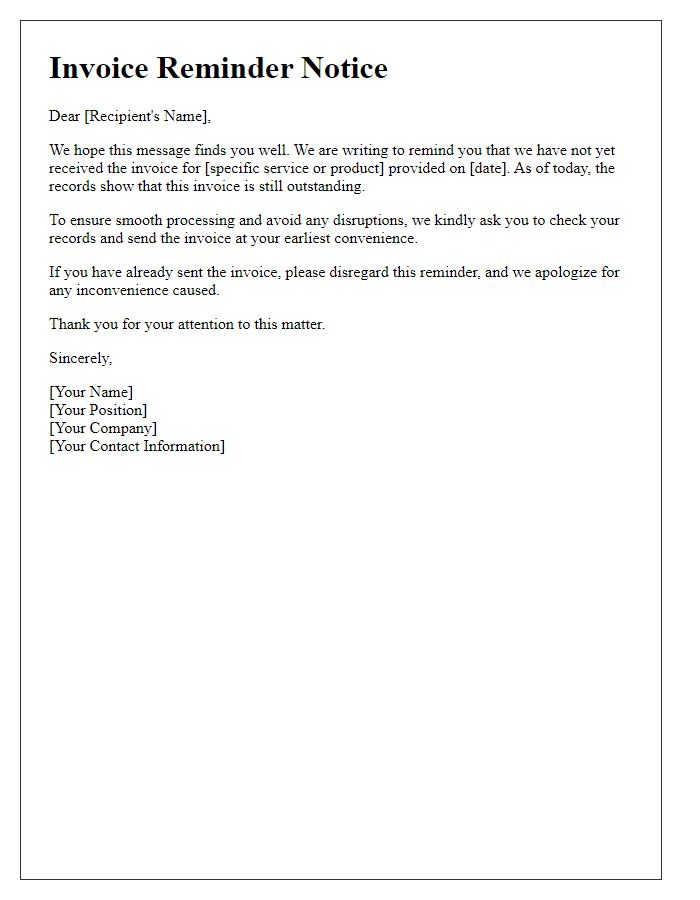

In cases of missing invoice reconciliation, organizations often experience disruptions in financial clarity. Accurate record-keeping ensures that all transactions, such as payments and receipts, align with corresponding invoices, like those from suppliers or service providers. Incomplete documentation, including missing invoices (common in industries like construction or retail), can lead to discrepancies during audits. Promptly addressing these issues can involve reaching out to departments or partners to locate missing documents. Maintaining comprehensive records assists in resolving payment disputes, avoiding potential penalties, and fostering transparent relationships with stakeholders.

Contact Information

Missing invoices can lead to discrepancies in financial records for businesses. Invoice reconciliation, a critical accounting process, ensures all transactions are accurately documented and accounted for. Specific details such as invoice numbers, dates, and amounts must match between vendor statements and internal accounts, often requiring thorough cross-checking. Contact information, including email addresses and phone numbers, is vital for effective communication with vendors, ensuring prompt resolution of discrepancies. Efficient reconciliation processes can prevent cash flow issues and maintain healthy business relationships.

Professional Tone and Formatting

Requesting missing invoices can impact financial accuracy and timely reconciliations. In organizations, like accounting firms or corporate finance departments, discrepancies often arise. For instance, missing documentation could delay the month-end closing process, potentially affecting revenue recognition. It is crucial to identify invoices, such as invoice number 12345 issued on January 15, 2023, that have not been received. This oversight complicates accounts payable and risks penalties or late fees. Following up promptly ensures continued supplier relationships and maintains accurate financial records. Employing a structured follow-up approach enhances communication, ensuring all parties are aligned on outstanding balances.

Comments