Are you feeling overwhelmed by a disputed chargeback invoice? You're not alone; many businesses face similar challenges when dealing with chargebacks, and navigating this process can be daunting. It's essential to respond effectively to ensure your concerns are heard and addressed. To help you tackle this issue head-on, we've put together a detailed guide with a customizable letter template that simplifies your responseâkeep reading to discover how to handle those pesky chargeback disputes!

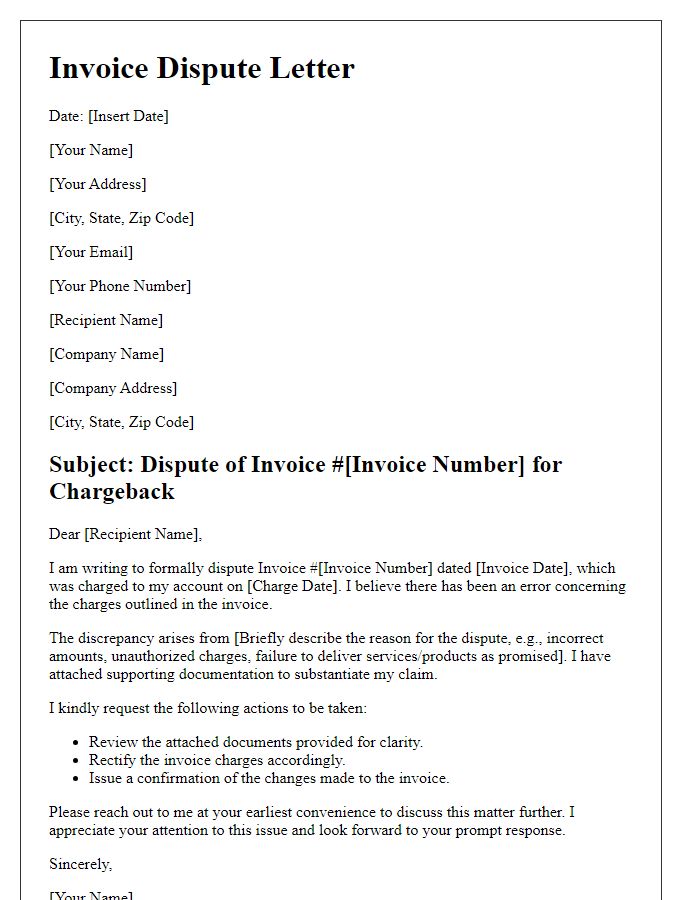

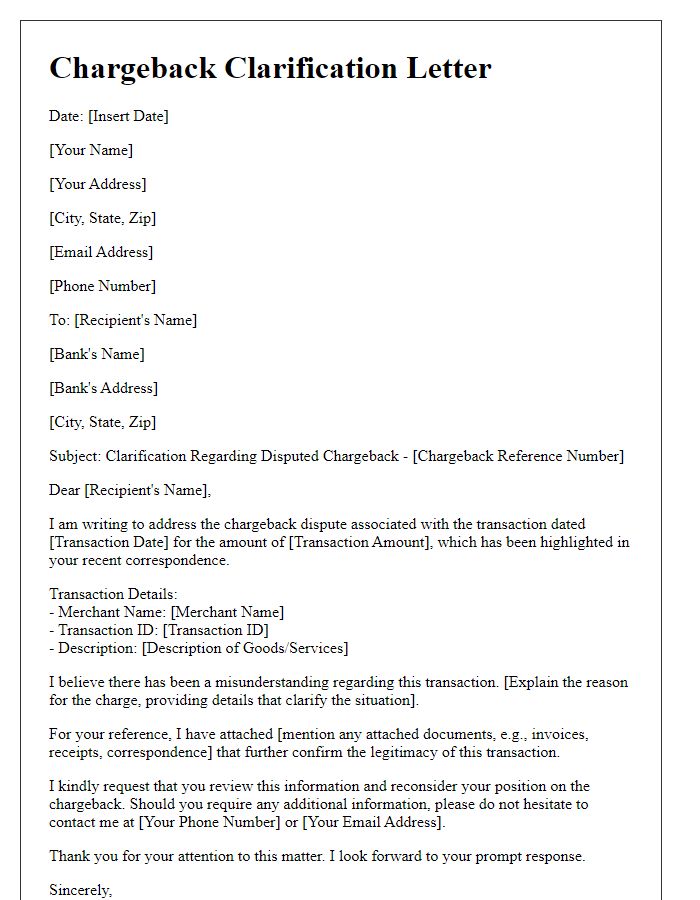

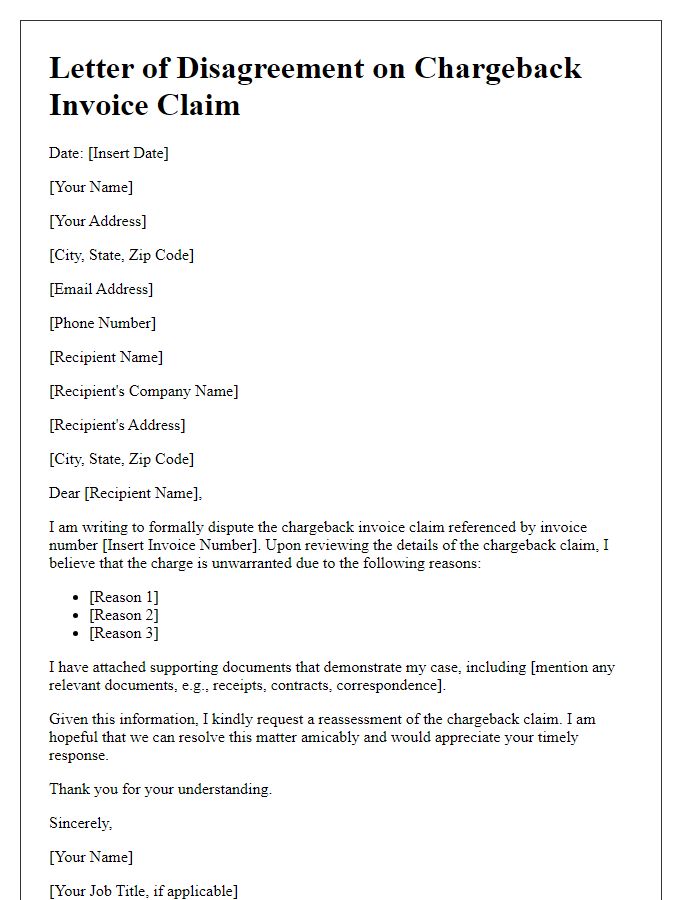

Clear identification of the transaction and dispute details

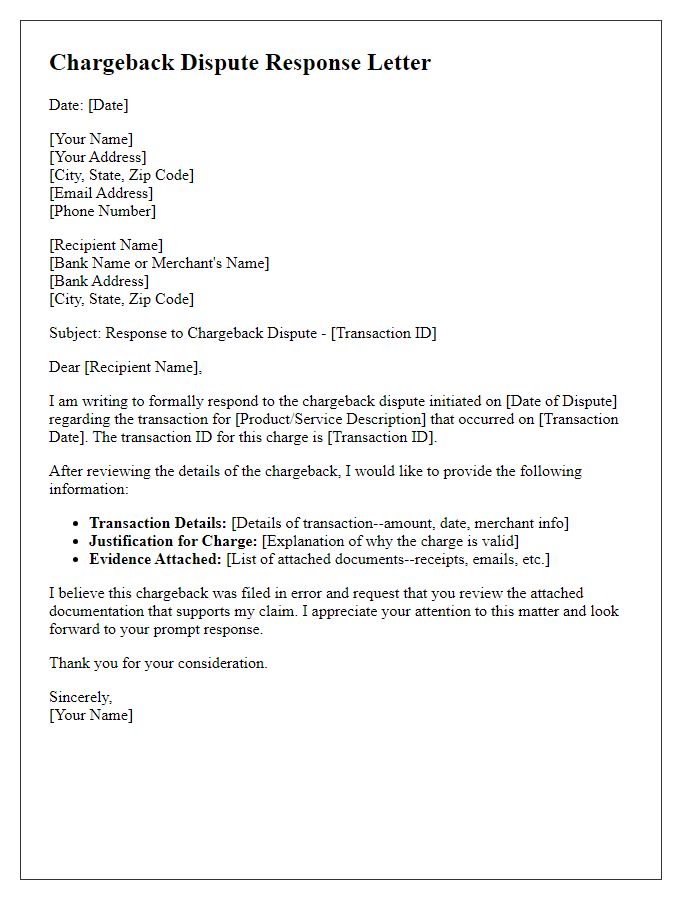

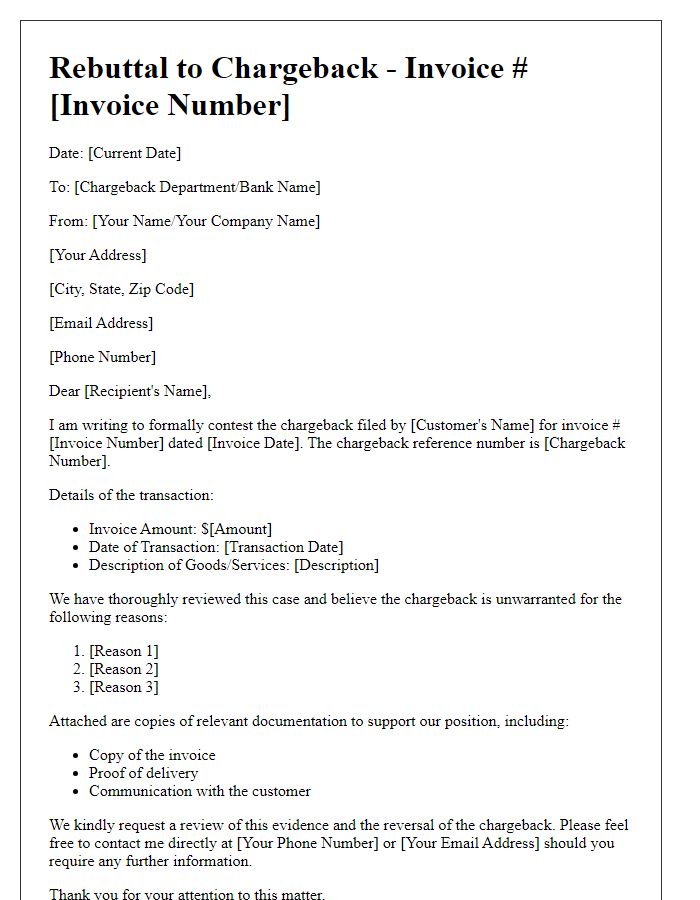

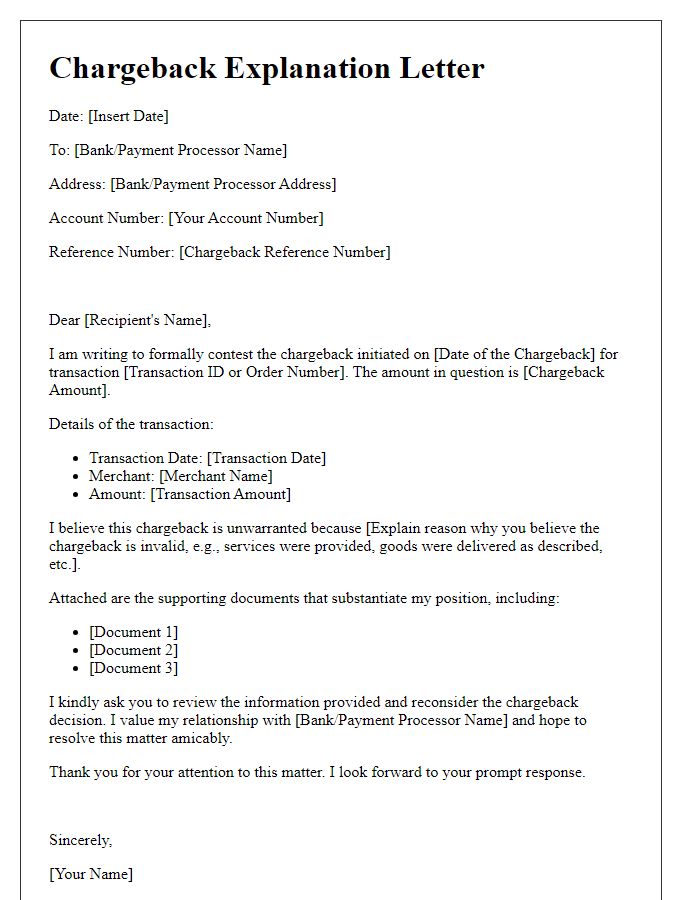

A disputed chargeback involves a financial transaction where a customer contests a charge made to their credit card or bank account. Essential aspects include transaction date (e.g., March 15, 2023), amount (e.g., $150), merchant name (e.g., ABC Retailers), and transaction reference number (e.g., 123456789). Dispute details often highlight reasons for the chargeback, such as unauthorized transaction or dissatisfaction with goods/services received. Including supporting documents like invoices, delivery confirmations, and correspondence can bolster the response. Clear identification allows for efficient investigation by financial institutions, ensuring accurate resolution of the dispute.

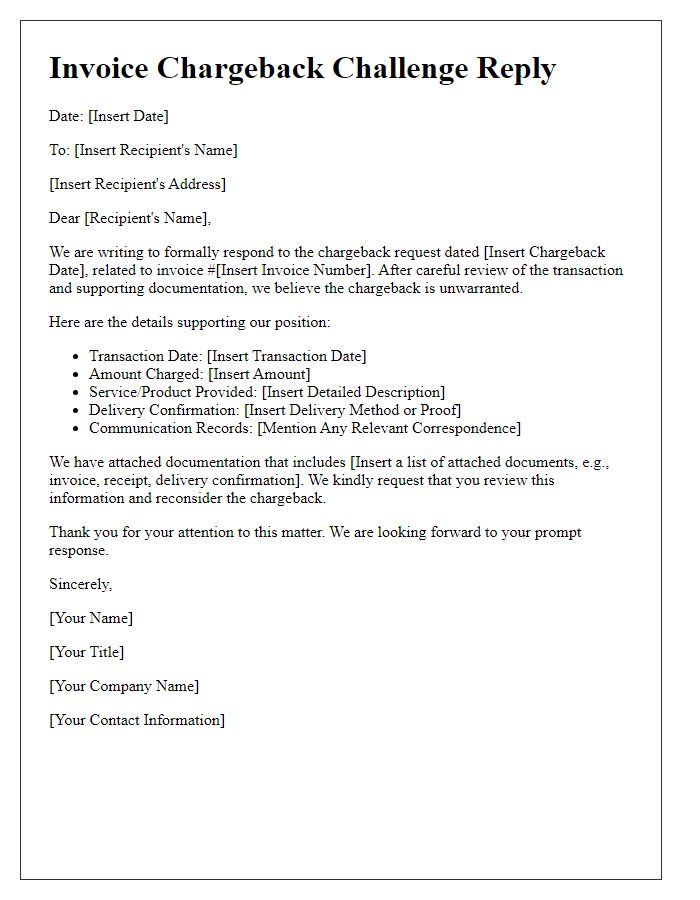

Concise explanation of the charges with supporting evidence

A disputed chargeback invoice may arise from transactions in various contexts, such as credit card processing fees or service agreements. This invoice pertains to a charge of $150, dated October 1, 2023, for consulting services rendered by XYZ Consulting Firm, located in New York City. Supporting evidence includes the signed contract, clearly outlining the scope of services, and an invoice detailing the specific service hours (5 hours at $30 per hour). Additionally, an email confirmation sent to the client on September 25, 2023, verifying the consultation schedule bolsters the validity of the charge. Documentation attached illustrates compliance with agreed terms, reinforcing the legitimacy of the billed amount.

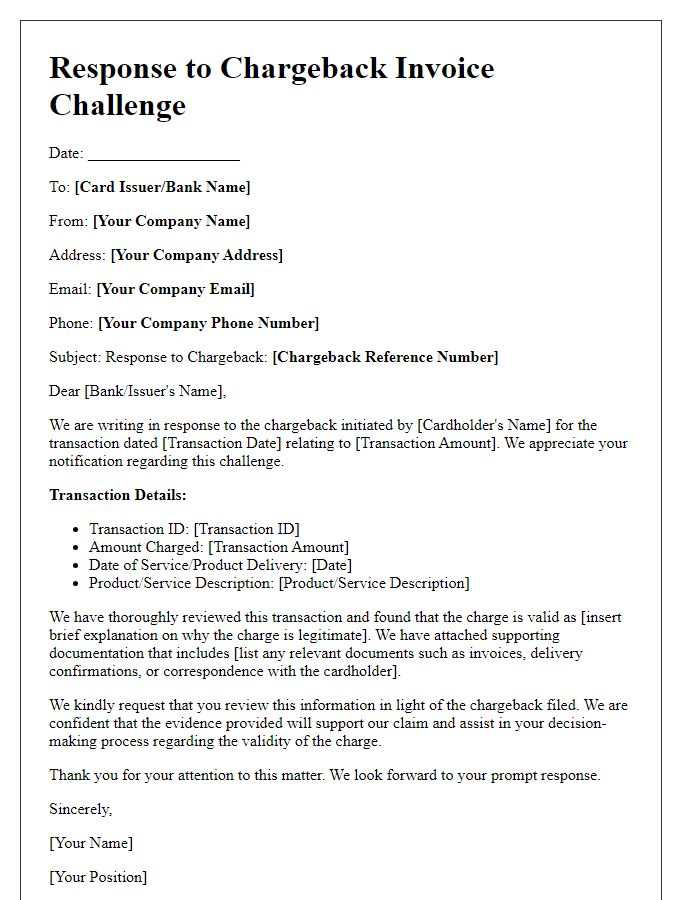

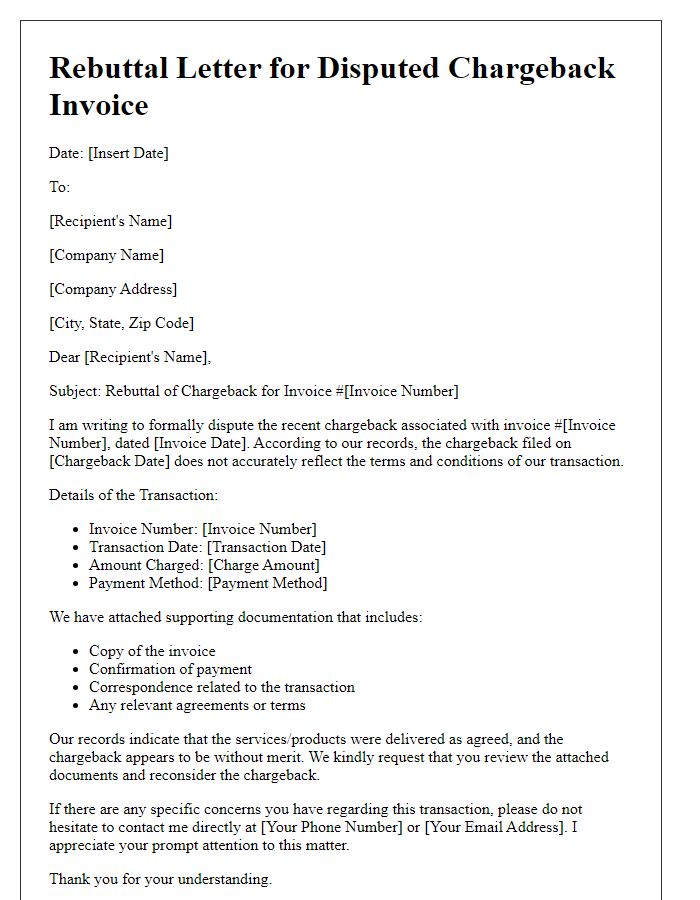

Reference to policy, terms, and conditions

In responding to a disputed chargeback invoice, it is essential to reference the specific policies and terms outlined in the service agreement. Chargebacks typically arise when customers perceive unauthorized transactions or service dissatisfaction. According to our payment policy, specifically sections 5.2 and 7.1 of the service agreement (effective January 2021), all charges must be reviewed within 30 days of receipt. The customer is expected to notify us directly regarding any discrepancies to allow for resolution. Additionally, the terms of service, particularly clauses regarding cancellation and refund, emphasize our commitment to clear communication and resolution of disputes prior to initiating chargebacks. Our documented communication logs from January through March 2023 highlight that proper channels were not utilized to address concerns before the chargeback was initiated. Therefore, we kindly request a review of this case in alignment with our established terms and conditions.

Professional tone and polite language

The disputed chargeback invoice process necessitates a thorough examination of transaction details involving customer accounts. Chargebacks, often initiated via card networks like Visa or Mastercard, aim to secure consumer interests following unrecognized transactions. Accurate documentation, including invoices, receipts, and communication records, is essential in establishing verifiable proof of the transaction authenticity. When responding to a chargeback, companies should reference specific dates, amounts, and order numbers, ensuring each aspect aligns with provided evidence. Effective communication emphasizes availability for any further clarifications or additional documentation required during the review process, facilitating resolution and maintaining positive customer relations.

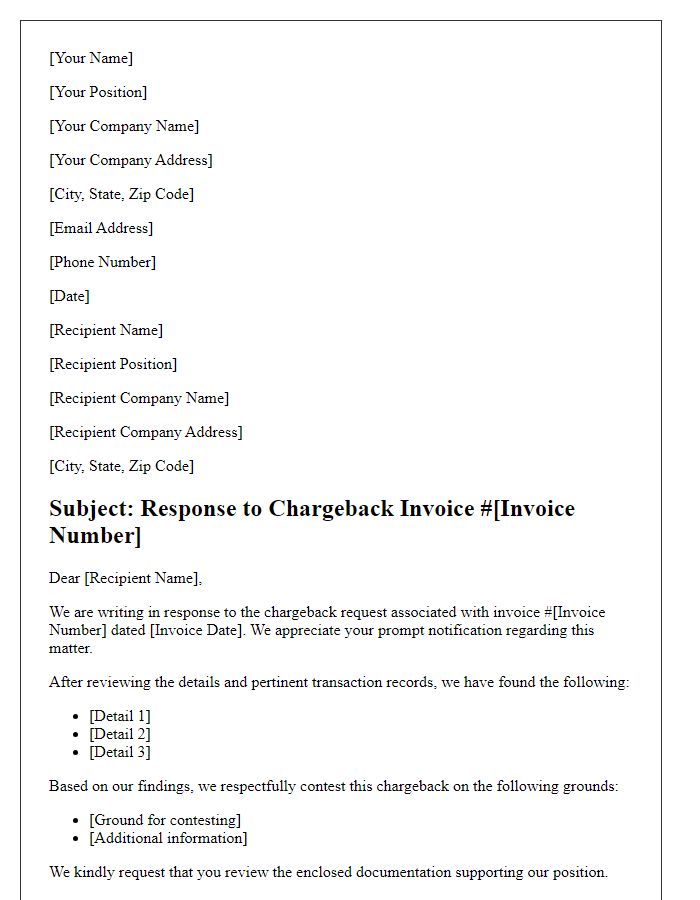

Contact information for further communication

In the case of disputed chargeback invoices, it is essential to provide clear and direct contact information. Include the company name (XYZ Corporation), the designated contact person (John Smith, Senior Account Manager), and specific communication channels such as a direct phone number (123-456-7890) and an email address (john.smith@xyzcorp.com). Additionally, provide the company's physical address (123 Business Avenue, Suite 456, New York, NY 10001) for formal correspondence. Highlight the preferred method of communication to expedite the resolution process, ensuring it's evident that prompt response and collaboration are desired. This facilitates efficient and effective communication regarding disputed charges.

Comments